China Coffee Market Report by Product Type (Whole-bean, Ground Coffee, Instant Coffee, Coffee Pods and Capsules), Distribution Channel (On-trade, Off-trade), and Region 2025-2033

China Coffee Market Size:

China coffee market size reached USD 18,686.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 22,332.0 Million by 2033, exhibiting a growth rate (CAGR) of 2% during 2025-2033. The market is experiencing rapid growth, driven by the rising consumer demand for premium coffee and increasing café culture across the counttry. Urbanization, a younger demographic, and higher disposable incomes are boosting market expansion, with both local and international brands capitalizing on this emerging trend and establishing a strong market presence.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18,686.4 Million |

|

Market Forecast in 2033

|

USD 22,332.0 Million |

| Market Growth Rate 2025-2033 | 2% |

China Coffee Market Analysis:

- Major Market Drivers: Key market drivers include the growing urbanization and a shift towards a more modern lifestyle which have increased the demand for coffee as a daily beverage. The rise in disposable income particularly among younger consumers is also fueling the trend toward premium and specialty coffee. The influence of Western culture and the popularity of socializing in coffee shops have led to a surge in café culture across major cities. In addition to this, the expansion of coffee chains and e-commerce platforms has made coffee more accessible, while innovative marketing strategies and product offerings continue to attract a diverse consumer base.

- Key Market Trends: Key trends in the market include the rapid growth of specialty coffee and a rising preference for premium, high-quality products. Consumers are increasingly interested in unique coffee experiences, such as single-origin beans, artisanal brewing methods, and cold brews. There is also a significant shift toward digitalization, with a surge in online coffee sales and delivery services driven by tech-savvy, younger consumers. In line with this, the market is witnessing a strong emphasis on sustainability and health-conscious options, with more brands offering organic, fair-trade coffee, and plant-based milk alternatives.

- Competitive Landscape: Key players in the market are focusing on expanding their footprint by opening more outlets and enhancing their digital presence. They are adapting to local tastes by offering customized products and leveraging e-commerce platforms to reach a broader audience. Companies are also emphasizing sustainability through eco-friendly practices and ethical sourcing. Additionally, there is a strong push toward innovation with new product offerings, such as cold brews and plant-based options, to attract health-conscious and younger consumers.

The report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. - Challenges and Opportunities: The market presents both challenges and opportunities. Opportunities arise from the growing middle class and a shift toward a modern, urban lifestyle, driving demand for premium and specialty coffee. There's also potential for innovation in products and services, such as introducing traditional Chinese flavors or sustainable options to meet evolving consumer preferences. However, challenges include intense competition from both international and local brands, which can lead to market saturation. Additionally, the strong tea-drinking culture and varying consumer tastes across regions pose hurdles for widespread coffee adoption. Economic fluctuations and supply chain disruptions could also impact growth and profitability.

China Coffee Market Trends:

Increase in Coffee Consumption

Coffee consumption is rising in China, primarily driven by younger consumers aged 18-35 who increasingly see it as a fashionable and social lifestyle choice. This demographic's growing exposure to Western culture and urban environments has made coffee a trendy alternative to tea. Moreover, China, traditionally a tea-drinking nation, is gradually shifting toward coffee due to increasing disposable incomes and changing consumer preferences, especially in urban areas. With more Chinese people exploring coffee, the beverage is gaining popularity as a modern, convenient option that aligns with the fast-paced, cosmopolitan lifestyles of today's younger generation. This shift is significantly contributing to the increase in overall China coffee market share, reflecting a broader cultural transformation and creating new opportunities for both local and international coffee brands to expand their presence in this rapidly growing market. For instance, in May 2024, Luckin Coffee expands with China's largest roastery and 2,342 store openings in Q1 2024, reflecting the booming Chinese coffee market. Despite a negative 20.3% sales growth, the roastery aims to meet the steadily increasing demand. With a focus on technology and customer engagement, Luckin aims to solidify its position in China's competitive coffee industry. China's coffee market continues to grow rapidly, with Luckin leading the charge domestically. The growing focus on expanding infrastructure, technological innovation, and customer engagement is contributing positively to the rising China coffee demand, further accelerating the growth of the overall coffee market across the country.

Rise in E-Commerce

E-commerce is becoming increasingly important in China's coffee market, with many brands utilizing platforms like Tmall, JD.com, and Pinduoduo to reach a larger audience. These online channels enable broader market penetration and offer consumers the convenience of exploring a diverse range of coffee products. Additionally, social media platforms such as WeChat, Douyin (TikTok in China), and Xiaohongshu (Little Red Book) are heavily influencing coffee trends. Key Opinion Leaders (KOLs) and influencers actively promote coffee brands and educate their followers on coffee culture, helping to boost awareness and drive growth within the market by making coffee trendier and more accessible. The China coffee market research report highlights these trends, underscoring the critical role of digital platforms and social media in shaping consumer behavior and preferences. As coffee brands increasingly invest in e-commerce and influencer marketing, they are not only expanding their reach but also fostering a deeper connection with consumers. For instance, in July 2023, Italian coffee giant illycaffè partnered with Hangzhou Onechance Tech to bolster e-commerce sales in China, aiming to triple revenues by 2026. The company plans to adapt its product range to suit local tastes and is set to launch a new instant coffee product for the Chinese market. Hangzhou Onechance Tech, an e-commerce platform, will provide support in online services and distribution. illycaffè is also expanding its café network globally, with plans to open 150 franchised locations in less familiar markets. These strategic expansion into e-commerce and the leveraging of social media influence are creating a positive China coffee market outlook.

Rising Focus on Sustainability

Sustainability and ethical sourcing are becoming increasingly important in China’s coffee market as consumers grow more aware of environmental and social issues. This shift is leading to a rising demand for coffee products that are fair trade, organic, and sustainably sourced. Chinese consumers are starting to prioritize brands that emphasize ethical practices, such as transparency in their supply chains and support for sustainable farming. These brands are gaining traction among environmentally conscious consumers who prefer products that align with their values. As a result, coffee companies are adopting more sustainable practices to meet consumer expectations and enhance their market appeal. The China coffee market report underscores the growing importance of sustainability and ethical sourcing as key drivers of the consumer demand. As awareness of environmental and social issues increases, Chinese consumers are gravitating toward coffee brands that demonstrate transparency and commitment to ethical practices. For instance, in August 2024, ECOM and China's Ministry of Environment Foreign Cooperation Centre (FECO) announced a collaboration to promote low-carbon coffee initiatives. It aims to provide tailored carbon footprint calculations and shade tree advice tools to Chinese coffee farmers. Collectively, they intend to work on piloting low-carbon communities in China's Yunnan province and develop coffee and shade trees suitable for China's climate and soi. These collaborative efforts to promote sustainability and reduce carbon footprints are contributing positively to the China coffee market growth by enhancing brand reputation, fostering consumer loyalty, and attracting a more environmentally conscious audience.

China Coffee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Breakup by Product Type:

To get more information on this market, Request Sample

- Whole-bean

- Ground Coffee

- Instant Coffee

- Coffee Pods and Capsules

The report has provided a detailed breakup and analysis of the market based on the product type. This includes whole-bean, ground coffee, instant coffee, and coffee pods and capsules.

Whole-bean coffee is made up of freshly roasted coffee beans that are sold intact and require grinding before brewing. This type of coffee is preferred by coffee enthusiasts who value freshness and full control over the brewing process, as grinding the beans just before use preserves the aroma and flavor. Whole-bean coffee caters to consumers who enjoy customizing their coffee's grind size and brewing method, offering a richer and more personalized experience. The market for whole-bean coffee is growing due to the increasing number of specialty coffee shops and the rising trend of at-home gourmet coffee preparation.

Ground coffee refers to coffee beans that have been pre-ground and packaged for convenience, eliminating the need for a grinder. It is widely popular among consumers who prioritize convenience and ease of use, as it allows for quick brewing without additional preparation. Ground coffee is available in various grind sizes, suitable for different brewing methods such as drip coffee makers, French presses, and espresso machines. This product type is favored for its balance between quality and convenience, making it a staple in households and offices. The market demand remains strong due to its affordability and widespread availability.

Instant coffee is a soluble form of coffee that dissolves quickly in hot water, providing a fast and convenient way to enjoy a cup of coffee. It is particularly popular among consumers who seek a quick, no-fuss coffee solution, often favored in workplaces and by travelers. Instant coffee comes in various flavors and strengths, catering to diverse taste preferences. The market for instant coffee is driven by its long shelf life, affordability, and the growing demand for convenient, on-the-go beverages. Additionally, the development of premium instant coffee varieties has attracted new consumers looking for a balance between quality and convenience.

Coffee pods and capsules are single-serve portions of coffee grounds sealed in containers, designed for use with specific machines like Keurig or Nespresso. They offer convenience and consistency, delivering a perfect cup of coffee with minimal effort. The market for coffee pods and capsules has expanded significantly due to the rise of single-serve coffee makers in households and offices. These products appeal to consumers looking for variety, as they are available in numerous flavors, blends, and strengths. The demand for coffee pods and capsules continues to grow, driven by the convenience, speed, and variety they offer in today's fast-paced lifestyles.

Breakup by Distribution Channel:

- On-trade

- Off-trade

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail Stores

- Others

A detailed breakup and analysis of the market based on the Distribution Channel have also been provided in the report. This includes on-trade and off-trade (supermarkets and hypermarkets, specialty stores, convenience stores, online retail stores, and others).

The on-trade distribution channel includes venues where coffee is served and consumed on-site, such as cafes, restaurants, hotels, and bars. This channel is driven by consumers who enjoy the experience of having coffee prepared by skilled baristas and the social atmosphere these places provide. On-trade establishments often offer a variety of coffee options, from traditional espresso-based drinks to specialty brews, appealing to a wide range of tastes. The on-trade segment has seen growth due to the increasing popularity of coffee culture and the desire for premium, artisanal coffee experiences. It caters to consumers seeking convenience, ambiance, and a social setting for coffee consumption.

The off-trade distribution channel encompasses retail outlets where coffee is purchased for home consumption, including supermarkets and hypermarkets, specialty stores, convenience stores, and online retail stores. This channel is convenient for consumers who prefer to brew coffee at home and offers a broad selection of coffee products, including whole beans, ground coffee, instant coffee, and coffee pods. Supermarkets and hypermarkets provide easy access to a wide range of brands and formats, while specialty stores offer premium and artisanal options. Online retail stores have gained traction for their convenience and variety, allowing consumers to explore and purchase coffee from the comfort of their homes.

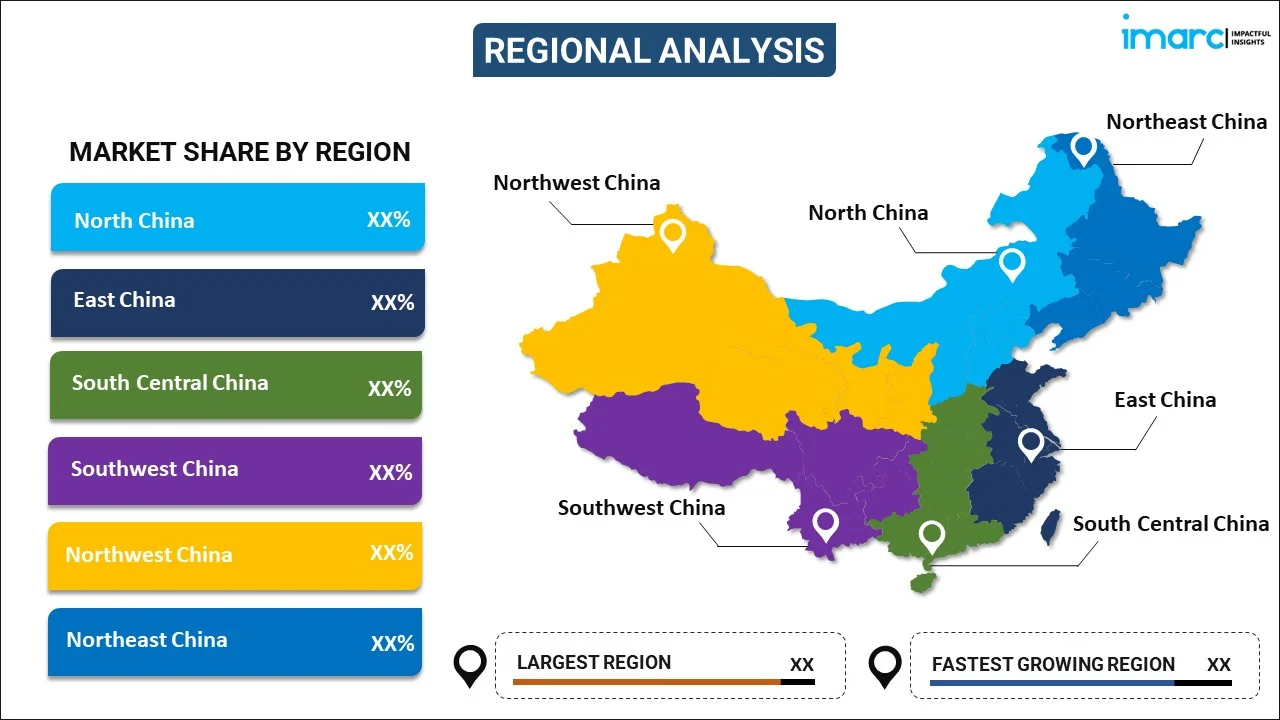

Breakup by Region:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

The report has also provided a comprehensive analysis of all the major markets in the region, which include North China, East China, South Central China, Southwest China, Northwest China, and Northeast China.

The coffee market in North China, which includes major cities like Beijing and Tianjin, is growing rapidly as consumer interest in coffee culture rises. The region benefits from a young, urban population with increasing disposable income and a taste for Western lifestyles. The market is characterized by a growing number of international coffee chains, independent cafes, and specialty coffee shops catering to diverse tastes. While traditionally a tea-drinking area, North China is experiencing a shift towards coffee consumption, driven by lifestyle changes and the influence of global coffee trends. The market also sees a rise in demand for high-quality beans and unique coffee experiences.

East China, home to Shanghai and Hangzhou, is a key region in China's coffee market, known for its dynamic and diverse consumer base. This region is a hub for international coffee brands, trendy cafes, and local roasters, reflecting its cosmopolitan culture and openness to new trends. Consumers in East China are increasingly interested in specialty coffee and innovative brewing methods, supported by a growing number of coffee festivals and barista competitions. The market benefits from strong economic growth and a high concentration of expatriates, fostering a sophisticated coffee culture that values quality, flavor, and the overall coffee-drinking experience.

South Central China, including cities like Guangzhou and Shenzhen, is a major coffee market influenced by its proximity to Hong Kong and its vibrant international trade. This region has a growing appetite for coffee, driven by a mix of local and expatriate populations. The market is diverse, with a strong presence of international coffee chains and a burgeoning scene of independent coffee shops and local roasters. The climate in South Central China is also conducive to coffee consumption, and the region’s consumers are increasingly experimenting with cold brews, iced coffees, and other innovative offerings that cater to the warm weather and dynamic lifestyle.

The coffee market in Southwest China, encompassing cities like Chengdu and Chongqing, is expanding as coffee gains popularity among young consumers and urban professionals. Known for its spicy cuisine, the region's developing coffee culture reflects a blend of traditional tastes with a growing interest in Western-style beverages. The market is witnessing an influx of coffee chains and local cafes, along with increased consumer interest in specialty coffee and home brewing. Southwest China's coffee scene is also supported by local production, as nearby Yunnan province is a significant coffee-growing region, which has helped foster a culture of fresh, locally sourced coffee.

Northwest China, covering areas like Xi'an and Urumqi, is an emerging market for coffee, primarily driven by urbanization and the growing influence of Western culture. Traditionally dominated by tea, the region is slowly adopting coffee as a trendy alternative, particularly among younger generations and urban dwellers. Coffee shops are gradually appearing in major cities, offering a mix of local flavors and popular Western coffee beverages. The market is characterized by a gradual but steady growth in coffee consumption, with potential for further expansion as consumer tastes evolve and the region’s economic development continues to improve purchasing power and access to diverse coffee products.

Northeast China, including cities like Harbin and Shenyang, is experiencing a gradual increase in coffee consumption, driven by colder climates and a desire for warm beverages. The market here is still developing, with a mix of international coffee chains and emerging local cafes introducing coffee culture to the region. The region’s consumers, traditionally more accustomed to tea, are beginning to explore coffee as a daily beverage, influenced by national trends and younger demographics seeking new experiences. The market potential in Northeast China is growing as coffee becomes more integrated into daily life, supported by rising disposable incomes and a slow but steady cultural shift towards Western lifestyles.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- The China coffee market is highly competitive, with both international and local brands vying for market share. Key players are expanding aggressively in major cities while also targeting emerging markets in smaller cities and rural areas. The competition is driven by a focus on product innovation, with brands introducing diverse offerings such as specialty coffees, ready-to-drink options, and premium instant coffee to cater to evolving consumer preferences. Digital strategies, including e-commerce and social media marketing, are essential in reaching younger, tech-savvy consumers. The emphasis on sustainability and ethical sourcing is also a growing competitive factor, as brands strive to align with increasing consumer awareness and demand for transparency. According to the China coffee market forecast, the market is expected to continue expanding rapidly, driven by rising consumer interest in premium and diverse coffee products, greater digital engagement, and an increasing emphasis on sustainability and ethical practices, which will further intensify competition among brands seeking to capture a larger share of this dynamic market.

China Coffee Market News:

- In June 2024, Luckin Coffee and the Brazilian government signed an MoU for a $500 million deal, marking a significant partnership in the global coffee trade. China's emergence as the 6th largest buyer of Brazilian coffee and Luckin Coffee's rapid expansion have led to this strategic alliance. The collaboration aims to strengthen market power for both countries, diversify coffee supply channels, and foster long-term trade relations.

- In May 2024, American café chain Reborn Coffee partnered with IAID to expand into the Chinese market, starting with a location in Guangzhou. The collaboration aims to introduce Reborn Coffee's unique culture to new geographies by combining its retail expertise with IAID's lifestyle design knowledge.

China Coffee Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Whole-bean, Ground Coffee, Instant Coffee, Coffee Pods and Capsules |

| Distribution Channels Covered |

|

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the China coffee market performed so far, and how will it perform in the coming years?

- What is the breakup of the China coffee market on the basis of product type?

- What is the breakup of the China coffee market on the basis of distribution channel?

- What are the various stages in the value chain of the China coffee market?

- What are the key driving factors and challenges in the China coffee market?

- What is the structure of the China coffee market, and who are the key players?

- What is the degree of competition in the China coffee market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China coffee market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the China coffee market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China coffee industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)