8-Bit Microcontroller Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2025-2033

8-Bit Microcontroller Market Size and Share:

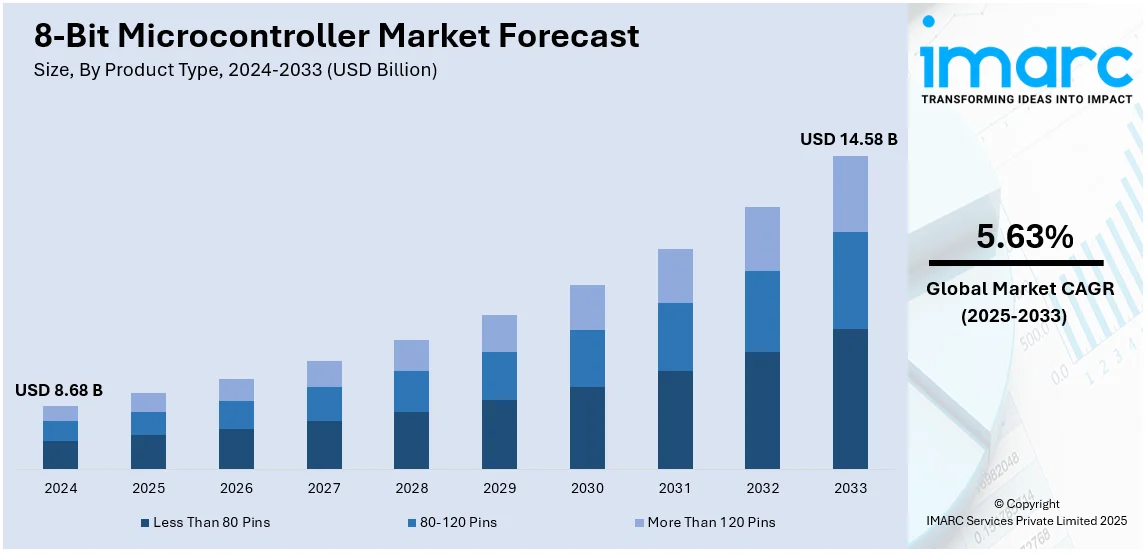

The global 8-bit microcontroller market size was valued at USD 8.68 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.58 Billion by 2033, exhibiting a CAGR of 5.63% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 57.8% in 2024. The 8-bit microcontroller market share is witnessing stable expansion, mainly driven by demand in industrial automation, automotive, and consumer electronics applications. Other major growth factors include reduced power consumption, cost-efficiency, and ease of incorporation into embedded systems, making them ideal for a wide range of effective, compact applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.68 Billion |

|

Market Forecast in 2033

|

USD 14.58 Billion |

| Market Growth Rate (2025-2033) | 5.63% |

The 8-bit microcontroller market growth is influenced by several key drivers, including increasing adoption of IoT applications, automotive electronics, and energy-efficient solutions. The use of 8-bit microcontrollers in IoT products, such as smart wearables, industrial sensors, and home automation systems, is on the rise because it is cost-effective and consumes less power while being capable of performing relatively simple tasks. The energy-efficient microcontrollers will be increasingly required with the expansion of smart homes and industrial automation. For instance, in February 2024, NXP Semiconductors launched the MCX A14x and A15x microcontroller series, featuring Arm Cortex-M33 cores, aimed at intelligent edge computing with advanced connectivity, motor control, and versatile applications. Moreover, in the automotive segment, an 8-bit microcontroller is quite essential for managing such sub-systems as lighting control, sensor management, and infotainment systems. With a low price and quite reliable, it can be used in modern vehicles, electric, and even autonomous cars. Moreover, those industries that emphasize saving energy intensely employ 8-bit microcontrollers in their battery-powered appliances since such microcontrollers have the largest savings in terms of power yet fulfill the required functionalities of the several applications.

The demand for 8-bit microcontrollers market outlook in the US is boosted as smart home technologies are taking ground and, similarly, by rising IoT technology around the globe. These types of microcontrollers control energy-saving devices that consume relatively low prices as well but work to drive home appliances along with lighting or even security devises. For example, in November 2023, Silicon Labs expanded its MCU platform with the BB5 family of 8-bit microcontrollers, offering optimized price-performance for simpler applications. These MCUs enhance development flexibility by integrating with Simplicity Studio, supporting both 8-bit and 32-bit systems. Moreover, with their accelerating deployment into modern vehicle types, for sensing systems or any lighting functions. As electric vehicles (EVs) and advanced automotive electronics grow, these microcontrollers become the necessity to operate at low costs and reliably. Another significant aspect is the rise in energy efficiency across healthcare, consumer electronics, and other fields. Since 8-bit microcontrollers consume power at the least possible levels, they are ideally suited for battery-driven devices, strengthening their applications in industries that are keener on conserving energy without degrading performance or functionality.

8-Bit Microcontroller Market Trends:

Increasing Product Demand in IoT Applications

The 8-bit microcontrollers market analysis indicates that the global market is experiencing an escalating demand in the Internet of Things (IoT) applications. Such microcontrollers are typically preferred for their cost-effectiveness, reduced power consumption, and capability to manage simple tasks in connected devices. Moreover, IoT systems, such as industrial sensors, smart wearable devices, and smart homes, demand energy-saving components for prolonged operation, establishing 8-bit microcontrollers as an ideal choice. As per industry reports, there are approximately 300 million smart homes globally. Furthermore, in 2023, around 60.4 million households in the U.S. actively leveraged smart home devices. In addition, with the magnifying adoption of IoT globally, especially in industrial automation systems and smart consumer devices, the role of 8-bit microcontrollers in powering such devices is anticipated to elevate stably.

Amplified Product Utilization in Automotive Electronics

The automotive industry is predominantly propelling the demand for 8-bit microcontrollers, mainly due to their utilization in numerous advanced embedded systems such as sensor management, lighting control, and infotainment. Such microcontrollers provide cost-efficiency and dependability, positioning them as preferable components for handling simple tasks in modern vehicles. Moreover, as automotive electronics are rapidly becoming more intricated, the requirement for microcontrollers capable of managing non-crucial, smaller functions is significantly fueling. In addition, with the rapid global expansion of autonomous driving technologies and electric vehicles (EVs), the role of 8-bit microcontrollers in the automotive sector is anticipated to remain robust. As per industry reports, in 2023, more than 40 million electric cars were in use worldwide.

Magnifying Emphasis on Energy-Efficient Solutions

Energy efficiency is a critical trend significantly fueling the global 8-bit microcontroller market. Key industries, including healthcare, consumer electronics, and industrial automation, are intensely emphasizing on incorporating energy-efficient technologies to lower their electrical consumption. Furthermore, 8-bit microcontrollers, prominently known for their minimum power consumption, are being deployed in applications where energy savings are crucial, such as battery-powered devices. For instance, in November 2023, Silicon Labs announced a new product line of 8-bit microcontroller units that are particularly designed for battery-powered operations and offer 36% more compute power than other products. Moreover, as numerous businesses are actively focusing on cost minimization and sustainability, the need for energy-saving components is projected to magnify, significantly contributing to the expansion of the 8-bit microcontroller market share in industries where high processing power is unnecessary, but energy conservation is requisite.

8-Bit Microcontroller Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type and end use industry.

Analysis by Product Type:

- Less Than 80 Pins

- 80-120 Pins

- More Than 120 Pins

The report has provided a detailed breakup and analysis of the market based on the product type. This includes less than 80 pins, 80-120 pins, and more than 120 pins. Microcontrollers with 80 pins or less are found in simple, cost-effective applications like household appliances and basic IoT devices where minimal I/O functionality is required. 80-120 pins are ideal for systems requiring moderate processing capabilities such as automotive systems, industrial automation, and mid-tier consumer electronics, striking a good balance between complexity and cost. On the other hand, microcontrollers with over 120 pins are used in complex systems that require higher processing and multiple peripheral connections such as robotics, advanced industrial control, and high-performance consumer electronics, where very complex functionalities are needed.

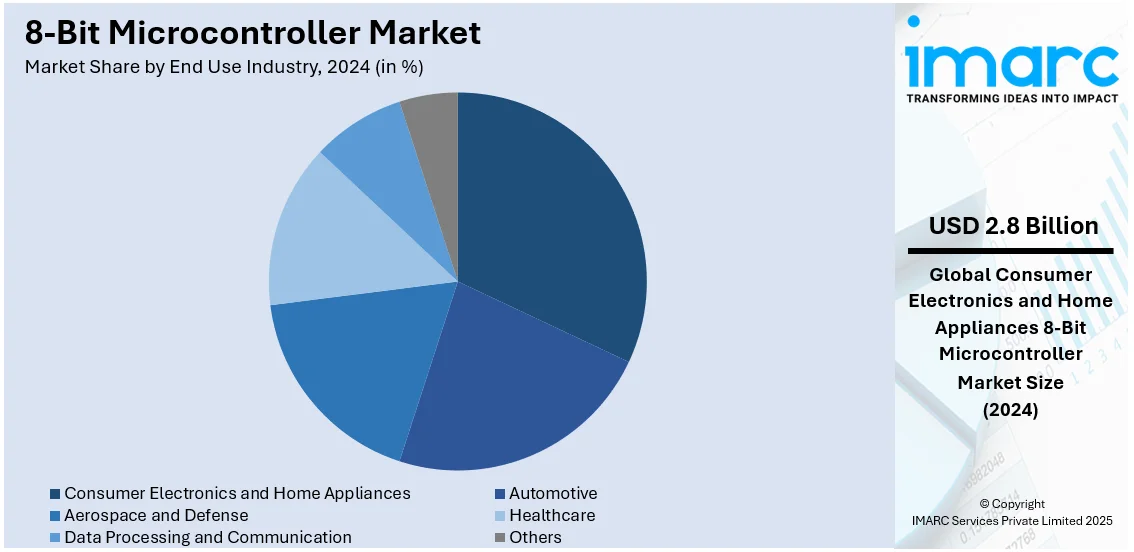

Analysis by End Use Industry:

- Automotive

- Aerospace and Defense

- Consumer Electronics and Home Appliances

- Healthcare

- Data Processing and Communication

- Others

The 8-bit microcontroller market is showing growth mainly in the consumer electronics and home appliances sector, with a 32.2% market share. Growth is observed to be highly dependent on accelerating demand for smart home devices, wearable technology, and connected consumer appliances requiring efficient and low-power microcontroller solutions. Microcontrollers become the important drivers in bringing improvement in functions and performance through increasing adoption of smart technologies that incorporate voice assistants, security systems, and energy-saving appliances among various households. With the boost in trend of household appliances automation, it is becoming more desirable for microcontrollers providing cost-effective processing solutions in each and every ordinary appliances like refrigerator, washing machines, and air conditioner. As the market for connected devices grows, consumer electronics and home appliances will remain the biggest contributor to the growth of 8-bit microcontrollers.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific accounts for a huge share of 57.8% in 8-bit microcontroller market. Asia-Pacific's massive share is primarily ascribed to rapid industrialization and technological improvements along with soaring consumer electronics and Internet of Things (IoT) equipment demands. Notable countries are China, Japan, and South Korea, each manufacturing a variety of electronics items. The region also has a huge consumer base with growing adoption of smart appliances and connected devices, which further fuels the demand for cost-efficient, low-power microcontrollers. Government initiatives to promote smart city projects and integration of IoT in various industries are also driving the market growth. As companies in the region continue to innovate and scale production, Asia-Pacific is expected to maintain its leadership in the 8-bit microcontroller market, with continued growth in both consumer electronics and industrial applications.

Key Regional Takeaways:

North America 8-Bit Microcontroller Market Analysis

North America contributes to the majority share in the market for 8-bit microcontrollers as it represents a strong locale for advanced electronics, automotive, and industrial applications. The region's market share is supported by increased demand for automation, smart appliances, and IoT-enabled devices, which depend on efficient microcontroller solutions for functionality and performance. Highly developed in tech, North America always gets deluged with innovation of consumer electronics. Innovations are mostly in wearable devices, home automation systems, and smart home products. The automotive sector, of course, is focused on EVs and autonomous driving technologies and needs 8-bit microcontrollers to administer various embedded systems. Strong infrastructure and a strong research and development base in the U.S. and Canada are some of the reasons driving the growth of the market. North America is, therefore, likely to remain a prominent player in the global 8-bit microcontroller market.

United States 8-Bit Microcontroller Market Analysis

U.S. 8-bit microcontroller demand is led by industrial robots and electric vehicle (EV) semiconductor demand. The International Council on Clean Transportation reported that in 2023, the U.S. sold approximately 1.4 million new electric light-duty vehicles, representing growth from nearly 1 million in 2022. This puts heightened demand for semiconductor components, such as the microcontrollers in EV applications. U.S. manufacturers Microchip Technology and Intel are leading in the microcontroller market, where innovation is seen for industrial applications and electric vehicles. The 8-bit microcontroller has good prospects, driven by strong demand from automation in manufacturing and rapid growth of the EV industry. Robotics and EVs drive enhanced connectivity and power management, and R&D investments continue to advance product performance.

Europe 8-Bit Microcontroller Market Analysis

In Europe, the 8-bit microcontroller market is rapidly rising, which is steered by an ever-growing industrial automation demand, rising demand in automotive applications, and energy efficiency. According to the Semiconductor Industry Association, in 2023, annual growth was realized in Europe, where sales increased by 4.0%. Countries such as Germany and France are at the forefront, focusing on Industry 4.0 initiatives that integrate advanced automation technologies, where 8-bit microcontrollers are integral to factory systems, robotics, and process control applications. The increasing demand for electric vehicles in Europe is also adding to the rise in automotive microcontroller usage, with 8-bit controllers being used in basic vehicle functions such as lighting and climate control. This growing demand for low-power solutions to meet sustainability goals in industrial and consumer products is the key driver for the demand for 8-bit microcontrollers. The European majors, such as STMicroelectronics and Infineon Technologies, are innovating more to respond to this growing market need, making Europe a prime location for the production of microcontrollers.

Asia Pacific 8-Bit Microcontroller Market Analysis

The Asia Pacific is a leading region for 8-bit microcontroller growth, driven by the increasing rate of automation in manufacturing and electric vehicle production. An industrial report indicates that in 2023, the Asia-Pacific region manufactured approximately 8 million electric vehicles (EVs), further driving the growth of EV semiconductors, including microcontrollers. Also, as per reports, the industrial robotics market in China increased to USD 9.5 billion in 2023, further showing the demand for microcontrollers in automation systems. The region focuses its efforts on the growth of the semiconductor industry for both industrial and electric vehicle applications. Market leaders Renesas and Toshiba are gaining value from these increasing demands through novel solutions specific to automation systems and electric vehicles. Government initiatives supporting smart manufacturing and clean energy are driving the increased adoption of microcontrollers.

Latin America 8-Bit Microcontroller Market Analysis

Latin America's 8-bit microcontroller market is growing sizeably, fuelled by the thrust of industrial automation and recent growth in the electric vehicle (EV) market. In 2023, Brazil experienced a strong increase in purchases of passenger EVs with nearly 55,000 units sold in the first half of 2024 and more than 46,000 units exported in 2023, as per reports. This increase in demand for EVs is pushing advanced semiconductors of types such as microcontrollers, which are used to control battery control systems, power management systems, and connectivity systems in an EV. The market for electric vehicles is expected to continue growing; therefore, the semiconductor sales for electric vehicles in Latin America are expected to be USD 300 million by 2024, as per reports. Local manufacturers are focusing on increasing their microcontroller production, and strategic partnerships with international firms are enhancing technological development, which is driving both smart manufacturing and energy-efficient vehicle production in the region.

Middle East and Africa 8-Bit Microcontroller Market Analysis

Gradual growth in 8-bit microcontroller adoption is being witnessed in the Middle East and Africa, driven by industrial automation and rising interest in electric vehicles. According to an industrial report, in 2023, Dubai registered 25,750 EVs, a 10.6 thousand increase from the previous year, indicating a strong upward trend in the adoption of electric vehicles in the region. Local companies collaborate with global players in the industry to infuse the latest microcontroller solutions in robotics and EV applications. Due to increased infrastructure developments and government investment in clean energy projects, the region has placed itself as a prospective candidate in the global 8-bit microcontroller market.

Competitive Landscape:

The 8-bit microcontroller market is competitive, with numerous players offering diverse products tailored for cost-sensitive and power-efficient applications. The key differentiators will include product portfolios, energy efficiency, and compatibility with industrial and consumer applications. Leading firms invest heavily in R&D to enhance processing capabilities and optimize designs for niche markets like automotive, industrial automation, and IoT devices. Collaboration with original equipment manufacturers (OEMs) and technology partners strengthens market positioning. Pricing strategies and customer support services also form a significant platform from which leadership can be gained. The market is witnessing innovation in design to cater to emerging technologies while maintaining low-cost solutions, ensuring sustained relevance amid competition from advanced microcontrollers with higher bit architectures.

The report provides a comprehensive analysis of the competitive landscape in the 8-bit microcontroller market with detailed profiles of all major companies, including:

- Analog Devices Inc.

- Holtek Semiconductor Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Seiko Epson Corporation

- Silicon Laboratories Inc.

- Sony Group Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Zilog Inc. (Littelfuse Inc.)

Latest News and Developments:

- April 2024: Microchip introduced the AVR DU MCU family, enhancing USB integration and security for 8-bit microcontrollers. With built-in USB 2.0 and USB-C power delivery (up to 15W), the family simplifies design by reducing component count. The AVR DU MCUs offer up to 64 KB Flash, 8 KB SRAM, and 3A charging management.

- November 2023: Silicon Labs expanded their MCU platform with a new family of 8-bit MCUs designed for optimal price and performance. These MCUs join the PG2x family of 32-bit MCUs, sharing a single development platform, Silicon Labs Simplicity Studio, which includes all necessary tools for development.

8-Bit Microcontroller Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Less Than 80 Pins, 80-120 Pins, More Than 120 Pins |

| End Use Industries Covered | Automotive, Aerospace and Defense, Consumer Electronics and Home Appliances, Healthcare, Data Processing and Communication, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc., Holtek Semiconductor Inc., Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, Seiko Epson Corporation, Silicon Laboratories Inc., Sony Group Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, Zilog Inc. (Littelfuse Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the 8-bit microcontroller market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global 8-bit microcontroller market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the 8-bit microcontroller industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The 8-bit microcontroller market was valued at USD 8.68 Billion in 2024.

IMARC Group estimates the market to reach USD 14.58 Billion by 2033, exhibiting a CAGR of 5.63% from 2025-2033.

Key factors driving the 8-bit microcontroller market include the growing demand for consumer electronics, IoT-enabled devices, and smart appliances, the need for cost-effective embedded solutions, advancements in automotive electronics, and increasing automation in industrial applications. Additionally, the expanding use of 8-bit microcontrollers in energy-efficient systems and their ease of integration into various applications also contribute to market growth.

Asia Pacific currently dominates the market driven by rapid industrialization, technological advancements, and the surging demand for consumer electronics and Internet of Things (IoT) devices.

Some of the major players in the 8-bit microcontroller market include Analog Devices Inc., Holtek Semiconductor Inc., Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, Seiko Epson Corporation, Silicon Laboratories Inc., Sony Group Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, Zilog Inc. (Littelfuse Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)