5G Services Market Report by Communication Type (Fixed Wireless Access (FWA), Enhanced Mobile Broadband (eMBB), Ultra-Reliable and Low Latency Communications (uRLLC), Massive Machine-type Communications (mMTC)), End Use (IT and Telecom, Media and Entertainment, Automotive, Energy and Utility, Aerospace and Defense, and Others), and Region 2025-2033

Market Overview:

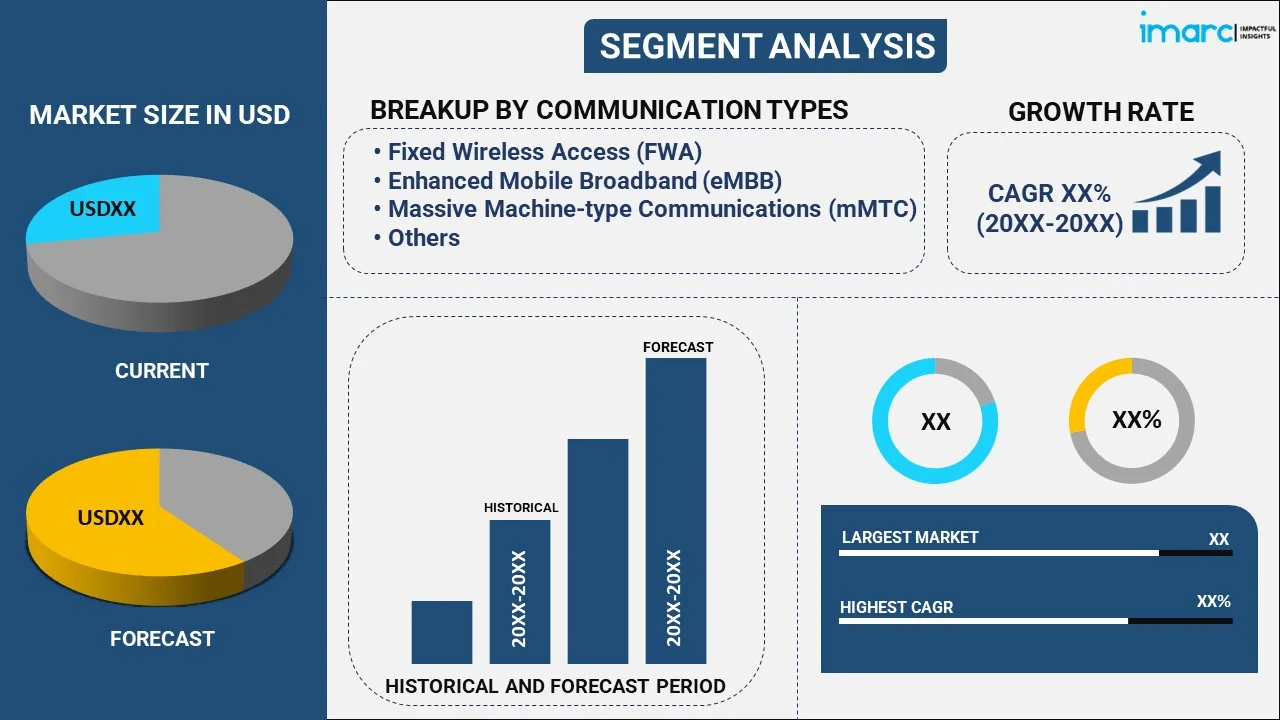

The global 5G services market size reached USD 184.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4,426.4 Billion by 2033, exhibiting a growth rate (CAGR) of 42.34% during 2025-2033. The widespread adoption of 5G services across numerous industries, the shift towards smart cities that incorporate intelligent transportation systems, and the advent of autonomous vehicles and real-time analytics are some of the major factors propelling the market. At present, North America holds the largest market share, driven by increasing advancements in efficient connectivity services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 184.6 Billion |

|

Market Forecast in 2033

|

USD 4,426.4 Billion |

| Market Growth Rate 2025-2033 | 42.34% |

5G services represent the fifth generation of mobile network technology, following the previous 4G standard. This technology is characterized by its enhanced data transmission speed, which can be up to 100 times faster than 4G, allowing for smoother streaming, faster downloads, and more responsive online gaming. Additionally, 5G offers greater bandwidth, accommodating more devices connected to the network simultaneously. It also has lower latency, reducing the delay in communication between devices, thus improving real-time applications like video conferencing or autonomous driving. With 5G, mobile and IoT (Internet of Things) devices can connect more efficiently, enabling more advanced and seamless digital experiences. The implementation of 5G services is seen as a major step forward in telecommunications and is being rolled out in various countries globally.

The escalating proliferation of IoT applications from the industrial sector majorly drives the 5G services market growth. This can be supported by the widespread adoption of 5G services across the industries such as healthcare, transportation, smart homes, and manufacturing. Along with this, the continuous shift towards mobile-first behavior and an increasing preference for video content, social media, and other data-intensive applications are driving consumers to seek faster and more reliable internet connections. As mobile devices become central to everyday activities, the demand for 5G's enhanced capabilities grows. In addition, the emerging trend towards Industry 4.0 and the adoption of smart manufacturing processes require robust and high-speed communication networks is positively influencing the market. Apart from this, the movement towards smart cities that incorporate intelligent transportation systems, smart energy grids, and interconnected public services depends heavily on advanced network technologies. 5G is essential in enabling these sophisticated systems to function cohesively, thus driving its adoption in urban development projects. Furthermore, the advent of autonomous vehicles and real-time analytics, which require immediate processing is creating a positive market outlook.

5G Services Market Trends/Drivers:

Increasing Demand for High-Speed Internet Connectivity

The global demand for faster and more reliable internet connectivity is one of the primary market drivers for 5G services. With the proliferation of high-definition streaming, online gaming, augmented and virtual reality applications, and real-time data analysis, existing 4G networks often struggle to meet the necessary speed and bandwidth requirements. In addition, the introduction of 5G technology, which promises significantly faster data transmission rates and reduced latency, meets these growing demands. Apart from this, corporations, governmental institutions, and individual users are driving the demand for 5G to enable enhanced digital experiences and more efficient communication.

Government Initiatives and Investments

The deployment of 5G infrastructure requires substantial investment, and many governments are recognizing the strategic importance of 5G in driving economic growth and innovation. In confluence with this, numerous countries are actively promoting the development of 5G networks through favorable policies, grants, and collaborations with private industry. As a result, these government-led initiatives are vital in fostering the growth of 5G services by easing regulatory constraints, offering financial incentives, and encouraging public-private partnerships to develop the necessary infrastructure. Therefore, this is significantly supporting the market across the globe. Since the security and privacy of data on 5G networks are significant concerns. This is encouraging government agencies to heavily invest in the implementation of robust security measures to protect against potential cyber threats.

Technological Innovations and Research

Continuous research and development in telecommunications technology are fostering the growth of 5G services. Innovations in network architecture, the use of millimeter-wave spectrum, beamforming, and other cutting-edge technologies are essential to achieving the high speeds and performance promised by 5G. Apart from this, academic institutions, technology companies, and research organizations are working collaboratively to drive these technological advancements across the globe. The resulting innovations are not only enhancing the capabilities of 5G networks but are also reducing costs, making 5G more accessible to a broader audience. These technological strides are instrumental in shaping the 5G services industry and sustaining its long-term growth.

5G Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global 5G services market report, along with forecasts at the global, regional and country levels from 2025-2033 Our report has categorized the market based on communication type and end use.

Breakup by Communication Type:

- Fixed Wireless Access (FWA)

- Enhanced Mobile Broadband (eMBB)

- Ultra-Reliable and Low Latency Communications (uRLLC)

- Massive Machine-type Communications (mMTC)

Enhanced mobile broadband (eMBB) dominates the market

The report has provided a detailed breakup and analysis of the market based on the communication type. This includes fixed wireless access (FWA), enhanced mobile broadband (eMBB), ultra-reliable and low latency communications (uRLLC), and massive machine-type communications (mMTC). According to the report, enhanced mobile broadband (eMBB) represented the largest segment.

Enhanced mobile broadband (eMBB) stands as a pivotal driver in the 5G services industry, fueled by escalating demand for high-speed, seamless connectivity. The rise in multimedia applications, such as 4K/8K video streaming, augmented reality (AR), and virtual reality (VR) necessitates advanced data transfer rates. Along with this, the rapid proliferation of Internet of Things (IoT) devices, spanning diverse sectors from smart homes to industrial automation, amplifies the requirement for a robust mobile network capable of accommodating numerous connected devices effortlessly. eMBB's prominence is underscored by 5G networks' ability to deliver unparalleled data speeds, significantly reduced latency, and heightened capacity, thus catalyzing cross-industry innovation and fundamentally reshaping the digital landscape. In an era of data-intensive applications and expanding IoT ecosystems, eMBB emerges as a linchpin propelling the 5G revolution forward.

Breakup by End Use:

- IT and Telecom

- Media and Entertainment

- Automotive

- Energy and Utility

- Aerospace and Defense

- Others

IT and telecom hold the largest share in the market

A detailed breakup and analysis of the market based on the end use has also been provided in the report. This includes IT and telecom, media and entertainment, automotive, energy and utility, aerospace and defense, and others. According to the report, IT and telecom accounted for the largest market share.

In the 5G services industry, the IT and Telecom sectors emerge as dynamic market drivers, fueled by a convergence of transformative factors. The ever-increasing demand for faster, more reliable connectivity propels the adoption of 5G technology. This is particularly evident in the telecom sector, where the promise of significantly enhanced data transfer speeds and reduced latency drives both consumer and enterprise interest. Simultaneously, the rise of Internet of Things (IoT) applications necessitates a robust infrastructure, compelling IT and Telecom players to harness the potential of 5G to seamlessly support the massive influx of interconnected devices. Additionally, the deployment of advanced technologies such as edge computing and cloud services aligns with the capabilities of 5G networks, further escalating its relevance in the IT sector. As these sectors intertwine to capitalize on 5G's capabilities, they jointly catalyze innovation, pave the way for novel services, and ultimately steer the trajectory of the 5G services industry toward unparalleled growth and transformation.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest 5G services market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

In North America, the market drivers propelling the 5G services industry into prominence are multifaceted and influential. The region's insatiable appetite for advanced connectivity fuels the rapid adoption of 5G technology. In addition, the proliferation of data-intensive applications, spanning from high-definition video streaming to augmented and virtual reality experiences, fuels the demand for faster data speeds and reduced latency, thus driving the evolution towards 5G networks. Moreover, North America's position as a technology and innovation hub amplifies the urgency to stay at the forefront of technological advancements, making the deployment of 5G networks a strategic imperative. The industrial implications of 5G, particularly in enabling smart cities, autonomous vehicles, and IoT applications, further cement its significance in the region. Collaborations between industry players, government initiatives, and the inherent need for seamless communication converge to shape North America's role as a frontrunner in the 5G services domain, with far-reaching implications for innovation, economic growth, and societal transformation.

Competitive Landscape:

The global 5G services market is experiencing significant growth due to the escalating strategic initiatives to capitalize on the transformative potential of 5G technology. These initiatives encompass network infrastructure expansion, innovation in service offerings, and ecosystem development. Along with this, leading companies are heavily investing in the deployment and enhancement of 5G infrastructure, including upgrading existing cell towers, building new ones, and deploying small cells to ensure widespread coverage and improved network capacity. This involves deploying advanced radio access equipment, fiber-optic backhaul, and cloud-based architecture to support the increased demands for speed and latency reduction. In addition, companies are introducing innovative 5G-centric services and solutions to cater to both consumer and enterprise needs. This includes ultra-fast mobile broadband, augmented and virtual reality experiences, and IoT solutions. Apart from this, collaboration and partnership are key drivers in the 5G ecosystem. Furthermore, advancements in beamforming, network slicing, edge computing, and AI-powered optimization are contributing to the market.

The report has provided a comprehensive analysis of the competitive landscape in the global 5G services market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AT&T Inc.

- Bharti Airtel Ltd.

- BT Group plc

- China Mobile Limited

- China Telecom Corporation Limited

- Deutsche Telekom AG

- KT Corp.

- NTT Docomo Inc. (Nippon Telegraph and Telephone)

- Saudi Telecom Company

- SK Telecom Co. Ltd.

- T-Mobile USA INC

- Verizon Communications Inc.

- Vodafone Group plc

Recent Developments:

- In March 2023, AT&T Inc. introduced a worldwide telecommunications product to assist communications service providers (CSPs) in managing the inventory of fibre and 5G networks. ServiceNow Telecom Network Inventory, built on the ServiceNow platform and accessible to telcos worldwide, was developed with design and technical advice from AT&T.

- In January 2023, Bharti Airtel Ltd. announced the expansion of the next-generation high-speed network in Haryana by launching its 5G services in Hissar and Rohtak.

- In August 2023, BT Group plc demonstrated the delivery of 5G services across a wideband FDD radio carrier (more than 20 MHz) in the sub-3 GHz spectrum range.

5G Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Communication Types Covered | Fixed Wireless Access (FWA), Enhanced Mobile Broadband (eMBB), Ultra-Reliable and Low Latency Communications (uRLLC), Massive Machine-type Communications (mMTC) |

| End Uses Covered | IT and Telecom, Media and Entertainment, Automotive, Energy and Utility, Aerospace and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AT&T Inc., Bharti Airtel Ltd., BT Group plc, China Mobile Limited, China Telecom Corporation Limited, Deutsche Telekom AG, KT Corp., NTT Docomo Inc. (Nippon Telegraph and Telephone), Saudi Telecom Company, SK Telecom Co. Ltd., T-Mobile USA INC, Verizon Communications Inc., Vodafone Group plc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the 5G services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global 5G services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the 5G services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global 5G services market to exhibit a CAGR of 42.34% during 2025-2033.

The increasing need for high speed and extensive network coverage, along with the growing mobile data traffic volume for broadband subscriptions, is primarily driving the global 5G services market.

The sudden outbreak of the COVID-19 pandemic has led to the rising adoption of 5G services for real-time access of files and applications in remote working and virtual learning scenario, during the implementation of lockdown regulations across several nations.

Based on the communication type, the global 5G services market has been divided into fixed wireless access (FWA), enhanced mobile broadband (eMBB), ultra-reliable and low latency communications (uRLLC) and massive machine-type communications (mMTC). Currently, enhanced mobile broadband (eMBB) holds the majority of the total market share.

Based on the end use, the global 5G services market can be categorized into IT and telecom, media and entertainment, automotive, energy and utility, aerospace and defense and others. Among these, the IT and telecom sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global 5G services market include AT&T Inc., Bharti Airtel Ltd., BT Group plc, China Mobile Limited, China Telecom Corporation Limited, Deutsche Telekom AG, KT Corp., NTT Docomo Inc. (Nippon Telegraph and Telephone), Saudi Telecom Company, SK Telecom Co. Ltd., T-Mobile USA INC, Verizon Communications Inc. and Vodafone Group plc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)