5G Satellite Communication Market Size, Share, Trends and Forecast by Orbit, Satellite Solution, Service, Spectrum Band, End User, and Region, 2026-2034

5G Satellite Communication Market Size and Share:

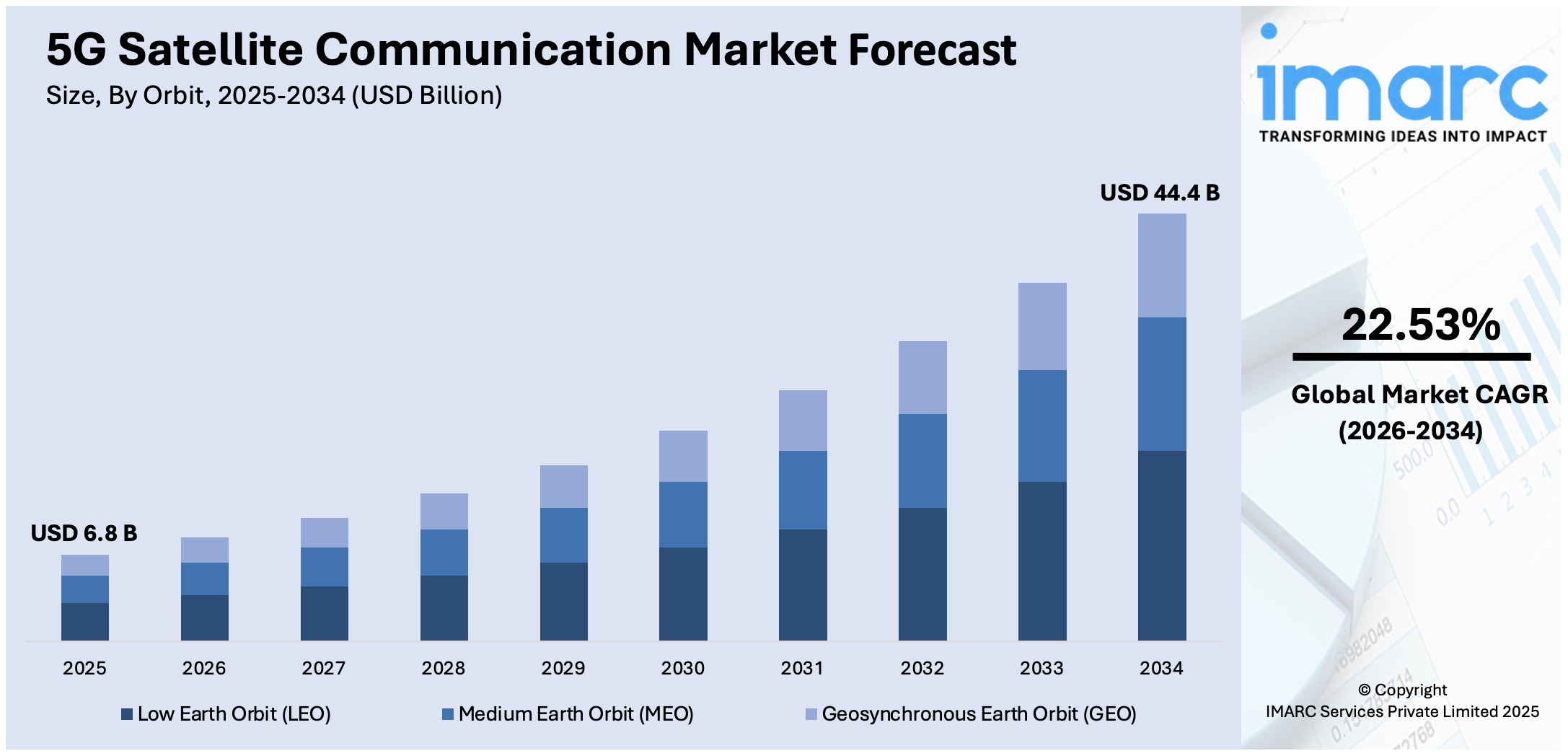

The global 5G satellite communication market size was valued at USD 6.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 44.4 Billion by 2034, exhibiting a CAGR of 22.53% from 2026-2034. North America currently dominates the 5G satellite communication market share by holding over 34.8% in 2025. The market in the region is driven by strong government investments in space and defense technologies, increasing demand for high-speed connectivity in rural and remote areas, rapid adoption of the Internet of Things (IoT) and autonomous systems, and significant research and development (R&D) efforts by key industry players.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.8 Billion |

| Market Forecast in 2034 | USD 44.4 Billion |

| Market Growth Rate (2026-2034) | 22.53% |

The expansion of the global 5G satellite communication market is propelled by increasing demand for high-speed connectivity in remote and underserved areas. For instance, by the end of 2024, Starlink had deployed nearly 7,000 satellites, amassing 4.6 million subscribers, primarily in underserved rural areas, highlighting the growing reliance on satellite networks for connectivity. In addition, the rapid expansion of IoT and machine-to-machine (M2M) communication requires reliable, low-latency networks, boosting the market demand. Moreover, the growing defense and military applications, including secure communications and surveillance, are driving investment and supporting the market growth. Besides this, the increasing adoption in aviation and maritime sectors is enhancing in-flight and offshore connectivity, providing an impetus to the market. Also, government initiatives supporting rural broadband expansion are aiding the market demand. Furthermore, continuous advancements in satellite technology and growing R&D investments by key players are fostering innovation and deployment, thus impelling the 5G satellite communication market growth.

To get more information on this market Request Sample

The United States 5G satellite communication market demand is driven by the country’s strong private space industry, led by companies like SpaceX and Amazon’s Project Kuiper. The market currently holds a share of 84.90%. In confluence with this, the increasing demand for secure military-grade communications is driving defense sector investments, which is contributing to the market expansion. Additionally, the rise of smart cities and autonomous transportation systems requires reliable satellite-based 5G connectivity, fostering the market growth. Concurrently, the expansion of telehealth services, especially in rural areas, is boosting the market demand. Furthermore, disaster preparedness initiatives are enhancing satellite adoption for emergency response, driving the market growth. Apart from this, growing public-private partnerships are bolstering innovation and large-scale infrastructure development in 5G satellite networks, thereby propelling the market forward. The Federal Communications Commission (FCC) has focused on auctioning high-band spectrum, introducing nearly 5 gigahertz of 5G spectrum to strengthen network capabilities and accelerate deployment efforts. These factors collectively propel the market demand.

5G Satellite Communication Market Trends:

Expanding Connectivity and Satellite Networks

The global market is experiencing significant growth driven by the rising need for seamless connectivity, especially in remote and underserved areas where traditional broadband infrastructure remains inadequate. For instance, the worldwide internet penetration rate stands at 66.2% of the total population where 5.35 billion people are active users by 2024 and this rate functions as the primary force behind this trend. Moreover, political institutions along with private companies dedicate their investments to satellite technology to bring digital connectivity and fast internet speeds into remote areas. Besides this, modern industries including maritime operations aviation, and defense are adopting satellite networks because these networks provide real-time communication capabilities in spaces where traditional land-based systems do not exist or are too expensive. Furthermore, the growing deployment of low-earth orbit (LEO) satellites is contributing to the market expansion by enhancing coverage and reducing latency.

5G and IoT Integration in Key Industries

The rapid expansion of 5G technology is revolutionizing various industries by enabling faster and more reliable mobile broadband services. In the media and entertainment sector, 5G enhances seamless content streaming, cloud gaming, and virtual reality (VR) experiences. In line with this, autonomous vehicles rely on 5G networks for real-time data processing, ensuring enhanced safety and efficiency. Additionally, telehealth is benefiting from high-speed connectivity, allowing for remote patient monitoring, virtual consultations, and advanced diagnostics. Concurrently, the increasing adoption of IoT devices and M2M communication drives the demand for 5G satellite networks, ensuring uninterrupted connectivity in remote and urban areas alike. For example, with the global IoT market reaching USD 1,022.6 billion in 2024, the integration of 5G continues to strengthen the 5G satellite communication market share.

Satellite Communications in Security and Emergency Services

The growing dependence on satellite communications for disaster management and emergency response is significantly driving the 5G satellite communication market outlook. Relief organizations and government entities depend on satellite networks to build reliable communication pathways during emergencies to speed up rescue efforts and resource delivery. Besides this, the military benefits from 5G satellite technology because this system establishes secure encrypted data links for strategic defense operations and intelligence gathering and surveillance functions. In confluence with this, the aviation industry demands unbroken high-speed satellite connectivity as in-flight connectivity emerges as a basic service aviation customers expect. Furthermore, government initiatives aimed at enhancing rural connectivity, coupled with increasing disposable incomes, are supporting the market demand. Apart from this, extensive R&D efforts by key industry players continue to drive advancements in satellite communication technologies, thereby enhancing the 5G satellite communication market trends. For example, in 2024, Filtronic secured a $20.9 million contract with SpaceX to supply radio-frequency power amplifiers for the Starlink program, enhancing satellite technology and connectivity, and further impelling the market growth.

5G Satellite Communication Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global 5G satellite communication market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on orbit, satellite solution, service, spectrum band, and end user.

Analysis by Orbit:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geosynchronous Earth Orbit (GEO)

Low Earth Orbit (LEO) satellites, operating at altitudes of 500-2,000 km, provide low-latency, high-speed connectivity, making them well-suited for real-time applications such as IoT, autonomous vehicles, and global broadband networks. Additionally, companies like SpaceX and OneWeb are aggressively expanding LEO satellite constellations, which is impelling the market demand.

Medium Earth Orbit (MEO) satellites, positioned between 2,000 and 35,786 km, offer an optimal balance of coverage and latency. They are widely utilized for navigation systems like GPS and high-capacity data transmission. Besides this, the growing demand for seamless connectivity in maritime, aviation, and remote areas is driving MEO satellite adoption, driving the market growth.

Geosynchronous Earth Orbit (GEO) satellites, positioned at an altitude of 35,786 km, offer wide coverage and are primarily used for broadcasting, weather monitoring, and military communications. Their stationary positioning ensures reliable connectivity, making them essential for government applications, telecommunications infrastructure, and emergency response networks, thus catalyzing the market demand.

Analysis by Satellite Solution:

- Backhaul and Tower Feed

- Trunking and Head-End-Feed

- Communication on the Move

- Hybrid Multiplay

Backhaul and tower feed dominate the 5G satellite communication market, accounting for 43.7% of the total share. The extension of 5G network infrastructure into remote areas represents a major growth factor because satellite-based backhaul can support telecom operators in regions where other network technologies are physically impossible. This segment is also driven by the growing utilization of small-cell networks for enabling high-speed 5G connectivity. Moreover, the market receives strong support from both public authorities and private businesses through heavy investments in infrastructure development. The development of high-throughput satellites (HTS) and low-latency technology solutions lowers operational expenses, boosting the effectiveness of satellite-based backhaul systems. Besides this, the satellite-fed towers provide continuous connectivity for disaster response and emergencies. Furthermore, the evolution of telecom networks depends on satellite backhaul technologies because they enable the necessary connection to distribute 5G services across the world without gaps.

Analysis by Service:

- Mobile Broadband

- Defense and Government Mission Critical Communication

- Satellite IoT

The demand for satellite-enabled mobile broadband is rising as 5G expands into remote and underserved regions. LEO and MEO satellite constellations enhance network coverage, ensuring high-speed, low-latency connectivity for applications like streaming, remote work, and smart city infrastructure.

Governments and defense agencies rely on encrypted 5G satellite communication systems for their surveillance needs, intelligence collection, and battlefield operations. In addition, satellite networks defense operations, and emergency response initiatives deliver dependable connectivity to security and emergency services during conflicts and dangerous situations.

Satellite IoT highly supports M2M communication across industries like agriculture, logistics, and energy. With global 5G integration, IoT devices leverage satellite networks for real-time data transfer, remote monitoring, and automation, driving efficiency in industrial operations and enhancing connectivity in remote environments.

Analysis by Spectrum Band:

- L and S Band (1-4GHZ)

- C and X Band (4-12GHZ)

- Ku and Ka Band (12-40GHZ)

L and S bands (1-4GHZ) offer reliable, low-frequency satellite communications with strong signal penetration, making them ideal for maritime, aviation, and military applications. Their resilience to weather interference ensures dependable connectivity for navigation, emergency response, and global positioning systems (GPS).

C and X bands (4-12GHZ) provide a balance between coverage and bandwidth, commonly used in broadcasting, weather forecasting, and military communications. Additionally, the X-band is specifically favored for defense and government applications due to its secure, anti-jamming capabilities, supporting mission-critical operations worldwide.

Ku and Ka (12-40GHZ) bands enable high-speed, high-capacity satellite communications, crucial for broadband, in-flight connectivity, and 5G backhaul. Their higher frequency supports greater data throughput, making them essential for emerging technologies like autonomous vehicles, telehealth, and ultra-high-definition (UHD) content streaming.

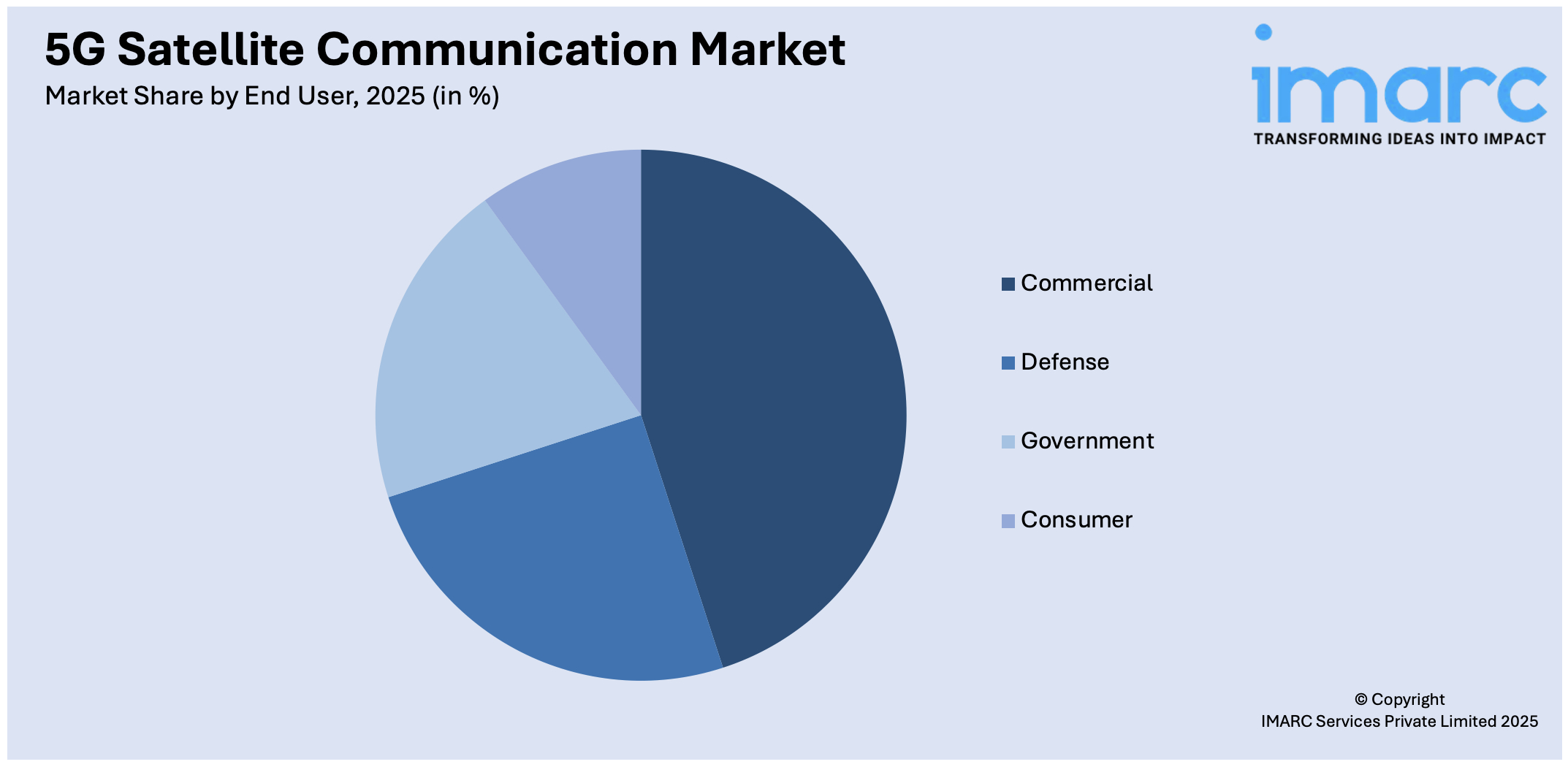

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Defense

- Government

- Commercial

- Consumer

The commercial sector dominates the 5G satellite communication market, holding 45.0% of the total share. This segment is driven by the growing demand for seamless, high-speed connectivity across industries. The media and aviation sectors along with maritime and logistics operations depend on satellite-based 5G solutions because they enable real-time data transfer and remote operations and improved customer experiences. In addition to this, the rising IoT implementation with satellite technology in smart agriculture, energy operations and industrial automation systems is fostering the market expansion. The combination of growing airline transportation and requirements for aircraft broadband access also drives the market demand for satellite communications systems to carry the commercial aviation process. As a result, the surge in worldwide advanced smart city implementations and digital transformation plans contributes to sector development since they mandate powerful 5G networks for continuous connectivity. Furthermore, the commercial market adopts more innovations because the advancement of LEO satellite constellations together with major companies' private sector investments, offer service capabilities through lower latency and enhanced network efficiency.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the 5G satellite communication market, holding 34.8% of the total share. The demand in the region is driven by strong government initiatives, technological innovation, and increasing demand for high-speed connectivity. Rural broadband expansion programs drive up the adoption of satellite-based 5G solutions because they extend coverage to remote areas that were previously underserved. Additionally, the advanced defense and aerospace sectors in this region spend on secure satellite communications for military operations and surveillance as well as emergency response needs. The implementation of smart cities together with autonomous transportation systems further drives the market expansion because these initiatives need dependable and fast satellite network services. Besides this, the rising use of industrial IoT within fields like agriculture, energy, and logistics drives the requirement for seamless connectivity. Apart from this, the R&D initiatives make North America the primary driver of 5G satellite communication development along with innovative breakthroughs.

Key Regional Takeaways:

United States 5G Satellite Communication Market Analysis

The U.S. 5G satellite communication market is driven by the rapid adoption of 5G technologies across industries and regions. Since the launch of 5G in 2018, three nationwide networks and regional providers have expanded coverage to 330 million Americans, according to CTIA. This widespread coverage enhances the need for satellite communications to bridge any remaining connectivity gaps in rural and underserved areas. Government initiatives, such as the FCC’s Rural Digital Opportunity Fund, further support satellite infrastructure development. Major telecom companies’ investments in 5G infrastructure contribute to strengthening satellite networks, while the increasing demand for IoT applications, autonomous vehicles, and low-latency communication in healthcare and manufacturing sectors boosts the market. Furthermore, ongoing advancements in satellite technologies, including Low Earth Orbit (LEO) satellites, promise improved bandwidth, scalability, and lower latency, contributing to enhanced network performance. The growing need for backup and disaster recovery communication in remote areas also strengthens the demand for satellite solutions, positioning the U.S. for continued growth in 5G satellite communication.

Europe 5G Satellite Communication Market Analysis

Europe's 5G satellite communication market is expanding due to rising demand for fast, reliable connectivity in urban and rural areas. The European Union's Digital Single Market strategy supports satellite services to enhance cross-border connectivity. This is vital in connecting remote areas like islands and mountainous regions where traditional infrastructure is limited. Additionally, as IoT applications and smart cities gain traction across the region, demand for low-latency, high-speed networks becomes critical. According to reports, 29% of EU enterprises were using IoT devices in 2021, primarily for securing their premises, highlighting the growing need for secure and robust satellite communication systems. The rise of LEO and MEO satellite systems promises better coverage, lower latency, and enhanced data speeds, which are expected to support Europe’s digital infrastructure. Furthermore, the European Space Agency and national governments are advancing satellite-based connectivity programs, aiming to enhance digital inclusion and provide reliable communication in emergencies or disaster-stricken areas. These factors, alongside regulatory support for innovation, position the region for significant growth in the 5G satellite communication market.

Asia Pacific 5G Satellite Communication Market Analysis

The APAC 5G satellite communication market is primarily driven by rapid urbanization and the growing demand for high-speed internet. South Korea leads the region with 31.3 Million 5G connections, representing 48% of its mobile connections, while China has over 700 Million 5G connections, accounting for 41% of its total mobile sector (GSMA). The demand for rural connectivity, especially in countries like India, is boosting investments in satellite infrastructure to bridge the digital divide. Furthermore, the increasing adoption of Internet of Things (IoT) technologies and the rise of smart city projects in nations such as Japan and Australia create a growing need for reliable, low-latency satellite networks. These factors contribute significantly to the market's expansion, as they support seamless connectivity for urban and rural areas alike, making satellite communications an integral part of the region’s digital transformation and future growth.

Latin America 5G Satellite Communication Market Analysis

The 5G satellite communication market in Latin America expands quickly because mobile internet usage continues to rise and MGR predicts 422 Million users by 2025. Government bodies are spending on satellite infrastructure to provide better connectivity services for rural regions and remote locations. The market expansion is also gaining momentum because of IoT technology adoption together with rising high-speed internet requirements. The regional developments serve essential purposes as they enhance digital accessibility while supporting both urban and rural areas and facilitating digital transformation in the region.

Middle East and Africa 5G Satellite Communication Market Analysis

The Middle Eastern and African 5G satellite communication market continues to grow because organizations strive to establish better broadband infrastructure in distant areas. By 2022 Saudi Arabia has become the top 5G provider in the world through its 11.2 Million subscriptions which represent 26% of mobile subscriptions. Satellite communication has become essential for the optimization of oil, gas, and logistic operations. The market development is further driven by essential connectivity needs in demanding locations which promotes advanced technology development together with economic efficiency primarily in areas with limited service and industrial areas.

Competitive Landscape:

Key market players in the 5G satellite communication industry are actively investing in technological advancements, strategic partnerships, and large-scale satellite deployments. LEO satellite constellations are being launched to expand global 5G coverage, ensuring seamless connectivity in remote and underserved regions. Major telecom providers are collaborating with satellite operators to enhance network capabilities and support high-speed data transmission. Additionally, the increasing R&D efforts focus on improving satellite efficiency, reducing latency, and enabling seamless integration with terrestrial 5G networks. As advancements in high-throughput and low-latency satellite systems continue, the 5G satellite communication market is experiencing rapid expansion across commercial, defense, and industrial sectors.

The report provides a comprehensive analysis of the competitive landscape in the 5G satellite communication market with detailed profiles of all major companies, including:

- Gilat Satellite Networks Ltd.

- Intelsat S.A

- Omnispace LLC

- Sateliot

- SES S.A.

- ST Engineering

- Thales Group

Latest News and Developments:

- December 2024: ESA and Telesat have set a world-first by establishing a 5G Non-Terrestrial Network (NTN) connection between a Low Earth Orbit (LEO) satellite and the ground using the Ka-band frequency. This breakthrough enables real-time, interactive connections via low-flying satellites, with potential applications in telehealth, autonomous vehicles, disaster response, and in-flight internet services. The successful test was conducted at ESA's 5G/6G laboratory in the Netherlands, using the LEO 3 satellite operated by Telesat.

- November 2024: Viasat, Inc. joined the 5GAA alongside major tech and automotive companies to advance connected transport applications, including autonomous vehicles and predictive safety. The 5GAA fosters a unified connectivity ecosystem for transport, known as Cellular Vehicle-to-Everything (C-V2X), enabling real-time interactions between vehicles, infrastructure, and mobile networks.

- September 2024: SoftBank and Intelsat partnered to develop a hybrid 5G-satellite communication network, enabling seamless connectivity anywhere. The collaboration focused on integrating terrestrial mobile networks with satellite communications, addressing coverage gaps in remote regions, and enhancing connectivity for autonomous vehicles, ships, and drones.

- November 2023: Lockheed Martin has successfully tested its Advanced 5G Non-Terrestrial Network (NTN) Satellite Base Station, a crucial element of the 5G.MIL® Unified Network Solutions Program. The demonstration, held in October, showcased high-speed data transfers, including live video streaming, in a hardware-in-the-loop lab environment.

- February 2023: Samsung Electronics developed standardized 5G non-terrestrial network (NTN) modem technology for direct smartphone-to-satellite communication, enhancing connectivity in remote areas. Integrated into Exynos modem solutions, this innovation advances 5G satellite communications and lays the groundwork for the 6G-driven Internet of Everything (IoE).

5G Satellite Communication Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Orbits Covered | Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geosynchronous Earth Orbit (GEO) |

| Satellite Solutions Covered | Backhaul and Tower Feed, Trunking and Head-End-Feed, Communication on the Move, Hybrid Multiplay |

| Services Covered | Mobile Broadband, Defense and Government Mission Critical Communication, Satellite IoT |

| Spectrum Bands Covered | L and S Band (1-4GHZ), C and X Band (4-12GHZ), Ku and Ka Band (12-40GHZ) |

| End Users Covered | Defense, Government, Commercial, Consumer |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Gilat Satellite Networks Ltd., Intelsat S.A, Omnispace LLC, Sateliot, SES S.A., ST Engineering, Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the 5G satellite communication market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global 5G satellite communication market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the 5G satellite communication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The 5G satellite communication market was valued at USD 6.8 Billion in 2025.

IMARC estimates the 5G satellite communication market to exhibit a CAGR of 22.53% during 2026-2034, expecting to reach USD 44.4 Billion by 2034.

Key factors driving the 5G satellite communication include increasing demand for high-speed connectivity in remote areas, rising adoption of IoT and machine-to-machine (M2M) communication, growing defense and military applications, expanding rural broadband initiatives, continuous advancements in satellite technology, and the integration of satellite networks with terrestrial 5G infrastructure for seamless global coverage.

North America currently dominates the market, accounting for a share exceeding 34.8% in 2025. This dominance is fueled by the rising demand for rural broadband expansion, secure military communications, smart city development, industrial IoT adoption, advanced space technology investments, and government-backed infrastructure projects enhancing nationwide connectivity.

Some of the major players in the 5G satellite communication market include Gilat Satellite Networks Ltd., Intelsat S.A, Omnispace LLC, Sateliot, SES S.A., ST Engineering, Thales Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)