4K TV Market Size, Share, Trends and Forecast by Technology, Screen Size, End User, and Region, 2025-2033

4K TV Market Size and Share:

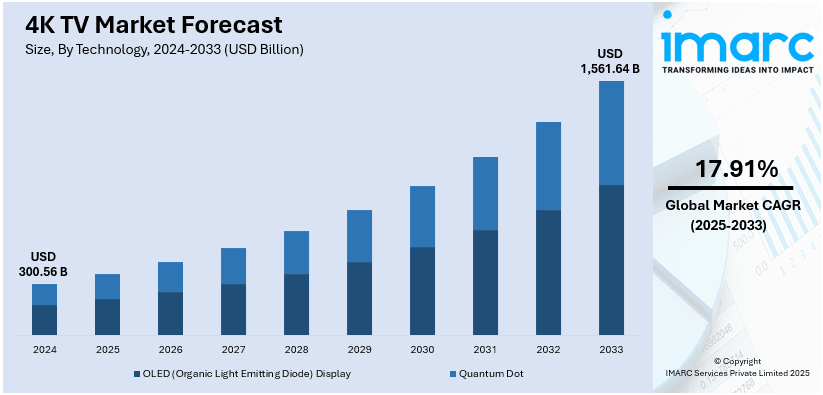

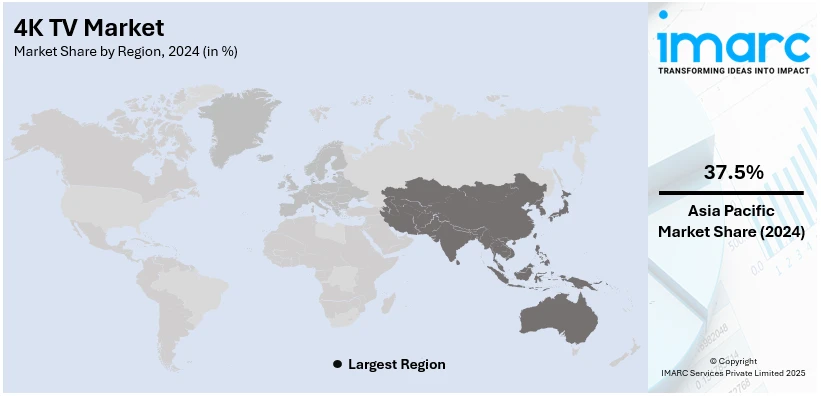

The global 4K TV market size was valued at USD 300.56 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,561.64 Billion by 2033, exhibiting a CAGR of 17.91% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 37.5% in 2024, driven by growing demand for high-quality visual experience and increasing digitalization efforts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 300.56 Billion |

| Market Forecast in 2033 | USD 1,561.64 Billion |

| Market Growth Rate (2025-2033) | 17.91% |

The market is seeing steady growth, fueled by consumer interest in premium display experiences, smart home integration, and brand-driven innovation. Manufacturers are focusing on advanced panel technologies, wireless features, and sleek designs to capture market share in competitive regions. As consumers seek immersive viewing and seamless design integration within modern living spaces, transparent displays and enhanced resolution are becoming important differentiators. The push toward minimalist, high-tech living rooms is also encouraging demand for visually unobtrusive TV models with advanced capabilities. In February 2025, Starpower announced the 2025 EXPO, featuring Texas' first public display of LG's 77" Transparent 4K OLED TV. The showcase offered a first-hand look at a fully wireless, see-through 4K television, drawing significant consumer attention. This development signaled growing demand for next-generation features and reinforced the shift toward premium models. It also positioned transparent OLED as a potential game-changer in the evolving 4K TV segment.

The United States has emerged as a significant growth center for the market, supported by the rapid rollout of 5G network infrastructure. Telecom providers are heavily investing in expanding 5G coverage to meet the rising demand for faster connectivity and enhanced streaming experiences. As of now, 5G low-band networks from major carriers cover over 300 Million people, while mid-band coverage reaches between 210 to 300 Million individuals. This widespread availability of high-speed networks is enhancing the performance of 4K TVs by enabling smooth streaming of ultra-high-definition content, faster downloads, and seamless integration with smart home systems. With the improved data transmission capabilities provided by 5G, 4K TVs are becoming more effective in handling high-bandwidth applications, further encouraging adoption across U.S. households. This strong alignment between advanced network infrastructure and television technology is positioning the country as a leading market for next-generation home entertainment solutions.

4K TV Market Trends:

Rising Consumer Demand for UHD Technology

The rising consumer demand for Ultra High Definition (UHD) technology is driving the 4K TV market growth. As the demand for UHD technology continues to rise globally, Omdia research highlights a major milestone, revealing that nearly 1 Billion UHD TVs were shipped worldwide as of September 2024. Since it enhances the desire for superior picture quality and immersive viewing experiences, it is gaining immense traction among consumers. Consumers are increasingly seeking TVs with higher resolution, vibrant colors, and better detail, making 4K technology appealing. This demand is fueled by the growing availability of 4K content from streaming services, gaming platforms, and broadcasters, along with the decrease in 4K TV prices, making these advanced features more accessible to a broader audience. For instance, in April 2021, Broadband TV News reported that UHD TV sets captured a 75% market share in Germany. In the first quarter of 2021, approximately 1.45 Million TV sets were sold, with 1.1 Million being UHD TVs. This significant uptake underscores the rising consumer demand for UHD technology, which is driving the growth of the 4K TV market. As more consumers seek enhanced viewing experiences, the demand for 4K UHD TVs continues to propel market expansion.

Technological Advancements and Competitive Pricing

The 4K TV industry has reaped benefits from rapid technological advancements, making high-resolution displays more affordable. Innovations in semiconductor and display technologies have significantly reduced production costs, allowing manufacturers to offer competitive pricing. Furthermore, DSCC states that improved market conditions in the display industry expected 47% growth in display equipment spending in 2024, reaching USD 7.3 Billion. Economies of scale further contribute, as increased production has led to more cost-efficient manufacturing processes, resulting in lower consumer prices. Brands also incorporate additional features like smart connectivity, voice controls, and built-in streaming apps, driving market growth. The availability of budget-friendly product variants has expanded the market, attracting first-time buyers and those upgrading from HD TVs. For instance, in June 2021, TCL, a China-based consumer electronics manufacturer, launched its first mini LED technology in the mini LED QLED 4K Android 11 TV C825. Unlike regular LEDs, mini LEDs are smaller in size, allowing original equipment manufacturers (OEMs) to pack more LEDs into the display. This advancement enhances picture quality and brightness, offering superior viewing experiences. The introduction of mini LED technology demonstrates TCL's commitment to innovation in the 4K TV market, driving consumer interest and market growth.

E-Commerce Boom

The rapid expansion of e-commerce is playing a major role in driving growth in the 4K TV market by enhancing accessibility, convenience, and consumer choice. Online platforms make it easier for consumers to browse a broad selection of 4K TV models, compare specifications, and read verified reviews, helping them make well-informed decisions. E-commerce also offers benefits like home delivery, easy return policies, and flexible payment options, which contribute to rising consumer confidence and higher purchase rates. As per the IMARC projection, the global e-commerce market will reach USD 26.8 Trillion in 2024 and is expected to soar to USD 214.5 Trillion by 2033. This enormous growth highlights the increasing reliance on digital platforms for high-value purchases, including electronics like 4K TVs. This surge is expanding digital retail infrastructure globally, increasing exposure for premium electronics such as 4K TVs. With frequent online promotional events and competitive pricing, consumers are more inclined to upgrade to high-definition displays. As a result, e-commerce continues to act as a key growth enabler for the 4K TV industry worldwide.

4K TV Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global 4K TV market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, screen size, and end user.

Analysis by Technology:

- OLED (Organic Light Emitting Diode) Display

- Quantum Dot

In 2024, OLED (organic light emitting diode) display led the 4K TV market, accounting for 56.5% of the total market share, driven by its exceptional picture quality, characterized by true blacks and vibrant colors. The self-emissive pixels in OLED screens eliminate the need for backlighting, resulting in more accurate color reproduction and ultra-thin designs. This technology's energy efficiency also appeals to eco-conscious consumers. Additionally, OLED's flexibility enables innovative designs such as curved and rollable screens. The premium viewing experience it offers attracts high-end consumers, further solidifying its market dominance. For instance, in January 2023, LG Electronics (LG Corporation) unveiled the 97-inch LG SIGNATURE OLED M (model M3), the first consumer TV globally to feature Zero Connect1. This innovative wireless technology enables real-time video and audio transfer at up to 4K 120Hz, setting a new standard for home entertainment

Analysis by Screen Size:

- Below 55 Inches

- 55-65 Inches

- Above 65 Inches

In 2024, below 55 inches led the 4K TV market, driven due to several key factors. Compact size, affordability, and compatibility with smaller living spaces made sub-55-inch 4K TVs highly attractive to urban households and individual users. These models offer the benefits of ultra-high-definition resolution without requiring extensive space, making them ideal for apartments and secondary rooms. Their cost-effectiveness compared to larger screens encouraged higher adoption rates among budget-conscious consumers. Additionally, frequent online discounts, bundled offers, and availability across both offline and e-commerce platforms further supported sales. Increasing content availability and enhanced streaming capabilities made smaller 4K TVs a practical, value-driven choice in both emerging and developed markets.

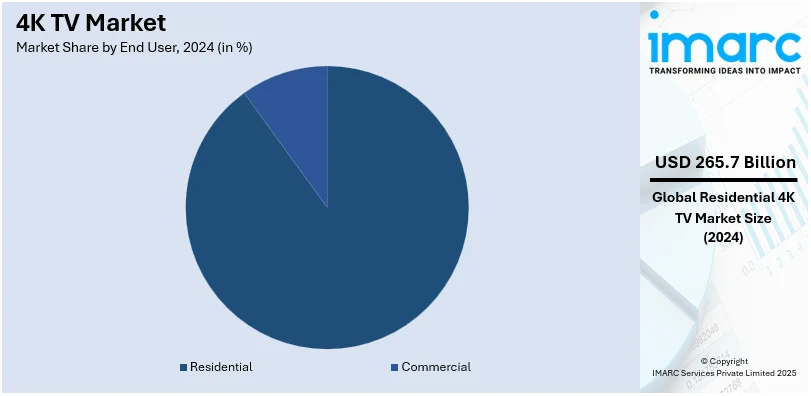

Analysis by End User:

- Residential

- Commercial

In 2024, residential led the 4K TV market, accounting for 88.4% of the total market share, fueled by rising consumer demand for immersive home entertainment experiences. The increasing popularity of OTT platforms, gaming consoles, and smart home integration has transformed 4K TVs into a staple of modern living rooms. Enhanced display quality, smart features, and affordable pricing encouraged households to upgrade from older models. The shift toward stay-at-home lifestyles and work-from-home setups also elevated media consumption, making high-resolution TVs essential for both entertainment and daily use. Easy access to online reviews and flexible financing options further influenced purchasing decisions, solidifying residential use as the primary driver behind the rapid expansion of the 4K TV market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific led the 4K TV market, accounting for 37.5% of the total market share, driven by .The Asia Pacific region is experiencing substantial growth in the 4K TV market, driven by the rapid expansion of broadband infrastructure, making high-speed internet widely accessible. This has boosted the rise of Over-the-Top (OTT) platforms, creating a strong ecosystem for 4K content consumption. Rising disposable incomes in countries like China, India, and South Korea are enabling consumers to invest in premium electronics, including 4K TVs. The presence of major electronics manufacturers in the region ensures competitive pricing and a wide range of options for consumers. Additionally, the growing popularity of eSports and online gaming, alongside government initiatives promoting advanced manufacturing and digital technologies, further supports market growth. Cultural factors, such as the popularity of local film industries and international sports events, also drive consumers to upgrade their home entertainment systems.

For instance, in August 2022, VU launched its new Ultra 4K TV line exclusively for the Indian market, featuring the Ultra-edge 4K display. These TVs offer Pro-picture Calibration, Parental Block, Upbeat Surround Sound, Backlight Controller, and 40% increased brightness. The range, priced between INR 25,999 and INR 48,999, includes models with screen sizes of 45, 50, 55, and 65 inches. The Pro Picture Calibration feature allows users to adjust gamma correction, color temperature, noise reduction, and HDMI dynamic range for a personalized viewing experience. Enhanced audio options include Upbeat Surround Sound, 30Watt Box Speakers, Sports Mode, and built-in Dolby Audio and DTS Virtual X Surround Sound Technologies.

Key Regional Takeaways:

United States 4K TV Market Analysis

In 2024, United States accounted for 86.50% of the market share in North America. The United States 4K TV market is witnessing substantial growth driven by increasing consumer preference for high-definition entertainment and home theater systems. Enhanced visual quality, larger screen sizes, and competitive pricing are influencing buying decisions, especially among tech-savvy consumers. The widespread availability of ultra-high-definition content across streaming platforms and broadcast channels further contributes to rising adoption rates. Additionally, the growing integration of smart features and voice control capabilities enhances the appeal of 4K TVs. The market is also benefiting from an uptrend in replacement cycles, with consumers opting for upgraded models offering better resolution and advanced functionalities. Retailers and manufacturers are focusing on product differentiation and promotional strategies to attract buyers across diverse income segments. Evolving lifestyle preferences, coupled with higher internet penetration, are accelerating the adoption of connected devices. Seasonal sales and financing options further support volume growth.

Europe 4K TV Market Analysis

The 4K TV market in Europe is growing due to a mature consumer electronics ecosystem and rising demand for advanced viewing technologies. Increasing household incomes and immersive entertainment are driving upgrades from standard HD to 4K resolution displays. Digital broadcasting and streaming platforms are driving market momentum. Energy-efficient features and aesthetic designs are also influencing consumer purchasing decisions. Retail dynamics and innovation in picture quality attract diverse consumer interest. Product affordability has also improved over time, broadening market reach and accessibility. Enhanced gaming experiences and cinematic visuals are appealing to a wider audience, particularly younger demographics. Technological integration with smart home ecosystems and voice assistants adds another layer of functionality, making 4K TVs a central part of modern living spaces. Furthermore, with the European Commission reporting that 94% of EU households had internet access in 2024, the infrastructure is well-positioned to support the continued rise in smart 4K TV adoption. As content providers expand their 4K offerings, demand is expected to maintain an upward trend across both urban and suburban households.

Asia Pacific 4K TV Market Analysis

The Asia Pacific 4K TV market is expanding rapidly, fueled by rising disposable incomes, digital transformation, and increasing consumer interest in smart home devices. Growing urbanization and an expanding middle class are creating demand for upgraded entertainment experiences, where 4K TVs are emerging as a preferred choice. Price competitiveness and localized manufacturing are enhancing affordability, allowing deeper market penetration across various income groups. Enhanced features such as high dynamic range, smart connectivity, and sleek design align with consumer expectations for value and innovation. The popularity of online content consumption is also playing a key role in market growth, as more users demand high-resolution displays for an enriched viewing experience.

Latin America 4K TV Market Analysis

The 4K TV market in Latin America is expanding due to increased awareness about high-definition display technologies and consumer preference for enhanced viewing experiences. The market is driven by increased availability of 4K content, affordability improvements, and consumer shift toward larger screen formats and advanced features. Economic growth in urban areas and retail strategies are also contributing to this growth. As demand rises across a broader demographic, manufacturers are responding with a wider product range catering to diverse preferences and budgets. Furthermore, Brazil’s USD 186.6 Billion investments in digital transformation, as stated by the Brazilian NR, reflect a broader regional trend toward digital advancement, which is likely to further accelerate 4K TV adoption as consumers gain access to enhanced digital services and content.

Middle East and Africa 4K TV Market Analysis

The 4K TV market in the Middle East and Africa is showing upward momentum, supported by increasing digital connectivity and growing interest in home entertainment systems. As consumers become more inclined toward high-quality visuals and smart features that enhance the viewing experience, the demand for 4K televisions is expected to rise. The expansion of e-commerce platforms and wider availability of content in ultra-high-definition formats further contribute to the market’s positive outlook. As disposable incomes gradually rise and urbanization continues, more households are incorporating advanced entertainment devices into their living spaces.

Competitive Landscape:

Key players in the 4K TV market are continuously innovating to offer features like improved HDR, higher refresh rates, and better color accuracy. They adopt competitive pricing strategies to reach a wider demographic, introducing budget-friendly models with essential 4K features to attract entry-level consumers. Companies are partnering with content providers, gaming firms, and sports events to showcase their 4K TVs' capabilities. Special promotions and discounts are common during major sporting events and holidays. Additionally, significant investments in consumer education through in-store demonstrations, online videos, and detailed buying guides are supporting the market. Enhanced after-sales service, warranty extensions, and quality assurance are becoming crucial in building brand loyalty and influencing consumer decisions, contributing to market growth.

The report provides a comprehensive analysis of the competitive landscape in the 4K TV market with detailed profiles of all major companies, including:

- Haier Inc

- Hisense Group

- Hitachi Ltd

- Koninklijke Philips N.V

- LG Electronics (LG Corporation)

- Panasonic Holdings Corporation

- Samsung Electronics Co. Ltd.

- Sceptre Inc

- Sharp Corporation

- Sony Group Corporation

- TCL Technology

- Vizio Inc

- Vu Televisions

Latest News and Developments:

- April 2025: Xiaomi launched the X Pro QLED (2025) smart TV series in India, offering 43-inch, 55-inch, and 65-inch variants with 4K resolution, Dolby Vision, and HDR10+ support. The TVs featured Xiaomi's Vivid Picture Engine 2, a Quad Core A5 chip, and up to 34W audio output.

- March 2025: Samsung introduced its 2025 Neo QLED 4K TVs, featuring the advanced Samsung Vision AI technology. The TVs also include AI upscaling to 4K resolution, adaptive sound, and a refreshed One UI Tizen interface with custom profiles.

- November 2024: LG announced its 2024 TV lineup, featuring the G4 and M4 OLED models powered by the new A11 AI chipset, offering improved graphics, processing speed, and AI-driven upscaling. The lineup also included the QNED99T, with enhanced UI, webOS Dynamic Q Card, and built-in virtual surround sound.

- September 2024: Sony launched a new series of AI-driven smart 4K OLED TVs in India. The TVs featured a studio-calibrated mode for enhanced viewing.

- June 2024: Samsung launched its 2024 QLED 4K TV series in India, featuring Quantum Dot, Quantum HDR, and 4K upscaling. Available in 55", 65", and 75" sizes, the TVs offer enhanced viewing with Quantum Processor Lite 4K, Q-Symphony, and Pantone Validation.

4K TV Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | OLED (Organic Light Emitting Diode) Display, Quantum Dot |

| Screen Sizes Covered | Below 55 Inches, 55-65 Inches, Above 65 Inches |

| End Users Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Haier Inc, Hisense Group, Hitachi Ltd, Koninklijke Philips N.V, LG Electronics (LG Corporation), Panasonic Holdings Corporation, Samsung Electronics Co. Ltd., Sceptre Inc, Sharp Corporation, Sony Group Corporation, TCL Technology, Vizio Inc, Vu Televisions, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the 4K TV market from 2019-2033.

- The 4K TV market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the 4K TV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The 4K TV market was valued at USD 300.56 Billion in 2024.

The 4K TV market is projected to exhibit a CAGR of 17.91% during 2025-2033, reaching a value of USD 1,561.64 Billion by 2033.

Key factors driving the 4K TV market include rising demand for ultra-high-definition content, increasing adoption of smart TVs, growth in disposable incomes, technological advancements in display panels, expanded OTT streaming services, and consumer preference for immersive viewing experiences in both developed and emerging markets.

In 2024, Asia-Pacific dominated the 4K TV market, accounting for the largest market share of 37.5%. The growth is driven by rising disposable incomes, strong demand for advanced home entertainment systems, rapid urbanization, and expanding availability of high-resolution content across emerging economies in the region.

Some of the major players in the 4K TV market include Haier Inc, Hisense Group, Hitachi Ltd, Koninklijke Philips N.V, LG Electronics (LG Corporation), Panasonic Holdings Corporation, Samsung Electronics Co. Ltd., Sceptre Inc, Sharp Corporation, Sony Group Corporation, TCL Technology, Vizio Inc, Vu Televisions, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)