3D Printing Materials Market Report by Type (Polymers, Metals, Ceramic, and Others), Form (Powder, Filament, Liquid), End User (Consumer Products, Aerospace and Defense, Automotive, Healthcare, Education and Research, and Others), and Region 2025-2033

Market Overview:

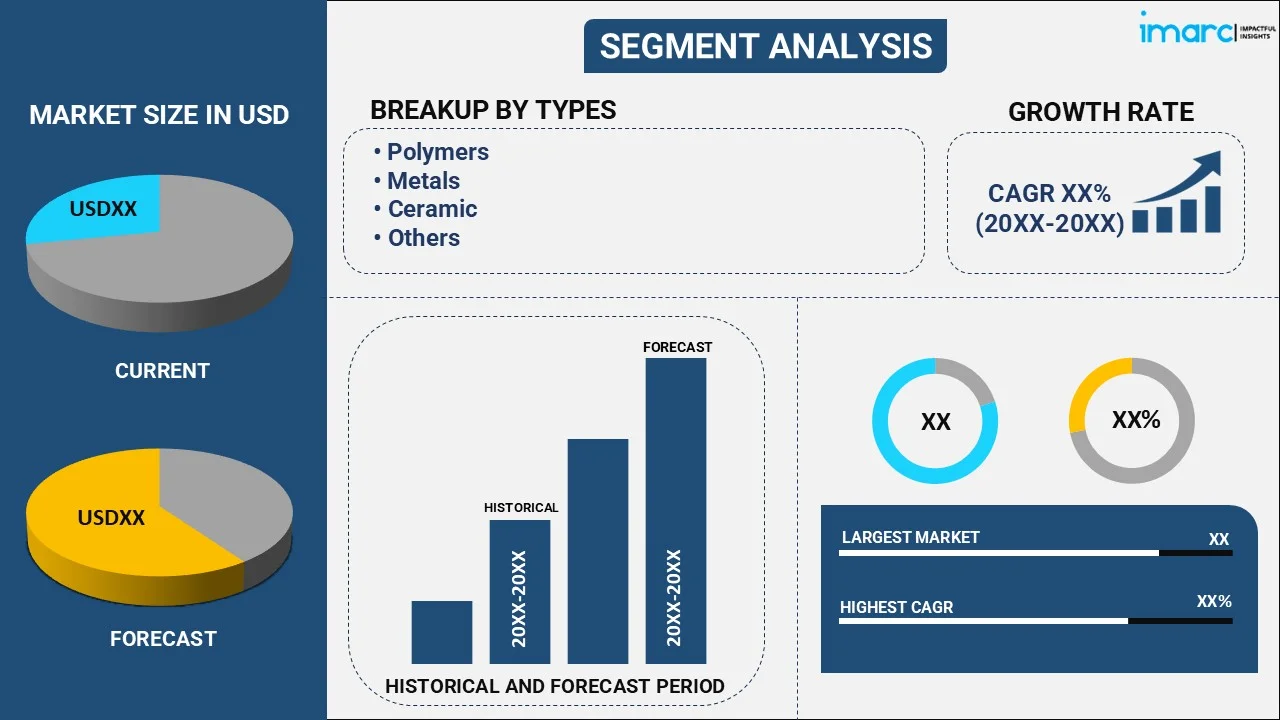

The global 3D printing materials market size reached USD 3.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.4 Billion by 2033, exhibiting a growth rate (CAGR) of 15.59% during 2025-2033. The growing demand for 3D printing materials from the industrial sector, the introduction of biocompatible and sterilizable materials, and favorable government regulations represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.2 Billion |

|

Market Forecast in 2033

|

USD 12.4 Billion |

| Market Growth Rate 2025-2033 | 15.59% |

3D printing materials are widely utilized in the additive manufacturing process. They come in a variety of forms and are used to create objects from a digital files. One of the most common 3D printing materials is thermoplastics, which are melted and formed using a 3D printer. They offer a variety of properties, including low cost, flexibility, and strength, making them the most popular type of 3D printing material. Other materials used in 3D printing include metal, carbon fiber, ceramic, and composite materials. Each material offers its own unique properties, allowing users to customize the objects they create. For instance, metal 3D printing materials provide superior strength, while carbon fiber and composite materials offer lighter weight and improved durability. Ceramics are used to create objects with a glossy finish, while composite materials provide a range of colors and textures. As a result, they are gaining widespread prominence across the globe as 3D printing materials provide a range of options for creating objects from digital files to the users.

Global 3D Printing Materials Market Trends:

The escalating demand for 3D printing materials from the industrial sector majorly drives the global market. This can be supported by the growing product adoption across various industries, including aerospace, healthcare, automotive, and architecture. Additionally, the widespread adoption has created a demand for 3D printing materials to meet the specific needs of these industries. For instance, the aerospace industry requires lightweight and high-strength materials, while the healthcare industry requires biocompatible and sterilizable materials, which is acting as another growth-inducing factor. In line with this, 3D printing materials are revolutionizing the field of medicine, allowing the production of customized medical devices, implants, and organs. This, in turn, is growing demand for 3D printing materials that are biocompatible, which do not cause an adverse reaction when implanted in the human body, propelling the market further. Apart from this, governments of various countries are promoting the adoption of 3D printing technology in various industries through funding programs, tax incentives, and subsidies, driving the demand on the global level. Moreover, the introduction of new 3D printing technologies, such as stereolithography (SLA), fused deposition modeling (FDM), and selective laser sintering (SLS) to develop new materials that are optimized for each technology is creating a positive market outlook. Some of the other factors driving the market include continual technological advancements and extensive research and development (R&D) activities.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global 3D printing materials market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on type, form and end user.

Type Insights:

- Polymers

- Acrylonitrile Butadiene Styrene (ABS)

- Polylactic Acid (PLA)

- Photopolymers

- Nylon

- Others

- Metals

- Steel

- Titanium

- Aluminum

- Others

- Ceramic

- Silica Sand

- Glass

- Gypsum

- Others

- Others

- Laywood

- Paper

- Others

The report has provided a detailed breakup and analysis of the 3D printing materials market based on the type. This includes polymers (acrylonitrile butadiene styrene (ABS), polylactic acid (PLA), photopolymers, nylon, others); metals (steel, titanium, aluminum, others); ceramic (silica sand, glass, gypsum, others); and others (laywood, paper, others). According to the report, polymers represented the largest segment.

Form Insights:

- Powder

- Filament

- Liquid

A detailed breakup and analysis of the 3D printing materials market based on the form have also been provided in the report. This includes powder, filament, and liquid. According to the report, filament accounted for the largest market.

End User Insights:

- Consumer Products

- Aerospace and Defense

- Automotive

- Healthcare

- Education and Research

- Others

The report has provided a detailed breakup and analysis of the 3D printing materials market based on the end user. This includes consumer products, aerospace and defense, automotive, healthcare, education and research, and others. According to the report, automotive represented the largest segment.

Regional Insights:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for 3D printing materials. Some of the factors driving the North America 3D printing materials market included continual technological advancements, escalating demand for 3D printing materials from the industrial sector, extensive research and development (R&D) activities, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global 3D printing materials market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include 3D Systems Inc., Arkema S.A., Carbon Inc., Clariant AG, EOS, Formlabs, Höganäs AB, Markforged, Materialise NV, Sandvik AB, Stratasys Ltd., Taulman3d LLC, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Type, Form, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3D Systems Inc., Arkema S.A., Carbon Inc., Clariant AG, EOS, Formlabs, Höganäs AB, Markforged, Materialise NV, Sandvik AB, Stratasys Ltd. and Taulman3d LLC |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the 3D printing materials market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global 3D printing materials market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the 3D printing materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global 3D printing materials market was valued at USD 3.2 Billion in 2024.

We expect the global 3D printing materials market to exhibit a CAGR of 15.59% during 2025-2033.

The rising utilization of 3D printing materials across various industry verticals, such as automotive, electronics, and healthcare for producing open-source designs with mass customization is primarily driving the global 3D printing materials market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous end-use industries for 3D printing materials.

Based on the type, the global 3D printing materials market can be segmented into polymers, metals, ceramic, and others. Currently, polymers hold the majority of the total market share.

Based on the form, the global 3D printing materials market has been divided into powder, filament, and liquid. Among these, filament currently exhibits a clear dominance in the market.

Based on the end user, the global 3D printing materials market can be categorized into consumer products, aerospace and defense, automotive, healthcare, education and research, and others. Currently, the automotive industry accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global 3D printing materials market include 3D Systems Inc., Arkema S.A., Carbon Inc., Clariant AG, EOS, Formlabs, Höganäs AB, Markforged, Materialise NV, Sandvik AB, Stratasys Ltd., and Taulman3d LLC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)