3D Cell Culture Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

3D Cell Culture Market Size and Share:

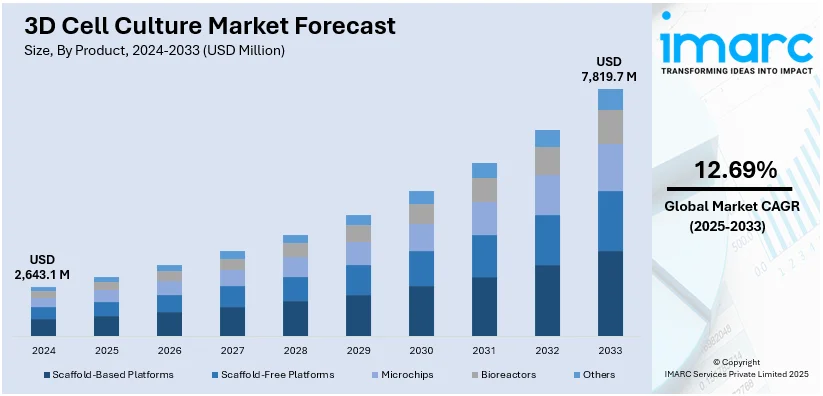

The global 3D cell culture market size was valued at USD 2,643.1 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 7,819.7 Million by 2033, exhibiting a CAGR of 12.69% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39.8% in 2024. The rising need for 3D tissue-engineered models to diagnose cancer and airway and air-liquid interface organoids, along with the widespread utilization of cell culture in studies that require in vivo model systems represent some of the key factors increasing the 3D cell culture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,643.1 Million |

| Market Forecast in 2033 | USD 7,819.7 Million |

| Market Growth Rate (2025-2033) | 12.69% |

The 3D cell culture market is driven by several key factors. Increasing adoption of 3D cell culture models in drug discovery and development is one of the primary drivers, as these models better replicate in vivo conditions as compared to traditional 2D cultures. The growing demand for more accurate, efficient, and cost-effective platforms in biomedical research, especially in cancer and regenerative medicine, is offering a favorable 3D cell culture market outlook. Technological advancements in scaffold materials, bioreactors, and culture media are improving the performance and scalability of 3D culture systems. Additionally, rising investments in personalized medicine and the increasing emphasis on reducing animal testing are contributing to the market expansion. The growing focus on tissue engineering and organ-on-a-chip technologies also supports the demand for 3D cell culture solutions.

Free PDF Sample to Learn More About This Market Get a Free Sample PDF

The 3D cell culture market in the United States is driven by a growing focus on personalized medicine and the need for more accurate drug testing models. 3D cell cultures offer better replication of human tissue behavior as compared to traditional 2D models. The rising prevalence of chronic diseases, such as cancer and cardiovascular conditions, is propelling research into more effective treatments, boosting demand for 3D culture systems. Technological advancements in scaffold materials, bioreactors, and culture media have improved the efficiency and scalability of 3D cell cultures, thereby supporting the 3D cell culture market growth. For instance, in April 2024, Sartorius, a life science organization, and TheWell Bioscience, a U.S.-based startup, decided to collaborate on the advancement of hydrogels and bioinks designed to create 3D advanced cell models for drug discovery processes. In addition, Sartorius will invest in a minority stake in TheWell Bioscience and distribute its products, broadening the scope of its lab business. Besides this, increased funding for biomedical research, regulatory support for reducing animal testing, and the expanding biotechnology sector are driving market growth.

3D Cell Culture Market Trends:

Advancements in Cell-Based Research

Three-dimensional cell culture systems used to discover drugs, study tumors, and understand the behavior of stem cells are being increasingly adopted and are a major driver for the growth of the 3D cell culture market. Unlike traditional 2D cultures, 3D cell culture systems offer enhanced predictive accuracy by closely mimicking the physiological conditions of living organisms. This has led to their extensive use in academic and industrial research for better experimental outcomes.

In cancer research, the demand for 3D cell cultures is increasing as these allow for development of physiologically relevant models that can almost exactly mimic a tumor microenvironment, thereby being helpful in achieving better understanding of the disease. The World Health Organization reports there were more than 19.3 million cases of new cases of cancer recorded worldwide in the year 2020. It is an urgent need today to develop these advanced research tools. This increased dependency on 3D culture technologies for treatment development and precision oncology further cements their place as the bedrock for moving medical research and solutions toward personalized medicine.

Increased Demand for Organ-On-Chip Models

One of the key 3D cell culture market trends is organ-on-chip (OoC) systems that use 3D cell culture technology to mimic the functionality of a human organ. These systems present a closer analogy to human physiology and, as such, prove to be valuable tools for drug testing and modeling diseases. OoC technology reduces the dependence on animal testing, thereby offering ethical and practical advantages that are in line with regulatory trends and industry needs for more precise and reliable drug development methods.

Organ-on-chip technology in drug development can, therefore, reduce the total costs for research and development by 25% of a drug candidate. This aspect, coupled with enhanced predictability in preclinical testing, makes the 3D cell culture-based OoC systems a transforming tool for the pharmaceutical industry. Demand for such innovative, cost-effective, and ethical methods of research will increase at an accelerated pace and drive further growth in this market.

Growing Focus on Personalized Medicine

The focus on personalized medicine has been on the rise, demanding physiologically relevant models like 3D cell cultures, which closely mimic the in vivo environment. These advanced models enable the development of tailored treatment strategies by providing more accurate insights into individual patient responses than traditional methods. The significance of personalized medicine, especially in precision health, has had a huge impact on the adoption of 3D cell culture systems in research and clinical applications.

The 3D cell culture market is further boosted by the increase in funding initiatives focused on the advancement of personalized healthcare. For example, in April 2022, the Canadian government announced the "All for One" precision health partnership to improve the health outcomes of Canadians. The program increases access to genome-wide sequencing, which is crucial for diagnosing and treating severe genetic disorders. Such initiatives underscore an increasing global push toward precision medicine, thereby underlining the higher demand for innovative 3D culture technologies in support of these transformative healthcare approaches.

Ethical Shift from Animal Testing

The growing awareness about the moral and scientific limitations of animal-based research is intensifying efforts to develop human-relevant models that provide accurate biological insights. Regulatory agencies worldwide are enforcing stricter guidelines on animal testing, particularly in drug development and cosmetics, prompting companies to adopt advanced in vitro systems. 3D cell culture technologies, including organoids and scaffold-based models, replicate physiological conditions more effectively than traditional methods, enhancing predictive accuracy in toxicity screening and disease modeling. The shift towards cruelty-free testing is particularly evident in the pharmaceutical and cosmetics sectors, where companies are investing in innovative platforms to comply with evolving policies and consumer expectations. As funding for alternative testing methods increases and bioprinting technologies advance, 3D cell cultures are gaining traction as a reliable and ethical solution for research and therapeutic development, reducing reliance on animal models without compromising scientific progress. In 2024, EU-funded researchers working on the ENLIGHT project advanced 3D bioprinting to create miniature human pancreas models, improving diabetes treatment testing. Their technology uses light-based printing to maintain cell viability and structure. Another EU project, PRISM-LT, explores 3D printing for both medical applications and cruelty-free cultured meat production.

3D Cell Culture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global 3D cell culture market report, along with forecasts at the global, regional and country level from 2025-2033. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Scaffold-Based Platforms

- Scaffold-Free Platforms

- Microchips

- Bioreactors

- Others

Scaffold-based platforms leads the market with around 48.9% of the market share in 2024 due to their ability to mimic the natural extracellular matrix, providing a more realistic environment for cell growth and differentiation compared to traditional 2D cultures. These platforms offer better cellular interactions, nutrient diffusion, and waste removal, leading to enhanced cell viability, functionality, and tissue formation. They support various applications such as drug testing, tissue engineering, and disease modeling. Additionally, scaffold-based systems allow for the customization of material properties, enabling precise control over cell behavior. The increasing demand for advanced drug development, personalized medicine, and regenerative therapies further drives the growth of scaffold-based platforms in the 3D cell culture market.

Analysis by Application:

- Cancer Research

- Stem Cell Research

- Drug Discovery

- Regenerative Medicine

- Others

Cancer research holds the largest share of the 3D cell culture market due to advancements in research studies that require improved models of tumor behavior. Traditional Two-dimensional cultures fail to mimic in vivo tumor characteristics and therefore, three-dimensional cell cultures are crucial for understanding cancer cell development, invasion, and resistance to treatment. In addition, the toxicity and efficacy of treatments can be predicted in 3D cultures, making them valuable tools for cancer treatment development. The continuously rising cancer incidence rate and the growing need for targeted treatments are pushing the 3D cell culture technologies demand, making cancer research the largest application in the market.

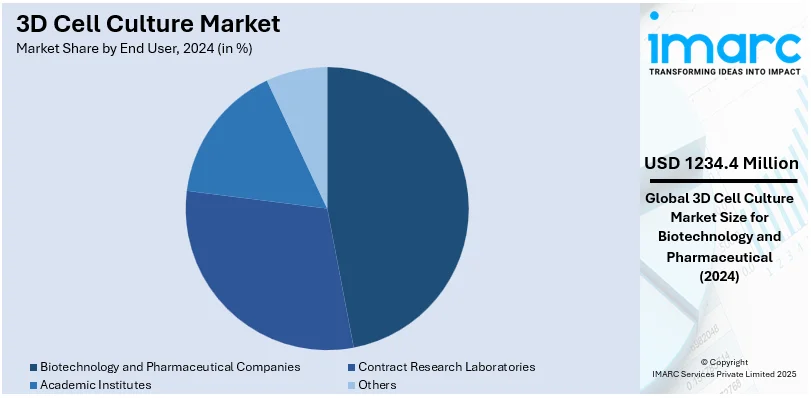

Analysis by End User:

- Biotechnology and Pharmaceutical Companies

- Contract Research Laboratories

- Academic Institutes

- Others

Biotechnology and pharmaceutical companies lead the market with around 46.7% of market share in 2024. Biotechnology and pharmaceutical companies hold the largest share of the 3D cell culture market due to their reliance on advanced cell culture models for drug discovery, development, and testing. These companies require more accurate in vitro systems to predict drug efficacy, toxicity, and safety, making 3D cell cultures ideal for simulating human tissues and organs. The increasing trends of the personalized approach to medicine miniaturization and reduction of animal-testing requirements also add to the usage of 3D culture platforms. Furthermore, massive amounts of funding are directed toward research and development (R&D) to reach advanced solutions in 3D cell culture for optimization of their drug discovery and therapeutic efficacy. Therefore, the 3D cell culture market forecast indicates growth, driven by increasing R&D investments, advancements in personalized medicine, and the rising demand for innovative in vitro models to enhance drug discovery and development.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.8%. The 3D cell culture market in North America is driven by several factors. Growing investments in biomedical research, particularly in drug discovery, cancer research, and personalized medicine, are leading to increased adoption of advanced 3D culture models. These models better replicate human tissue behavior compared to traditional 2D cultures, improving the accuracy and predictability of drug testing. The rising prevalence of chronic diseases like cancer and cardiovascular conditions fuels the demand for effective treatments, boosting research activities. Technological advancements in scaffold materials, bioinks, and culture media are enhancing the performance of 3D cell culture systems. Additionally, regulatory pressures to reduce animal testing and the presence of key industry players and research institutions in North America further drive market growth.

Key Regional Takeaways:

United States 3D Cell Culture Market Analysis

In 2024, the United States accounted for the largest market share of over 76.80% in North America. The United States 3D cell culture market is growing rapidly, influenced by the ever-increasing number of cancer patients and the rising demand for research tools that are highly advanced to enable the development of effective treatments. The National Cancer Institute estimates that in 2024, around 2,001,140 new cancer cases will be identified in the U.S., with 611,720 fatalities resulting from the illness. This scary data points highlight the demand for innovative, physiologically relevant models for bettering research on cancer as well as discovering drugs.

The 3D cell culture system allows a more biologically relevant, transformative approach when compared to 2D in terms of imitating the microenvironment of tumors in vivo. Such improved accuracy helps researchers get better insights in cancer progression and metastasis besides the therapeutic responses. As a result, the adoption of 3D cell culture technologies in academic, clinical, and industrial research is accelerating. In addition, increasing investments in cancer research and biopharmaceutical innovation in the United States are poised to drive further advancements in this critical market segment.

Europe 3D Cell Culture Market Analysis

The market for Europe 3D cell culture is growing on robust grounds, as pharmaceutical research and development spendings have been enhanced throughout the region. According to an industry report, pharmaceutical R&D spendings in the European Union have been seen to grow by an average of 4.4% per annum between 2010 and 2022. This has increased spendings from Euro 27.8 Billion (USD 28.3 Billion) to Euro 46.2 Billion (USD 47.1 Billion) during this period. This significant increase reflects the region's dedication to the development of drug discovery and development.

Increased R&D spending is fueling the adoption of novel technologies, including 3D cell culture systems, which are more physiologically relevant than traditional 2D models. These systems allow for more accurate preclinical testing and disease modeling, which is in line with the increasing focus of the industry on personalized medicine and targeted therapies. With European pharmaceutical companies focusing more on innovation and efficiency, the demand for 3D cell culture technologies is likely to grow further in support of advanced research and therapeutic breakthroughs.

Asia Pacific 3D Cell Culture Market Analysis

The Asia Pacific 3D cell culture market is growing strongly with the escalating rate of cancer cases in this region. According to the NIH, the five most common cancers diagnosed in Asia in 2020 were lung cancer (1,315,136 new cases, 13.8% of all newly reported cases), breast cancer (1,026,171 cases, 10.8%), colorectal cancer (1,009,400 cases, 10.6%), stomach cancer (819,944 cases, 8.6%), and liver cancer (656,992 cases, 6.9%). This alarming prevalence requires the need for advanced research tools and models in the study of these diseases.

3D cell culture systems provide unprecedented advantages in cancer research by providing physiologically relevant models that closely mimic in vivo tumor microenvironments. Such systems will allow for more accurate drug testing and personalized treatment development, in line with the growing focus of the region on precision medicine. As healthcare and research infrastructure continue to expand in Asia Pacific, the adoption of 3D cell culture technologies is poised to accelerate, addressing critical gaps in oncology research and driving market growth.

Latin America 3D Cell Culture Market Analysis

Latin America 3D cell culture markets will spur ahead, driven by surging prevalence of cancer in the region. An estimated 1.5 million new cancer cases occur annually in Latin America and the Caribbean, coupled with about 700,000 deaths, as estimated by the European Society for Medical Oncology. The incidence and mortality rates of the region are 186.5 and 86.6 per 100,000, respectively; hence, the need for more advanced research tools to combat the ever-growing public health challenge.

3D cell culture systems have emerged as crucial to offer physiologically relevant models that closely recapitulate in vivo conditions enabling more effective cancer research, drug discovery, and personalized treatment development. The increasing modernization of the research infrastructure and incorporation of precision medicine approaches by the health care systems in Latin America is likely to increase the demand for 3D cell culture technologies. Such innovations respond to some of the region's dire needs for the development of effective solutions to improve patient outcomes and reduce the cancer-related burden.

Middle East and Africa 3D Cell Culture Market Analysis

The Middle East and Africa 3D cell culture market is expected to grow exponentially with the rising prevalence of cancer in the region. New cancer incidence rates per 100,000 population rose between 10% and 100% between 2000 and 2019, based on industry reports. The incidence is projected to increase further until 2040 by at least 27% in Egypt, and as much as 208% in the United Arab Emirates, due largely to projected changes in demographics, such as population aging and urbanization.

This is a worrying increase in cancer cases, which necessitates more advanced research and therapeutic solutions, including 3D cell culture systems. These technologies allow for the creation of more accurate, physiologically relevant models for cancer research and drug discovery, thereby reducing reliance on traditional methods and improving treatment outcomes. Governments and private sectors in the region are investing more in modernizing healthcare and research infrastructure, which is expected to bolster the adoption of 3D cell culture technologies, ultimately addressing the region's growing healthcare challenges.

Competitive Landscape:

The 3D cell culture market is highly competitive, with key players such as Thermo Fisher Scientific, Corning Incorporated, Merck KGaA, and Lonza Group leading the sector. These companies focus on product innovation, offering advanced 3D culture platforms, scaffolds, and media that mimic in vivo conditions for more accurate research outcomes. Furthermore, there are new entrants especially small firms which are serving providers of disease models and research solutions encompassing 3D culture systems for drug discovery, cancer research, and regenerative medicine. Strategic alliances, affiliations, and acquisitions are frequent because firms seek to increase product offerings and research operations. The market is also witnessing significant R&D investments to improve technology and address unmet needs in cell-based assays.

The report has also provided a comprehensive analysis of the competitive landscape in the global 3D cell culture market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- 3D Biotek LLC

- Advanced Biomatrix Inc.

- Avantor Inc.

- CN Bio Innovations Limited

- Corning Incorporated

- Emulate Inc.

- InSphero AG

- Lonza Group AG

- Merck KGaA

- Promocell GmbH

- Synthecon Inc

- Thermo Fisher Scientific Inc.

Recent Developments:

- January 2025: Inventia Life Science launched RASTRUM™ Allegro, a high-throughput 3D cell culture platform designed to improve drug discovery and disease research. It enables scalable, reproducible, and cost-effective 3D cell modeling with minimal hands-on time. The technology enhances research efficiency, making advanced biology more accessible to laboratories worldwide.

- October 2024: MicroQuin used the ISS National Lab to grow 3D cancer cell cultures in microgravity, revealing key pathways for targeting cancer cells. Their research led to a new small-molecule drug that targets cancer cells specifically while leaving healthy ones unharmed. The findings also have potential applications for neurodegenerative diseases, brain injuries, and immunotherapy improvements.

- October 2024: Univercells Technologies announced the launch of the Scale-X Nexo bioreactor, focusing on improving the efficiency of developing cell culture processes for various therapeutic applications.

- September 2023: Curi Bio released two new platforms, Nautilus and Stingray, to assist researchers in studying electrophysiology in 2D and 3D cell culture conditions.

- July 2023: 3D BioFibR, a Canadian company, raised around USD 3.52 million in funding to further its business and launch collagen fiber products that are tailored for 3D bioprinting.

- February 2023: Corning Life Sciences has also announced new advanced tools for 3D cell culture, such as the Elplasia plate with an open-well format to catalyze easier manipulation of spheroids and organoids.

3D Cell Culture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Scaffold-Based Platforms, Scaffold-Free Platforms, Microchips, Bioreactors, Others |

| Applications Covered | Cancer Research, Stem Cell Research, Drug Discovery, Regenerative Medicine, Others |

| End Users Covered | Biotechnology and Pharmaceutical Companies, Contract Research Laboratories, Academic Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3D Biotek LLC, Advanced Biomatrix Inc., Avantor Inc., CN Bio Innovations Limited, Corning Incorporated, Emulate Inc., InSphero AG, Lonza Group AG, Merck KGaA, Promocell GmbH, Synthecon Inc, Thermo Fisher Scientific Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the 3D cell culture market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global 3D cell culture market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the 3D cell culture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The 3D cell culture market was valued at USD 2,643.1 Million in 2024.

IMARC estimates the 3D cell culture market to reach USD 7,819.7 Million by 2033, exhibiting a CAGR of 12.69% during 2025-2033.

Key factors driving the 3D cell culture market include increased demand for accurate drug testing models, advancements in scaffold materials and bioinks, growing adoption in cancer and personalized medicine research, regulatory pressure to reduce animal testing, and rising investments in biomedical R&D for more predictive, in vitro systems.

North America currently dominates the market, holding a significant share of 39.8%. This dominance can be attributed to its advanced healthcare infrastructure, high research and development investments, and strong presence of key biotech and pharmaceutical companies. The region has a robust pipeline of drug discovery and development processes that increasingly rely on 3D cell culture technologies for more accurate results. Additionally, the growing demand for personalized medicine, regenerative therapies, and organ-on-chip models has driven market growth. The U.S. and Canada also benefit from significant funding and collaborations in life sciences, fostering innovation and adoption of 3D cell culture platforms for academic and industrial applications. This, in turn, is creating a positive 3D cell culture market outlook.

Some of the major players in the 3D cell culture market include 3D Biotek LLC, Advanced Biomatrix Inc., Avantor Inc., CN Bio Innovations Limited, Corning Incorporated, Emulate Inc., InSphero AG, Lonza Group AG, Merck KGaA, Promocell GmbH, Synthecon Inc, Thermo Fisher Scientific Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)