Indian LED Lighting Market Size, Share, Trends and Forecast by Product Type, and Application, 2026-2034

Indian LED Lighting Market Summary:

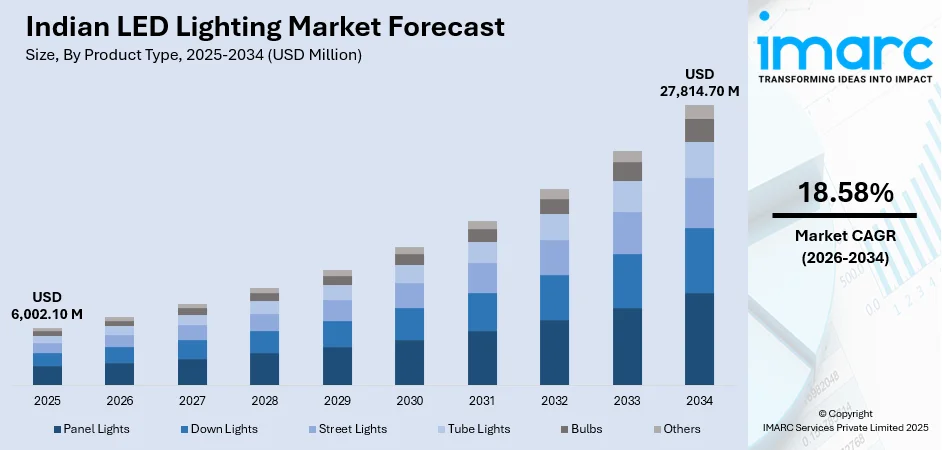

The Indian LED lighting market size was valued at USD 6,002.10 Million in 2025 and is projected to reach USD 27,814.70 Million by 2034, growing at a compound annual growth rate of 18.58% from 2026-2034.

The development of smart city infrastructure, government energy efficiency programs, and rising consumer demand for environmentally friendly lighting options are driving India's LED lighting market's explosive growth. The competitive landscape is changing as a result of declining production costs and technological improvements in smart lighting systems. India is becoming a major player in the worldwide Indian LED lighting market share due to rising urbanization, growing commercial real estate sectors, and consumer awareness of environmental issues. These factors are improving adoption rates across residential, commercial, and industrial applications.

Key Takeaways and Insights:

- By Product Type: Panel lights dominate the market with a share of 26% in 2025, because of their extensive use in contemporary retail areas, institutional structures, and commercial office buildings. Panel lights are the favored option for modern architectural projects due to their elegant design, consistent illumination, and exceptional energy economy.

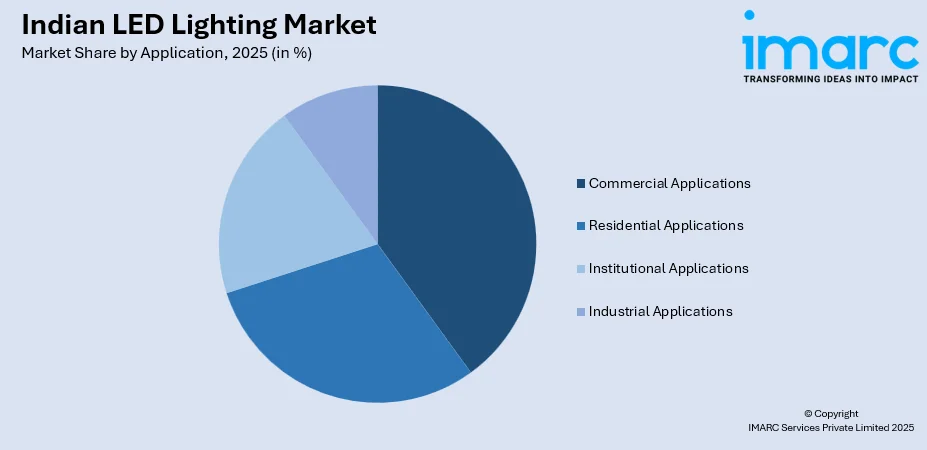

- By Application: Commercial applications lead the market with a share of 30% in 2025. This dominance is driven by rapid expansion of office spaces, retail establishments, hospitality venues, and healthcare facilities requiring energy-efficient lighting solutions. The implementation of Energy Conservation Building Code standards further accelerates commercial LED adoption.

- Key Players: Major companies drive market expansion through strategic product diversification, technology partnerships, and nationwide distribution network strengthening. Investments in smart lighting innovation, energy-efficient manufacturing, and collaborations with government initiatives enable sustained competitive positioning. Some of the key players operating in the market include Signify NV, Surya Roshni Limited, Crompton Greaves Consumer Electricals Limited, Bajaj Electricals Limited, Halonix Technologies Pvt. Ltd., and Havells India Limited.

To get more information on this market Request Sample

Government-led energy saving initiatives, growing infrastructure development, and growing consumer awareness of sustainable lighting options are some of the convergent factors driving the transformative growth of the Indian LED lighting industry. Millions of homes in both urban and rural areas now have access to energy-efficient lightbulbs thanks to national distribution programs, which have drastically reduced consumer electricity costs and produced huge energy savings. LED streetlights have been added in towns and village councils around the country as part of complementary public infrastructure plans, indicating the government's ongoing commitment to energy-efficient lighting solutions. Intelligent lighting solutions with extensive automation features and IoT capabilities are becoming more popular as a result of smart city development plans. Declining manufacturing costs through economies of scale, technological innovations in smart lighting controls and connectivity, and the expanding real estate sector are creating favorable conditions for sustained market expansion. Commercial establishments, institutional facilities, and industrial complexes are increasingly adopting LED solutions to comply with evolving building codes, meet sustainability targets, and reduce long-term operational expenses while enhancing occupant comfort and productivity.

Indian LED Lighting Market Trends:

Expansion of Smart Lighting and IoT Integration

India's LED lighting sector is experiencing significant technological transformation through the integration of Internet of Things connectivity, app-based controls, and intelligent automation systems. Smart lighting solutions featuring occupancy sensors, daylight harvesting, and remote monitoring capabilities are gaining traction across residential and commercial segments throughout the country. Leading manufacturers are establishing dedicated experience centers to showcase advanced lighting management systems and demonstrate emerging technologies to architects, designers, and facility managers. Companies are developing human-centric lighting solutions that adjust color temperature and intensity based on circadian rhythms, enhancing productivity and wellbeing in modern workspaces. These technological advancements enable building operators to optimize energy consumption, improve occupant comfort, and achieve sustainability objectives through intelligent lighting infrastructure.

Government-Led Distribution and Energy Efficiency Programs

Government initiatives continue reshaping the Indian LED lighting market growth through ambitious distribution programs and stringent energy efficiency mandates. The UJALA scheme transformed consumer adoption patterns by reducing LED bulb procurement prices from INR 310 to INR 38.45 through demand aggregation strategies. As of January 2025, Energy Efficiency Services Limited successfully installed over 1.34 Crore LED streetlights across municipalities and gram panchayats, achieving annual energy savings exceeding 9,001 Million Units. These programs demonstrate India's commitment to sustainable illumination while establishing frameworks for continued market expansion through public-sector procurement.

Growth of E-Commerce and Digital Distribution Channels

Digital commerce is revolutionizing LED lighting distribution, enabling manufacturers to reach previously underserved tier-two and tier-three markets across the country. Online platforms have recorded strong growth driven by smartphone proliferation and widespread digital payment adoption among consumers. E-commerce channels prove particularly effective for smart bulbs and IoT-enabled lighting kits requiring extended consumer education and comparison shopping before purchase decisions. Manufacturers are establishing direct-to-consumer storefronts to capture higher margins while gathering real-time demand analytics that inform product development and inventory management. This digital transformation is prompting traditional wholesalers to develop omnichannel strategies combining physical presence with online capabilities for sustained competitiveness in an evolving retail landscape.

Market Outlook 2026-2034:

India's LED lighting market is positioned for sustained expansion, supported by infrastructure modernization initiatives, declining product costs, and evolving consumer preferences toward energy-efficient solutions. The market generated a revenue of USD 6,002.10 Million in 2025 and is projected to reach a revenue of USD 27,814.70 Million by 2034, growing at a compound annual growth rate of 18.58% from 2026-2034. Expanding smart city developments, continued government procurement programs, and increasing domestic manufacturing capabilities are expected to accelerate revenue generation. The integration of advanced technologies including smart controls, IoT connectivity, and human-centric lighting features will create new growth opportunities across residential, commercial, and industrial segments, establishing India as a significant regional LED lighting hub.

Indian LED Lighting Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Panel Lights |

26% |

|

Application |

Commercial Applications |

30% |

Product Type Insights:

- Panel Lights

- Down Lights

- Street Lights

- Tube Lights

- Bulbs

- Others

Panel lights dominate with a market share of 26% of the total Indian LED lighting market in 2025.

Panel lights have emerged as the dominant product segment in India's LED lighting market, driven by their widespread adoption in commercial office buildings, institutional facilities, and modern retail environments. The sleek, low-profile design combined with uniform light distribution makes panel lights ideal for contemporary architectural applications. Energy Conservation Building Code requirements mandate specific lighting power density ceilings that favor high-efficiency panel light installations. In February 2024, the West Bengal government allocated INR 2.9 Crore to the Kolkata Metropolitan Development Authority for transitioning from high-pressure sodium vapor lamps to LED panel systems across urban development projects.

The commercial real estate boom across metropolitan areas including Delhi-NCR, Mumbai, Bengaluru, Chennai, and Hyderabad has substantially increased panel light demand. Corporate offices, co-working spaces, educational institutions, and healthcare facilities prioritize panel lighting for its aesthetic appeal, reduced glare characteristics, and extended operational lifespan. Manufacturers are introducing advanced features including tunable white technology, integrated motion sensors, and centralized control systems to address evolving workplace requirements. The standardization around common specifications and mounting configurations expedites procurement and replacement cycles, solidifying panel lights' market leadership position.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial Applications

- Residential Applications

- Institutional Applications

- Industrial Applications

Commercial applications lead with a share of 30% of the total Indian LED lighting market in 2025.

Commercial applications represent the largest revenue-generating segment in India's LED lighting market, encompassing office buildings, retail establishments, hospitality venues, healthcare facilities, and educational institutions. The segment benefits from stringent energy efficiency mandates under the Energy Conservation Building Code, which enforces lighting power density ceilings practically unattainable without LED technology adoption. Andhra Pradesh operationalized state-specific ECBC rules in early 2025, providing a policy template being replicated across multiple states. Real estate expansion supports LED demand, with approximately 4.74 Lakh residential and commercial units sold in primary markets across major cities in recent periods.

The commercial segment demonstrates strong growth potential driven by corporate sustainability commitments, operational cost reduction initiatives, and enhanced occupant comfort requirements. Modern commercial facilities increasingly specify LED lighting systems integrated with building automation platforms, enabling centralized control, energy monitoring, and adaptive illumination based on occupancy patterns and daylight availability. The hospitality and retail sectors prioritize LED solutions for their superior color rendering capabilities, highlighting merchandise and creating appealing ambiences. Financial incentives including accelerated depreciation benefits and utility rebate programs further encourage commercial establishments to transition from conventional lighting systems.

Market Dynamics:

Growth Drivers:

Why is the Indian LED Lighting Market Growing?

Government Energy Efficiency Initiatives and Distribution Programs

India's comprehensive government-led energy efficiency programs have fundamentally transformed the LED lighting market landscape. National distribution initiatives revolutionized consumer access to energy-efficient lighting by leveraging demand aggregation strategies that significantly reduced LED bulb procurement prices, making products affordable for millions of households across diverse income segments. These programs have distributed substantial volumes of LED bulbs nationwide, generating considerable annual energy savings and meaningfully reducing household electricity expenditure across participating states and territories.

Complementing residential initiatives, public infrastructure modernization programs focus on replacing conventional streetlights with energy-efficient LED systems across the country. Government agencies have successfully installed LED streetlights across Urban Local Bodies and Gram Panchayats, achieving meaningful annual energy savings and reducing peak electricity demand substantially. These installations demonstrate sustained commitment to sustainable public infrastructure while enhancing nighttime safety and visibility in urban and rural communities alike. State governments reinforce these national programs with dedicated budget allocations, creating sustained multi-year procurement pipelines that provide manufacturers with predictable order volumes and encourage capacity expansion investments. The combination of residential distribution programs and public infrastructure initiatives establishes a comprehensive framework supporting continued LED adoption growth across all market segments.

Rapid Urbanization and Smart City Infrastructure Development

India's accelerating urbanization trajectory and ambitious smart city development initiatives are creating substantial demand for advanced LED lighting solutions. The government's Smart Cities Mission, targeting numerous urban centers nationwide, has attracted significant investments with LED lighting forming a central component of infrastructure modernization programs. Multiple cities have achieved transformation milestones under mission requirements, implementing intelligent lighting systems across public spaces, transportation corridors, and municipal facilities throughout the country.

Real estate sector expansion further amplifies LED lighting demand, with substantial residential and commercial unit transactions occurring across primary markets in major metropolitan areas. Modern construction projects increasingly specify LED systems to comply with Energy Conservation Building Code requirements, which mandate lighting power density ceilings achievable primarily through LED technology adoption. Smart lighting integrations featuring IoT connectivity, occupancy sensing, and adaptive controls enable municipalities and building operators to optimize energy consumption while enhancing public safety and operational efficiency. The convergence of urban development priorities and regulatory frameworks establishes sustained momentum for LED lighting adoption across diverse infrastructure applications.

Declining Manufacturing Costs and Production Linked Incentives

Declining LED manufacturing costs combined with government incentives for domestic production are strengthening market accessibility and competitive positioning. Economies of scale on component assembly lines have compressed LED bulb prices substantially, narrowing consumer payback periods significantly in grid-connected regions across the country. Government ministries have enhanced Production Linked Incentive outlays for relevant product categories, reinforcing incentives for LED component localization and encouraging domestic manufacturing investments.

Designated industrial clusters across multiple states offer plug-and-play infrastructure and favorable tax treatment, accelerating greenfield plant establishment for lighting manufacturers. Major international lighting companies are forming strategic joint ventures with established domestic electronics manufacturers to build LED production capacity aimed at both domestic and export markets, combining global lighting technology leadership with local manufacturing excellence. These initiatives support national manufacturing development priorities while improving cost competitiveness and reducing import dependence, enabling manufacturers to offer affordable products across diverse market segments serving residential, commercial, and industrial consumers nationwide.

Market Restraints:

What Challenges is the Indian LED Lighting Market Facing?

High Initial Investment Costs for Commercial and Industrial Projects

The substantial upfront capital requirements for large-scale LED lighting installations present significant barriers for commercial and industrial adoption. While long-term operational savings through energy efficiency demonstrate favorable return on investment calculations, initial project expenses deter small and medium enterprises operating with constrained capital budgets. Smart lighting infrastructure incorporating advanced controls, sensors, and building automation integration further elevates implementation costs, limiting adoption among price-sensitive commercial segments.

Limited Rural Market Penetration and Consumer Awareness Gaps

Despite significant urban success, LED adoption in rural India remains constrained by awareness limitations, affordability concerns, and inadequate distribution infrastructure. Semi-urban regions across Uttar Pradesh, Rajasthan, and Bihar demonstrate pent-up demand restrained by weaker after-sales service networks and higher price elasticity among consumers. Northeast and hill states exhibit lower baseline penetration due to challenging terrain inflating freight costs and voltage fluctuations shortening LED driver lifespan. Government distribution programs partially offset these barriers, yet absence of reliable service centers discourages larger retrofit investments in commercial facilities.

Market Fragmentation and Quality Concerns from Unorganized Sector

A fragmented supply chain with uneven enforcement of product quality standards creates competitive challenges for established manufacturers. The large unorganized sector selling low-cost, substandard products makes it difficult for reputable players to maintain margins without compromising quality. Thermal management challenges in industrial environments can cause premature LED failure when proper cooling systems are not implemented. Color consistency variations and inadequate driver specifications in low-quality products undermine consumer confidence, requiring continued regulatory enforcement and consumer education initiatives.

Competitive Landscape:

The Indian LED lighting market features a moderately concentrated structure combining large multinational corporations with established domestic players. Leading companies including Signify, Havells, Crompton Greaves, Wipro Lighting, and Bajaj Electricals collectively maintain significant market presence through pan-India distribution networks, technological innovation, and government project collaborations. Competition centers on pricing strategies, product feature differentiation, brand reputation, and distribution network expansion. Domestic incumbents increasingly backward-integrate into driver and PCB assembly operations to protect margins from component price volatility. International players focus on technology-intensive segments including horticulture lighting, human-centric luminaires, and Li-Fi-enabled fixtures, while joint ventures enable Production Linked Incentive eligibility and tariff risk mitigation.

Some of the key players include:

- Signify NV

- Surya Roshni Limited

- Crompton Greaves Consumer Electricals Limited

- Bajaj Electricals Limited

- Halonix Technologies Pvt. Ltd.

- Havells India Limited

Recent Developments:

- In March 2025, Signify and Dixon Technologies announced a strategic joint venture to enhance lighting manufacturing excellence in India. The proposed venture will manufacture LED bulbs, downlights, spots, battens, ropes, strips, and lighting accessories, combining Signify's global lighting technology leadership with Dixon's manufacturing capabilities to serve both domestic and export markets.

Indian LED Lighting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Panel Lights, Down Lights, Street Lights, Tube Lights, Bulbs, Others |

| Applications Covered | Commercial Applications, Residential Applications, Institutional Applications, Industrial Applications |

| Companies Covered | Signify NV, Surya Roshni Limited, Crompton Greaves Consumer Electricals Limited, Bajaj Electricals Limited, Halonix Technologies Pvt. Ltd., Havells India Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian LED lighting market size was valued at USD 6,002.10 Million in 2025.

The Indian LED lighting market is expected to grow at a compound annual growth rate of 18.58% from 2026-2034 to reach USD 27,814.70 Million by 2034.

Panel lights dominated the market with a share of 26%, driven by widespread adoption in commercial office buildings, institutional facilities, and modern retail spaces requiring uniform illumination and energy efficiency.

Key factors driving the Indian LED lighting market include government energy efficiency programs, smart city infrastructure development, declining manufacturing costs, urbanization acceleration, and expanding commercial real estate construction requiring compliant lighting solutions.

Major challenges include high initial investment costs for commercial projects, limited rural penetration due to awareness and distribution gaps, market fragmentation from unorganized sector competition, and thermal management issues in industrial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)