In-app Advertising Market Size, Share, Trends and Forecast by Advertising Type, Platform, Application, and Region, 2025-2033

In-app Advertising Market Size and Share:

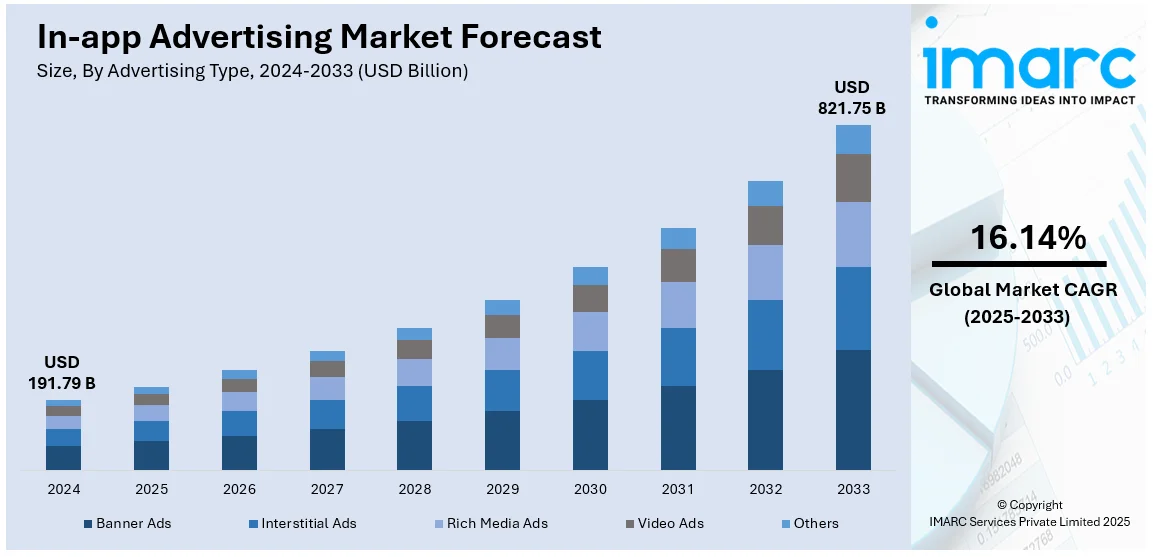

The global in-app advertising market size was valued at USD 191.79 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 821.75 Billion by 2033, exhibiting a CAGR of 16.14% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 37.6% in 2024. The in-app advertisement market share is expanding, principally influenced by seamless accessibility to high-speed internet, increasing consumption of smartphones and tablets, rising advent of online gaming, growing utilization of mobile applications to access social media, and escalating penetration of broadband services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 191.79 Billion |

| Market Forecast in 2033 | USD 821.75 Billion |

| Market Growth Rate (2025-2033) | 16.14% |

In-app advertising forms an ascending business sector worldwide due to expanding smartphone usage and mobile app adoption among industries, such as gaming, entertainment, and retail. AI-powered analytics help businesses create tailored relevant advertisements which boosts user interaction and leads to greater conversion success. Moreover, process automation in advertising has emerged as a prevalent option for delivering targeted advertising to specific audiences through precise spending optimization. Additionally, the shift towards video and interactive ad formats has boosted audience interaction, making in-app advertising a preferred channel for digital marketers. Privacy regulations and evolving consumer preferences for non-intrusive ad experiences are further shaping the strategies of advertisers and app developers.

The United States remains a prominent player in the in-app advertising market, supported by a mature digital infrastructure and high app usage among consumers. With the proliferation of e-commerce and mobile gaming apps, advertisers are increasingly allocating budgets to this channel to capture diverse audiences, thereby improving the in-app advertising revenue. Advanced targeting mechanisms, driven by artificial intelligence and machine learning technologies, are allowing companies to optimize returns on advertising investments effectively. The adoption of 5G technology has enhanced ad delivery speed and quality, further solidifying the U.S. position as a global leader in in-app advertising innovation. For instance, according to industry reports, programmatic advertising accounted for 81.9% of total digital advertising expenditure in the United States as of January 2024, highlighting its significant role in the market.

In-app Advertising Market Trends:

Increasing Mobile App Usage

One primary factor driving the market is the continuous rise in mobile app usage. Mobile app use continues to rise due to smartphone technology advances and growing network speed capabilities, allowing users to stay on apps for longer periods, individuals are spending more time on mobile applications for various purposes. According to industry reports, in the first quarter of 2024, the overall global consumer spending on mobile applications reached USD 35.28 Billion. This heightened user engagement within apps provides advertisers with a vast and targeted audience. As users interact with apps, advertisers can leverage this opportunity to deliver personalized and contextually relevant advertisements, enhancing the overall effectiveness of these advertising campaigns. The growth of mobile app usage across diverse demographics contributes significantly to the expansion of the in-app advertisement market share.

Targeted Advertising Capabilities

In-app advertising enables highly targeted and personalized campaigns, which is a key driver for its market growth. Advertisers can access a wealth of user data, including demographics, preferences, and behavior patterns, collected by apps. This rich data allows for precise audience targeting, ensuring that advertisements reach the most relevant users. According to industry reports, in-app ad investments are paying off for brands as 8 out of 10 marketers report that their brand awareness has improved. Advertisers can tailor their messages based on user interests, location, and demographics, increasing the likelihood of engagement and conversion. The ability to deliver targeted advertisements not only enhances the user experience by showing more relevant content but also maximizes the efficiency of ad spending for advertisers, making this advertising an increasingly attractive option in the digital advertising landscape.

Growing App Monetization Strategies

App developers and publishers are increasingly adopting diverse monetization strategies, with this form of advertising playing a central role. As competition among app developers intensifies, this advertising provides a revenue stream that complements or substitutes traditional app purchase models. Through partnerships with advertisers, developers can monetize their apps while offering them for free or at a reduced cost to users. This mutually beneficial relationship between app developers and advertisers propels the market forward. The flexibility of various ad formats, such as display ads, video ads, and native ads, allows developers to choose the most suitable approach for monetizing their apps, contributing to the continued in-app advertising market demand. Furthermore, According to GSMA's State of Mobile Internet Connectivity Report 2023 (SOMIC), over 4.3 billion people, or 54% of the global population, now possess a smartphone. This widespread smartphone adoption significantly expands the audience base for in-app advertisements, providing greater opportunities for developers to generate revenue while engaging a larger user demographic.

In-app Advertising Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global keyword market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on advertising type, platform, and application.

Analysis by Advertising Type:

- Banner Ads

- Interstitial Ads

- Rich Media Ads

- Video Ads

- Others

Banner ads lead the market with around 38.7% of market share in 2024. Banner ads are a traditional form of in-app advertising, represented by rectangular graphics displayed within app interfaces. Despite their simplicity, banner ads remain prevalent due to their cost-effectiveness and ease of implementation. However, these visual advertisements face difficulties due to banner blindness since users tend to dismiss repeated ad displays causing advertisers to look for innovative formats that grab attention and enhance performance indicators.

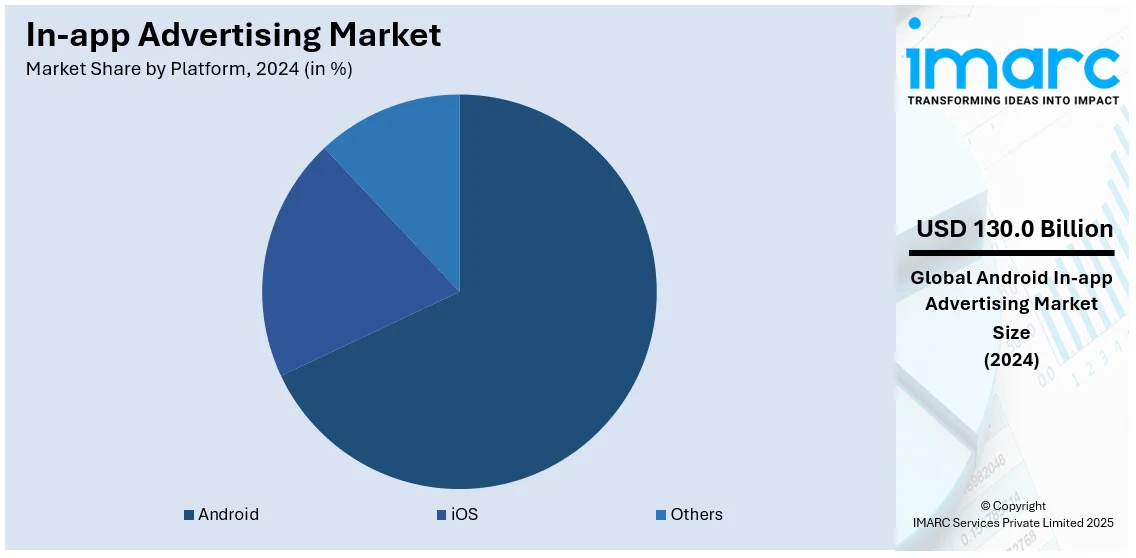

Analysis by Platform:

- Android

- iOS

- Others

Android leads the market with around 67.8% of market share in 2024. This is due to its widespread global adoption and open-source nature. With a diverse range of devices and a large user base, Android provides advertisers with extensive opportunities to reach a diverse audience. The platform's flexibility enables innovative ad formats and targeting options. Advertisers on Android often face the challenge of device fragmentation, requiring careful optimization for various screen sizes and specifications. However, the platform's sheer market share makes it a crucial focus for in-app advertising strategies, ensuring brands can maximize their reach and engagement.

Analysis by Application:

- Messaging

- Entertainment

- Gaming

- Online Shopping

- Payment and Ticketing

- Others

Messaging leads the market in 2024. This advertising within messaging applications has become a significant channel for marketers to reach users in a personalized and contextual manner. Advertisers leverage messaging platforms to engage users with targeted promotions, sponsored content, and interactive ad formats. With the increasing popularity of messaging apps worldwide, this segment provides a valuable avenue for brand communication and customer engagement. Furthermore, increasing consumer reliance on messaging applications makes the in-app advertising market outlook attractive for promising future prospects by engaging users with personalized content and new advertising opportunities.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 37.6%. The Asia Pacific region demonstrates growth dynamics coupled with rapid market expansion. With a massive population and increasing smartphone adoption, countries like China, India, and Southeast Asian nations offer substantial opportunities for advertisers. The region's fast economic development, together with urbanization patterns, inspire growing consumer spending that sets the stage for stronger advertising investments. Additionally, the diversity in languages, cultures, and consumer behaviors presents both challenges and opportunities for targeted and localized advertising strategies. The in-app advertisement market statistics reveal a robust growth trajectory as advertisers in Asia Pacific emphasize mobile-first approaches, capitalizing on the popularity of apps across various industries, contributing significantly to the global landscape.

Key Regional Takeaways:

United States In-app Advertising Market Analysis

In 2024, United States accounted for 89.80% of the market share in North America. The World Economic Forum estimated that the overall media consumption by adults in the United States had reached around 666 minutes per day, which is 11.1 hours, by 2021. This increasing amount of time spent on media platforms, including mobile applications, plays a significant role in expanding the in-app advertising market in the United States. Advertisers have the great opportunity of reaching consumers at their most accessible times, now that consumers are spending more hours per day on smartphones. With this rise in the use of mobile apps for entertainment, shopping, and social networking, brands are taking in-app advertisements as a mean to reach very engaged and active audiences. Furthermore, the increasing use of mobile devices across various demographics, coupled with the growing preference for free or low-cost apps supported by advertising, provides additional fuel for market growth. The shift towards digital advertising, combined with the significant time spent on mobile devices, makes in-app advertising a key channel for brand engagement and consumer conversion.

North America In-app Advertising Market Analysis

The North America in-app advertising market is experiencing robust growth, driven by increased smartphone penetration, high app usage, and advancements in ad targeting technologies. Companies are utilizing tailored and interactive advertisements to improve audience engagement and drive higher conversion rates. For instance, in November 2024, MobileFuse partnered with ID5, integrating the ID5 ID to improve audience targeting, campaign efficiency, and compliance with privacy regulations. This collaboration enhances advertiser ROI by reducing CPA, CPC, and CPM while maintaining effective, privacy-first personalization across channels. In addition, rising investment in mobile gaming and entertainment apps further contributes to market expansion, as these platforms attract large audiences. The integration of automated advertising solutions and analytics powered by artificial intelligence is enhancing the efficiency and effectiveness of ad placement and results tracking. Additionally, regulatory compliance and growing consumer demand for seamless ad experiences are shaping market strategies, positioning North America as a key region for in-app advertising innovation.

Europe In-app Advertising Market Analysis

Internet penetration for households was recorded at 94% across the European Union as of 2024, and household internet access has been as high as 99% in both the Netherlands and Luxembourg, the European Commission reported. Therefore, these penetration rates mean an increase in demand for the in-app ad market in Europe. With more and more households becoming internet-enabled, especially in terms of smartphone and other mobile devices, it opens up wider opportunities for the in-app ad market. Mobile devices are more penetrating, combined with high access rates to internet, offering the advertisements a broader and diversified reach through targeted and personalized campaigns. With mobile app usage continuing to increase, especially for entertainment, shopping, and social media, in-app advertising becomes an increasingly effective method for advertisers to engage users. In addition, with more connected households, app developers have more opportunities to monetize their platforms, thus creating a mutually beneficial relationship with advertisers, which further propels growth in the European in-app advertising market.

Asia Pacific In-app Advertising Market Analysis

By 2030, GSMA anticipates the Asia Pacific mobile economy contribution will cross over the threshold of more than USD 1 Trillion as fueled by more aggressive uptake of 5G technologies. It influences the in-app ad market as improvements in the internet speeds facilitated through rollout of 5G networks result in a much more enriching in-app advertisement. Faster data transmission allows for high-quality video ads, augmented reality (AR) ads, and other dynamic content that enhances user engagement. The increased mobile connectivity also leads to greater mobile app usage across diverse sectors, from entertainment to e-commerce, further expanding the audience base for advertisers. With the rise of 5G, advertisers can leverage real-time data and target users more effectively, leading to higher conversion rates. This technological advancement, coupled with the growing number of mobile app users, positions Asia Pacific as a key driver for the continued growth of the in-app advertising market in the coming years.

Latin America In-app Advertising Market Analysis

According to industry reports, in 2023, mobile technologies and services made up 8% of the GDP in Latin America in 2023, generating USD 520 Billion in economic value, according to GSMA. This substantial impact propels the regional expansion of the in-app advertising sector. With mobile technology becoming a core aspect of everyday activities, the growing smartphone user base broadens mobile app accessibility. This growth, coupled with greater internet penetration across the region, gives advertisers an expanded, more interactive audience. Additionally, with the rapid introduction of 4G and 5G across Latin America, mobile connectivity becomes more robust and enables richer and more interactive forms of advertising - video, augmented reality, in-app purchases - among others. Advertisers are using all these developments to provide personalized contextually relevant messages that increase the engagement and conversion rates of their consumers. With mobile services significantly contributing to the region's economy, growth in mobile applications and the evolving landscape of advertising position in-app advertising as one of the growth drivers in Latin America.

Middle East and Africa In-app Advertising Market Analysis

The adoption of 5G is expected to significantly accelerate from 2025, with projections indicating that half of the region’s population will be covered by the end of the decade. The GCC countries will continue to be the leaders, as 5G coverage is expected to reach 95% of the population by 2030, as per reports. This fast pace of 5G infrastructure will drive the growth of in-app advertising, allowing more engaging and interactive ad formats such as high-definition video and AR ads. Advanced technologies will open up new avenues for brands to target consumers with more personalized and immersive experiences. Additionally, the growing mobile penetration and increased app usage across the region will create a larger audience base for advertisers, enhancing the effectiveness of in-app ads. As 5G enhances the mobile user experience, in-app advertising will become a key component of the evolving digital advertising landscape.

Competitive Landscape:

The key players in the market are driving in-app advertising market growth through innovative strategies and technological advancements. As the mobile app ecosystem expands, companies like Google, Facebook, and Apple leverage their extensive user bases to offer targeted and personalized in-app ads. These industry giants invest heavily in data analytics and artificial intelligence to understand user behavior, enabling advertisers to tailor their campaigns effectively. Additionally, the integration of interactive and immersive ad formats, such as playable ads and augmented reality experiences, enhances user engagement, contributing to the market's expansion. Strategic partnerships and acquisitions by key players further strengthen their positions, creating comprehensive advertising ecosystems. For instance, in August 2024, Reddit announced the acquisition of Memorable AI, a company specializing in AI models to optimize ad performance. This move strengthens Reddit's AI capabilities and enhances its advertising technology offerings for improved campaign effectiveness. According to the in app advertising market forecast, with the rising demand for mobile applications and the continuous improvement of ad technologies, key players play a pivotal role in driving sustained in-app advertising market growth and shaping the future landscape of the market.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Amobee Inc. (Singapore Telecommunications Limited)

- Apple Inc.

- BYYD Inc.

- Chartboost Inc.

- Facebook Inc.

- Flurry Inc. (Verizon Media)

- Google AdMob (Google Inc.)

- InMobi (InMobi Pte Ltd.)

- MoPub Inc. (Twitter)

- One by AOL (AOL)

- Tapjoy Inc.

- Tune Inc.

Latest News and Developments:

- January 2025: T-Mobile revealed that it has officially signed a definitive agreement to purchase Vistar Media, which stands as the leading provider of technology solutions for digital-out-of home advertisements reaching numerous consumers daily.

- September 2024: Fueled by AI enhancement, Display.io's latest ad units create additional revenue opportunities for top app publishers and offer unique inventory to advertisers.

- November 2024: Meta announced that it will launch ads to its text application, Threads from early 2025. This action changed Threads from solely a social platform into a possible advertising giant, enabling companies to seamlessly expand their current Meta ad campaigns with little extra effort.

In-app Advertising Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Advertising Types Covered | Banner Ads, Interstitial Ads, Rich Media Ads, Video Ads, Others |

| Platforms Covered | Android, iOS, Others |

| Applications Covered | Messaging, Entertainment, Gaming, Online Shopping, Payment and Ticketing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amobee Inc. (Singapore Telecommunications Limited), Apple Inc., BYYD Inc., Chartboost Inc., Facebook Inc., Flurry Inc. (Verizon Media), Google AdMob (Google Inc.), InMobi (InMobi Pte Ltd.), MoPub Inc. (Twitter), One by AOL (AOL), Tapjoy Inc., Tune Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the in-app advertising market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global in-app advertising market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the in-app advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The in-app advertising market was valued at USD 191.79 Billion in 2024.

IMARC estimates the global in-app advertising market to reach USD 821.75 Billion in 2033, exhibiting a CAGR of 16.14% during 2025-2033.

The market is driven by increasing smartphone penetration, growing app usage across entertainment, gaming, and e-commerce, and advancements in targeting technologies like AI and machine learning. Additionally, businesses prioritize in-app ads due to their ability to deliver personalized user experiences, drive engagement, and offer measurable ROI, fueling market growth worldwide.

Asia Pacific currently dominates the market, holding a market share of over 37.6% in 2024. This leadership can be attributed to the region’s high smartphone penetration, extensive app usage, and a large population base. Rapid digital transformation, increasing mobile commerce, and advanced mobile networks drive growth. Additionally, strong advertising investments in markets like China, India, and Southeast Asia contribute significantly to this leadership.

Some of the major players in the keyword market include Amobee Inc. (Singapore Telecommunications Limited), Apple Inc., BYYD Inc., Chartboost Inc., Facebook Inc., Flurry Inc. (Verizon Media), Google AdMob (Google Inc.), InMobi (InMobi Pte Ltd.), MoPub Inc. (Twitter), One by AOL (AOL), Tapjoy Inc., Tune Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)