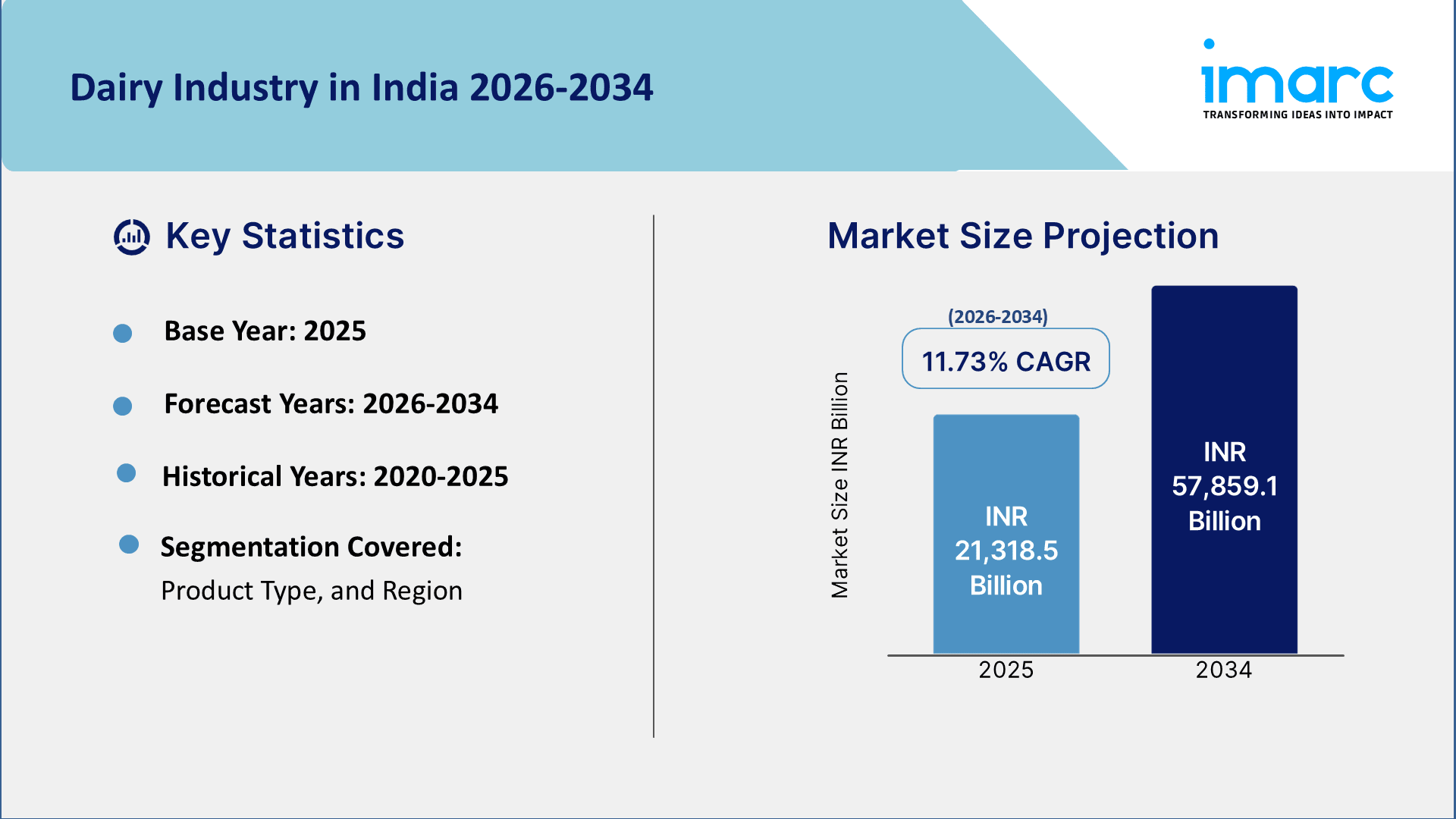

Dairy Industry in India Size, Share, Trends and Forecast by Product and Region, 2026-2034

Dairy Industry in India Summary:

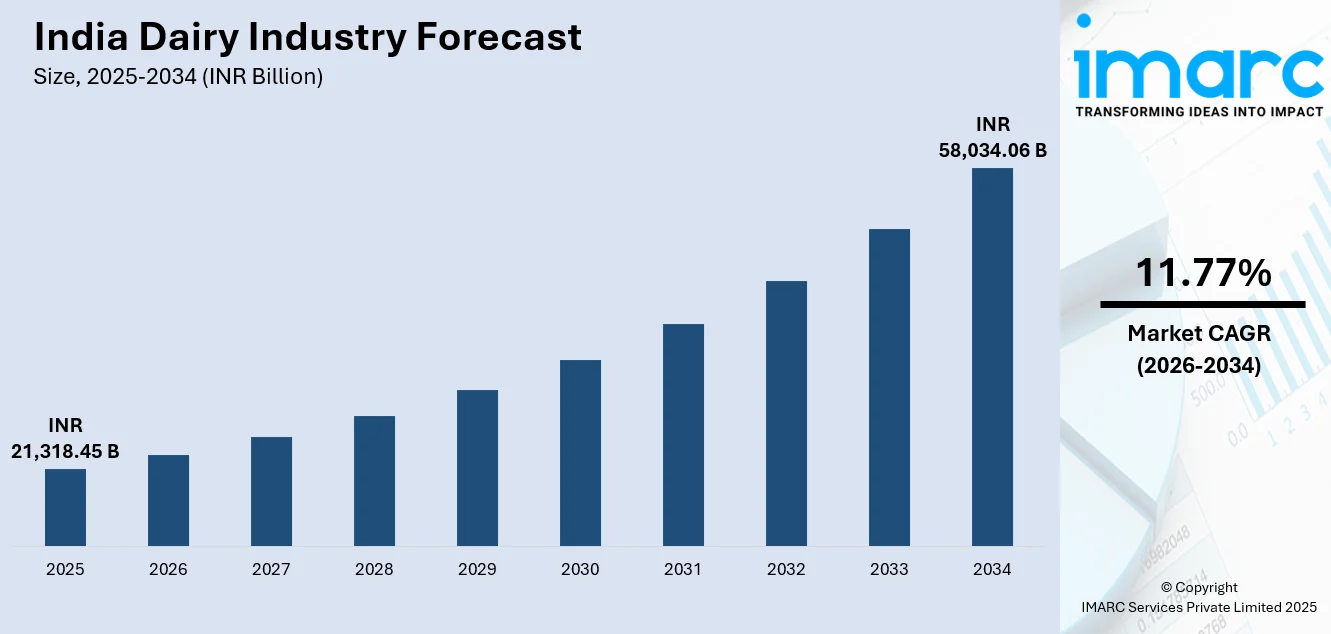

The dairy industry in India size was valued at INR 21,318.45 Billion in 2025 and is projected to reach INR 58,034.06 Billion by 2034, growing at a compound annual growth rate of 11.77% from 2026-2034.

The market growth is fueled by escalating demand for milk and milk-based products across both urban and rural populations, coupled with rising health consciousness among consumers. Apart from this, government-backed initiatives and improved cooperative dairy infrastructure continue to strengthen the foundation of the dairy market, creating a conducive environment for sustained growth and expanding the dairy industry share in India.

To get more information on the market, Request Sample

Key Takeaways and Insights:

- By Product: Liquid milk dominates the market with a share of 65.3% in 2025, establishing itself as the dominant product segment in the India dairy industry.

- By Region: Uttar Pradesh leads the market with a share of 18.7% in 2025, driven by its position as the country's most populous state and largest dairy animal population.

- Key Players: Major players leverage strong cooperative networks, advanced processing infrastructure, and established distribution channels to serve diverse consumer segments across organized and unorganized markets. Some of the key players include Bihar State Milk Co-operative Federation Ltd. (COMFED), Gujarat Co-operative Milk Marketing Federation Ltd., Haryana Dairy Development Cooperative Federation Limited, Karnataka Co-operative Milk Producers Federation Ltd., Madhya Pradesh State Cooperative Dairy Federation Ltd., Maharashtra Rajya Sahakari Dudh Mahasangh Maryadit (MRSDMM), Mother Dairy Fruits & Vegetables Pvt. Limited, Rajasthan Cooperative Dairy Federation (RCDF), Tamilnadu Co-operative Milk Producers’ Federation Limited, The Odisha State Cooperative Milk Producers' Federation Limited (OMFED), Godrej Creamline Jersey Products Limited, HAP, Bhole Baba Milk Food Industries Ltd., Creamy Foods Limited, Heritage Foods Ltd., Kwality Limited, Milkfood Limited, Nestlé S.A., Parag Milk Foods, Prabhat Dairy (Sunfresh Agro Industries Pvt. Ltd.), Sterling Agro Industries Ltd., Tirumala Milk Products Pvt. Ltd., and VRS Foods Limited.

To get more information on this market Request Sample

The India dairy market includes various categories of products such as liquid milk, UHT milk, A2 milk, organic milk, flavored milk, yogurt, cheese, butter, ghee, paneer, and ice cream, catering to different consumer demands. The country’s status as the largest milk-producing nation in the world, accounting for 23% of global milk production with annual production exceeding 248 million tons, is an added advantage. The cooperative structure, especially in Gujarat and Karnataka, has developed an effective supply chain that acts as a best practice example in the global dairy industry. Urban innovations and developments, rising per-capita income, and health benefits of dairy products have opened up vast consumption opportunities in urban, tier-2, and rural India. In Budget 2025, the government allocated ₹7,544 crore for the Ministry of Fisheries, Animal Husbandry, and Dairying, representing roughly 0.15% of the overall government spending, as reported by the Indian Dairy Association.

Dairy Industry in India Trends:

A2 Milk and Organic Product Market Penetration

The shift toward A2 milk and organic dairy products reflects evolving consumer beliefs regarding health benefits and quality assurance. Farmery introduced fresh A2 cow milk in eco-friendly glass bottles in November 2024, enhancing consumer choices in the premium segment. Organic dairy products, including organic milk, curd, and ghee from certified farms, have gained traction among environmentally conscious consumers. Market research indicates the organic milk segment is projected to grow at approximately 20% annually, driven by consumers seeking chemical-free, hormone-free, and antibiotic-free options that align with clean-label preferences and environmental sustainability concerns.

E-Commerce and Direct-to-Consumer Distribution Channel Transformation

Digital platforms and quick-commerce services are transforming the distribution of dairy products, allowing new-age startups to disrupt the conventional retail model. Subscription-based platforms, home delivery, and digital supply chains have mushroomed in urban areas, with players using data analytics to understand consumer behavior. The rise of specialty stores and supermarket chains, along with digital platforms, has made it easier for consumers to access a range of product varieties, including high-end, organic, and specialty dairy products. This omnichannel retail model ensures the freshness of products while meeting the demands of modern consumers for convenience and a range of products beyond the conventional offerings of milk vans and local stores. According to IMARC Group, the India e-commerce market is expected to reach USD 651.10 Billion by 2034.

Health-Conscious Product Innovation and Functional Dairy Expansion

Customers are increasingly demanding dairy products with optimized nutritional benefits, and this has forced manufacturers to develop innovative functional segments. In May 2024, Amul introduced "super milk" with 35 grams of protein per glass, which is specifically targeted at health-conscious customers. A2 milk, known for its superior digestibility and reduced inflammation, has become one of the fastest-growing segments, with a premium price tag attached to it due to its positioning as a healthier alternative. The International Organization for Standardization and consumer research confirm the increasing awareness about probiotic dairy, fortified dairy products, and lactose-free dairy, especially among the urban millennial and Gen-Z segments, who consider dairy a form of preventive healthcare rather than basic nutrition.

Market Outlook 2026-2034:

The India dairy industry is poised for robust expansion driven by favorable demographic trends, supportive government policies, infrastructure modernization, and evolving consumer preferences toward packaged and value-added products. Increasing urbanization, expanding retail networks including modern trade and e-commerce platforms, and rising per capita income are creating strong demand momentum. The market generated a revenue of INR 21,318.45 Billion in 2025 and is projected to reach a revenue of INR 58,034.06 Billion by 2034, growing at a compound annual growth rate of 11.77% from 2026-2034. Growing export opportunities particularly to Middle Eastern and Asian markets present additional revenue streams for Indian dairy companies. Investments in cold chain infrastructure, processing technologies, and breed improvement programs are enhancing supply.

Dairy Industry in India Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Liquid Milk |

65.3% |

|

Region |

Uttar Pradesh |

18.7% |

Product Insights:

- Liquid Milk

- Cow Milk

- Goat Milk

- Camel Milk

- UHT Milk

- A2 Milk

- Organic Milk

- Flavoured Milk

- Curd

- Cup Curd

- Pouch Curd

- Lassi

- Butter Milk (Chach)

- Flavoured and Frozen Yoghurts

- Cheese

- Probiotic Dairy Products

- Table Butter

- Ghee

- Cow Ghee

- Desi Ghee

- Paneer

- Khoya

- Dairy Whitener

- Skimmed Milk Powder

- Ice Cream

- Dairy Sweets

- Cream

- Whey

- Milk Shake

- Sweet Condensed Milk

Liquid milk dominates with a market share of 65.3% of the total dairy industry in India in 2025.

Liquid milk is the most prominent category of milk products because of its irreplaceable significance in consumption patterns, acting as a basic nutritional requirement for all sections of society in India. Its prominent market position is an outcome of deeply ingrained cultural acceptance, with milk being a part of traditional Indian cuisine, rituals, and consumption patterns for making tea, coffee, sweets, and other traditional dishes. The regularity of demand is further strengthened by the government's strong support through subsidized pricing structures, cooperative dairy models for regular supply, and procurement chains that link millions of small-scale farmers to the market.

The liquid milk segment benefits from well-established distribution networks spanning urban, semi-urban, and rural areas, with products available through multiple channels including doorstep delivery systems, retail parlors, cooperative milk booths, organized retail chains, and modern e-commerce platforms. Diverse variants catering to different consumer preferences and price points, including whole milk, toned milk, double-toned milk, skimmed milk, and standardized milk, ensure market penetration across income categories. Growing health consciousness is driving demand for fortified liquid milk enriched with vitamins, minerals, and other nutritional supplements.

Region Insights:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Orissa

Uttar Pradesh leads with a share of 18.7% of the total dairy industry in India in 2025.

Uttar Pradesh commands the largest market share as India's most populous state with over 240 million residents, providing enormous domestic consumption base alongside robust agricultural economy characterized by extensive livestock rearing traditions. The state houses the highest number of dairy animals nationally with 5.31 crore milch animals representing 19 percent of the country's total, including both cows and buffaloes that contribute substantially to India's overall milk production. Uttar Pradesh's dairy sector benefits from strong government policy support through the Dairy Policy 2022, which focuses on increasing milk processing levels, improving product quality, enhancing access to animal nutrition and feed, and providing comprehensive investor support through dedicated cell for facilitating approvals and addressing grievances across the sector.

The state's highly efficient dairy infrastructure supported by milk committees engaging dairy farmer members in procurement and distribution networks. Small and marginal farmers predominantly contribute to the industry, with cooperative models ensuring fair procurement prices and timely payments that sustain rural livelihoods. Growing population, rising disposable incomes, and increasing nutritional awareness are driving heightened consumer spending on milk and associated products across both urban and rural markets. The dairy market is further enhanced by expanding consumption of value-added products including curd, paneer, ghee, butter, flavored milk, and ice cream, particularly in metropolitan areas.

Market Dynamics:

Growth Drivers:

Why is the Dairy Industry in India Growing?

Rising Health Consciousness and Nutritional Awareness Among Consumers

Growing awareness of milk and dairy products as sources of essential proteins, vitamins, minerals, and functional compounds drives sustained demand across income segments. Post-pandemic health consciousness has accelerated demand for fortified milk, probiotic yogurts, and protein-enriched dairy products. The National Programme for Dairy Development (NPDD) commenced in February 2014 to enhance the dairy industry nationwide. The program was reorganized in July 2021 and is in effect from 2021-22 to 2025-26. The main goal of NPDD is to establish and enhance infrastructure for the generation of high-quality milk, in addition to its acquisition, processing, and marketing. Urban millennials and Gen-Z consumers increasingly view dairy proteins as accessible, cost-effective alternatives to expensive nutritional supplements, creating market opportunities for brands communicating scientific validation of health benefits. This shift transcends traditional consumption patterns, with consumers willing to pay premium pricing for products addressing specific health concerns including gut health, bone strength, immunity enhancement, and muscle development.

Expanding Middle Class and Rising Disposable Incomes Driving Premium Product Demand

By 2047, the proportion of India’s middle class is expected to reach nearly 61% of its total population, rising from 31% in 2020-21, driven by ongoing political stability and economic reforms along with a consistent annual growth rate of 6% to 7% over the next 25 years, positioning the nation as one of the largest markets globally. Growing urban developments and rising rural incomes generate demand for packaged milk, organic products, A2 milk, and specialty items like cheese, paneer, and yogurt from organized retail channels. The correlation between income growth and value-added product consumption is evidenced by rapid expansion of premium segments, with consumers transitioning from basic toned milk to UHT milk, organic variants, and fortified options. Metropolitan and tier-2 city consumers increasingly purchase dairy through supermarkets and e-commerce platforms rather than traditional informal channels, supporting organized market growth and enabling companies to capture higher margins through branded products.

Government Support and Cooperative Dairy Infrastructure Modernization

Government initiatives including the Rashtriya Gokul Mission (with total allocation of INR 3,400 Crore approved in March 2025), National Dairy Development Board (NDDB), National Dairy Plan, and Dairy Entrepreneurship Development Scheme (DEDS) provide sustained policy support for dairy sector development. These programs focus on enhancing milk productivity, modernizing cooperative networks, improving cold-chain infrastructure, and strengthening farmer income security. The allocation of funds for the National Programme for Dairy Development in 2024-25 specifically targets productivity enhancement and infrastructure modernization. Cooperative dairy federations, particularly Gujarat Cooperative Milk Marketing Federation (GCMMF), have established globally benchmarked supply chain models that ensure procurement efficiency, quality consistency, and market access for smallholder farmers, thereby creating structural market expansion opportunities.

Market Restraints:

What Challenges the Dairy Industry in India is Facing?

Feed and Fodder Price Volatility and Supply Shortages

India faces a significant deficit in fodder availability, with reported shortages of green fodder, dry fodder, and grain-based concentrate feed. Feed costs account for 60-70% of total milk production expenses, making fodder price volatility directly impact dairy farmer profitability and herd expansion decisions. In 2024, feed prices rose, straining farm economics particularly for smallholder producers. Climate-induced fodder scarcity, urbanization reducing cultivable area for fodder crops, and shift toward commercial crop cultivation exacerbate supply challenges. Fodder prices have nearly tripled in certain regions, forcing farmers to distress-sell cattle, reducing herd sizes and constraining future milk production capacity essential for meeting growing domestic and global demand.

Inadequate Cold Chain Infrastructure Leading to Post-Harvest Losses

Infrastructure gaps in cold storage, transportation, and processing facilities constrain market growth and product quality maintenance. According to the National Centre for Cold-chain Development, India loses approximately 10-15% of total milk production due to spoilage and inadequate refrigeration throughout the supply chain. Many rural collection centers and milk chilling facilities operate at reduced efficiency, compromising product freshness and safety, particularly in non-cooperative regions. The fragmented nature of milk procurement, with only approximately 25% of collected milk processed through organized dairies while informal channels (local milkmen, vendors, household use) dominate, perpetuates inefficiencies. Infrastructure investment requirements remain substantial, particularly in tier-2 and tier-3 markets where retail modernization and cold-chain development lag behind metropolitan regions.

Disease Outbreaks and Cattle Productivity Constraints

Contagious livestock diseases including Foot-and-Mouth Disease (FMD), Lumpy Skin Disease (LSD), Brucellosis, and Black Quarter infections periodically disrupt production volumes and farmer incomes. Low scientific breeding coverage, with only 33% of breedable bovines undergoing artificial insemination while 70% rely on scrub bulls of unknown genetic merit, constrains productivity improvement. Average cattle productivity at 1,777 kg per animal per year remains significantly below global average of 2,699 kg per animal per year, indicating substantial gap for improvement. State-level variability in cattle productivity, reflects uneven adoption of modern breeding and farm management practices. These productivity constraints, coupled with disease risks and climate vulnerabilities, create structural challenges for expanding milk output to meet rising demand.

Competitive Landscape:

India's dairy market exhibits robust competitive dynamics with well-established cooperatives maintaining dominant positions alongside growing presence of organized private players and emerging regional brands. Private sector participants are expanding through strategic investments in processing capacity, value-added product development, and marketing initiatives. Competition is intensifying in premium segments including A2 milk, organic products, fortified variants, and cheese categories where margins are higher. Players are differentiating through product innovation, quality assurance, brand positioning, and distribution expansion strategies. Strategic acquisitions, capacity expansions, and technology adoption are reshaping competitive landscape as companies seek to capture growth opportunities in evolving market. Some of the key market players include:

- Bihar State Milk Co-operative Federation Ltd. (COMFED)

- Gujarat Co-operative Milk Marketing Federation Ltd.

- Haryana Dairy Development Cooperative Federation Limited

- Karnataka Co-operative Milk Producers Federation Ltd.

- Madhya Pradesh State Cooperative Dairy Federation Ltd.

- Maharashtra Rajya Sahakari Dudh Mahasangh Maryadit (MRSDMM)

- Mother Dairy Fruits & Vegetables Pvt. Limited

- Rajasthan Cooperative Dairy Federation (RCDF)

- Tamilnadu Co-operative Milk Producers’ Federation Limited

- The Odisha State Cooperative Milk Producers' Federation Limited (OMFED)

- Godrej Creamline Jersey Products Limited

- HAP

- Bhole Baba Milk Food Industries Ltd.

- Creamy Foods Limited

- Heritage Foods Ltd.

- Kwality Limited

- Milkfood Limited

- Nestlé S.A.

- Parag Milk Foods

- Prabhat Dairy (Sunfresh Agro Industries Pvt. Ltd.)

- Sterling Agro Industries Ltd.

- Tirumala Milk Products Pvt. Ltd.

- VRS Foods Limited

Recent Developments:

- In January 2026, Milky Mist Dairy Food Ltd intends to allocate Rs 1,130 crore to establish a processing facility in Maharashtra as a component of its growth strategy. In a statement released on Friday, the company announced that it has entered into a memorandum of understanding (MoU) with the Maharashtra government to establish a significant milk processing and dairy products manufacturing plant in the state. The MoU was executed at the current World Economic Forum (WEF) Annual Meeting in Davos, with Maharashtra Chief Minister Devendra Fadnavis in attendance.

- In January 2026, Karnataka Cooperative Milk Producers’ Federation (KMF) unveiled a new selection of dairy items under its prominent Nandini brand. The shift broadens its range to address changing consumer demands related to nutrition, quality, and product transparency. The recently launched items consist of N-Pro Milk (high-protein milk), medium-fat paneer, GoodLife high-aroma ghee, Nandini pure ghee, probiotic curd, probiotic mango lassi, probiotic strawberry lassi, dairy whitener, and budget-friendly small packs of milk and curd priced at ₹10. Chief Minister unveiled these at the Vidhana Soudha office, attended by senior government officials, legislators, and KMF representatives.

- In November 2025, In anticipation of National Milk Day (November 26), Milma has introduced five new products to its lineup, featuring Samridhi ghee, Milma Plus flavored milk in a can, ghee halwa, kanthari buttermilk, and banana burfi.

- In November 2025, The Ramgarh Gaushala (Cow Farmhouse), a two-year-old facility with 125 cows, situated in Vikas Nagar area of Ramgarh town, is preparing to set up a milk packaging machine and commence the distribution of pure cow milk in Ramgarh shortly. It is operated and overseen by the Shri Ramgarh Gaushala Committee. This was declared by the Shri Ramgarh Gaushala Committee at its 67th Gopashtami Mahotsava (Cow Festival Event). The chairman of the Federation of Jharkhand Chamber of Commerce and Industries (FJCCI) inaugurated the event as the chief guest.

Dairy Industry in India Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Billion INR |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Products Covered |

|

|

Regions Covered |

Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, Orissa |

|

Companies Covered |

Bihar State Milk Co-operative Federation Ltd. (COMFED), Gujarat Co-operative Milk Marketing Federation Ltd., Haryana Dairy Development Cooperative Federation Limited, Karnataka Co-operative Milk Producers Federation Ltd., Madhya Pradesh State Cooperative Dairy Federation Ltd., Maharashtra Rajya Sahakari Dudh Mahasangh Maryadit (MRSDMM), Mother Dairy Fruits & Vegetables Pvt. Limited, Rajasthan Cooperative Dairy Federation (RCDF), Tamilnadu Co-operative Milk Producers’ Federation Limited, The Odisha State Cooperative Milk Producers' Federation Limited (OMFED), Godrej Creamline Jersey Products Limited, HAP, Bhole Baba Milk Food Industries Ltd., Creamy Foods Limited, Heritage Foods Ltd., Kwality Limited, Milkfood Limited, Nestlé S.A., Parag Milk Foods, Prabhat Dairy (Sunfresh Agro Industries Pvt. Ltd.), Sterling Agro Industries Ltd., Tirumala Milk Products Pvt. Ltd., and VRS Foods Limited |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The dairy industry in India size was valued at INR 21,318.45 Billion in 2025.

The dairy industry in India is expected to grow at a compound annual growth rate of 11.77% from 2026-2034 to reach INR 58,034.06 Billion by 2034.

Liquid milk dominates the market with a share of 65.3% in 2025, driven by its essential role in daily consumption, deep cultural acceptance, integration into traditional cuisine, government support through cooperative models, and India's position as the world's largest milk producer.

Growth is driven by rising health awareness, demand for fortified and protein-rich dairy, expanding middle-class incomes, urban retail penetration, and strong government support through dairy infrastructure, productivity programs, and cooperative-led supply chain modernization.

Key challenges include rising feed and fodder costs, fodder shortages, weak cold-chain infrastructure causing milk losses, frequent livestock disease outbreaks, low breeding efficiency, and below-average cattle productivity that limits sustainable growth in milk output.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)