Global Warehousing and Storage Market Expected to Reach USD 716.1 Billion by 2033 - IMARC Group

Global Warehousing and Storage Market Statistics, Outlook and Regional Analysis 2025-2033

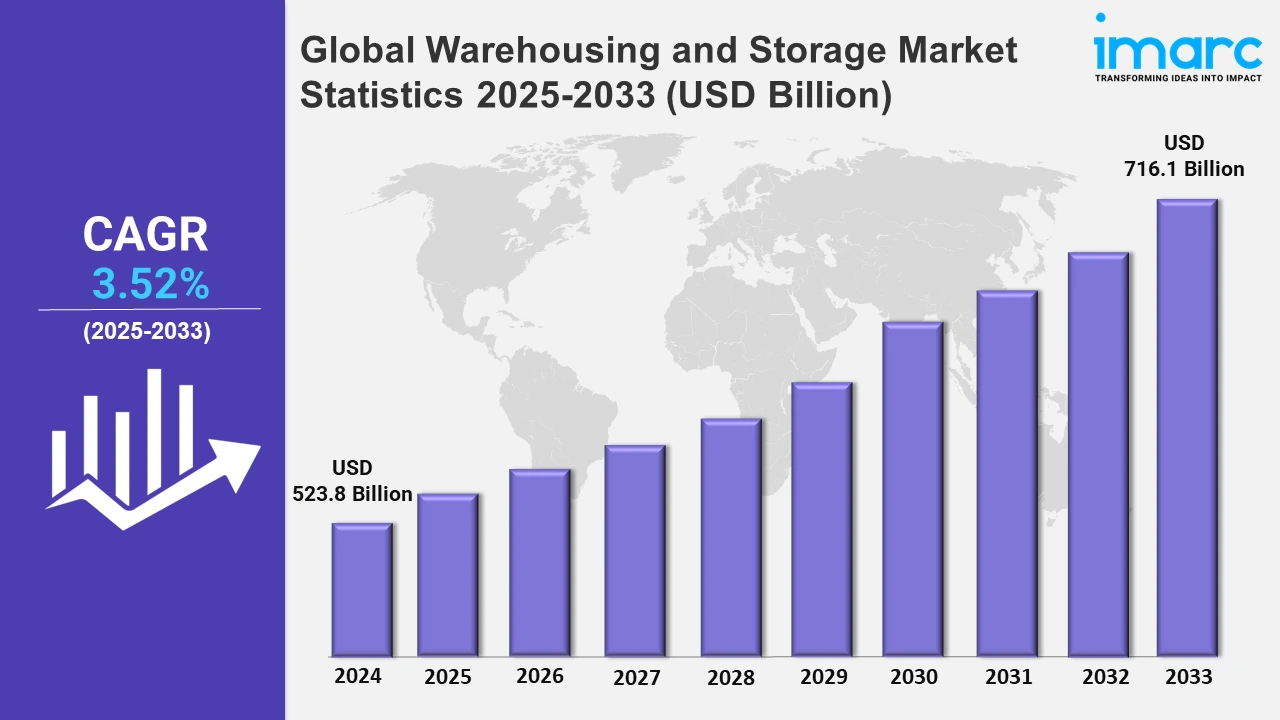

The global warehousing and storage market size was valued at USD 523.8 Billion in 2024, and it is expected to reach USD 716.1 Billion by 2033, exhibiting a growth rate (CAGR) of 3.52% from 2025 to 2033.

To get more information on this market, Request Sample

The growing demand for efficiency, advancement in technology, the rise of e-commerce and international trade, etc., are boosting the market. Aligned with this, the emerging trend of smart and automated warehousing systems is inflating the need for advanced warehousing solutions to eliminate these storage concerns. Storage and retrieval operations are becoming more flexible and scalable as a result of the incorporation of robotics and artificial intelligence into warehouse management systems. For instance, in May 2024, Mytra introduced a cutting-edge 3D robotic storage system, which increases efficiency by allowing full pallet movement in any direction, enhancing material flow, and reducing complexity. Apart from that, India's logistics industry is expanding with substantial investments in extensive warehouse developments. Welspun One opened India's largest single-location Grade A warehouse and industrial park at JNPA SEZ in November 2024, marking a significant milestone in the development of the nation's logistics infrastructure. This facility covers 55 acres and provides 4.45 million square feet of space with a Rs 2,700 Crore investment. It also meets the increasing need for imports and exports. Its strategic location close to India's biggest container port makes it a vital component of the region's effective logistics network.

In accordance with these trends, there is a steady increase in the requirement for temperature-controlled environments to keep delicate products as the demand of customers for fresh and frozen items increases worldwide. Moreover, this is demonstrated by CJ Logistics America's announcement in May 2024 of a new 291,000-square-foot cold storage facility in New Century, Kansas. The facility is built to meet the increasing need for cold storage logistics with direct rail access and Alta EXPERT refrigeration. Beyond that, the demand for these facilities is further impelled by the growing necessity of global distribution networks to help supply chains and e-commerce. For preserving the quality of products, cold storage options are essential, which increases the demand for creative, state-of-the-art warehouse facilities and ensures on-time delivery that can meet the demands of a wide range of industries.

Global Warehousing and Storage Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia Pacific, Europe, Middle East and Africa, and Latin America. According to the report, Asia Pacific is the largest market driven by its growing e-commerce industry, quick economic expansion, robust manufacturing base, etc.

North America Warehousing and Storage Market Trends:

The rapid expansion of e-commerce in North America is necessitating the need for effective last-mile delivery solutions in the warehousing and storage industry. Consistent with this, the trend is illustrated by Amazon's investment in distribution centers in the United States, thereby including their 3.8 million square foot warehouse in Ohio. Companies like Lineage Logistics are expanding their facilities across the region to meet the needs for perishable goods storage.

Europe Warehousing and Storage Market Trends:

The warehousing and storage industry in Europe is strengthened by automation and the development of smart warehouses. Countries like Belgium, France, Germany, Greece, etc., are spreading this trend with companies like DHL utilizing robotics and artificial intelligence to fulfill orders. Besides this, to invest more in regional storage options in order to minimize interruptions and guarantee cross-border trade efficiency, companies like Brexit have initiated logistics and supply chains in the region.

Asia Pacific Warehousing and Storage Market Trends:

Asia Pacific leads the overall market due to the substantial expenditures made in warehouse infrastructure, particularly in countries like India, Japan, and China. Moreover, the increased industrial production and trade have seen a rise due to the necessity for advanced logistics networks. For instance, Zepto and NX Logistics India opened a luxurious 1.8 lakh square foot warehouse facility in December 2024 in Sumadhura Park. The 100-acre park eventually includes 6 million square feet of warehouse space.

Latin America Warehousing and Storage Market Trends:

In Latin America, the warehousing and storage business is growing due to the rising demand for logistical infrastructure. Furthermore, the expansion of retail and e-commerce is pushing this trend, with businesses like Mercado Libre constructing cutting-edge logistics facilities. Adding to this, cold storage is also becoming more vital as the region's agricultural exports, like those from Argentina, increase, which, in turn, requires more modern storage facilities in the region to handle perishable goods efficiently.

Middle East and Africa Warehousing and Storage Market Trends:

The addition of free trade zones and e-commerce in the Middle East and Africa is changing the businesses of warehousing. Additionally, as major international retailers have chosen to establish distribution centers in the UAE, Dubai is at the forefront of this expansion, thereby contributing to the market expansion. Moreover, with the raised demand for more advanced warehouses to support regional growth and trade, Saudi Arabia has also increased investment in logistics infrastructure to support this development.

Top Companies Leading in the Warehousing and Storage Industry

The global warehousing and storage market is examined in-depth in this analysis, which highlights key market components. It explores both general and specialized aspects of market dynamics, such as industry performance indicators, recent advancements, key motivators and challenges, Porter's Five Forces framework, SWOT analysis, value chain insights, etc. This research, which is intended for consultants, business planners, analysts, investors, and entrepreneurs, is an essential tool for everyone working in or thinking about entering the warehousing and storage industry.

Global Warehousing and Storage Market Segmentation Coverage

- On the basis of the type of warehouses, the market has been bifurcated into general warehousing and storage, refrigerated warehousing and storage, and farm product warehousing and storage, wherein general warehousing and storage represent the most preferred segment. Warehousing and storage services facilitate effective distribution throughout supply chains, order fulfillment, and inventory control.

- Based on ownership, the market is categorized into private warehouses, public warehouses, and bonded warehouses. Among these, private warehouses lead the market. Companies own private warehouses for their exclusive use, as they provide tailored storage solutions, greater control over inventory, and flexibility in operations.

- On the basis of the end-use, the market has been divided into manufacturing, consumer goods, retail, food and beverage, IT hardware, healthcare, chemicals, and others. Currently, manufacturing exhibits a clear dominance in the market. Storage of components, raw materials, and completed commodities is essential to manufacturing. Production flow, inventory control, and distribution are all improved by efficient warehousing, which cuts down on operational delays in industrial operations.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 523.8 Billion |

| Market Forecast in 2033 | USD 716.1 Billion |

| Market Growth Rate 2025-2033 | 3.52% |

| Units | Billion USD |

| Segment Coverage | Type of Warehouses, Ownership, End-Use, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Central Warehousing Corporation (CWC), CEVA Logistics, Deutsche Post AG, DSV A/S, FedEx, Geodis Group, GMK Logistics (CTI Logistics Limited), Indu Logistics, Nippon Express Holdings, Inc., RXO Inc., Ryder System, Inc., Sozo Logistics (Pty) Ltd, XPO, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Warehousing and Storage Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)