Global Vodka Market Expected to Reach USD 81.1 Billion by 2033 - IMARC Group

Global Vodka Market Statistics, Outlook and Regional Analysis 2025-2033

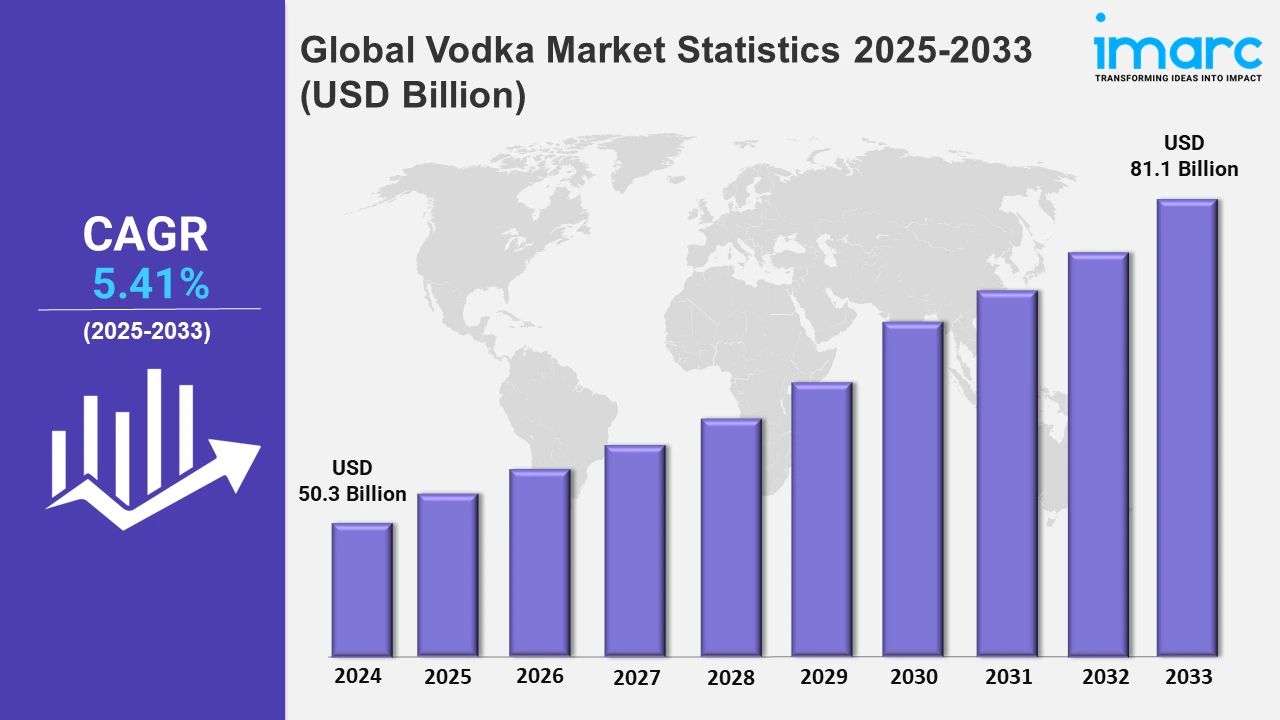

The global vodka market size was valued at USD 50.3 Billion in 2024, and it is expected to reach USD 81.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.41% from 2025 to 2033.

To get more information on this market, Request Sample

The vodka market is growing rapidly because of shifting consumer preferences towards premium and flavored options. Today, people are increasingly looking for unique, high-quality, and often infused vodka variations with exotic flavors. This has made premium vodka brands to focus on delivering a smoother taste and market their product as the go-to choice for sophisticated drinkers. This shift in preference is also motivated by a younger demographic that is willing to spend extra for a better drinking experience. In the year 2023, as per the Distilled Spirits Council of the United States, approximately 75 million nine-liter cases of vodka were recorded to be sold in the United States, creating $7.2 billion in revenue for distillers. An important growth driver has been the consistent demand of flavored vodkas.

Another significant factor driving the vodka market is the rising demand for vodka-based cocktails. Cocktails like the Moscow Mule, Cosmopolitan, and Bloody Mary have become cultural icons, and vodka is their key ingredient. This has made vodka the spirit of choice for both bartenders and consumers, due to its neutral taste that blends seamlessly with other flavors. Also, the surge in ready-to-drink (RTD) vodka products is another driver of the vodka market. Consumers today are seeking convenience without compromising on quality or flavor, and RTD beverages fit this demand perfectly. Whether it is canned vodka soda or pre-mixed cocktails like vodka lemonade, these products are gaining immense popularity among busy professionals, partygoers, and even casual drinkers. As per industry reports, in 2023, across ten key RTD markets, 45% of alcohol buyers purchased RTDs and 54% of buyers were seen to associate this segment with spirits, including vodkas.

Global Vodka Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its strong cocktail culture and high consumer spending on premium spirits.

North America Vodka Market Trends:

North America dominates the global vodka market, accounting for the largest share due to the region’s high consumption levels and well-established spirits industry. The United States leads this segment, with vodka representing a significant share of all spirits consumed annually. The market benefits from strong consumer demand for premium and craft vodka brands, with millennials and Gen Z driving the shift toward flavored and high-quality options. The rise of ready-to-drink vodka beverages has further fueled growth, making vodka an integral part of North America's thriving cocktail culture. Additionally, large-scale marketing campaigns and celebrity-endorsed vodka brands have elevated the spirit’s popularity in this region.

Asia-Pacific Vodka Market Trends:

Vodka is becoming an increasingly important and vibrant market in Asia Pacific. This growth is because of its rapid urbanization, increasing disposable incomes, and a shift in consumer preference towards Western-style spirits. Vodka consumption is growing phenomenally in several countries such as India, China, and Japan among consumers who are young and in their late 20s to early 30s. Above all, the trend is being led by cocktails-loving consumers that are mixed with vodka and the backing of heavy international marketing efforts.

Europe Vodka Market Trends:

Europe holds a significant share of the global vodka market, largely due to its cultural roots in vodka consumption. Countries like Russia, Poland, and Sweden are historically known for their vodka production and consumption. European consumers often prefer traditional vodka styles, though there is a growing interest in premium and organic varieties. Export markets have also contributed to Europe’s strong position. The region’s demand is further supported by the tourism industry, with vodka being a key part of many cultural and culinary experiences.

Latin America Vodka Market Trends:

The Latin American vodka market continues to grow because of the increased infusion of cocktails in the culture and an uptake of foreign spirits that encourage more consumption of vodka. Countries such as Brazil, Mexico, and Argentina carry a major share of regional demand. In fact, it is believed that vodka is one of the most-catered types of liquor in all trendy and upscale social locales and is becoming a favorite drink among consumers living in urban areas. Alongside this, the emergence of an increasing number of vodkas being manufactured locally in the region as craft distilleries experiment with more innovative ingredients and flavors catering to such local tastes is boosting its popularity. Although, the market is not as huge compared to North America and Europe, but the burgeoning middle class and improved distribution networks have helped fuel continued growth.

Middle East and Africa Vodka Market Trends:

This region's vodka market shows a promising growth prospect in the future. South Africa is one of the key markets and is expected to continuously increase its consumption, mainly because of urbanization and the influence of Western culture. In the Middle East, where there is a restriction on alcohol consumption, premium vodka is aimed more at expatriates and tourists. With innovative marketing and the introduction of non-alcoholic vodka alternatives, the growth has been fruitful in developing the market.

Top Companies Leading in the Vodka Industry

Some of the leading vodka market companies include Anheuser-Busch InBev SA/NV, Bacardi Limited, Becle SAB de CV, Brown–Forman Corporation, Constellation Brands Inc., Davide Campari-Milano N.V. (Lagfin S.C.A.), Diageo plc, Distell Group Limited, Iceberg Vodka Corporation, LVMH Moet Hennessy Louis Vuitton, Pernod Ricard, Russian Standard Vodka LLC, Stoli Group S. à r.l., Suntory Holdings Limited, among many others.

- In October 2024, Diageo announced the trial of Everpour, an innovative new keg and integrated bottle dispensing system. It started initially with Smirnoff at selected bars in and around Dublin, Ireland. In this trial, the company will use stainless-steel kegs in 5 or 17.5-litre sizes of Smirnoff vodka.

- In October 2024, Roust Corporation partnered with Indian spirits company Allied Blenders and Distillers Russian to launch Standard Vodka LLC in the Indian market.

Global Vodka Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into flavored and non-flavored, wherein flavored vodka represents the leading segment. It appeals to a wider audience by offering diverse taste profiles that cater to evolving consumer preferences. Its versatility in cocktails and increasing popularity among younger demographics have driven its dominance in the market.

- Based on the quality, the market is classified into standard, premium, and ultra-premium, amongst which ultra-premium dominates the market. This vodka segment is gaining traction as consumers increasingly value high-quality spirits that offer smoother taste and exclusive branding. The growing demand for luxury experiences and the willingness to pay more for premium products have made this segment the largest.

- On the basis of the distribution channel, the market has been divided into off and on trade. Among these, off-trade channels accounts for the majority of the market share. Supermarkets, liquor stores, and online platforms are off-trade channels that dominate the market as they offer convenience and accessibility for consumers purchasing vodka for home consumption. The rise of e-commerce and bulk buying trends further reinforces the significance of this segment.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 50.3 Billion |

| Market Forecast in 2033 | USD 81.1 Billion |

| Market Growth Rate 2025-2033 | 5.41% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Flavored, Non-Flavored |

| Qualities Covered | Standard, Premium, Ultra-Premium |

| Distribution Channels Covered | Off Trade, On Trade |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anheuser-Busch InBev SA/NV, Bacardi Limited, Becle SAB de CV, Brown–Forman Corporation, Constellation Brands Inc., Davide Campari-Milano N.V. (Lagfin S.C.A.), Diageo plc, Distell Group Limited, Iceberg Vodka Corporation, LVMH Moet Hennessy Louis Vuitton, Pernod Ricard, Russian Standard Vodka LLC, Stoli Group S. à r.l., Suntory Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)