US Deodorant Market Expected to Reach USD 12.7 Billion by 2033 - IMARC Group

US Deodorant Market Statistics, Outlook and Regional Analysis 2025-2033

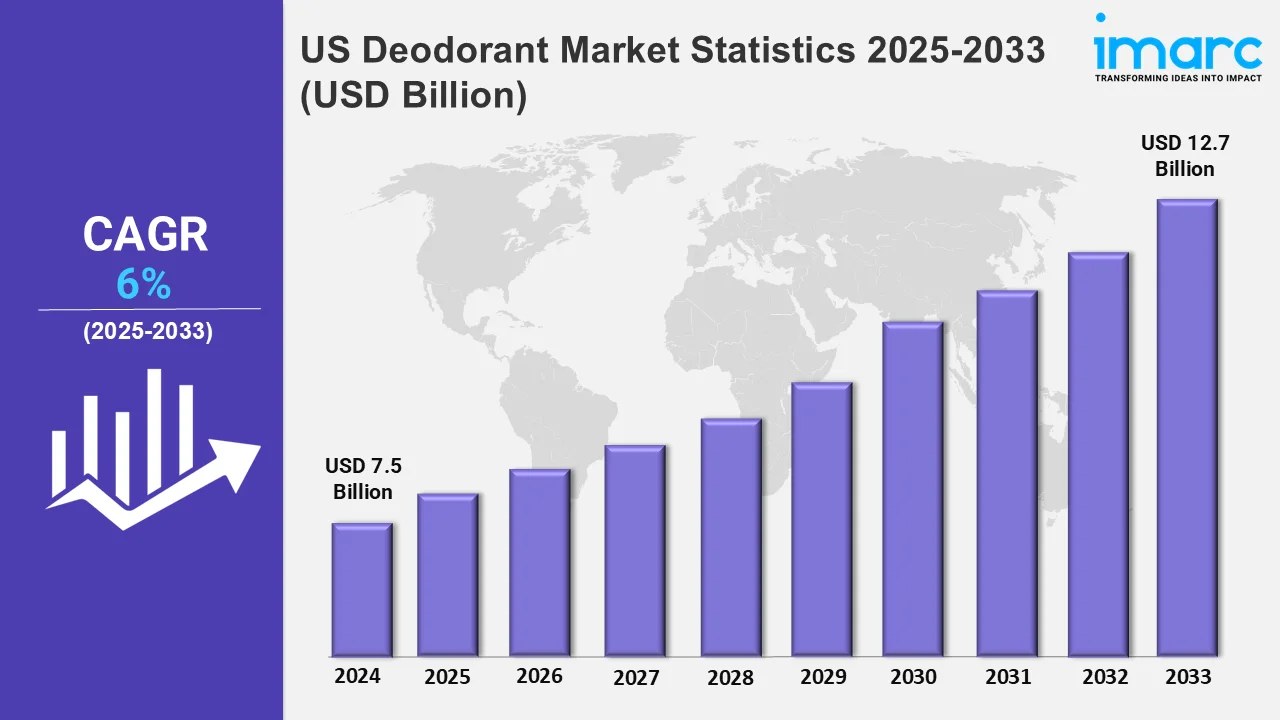

The US deodorant market size was valued at USD 7.5 Billion in 2024, and it is expected to reach USD 12.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing focus on personal hygiene and grooming is aiding significant expansion of the US deodorant market. Consumers are becoming more conscious of odor protection beyond traditional underarm applications, leading to a surge in demand for whole-body deodorants. Additionally, rising awareness of specialized formulations, such as aluminum-free, skin-nourishing, and dermatologist-tested products, is further strengthening market growth. This trend is particularly evident in mass retail and online channels, where companies are launching innovative products to meet evolving consumer preferences. In line with this, major brands are introducing new product lines to address growing concerns about skin hydration, long-lasting freshness, and the effectiveness of natural formulations. For instance, in January 2025, Dove Men+Care launched Whole Body Deodorant Sprays in New York, with Marshawn Lynch as the brand ambassador. This expansion strengthens the men's grooming segment by promoting full-body odor protection solutions, driving greater adoption across mass retail.

Similarly, in June 2024, O Positiv introduced URO Intimate Deodorant, catering to odor control and skin hydration needs in the feminine hygiene segment. By offering specialized deodorants, this development enhances product diversity and increases consumer confidence in intimate personal care solutions across the country. These innovations highlight the shift towards more targeted deodorant solutions that cater to specific consumer needs beyond traditional applications. Furthermore, the rising preference for natural and aluminum-free deodorants is accelerating product innovation in the market. Consumers are prioritizing gentle yet effective formulations that ensure all-day freshness without the use of harsh chemicals. This shift is leading brands to develop dermatologist-tested and skin-friendly alternatives that align with the increasing demand for clean-label personal care products. In this regard, Native introduced Whole Body Deodorant Cream in 2024, offering a natural, aluminum-free solution that provides long-lasting odor protection. This product launch reinforces the expansion of the natural deodorant segment while addressing consumer concerns about skin sensitivity and product safety, further driving market evolution.

US Deodorant Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The market for deodorant in the United States is driven by factors such as rising skincare awareness, gender-specific launches, eco-friendly demand, sports participation, e-commerce growth, etc.

Northeast Deodorant Market Trends:

The Northeast sees strong demand for natural and aluminum-free deodorants due to eco-conscious consumers. Urban areas like Boston and Massachusetts favor premium brands with organic formulations. Seasonal shifts, including humid summers and harsh winters, drive interest in moisture control and long-lasting formulas. Brands like Native and Schmidt’s thrive here, leveraging sustainable packaging. Retailers like Whole Foods and CVS stock niche and dermatologist-recommended deodorants appealing to health-conscious buyers.

Midwest Deodorant Market Trends:

The Midwest deodorant market is growing with innovations addressing long-lasting protection needs. In December 2024, Degree launched Whole Body Deodorant in Illinois and other areas, offering 72-hour odor control for multiple body parts. This expansion enhances product versatility, appealing to consumers seeking all-in-one solutions beyond underarm applications. Retail chains like Target and Walmart in Chicago drive market adoption. Seasonal temperature variations in Michigan further increase demand for deodorants providing all-day freshness across different body areas.

South Deodorant Market Trends:

Southern states see rising demand for full-body deodorants due to high temperatures and increased grooming awareness. In February 2024, Old Spice introduced Total Body Deodorant in Georgia and Texas, promoting 24/7 freshness for full-body use. This launch strengthens the men’s grooming segment by expanding beyond underarm protection. Atlanta’s growing fitness culture fuels demand, with gyms and wellness stores stocking specialized deodorants. Consumers in humid cities like Houston prefer long-lasting odor-control products for everyday activities.

West Deodorant Market Trends:

The West Coast deodorant market is shifting toward biotech-driven solutions emphasizing skin health. In March 2023, Arcaea launched ScentARC in Massachusetts and California, using prebiotics to neutralize odor-causing microbes without masking agents. This scientific approach increases interest in microbiome-friendly deodorants. Los Angeles, a leader in clean beauty, drives demand for such innovations, with premium retailers expanding biotech-based product lines. San Francisco’s eco-conscious consumers further boost sales, preferring sustainable deodorant formulations with innovative odor-control ingredients.

Top Companies Leading in the US Deodorant Industry

The US deodorant market is evolving, with companies prioritizing factors such as innovative formulations, sustainability, targeted branding, etc. Market leaders are expanding product lines with natural, organic, and gender-specific options while adopting biodegradable packaging and carbon-reducing initiatives. In August 2023, Curie entered Walmart stores in Illinois, Georgia, and Texas, launching an out-of-home campaign to drive awareness. The natural deodorant industry benefits from this retail expansion by increasing accessibility and consumer reach. Prominent companies are also using athletes, celebrities, and social media influencers for marketing purposes while spending money on research to learn about consumer preferences. The study offers a thorough competition analysis that covers the leading competitors, strategic plans, and significant advancements influencing the deodorant market in the United States.

US Deodorant Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into sprays, roll-ons, creams, and others. These types of deodorants offer distinct application methods, absorption rates, and skin compatibility, catering to consumer preferences for convenience, efficacy, and skin sensitivity in personal hygiene products.

- Based on distribution channel, the market is categorized into supermarkets and hypermarkets, convenience stores, pharmacies, online stores, and others. These channels provide consumers with diverse deodorant options, ensuring accessibility, affordability, and convenience through physical and digital shopping experiences tailored to various purchasing behaviors and brand preferences.

- On the basis of the packaging type, the market has been divided into metal, plastic, and others. Deodorant packaging utilizes metal, plastic, and alternative materials, balancing durability, recyclability, and environmental impact while ensuring product stability, ease of use, and compliance with industry regulations for safety and sustainability.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 12.7 Billion |

| Market Growth Rate 2025-2033 | 6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Sprays, Roll-On, Creams, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Online Stores, Others |

| Packaging Types Covered | Metal, Plastic, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)