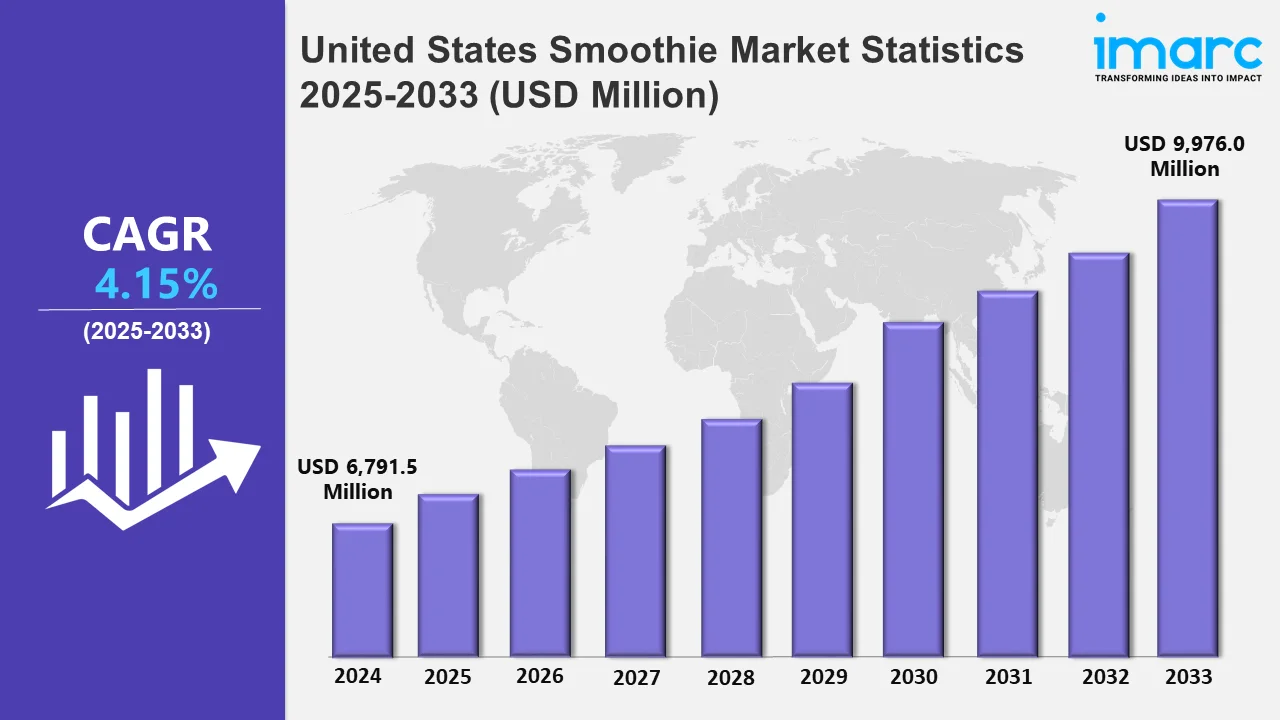

United States Smoothie Market Expected to Reach USD 9,976.0 Million by 2033 - IMARC Group

United States Smoothie Market Statistics, Outlook and Regional Analysis 2025-2033

The United States smoothie market size was valued at USD 6,791.5 Million in 2024, and it is expected to reach USD 9,976.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.15% from 2025 to 2033.

To get more information on this market, Request Sample

The growing emphasis on health-conscious choices, clean-label ingredients, and functional nutrition is driving expansion in the United States smoothie market. Consumers are increasingly prioritizing beverages with natural ingredients, no added sugars, and nutritional benefits, prompting brands to innovate and differentiate their offerings. There is an increasing need for high-quality smoothies that are packed with protein, fiber, and vitamins as customer preferences and disposable incomes change. As a result, companies are using strategic alliances and growing their product lines to accommodate a range of dietary requirements. For example, with the support of Grupo Jumex and Full Sail IP Partners, Odwalla returned to the US smoothie industry in January 2025 with varieties of mango, strawberry-banana, and berries. This relaunch strengthens premium smoothie availability, focusing on natural ingredients, diverse packaging formats, and a commitment to health-oriented choices.

Concurrent with this, Smoothie King addressed the needs of people on GLP-1 drugs in October 2024 by introducing the GLP-1 Support Menu. These sugar-free, high-protein, fiber-rich smoothies demonstrate the brand's commitment to functional nutrition and its competitive stance in the health-conscious QSR market. These changes are part of a larger trend in which companies are using nutritional science to appeal to health-conscious consumers. Besides this, the necessity for creative and unique beverages is rising in the country, particularly among Gen Z and Millennials. Consumers are looking for unique, refreshing drinks that integrate functional ingredients, such as caffeine, adaptogens, and plant-based proteins, to support their active lifestyles. This trend is reshaping product innovation and marketing strategies, with brands investing in experiential campaigns and new formulations to captivate evolving consumer preferences. In line with this, in September 2024, Jamba launched the Sunrise Smoothie Tour and introduced blended coffees to reinforce its Hello Sunshine brand identity. This initiative enhances consumer engagement, strengthens Jamba’s market presence, and aligns with the rising demand for smoothie-based beverages infused with caffeine, appealing to younger demographics seeking multifunctional drinks.

United States Smoothie Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. Currently, the West dominates the overall market. Growing health consciousness, the need for wholesome convenience, a variety of tastes, plant-based ingredients, useful additives, portable packaging, new product innovations, etc., are all contributing reasons to the US smoothie industry's expansion in the western parts.

Northeast Smoothie Market Trends:

The Northeast smoothie business is moving toward high-protein, plant-based beverages as customers place a higher value on clean-label nutrition. Driven by these changes, New York-based Daily Harvest introduced high-protein smoothies with 20g of organic pea protein in January 2025. These smoothies are sold online and at a few Kroger locations. Furthermore, this aligns with consumers' increasing requirement for functional beverages free of allergens. The demand for organic, plant-based options is rising, particularly in urban centers like New York City, where busy professionals seek convenient yet nutritious solutions, strengthening the functional beverage segment.

Midwest Smoothie Market Trends:

In response to the heightened demand for fresh, nutrient-dense beverages, health-conscious smoothie franchises are expanding throughout the Midwest. Fresh juices, smoothies, and acai bowls were introduced in Robeks' new location in Orland Park, Illinois, in July 2023. In line with this, on-the-go health foods are becoming popular, especially in suburban regions where people are looking for quick and wholesome solutions. Besides this, smoothies are gaining traction outside of typical retail settings because of delivery services and grab-and-go forms, which also improve accessibility in suburban Midwestern regions.

South Smoothie Market Trends:

The Southern smoothie market is embracing functional snacks, integrating tropical flavors and plant-based ingredients. In August 2024, Dallas-based Smoothie King expanded its Smoothie Bowl lineup with Coconut Bowls, offering gluten-free, dairy-free options made with real fruits and premium granola. This reflects rising interest in functional, whole-food ingredients across the region, particularly in Dallas County, where consumers favor nutrient-dense snacks. The quick-service smoothie sector is witnessing robust growth, fueled by demand for wholesome, ready-to-eat options in retail and food service.

West Smoothie Market Trends:

The Western region dominates the overall market, driven by advancing tech-driven innovations and sustainable packaging solutions. In January 2025, Smoothie Bar Infusions launched a California-wide campaign featuring digital smoothie devices for enhanced customization and user experience. This aligns with growing consumer interest in eco-friendly, high-tech food solutions, particularly in Los Angeles County, where digital convenience and environmental responsibility shape purchasing trends. The integration of smart technology in beverage consumption is setting a precedent, making smoothies more interactive, customizable, and sustainable in the Western US.

Top Companies Leading in the United States Smoothie Industry

The United States smoothie industry is evolving, as major participants such as Jamba Juice, Smoothie King, and Tropical Smoothie Cafe are increasing the range of products they provide to benefit health-conscious consumers. Moreover, the competition landscape, including company product portfolios, market positioning, and strategic developments, is well analyzed in the market research report. Reflecting this trend, Tropical Smoothie Cafe strengthened its position in smoothie-inspired bowls by including Dragon Fruit and Acai Bowl with Nutella in its Tropic Bowl menu in January 2025. It reaffirmed its dedication to providing wholesome, tasty lunch options, thereby leveraging market opportunities. Aligned with these advancements, in October 2024, Seal the Seasons launched the Blue Spirulina Tropical Smoothie Kit, featuring locally sourced peaches and spirulina, enhancing accessibility to premium juice bar flavors in the frozen smoothie segment. These innovations reflect the industry's response to rising consumer demand for plant-based, protein-rich, and low-sugar alternatives.

United States Smoothie Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into dairy-based and fruit-based, wherein fruit-based represents the most preferred segment. Fruit-based options primarily drive smoothie sales, as consumers prefer natural ingredients, nutritional benefits, and diverse flavors, thereby making them the leading category in the industry, particularly among health-conscious individuals seeking fresh, minimally processed beverages.

- Based on the distribution channel, the market is categorized into restaurants and smoothie bars, supermarkets and hypermarkets, convenience stores, and others. Currently, restaurants and smoothie bars dominate the market by offering customized, freshly prepared blends that cater to consumer preferences, convenience, and health trends, making them the preferred choice for those seeking on-the-go nutrition and diverse ingredient combinations.

- On the basis of the packaging material, the market has been divided into plastic, paper, glass, and others. Among these, plastic exhibits a clear dominance in the market. Plastic packaging remains the most widely used material in the smoothie market due to its cost-effectiveness, durability, and ability to preserve freshness.

- Based on the consumption pattern, the market is bifurcated into out of home and at home, wherein at home dominates the market. At home smoothie consumption is expanding as consumers seek convenience, cost savings, and control over ingredients, with blenders and ready-to-mix products enabling easy preparation of personalized, nutritious beverages tailored to individual dietary needs and taste preferences.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 6,791.5 Million |

| Market Forecast in 2033 | USD 9,976.0 Million |

| Market Growth Rate 2025-2033 | 4.15% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Dairy-Based, Fruit-Based |

| Distribution Channels Covered | Restaurants and Smoothie Bars, Supermarkets and Hypermarkets, Convenience Stores, Others |

| Packaging materials Covered | Plastic, Paper, Glass, Others |

| Consumption Patterns Covered | Out of Home, At Home |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Smoothie Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)