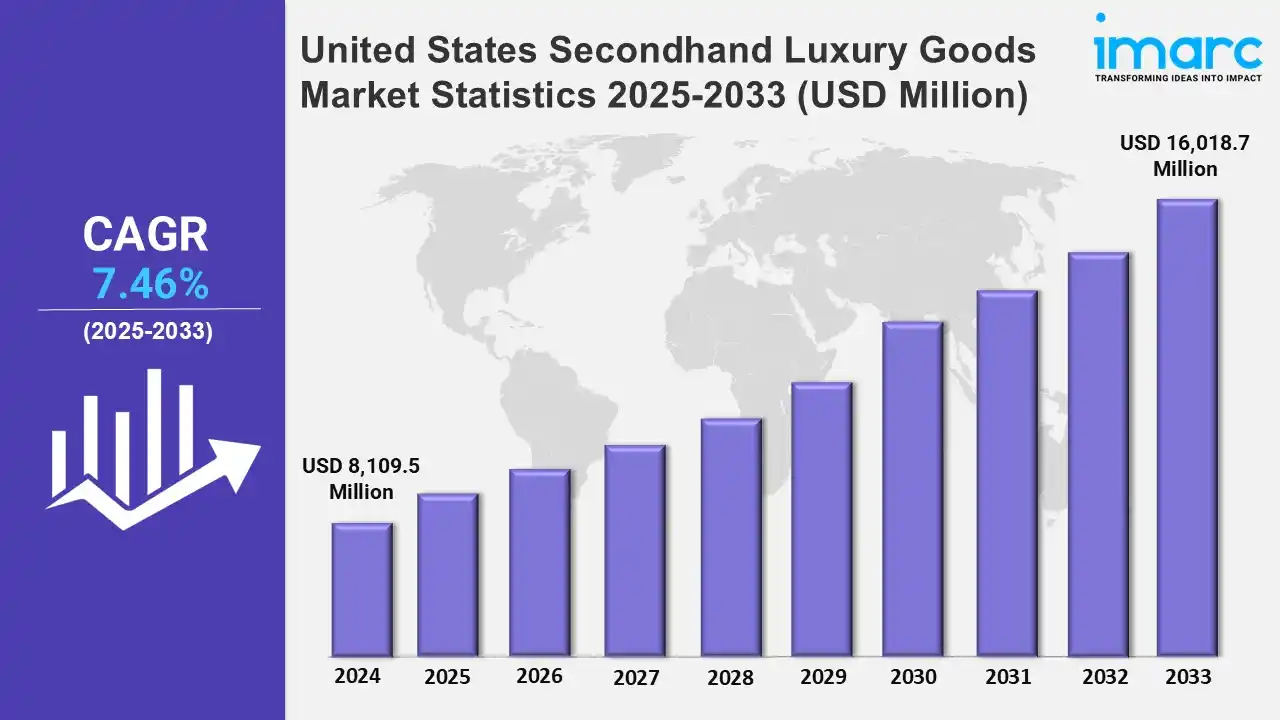

United States Secondhand Luxury Goods Market Expected to Reach USD 16,018.7 Million by 2033 - IMARC Group

United States Secondhand Luxury Goods Market Statistics, Outlook and Regional Analysis 2025-2033

The United States secondhand luxury goods market size was valued at USD 8,109.5 Million in 2024, and it is expected to reach USD 16,018.7 Million by 2033, exhibiting a growth rate (CAGR) of 7.46% from 2025 to 2033.

To get more information on this market, Request Sample

The market is stimulated by the inflating e-commerce sector in the nation. For example, in August 2024, resale platform eBay showcased its pre-loved fashion week in New York, US, to cater to the elevating demand for secondhand luxury goods. Besides this, the rising environmental awareness and the shifting consumer attitudes towards buying pre-owned items at a lower cost are further stimulating the market growth.

The skiwear brand Perfect Moment allied with luxury platform Reflaunt to launch a resale program in May 2024 across the US to extend the durability and quality of its products while catering to eco-conscious individuals. Moreover, the emergence of online platforms and the expanding e-commerce sector are catalyzing the secondhand luxury goods industry across the nation. Furthermore, dedicated online marketplaces and reselling platforms offer a chance for individuals to list and sell their pre-owned items and extend their market reach. For example, in October 2023, Vestiaire Collective, which is a luxury resale site, partnered with Burberry to introduce a program via which secondhand shoppers in the US could trade their pre-owned goods and contribute towards a circular economy.

United States Secondhand Luxury Goods Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The expanding popularity of online platforms that are encouraging secondhand luxury fashion is escalating the market across the US.

Northeast Secondhand Luxury Goods Market Trends:

Given its wealthy population and fashion-forward culture, the Northeastern United States, especially cities like Boston and New York, has a higher demand for used luxury items. For instance, in August 2024, Bloomingdale’s and luxury resale platform Rebag collaborated on a joint retail and digital partnership that offered more than 2,500 pre-owned designer watches, fine jewelry pieces, handbags, etc.

Midwest Secondhand Luxury Goods Market Trends:

The market in the Midwest region is mainly bolstered by the increasing interest in consumers seeking luxury products at more affordable rates. Cities, including Minneapolis and Chicago, have a huge presence of online platforms and brick-and-mortar stores that provide an extensive range of secondhand luxury goods, further catalyzing the market expansion. For example, in February 2024, the leading authentic pre-owned luxury handbag and accessories corporation, Season 2 Consign, decided to open its franchise in Chicago.

South Secondhand Luxury Goods Market Trends:

The demand for luxury secondhand products has been rising in the Southern United States, namely in major cities like Miami, Atlanta, and Houston. Moreover, in December 2024, RealReal, the largest online marketplace for secondhand luxury goods, opened up its store in the Design District in Miami, Florida.

West Secondhand Luxury Goods Market Trends:

Growing affluent populations and the growth of luxury retail districts, particularly in places like San Francisco, Los Angeles, and Las Vegas, are driving the market in the West region of the United States, primarily in states like Nevada, California, and Washington. For example, in January 2023, a luxury consignment store, the Closet Trading Co., opened its boutique in Westlake Village, California, to provide used designer clothing and accessories at unbeatable prices.

Top Companies Leading in the United States Secondhand Luxury Goods Industry

There are several companies encompassing the United States secondhand luxury goods market. Walmart and Rebag, an online luxury resale site, announced their agreement in January 2025, which enables customers to buy designer bags and accessories from companies, including Dior, Hermès, Chanel, Goyard, and Louis Vuitton.

United States Secondhand Luxury Goods Market Segmentation Coverage

- Based on product type, the market has been segmented into handbags, jewelry and watches, clothing, small leather goods, footwear, accessories, and others. Among these, handbags hold the largest market share. They appeal as a unique fashion accessory and status symbol. Besides this, handbags retain their value over time and are highly durable, thereby bolstering their demand for resale.

- Based on the demography, the market has been categorized into women, men, and unisex. According to the market perspective, women make up the largest market segment since they are more interested in fashion and are, therefore, more inclined to purchase upscale and distinguished goods.

- Based on the distribution channel, the market has been divided into offline and online. Between the two, offline has the larger share, encompassing luxury boutiques, physical retail stores, consignment shops, and auction houses. These establishments allow customers to inspect and verify items physically before making a purchase.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 8,109.5 Million |

| Market Forecast in 2033 | USD 16,018.7 Million |

| Market Growth Rate 2025-2033 | 7.46% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Handbags, Jewelry and Watches, Clothing, Small Leather Goods, Footwear, Accessories, Others |

| Demographics Covered | Women, Men, Unisex |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Secondhand Luxury Goods Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)