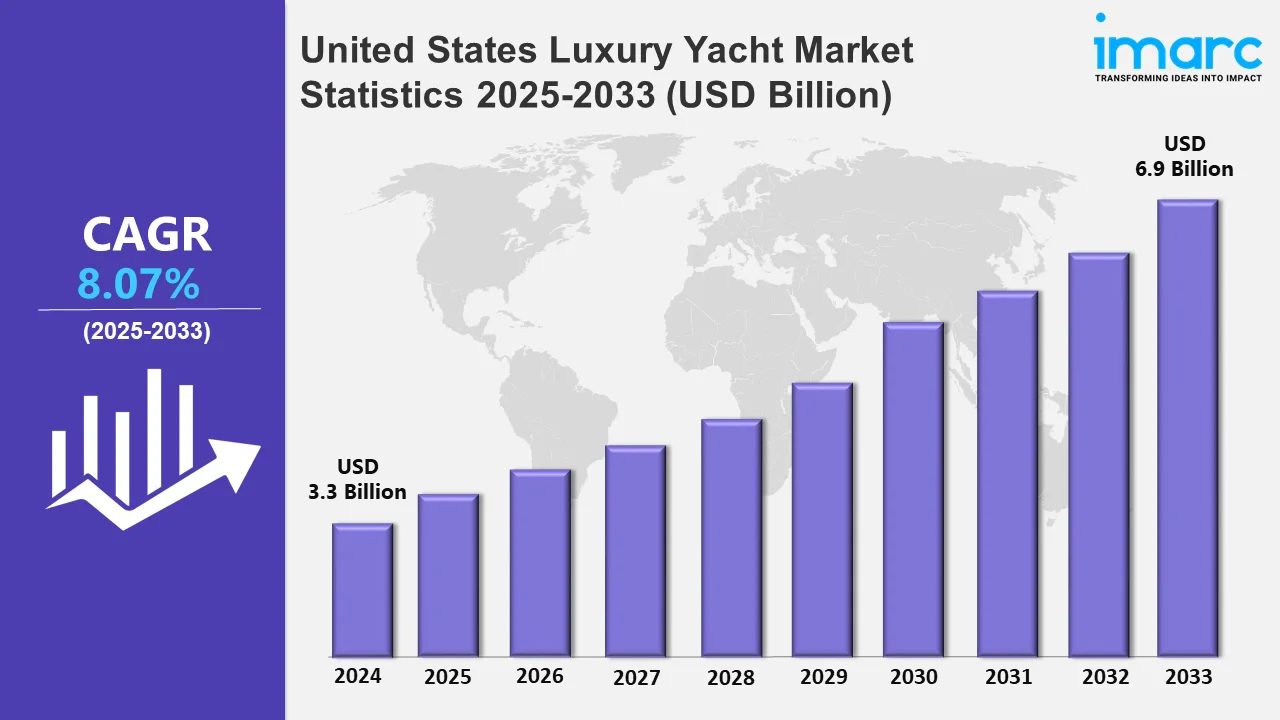

United States Luxury Yacht Market Expected to Reach USD 6.9 Billion by 2033 -IMARC Group

United States Luxury Yacht Market Statistics, Outlook and Regional Analysis 2025-2033

The United States luxury yacht market size was valued at USD 3.3 Billion in 2024, and it is expected to reach USD 6.9 Billion by 2033, exhibiting a growth rate (CAGR) of 8.07% from 2025 to 2033.

To get more information on this market, Request Sample

The United States luxury yacht market is experiencing a shift driven by sustainability, technological advancements, and evolving consumer preferences. Electric propulsion is becoming popular due to the rising priority on environmentally friendly solutions, which lowers the carbon footprint of recreational boating. Silent, emission-free yachts that provide both environmental advantages and improved onboard experiences are gaining prominence among consumers. Along with this, electric yachts are becoming increasingly feasible because of government policies that favor sustainable energy and developments in battery technology. Besides this, younger and affluent people are also joining the industry in search of sustainable solutions and creative ownership arrangements that fit with their ideals. These factors are accelerating the adoption of green marine technology and reshaping luxury yacht offerings. In October 2024, Sialia Yachts expanded to Fort Lauderdale, partnering with Yacht Sales International to introduce its electric yacht lineup. With silent, zero-emission propulsion, this move accelerates electric yacht adoption, pushing the market toward more sustainable alternatives while increasing consumer awareness of green marine technology.

Additionally, the appeal of sustainable tourism is influencing consumer choices, with many preferring eco-conscious options for yachting experiences. The evolving preferences of high-net-worth individuals are also driving innovation in yacht accessibility and ownership models. Rising maintenance costs, high initial investments, and limited usage periods have made traditional yacht ownership less attractive to some consumers. As a result, companies are launching adaptable options that offer yachting advantages without requiring long-term financial commitments. Frequent travelers can experience luxury yachting without the hassles of full ownership due to subscription-based memberships and fractional ownership models, which are becoming more and more popular. Aligned with this, Exclusive Yachts launched a subscription-based yacht membership program in Naples in May 2023, giving members access to vessels ranging in length from 35 to 115 ft in a variety of locations. This innovation transforms the industry by lowering ownership costs and increasing accessibility, thereby making luxury yachting more affordable for frequent visitors. Furthermore, these changes are part of a larger trend in the luxury yacht sector in the United States, where new growth prospects are being driven by technology, sustainability, and flexible ownership models.

United States Luxury Yacht Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. Economic growth coupled with more significant disposable income, improved technology, rising demand for travel, and changing customer preferences for upscale nautical experiences are all contributing factors to the expansion of the luxury yacht market in the US.

Northeast Luxury Yacht Market Trends:

Affluent consumers in coastal regions like Massachusetts are driving the Northeast's luxury yacht industry's growing desire for environmentally friendly vessels. In addition, wealthy people in Nantucket County are increasingly preferring solar-powered yachts and hybrid propulsion systems. Moreover, organizations like Silent Yachts are growing their market share by providing eco-friendly options for boaters. Also, Rhode Island's marinas are likewise upgraded to handle larger vessels as the region's predilection for superyachts over conventional models grows, further contributing to the market growth.

Midwest Luxury Yacht Market Trends:

The Midwest luxury yacht market is seeing growth in Great Lakes yachting, particularly in Michigan’s Macomb County. Buyers prefer sport and day yachts for lake cruising, with manufacturers like Tiara Yachts catering to demand. Private yacht clubs in Lake St. Clair are expanding, offering premium docking facilities. Concurrent with this, charter services for summer lake tourism are also gaining traction, thereby attracting wealthy travelers.

South Luxury Yacht Market Trends:

The luxury yacht market in the southern US. is expanding, with demand for eco-friendly propulsion, AI-assisted navigation, and bespoke interiors. Florida, particularly Broward County, remains a dominant hub for yacht sales and charters. In September 2024, Ritz-Carlton introduced Ilma in Fort Lauderdale, a 790-foot ultra-luxury yacht offering Michelin-star dining and exclusive itineraries. This launch strengthens hospitality-driven yachting, raising competition in experiential travel. Sustainability, hybrid engines, and technology-driven enhancements are shaping future yacht designs to cater to evolving luxury consumer preferences.

West Luxury Yacht Market Trends:

The West Coast is witnessing increasing demand for expedition yachts, particularly in California’s Orange County. Wealthy buyers prefer long-range vessels for Pacific Ocean voyages. Brands like Nordhavn cater to this niche, offering advanced navigation and extended fuel capacities. Luxury yacht sales are growing in Newport Beach, driven by Hollywood celebrities and tech executives. Sustainability remains a priority, with yacht builders integrating hybrid propulsion. Also, marinas in San Diego are modernizing to accommodate larger, luxury-class yachts.

Top Companies Leading in the United States Luxury Yacht Industry

Leading luxury yacht manufacturers are driving market expansion in the US through innovation, sustainability, and strategic efforts. The luxury yacht industry in the country is transforming, and businesses are concentrating on marketing, innovation, and personalization to improve their standing. This tendency is reflected in Wheeler Yacht Company's June 2024 launch of the Wheeler 55 in Chapel Hill. The demand for thoughtful, custom-built yachts with high-end details is encouraged by the handcrafted, cold-molded yacht, which combines traditional artistry with contemporary technology. Similarly, corporations expend money on products and analyses to enhance eco-friendly characteristics, performance, and fuel economy. They leverage yacht shows, digital marketing, and collaborations with luxury brands to boost visibility, attract high-net-worth clientele, and reinforce market leadership.

United States Luxury Yacht Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into sailing luxury yacht, motorized luxury yacht, and others. Among these, motorized luxury yacht represents the most preferred segment due to cutting-edge propulsion systems, foremost speed, improved maneuverability, and robust demand from wealthy consumers looking for convenience and comfort.

- Based on the size, the market is categorized into 75-120 feet, 121-250 feet, and above 250 feet. Currently, 75-120 feet exhibit a clear dominance in the market. Luxury yachts between 75 and 120 feet are in high demand among wealthy people looking for spacious interiors, cutting-edge amenities, long-range, and the best crew accommodations.

- On the basis of the material, the market has been divided into FRP/ composites, metal/ alloys, and others. Among these, FRP/composites exhibit a clear dominance in the market. FRP/composites maintain market dominance in luxury yacht construction, offering superior strength-to-weight ratio, corrosion resistance, fuel efficiency, and design flexibility, making them the preferred material for manufacturers aiming to enhance performance, durability, and sustainability.

- Based on the application, the market is bifurcated into commercial and private. Among these, commercial dominates the market, as charter operations, fractional ownership programs, and corporate hospitality drive increasing demand for high-end vessels, ensuring profitability for operators while catering to affluent clientele seeking premium maritime experiences.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.3 Billion |

| Market Forecast in 2033 | USD 6.9 Billion |

| Market Growth Rate (2025-2033) | 8.07% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Sailing Luxury Yacht, Motorized Luxury Yacht, Others |

| Sizes Covered | 75-120 Feet, 121-250 Feet, Above 250 Feet |

| Materials Covered | FRP/ Composites, Metal/ Alloys, Others |

| Applications Covered | Commercial, Private |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)