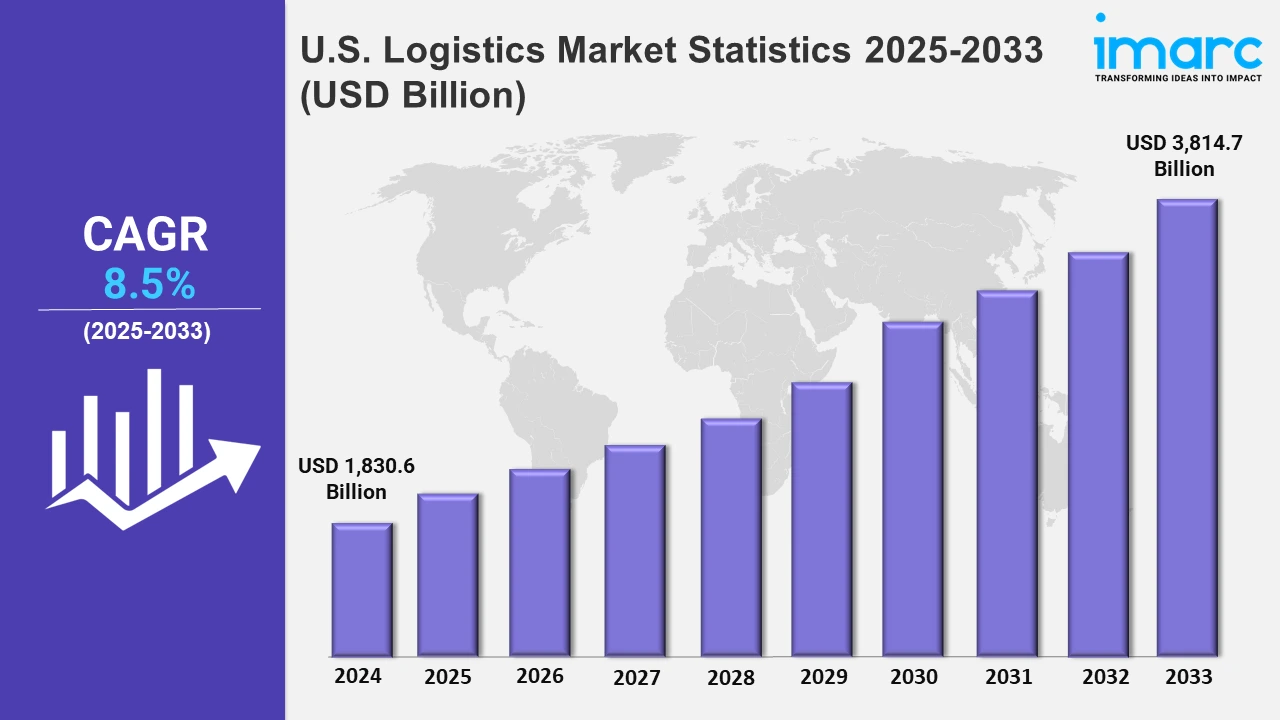

U.S. Logistics Market Expected to Reach USD 3,814.7 Billion by 2033 - IMARC Group

U.S. Logistics Market Statistics, Outlook and Regional Analysis 2025-2033

The U.S. Logistics Market size was valued at USD 1,830.6 Billion in 2024, and it is expected to reach USD 3,814.7 Billion by 2033, exhibiting a growth rate (CAGR) of 8.5% from 2025 to 2033.

To get more information on this market, Request Sample

The U.S. is making substantial efforts to decarbonize rail transport by using hydrogen and electric technologies, which are expected to help achieve net-zero rail transport. The World Economic Forum's Advanced Energy Solutions group aims to accelerate the general use of sustainable fuels, such as hydrogen, enhanced nuclear energy, carbon capture, and unique storage technologies. For example, in September 2024, the U.S. launched its first zero-emission passenger train, i.e., Zero-Emission Multiple Unit (ZEMU), which carries about 108 passengers and is scheduled to go into full service in early 2025.

Moreover, the logistics industry is focusing more on creating key hubs to improve connections. New facilities are making it easier to move goods from various parts of the world using cost-efficient routes. By combining passenger and freighter services, these hubs are boosting supply chains and supporting smoother international trade. This shift is acting as a significant growth-inducing factor. For instance, in May 2024, A.P. Moller - Maersk launched a full-service air freight gateway in Miami, strengthening connectivity to major markets in Latin America. The facility, modeled after hubs in Atlanta and Los Angeles, enables efficient shipment of goods from Asia and Europe to Latin America, supporting smooth trade and cost-effective U.S. export routes. Furthermore, the logistics sector in the United States is quickly developing in response to the increased need for sustainability and efficiency. Companies are implementing innovative technology and techniques to lessen their environmental effect, such as strengthening fuel economy and incorporating environmentally friendly practices into their operations. These measures are consistent with federal objectives to promote cleaner and more cost-effective supply chains across industries. For example, the emergence of intermodal transportation systems, which mix rail and trucking to improve efficiency and reduce pollution. Leading key players like J.B. Hunt and Schneider National are investing significantly in electric vehicles and strengthening rail connectivity. These modifications not only lower carbon footprints but also respond to the growing need for faster and more dependable delivery. This transformation is especially important in industries such as e-commerce and retail, where speed and sustainability are essential for achieving customer expectations.

U.S. Logistics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The inflating emphasis on eco-friendly procedures for minimizing waste in packaging, along with the expanding e-commerce activities, is stimulating the market in these regions.

Northeast Logistics Market Trends:

The Northeast is experiencing an upsurge in last-mile delivery alternatives as e-commerce grows. Companies like Amazon and UPS are developing same-day delivery services in cities like New York and Boston, where dense populations require speed and efficiency. Logistics hubs manage warehouses and transportation networks, with the Port of New York and New Jersey serving as main entrance points for imported goods.

Midwest Logistics Market Trends:

Since the Midwest is located in the center, it makes it an important logistical hub, with FedEx Freight and the Union Pacific Railroad linking the coasts via Chicago. Agricultural logistics is of great importance here, with corporations, including Cargill, handling grain and cattle exports. The region's extensive rail and road networks make it essential for transporting bulk goods across the country and abroad.

South Logistics Market Trends:

Companies such as Lineage Logistics and Americold are driving rapid growth in cold chain logistics in the South. These companies are increasing refrigerated storage and shipping in places, including Texas and Florida, to help the food and beverage industry. Houston and Miami are important ports for exporting perishables, underscoring the South's involvement in supply networks.

West Logistics Market Trends:

The West is at the top of technology-driven logistics, with companies such as Google (Waymo) developing self-driving cars and Flexport utilizing artificial intelligence to enhance inventory systems. Los Angeles and Long Beach ports enhance their relations with Asia Pacific trade. Additionally, Tesla is leading the charge for sustainable logistics by incorporating electric vehicles into delivery fleets, highlighting the region's emphasis on innovation and green solutions.

Top Companies Leading in the U.S. Logistics Industry

Some of the leading United States logistics market companies have been mentioned in the report. Companies focus on extensive networks and providing niche competition. In addition, they also emphasize on enhancing operational efficiencies and integrating advanced technologies.

U.S. Logistics Market Segmentation Coverage

- Based on the model type, the market has been classified into 2 PL, 3 PL, and 4 PL. Companies specializing in 2 PL prioritize transportation between clients and carriers. 3 PL incorporates warehousing and additional services, resulting in more customizable solutions. 4 PL manages complete supply chains and leverages technology to increase efficiency and optimize operations.

- Based on the transportation mode, the market is categorized into roadways, seaways, railways, and airways. The market uses roadways for flexible deliveries both locally and over long distances, seaways for affordable shipping of large goods overseas, railways for moving heavy items efficiently across the country, and airways for fast delivery of valuable or urgent products, resulting in a balanced system to meet various needs.

- Based on the end use, the market has been divided into manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others. Raw material transportation reliability is critical in manufacturing. Consumer goods prioritize speedy delivery to fulfill demand. Retail requires effective distribution networks. Food and beverages rely on temperature-controlled logistics. IT hardware requires secure handling. Healthcare focuses on prompt medical deliveries. Chemicals favor safe transportation. Construction workers transport heavy equipment. Automotive assures part distribution. Telecom relies on the secure supply of network components, while oil and gas demand customized solutions for heavy equipment and cargo transportation.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,830.6 Billion |

| Market Forecast in 2033 | USD 3,814.7 Billion |

| Market Growth Rate 2025-2033 | 8.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)