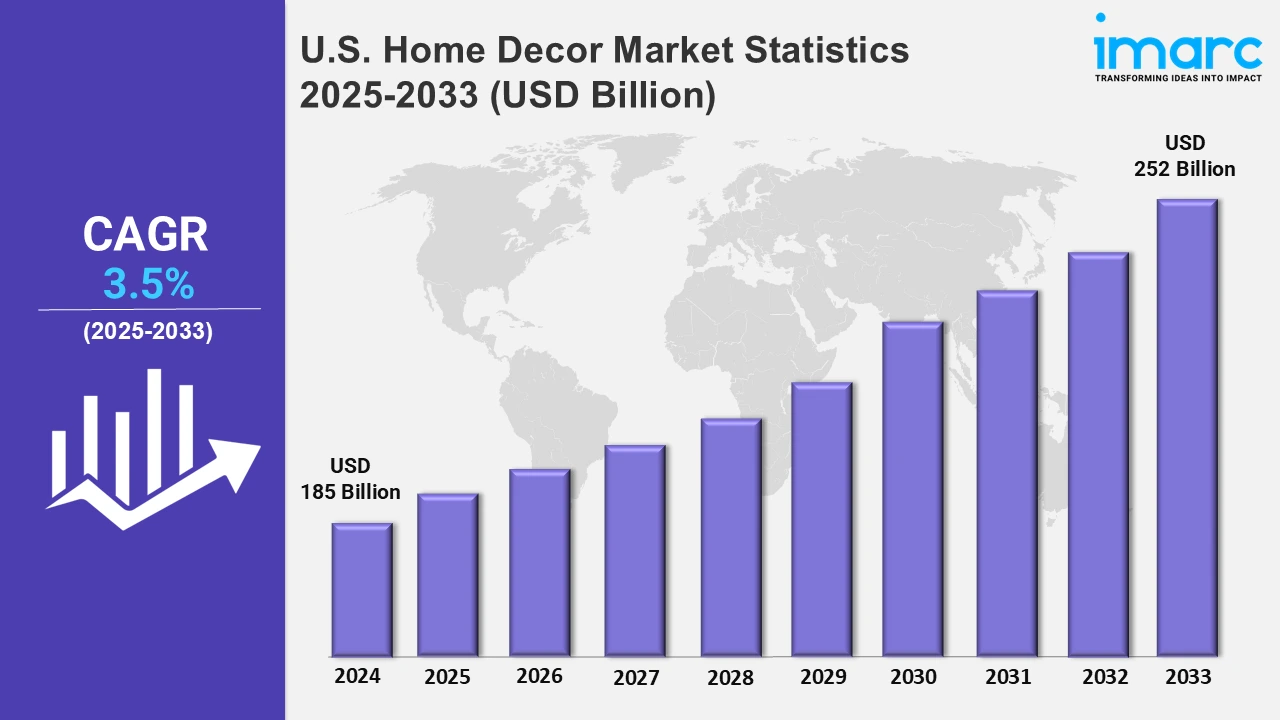

U.S. Home Decor Market Expected to Reach USD 252 Billion by 2033 - IMARC Group

U.S. Home Decor Market Statistics, Outlook and Regional Analysis 2025-2033

The U.S. home decor market size was valued at USD 185 Billion in 2024, and it is expected to reach USD 252 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% from 2025 to 2033.

To get more information on this market, Request Sample

In the home decor sector, luxury furniture manufacturers are focused on substantial customization to appeal to high-end clients looking for distinctive designs. The desire for personalized finishes, various materials, and creative influences is increasing, allowing customers to customize furniture with special wood, metal, and aesthetic options for a truly unique home experience. For example, in October 2024, Abner Henry, an Ohio-based luxury furniture business, debuted two new collections, an extension of its Met Facade series inspired by The Metropolitan Museum of Art and the Fall/Winter 2024 range. Both sets provide substantial personalization, with over 600 wood finishes, 10 wood species, and 50 metal color possibilities.

Moreover, retailers are extending their home decor offerings to attract budget-conscious consumers looking for beautiful and economical solutions. The emphasis on varied product categories such as wall art, lighting, and seasonal decor reflects the growing need for affordable and fashion-forward home items that combine utility with modern aesthetics. For instance, in March 2024, Kohl's launched a new home collection, boosting its offerings by 40% to include wall art, botanicals, pet accessories, storage solutions, ceramics, etc. This campaign sought to establish Kohl's as a source of attractive and affordable home items. Furthermore, the home decor business in the US is expanding in response to rising customer demand for fashionable and environmentally friendly interior solutions. Companies are improving production processes and extending distribution channels across both online and offline platforms. As homeowners seek individualized and ecologically responsible solutions, there is an increase in demand for eco-friendly furniture, energy-efficient lighting, and handcrafted decor. Additionally, luxury home textiles and wall decor products are increasing in popularity, particularly in metropolitan areas that value aesthetics and utility. For example, Pottery Barn introduced sustainable furniture collections and collaborated with artisans to make handcrafted home items. These projects reflect customer demand for high-quality, sustainably manufactured decor. The trend toward sustainable and inventive designs reflects the industry's emphasis on durability, beauty, and ethical sourcing, assuring long-term growth while tackling environmental issues. Expanding product lines and distribution networks enhances the market's accessibility and competitiveness.

U.S. Home Decor Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The wide accessibility of home decor goods through distribution methods that are both online and offline in various regions of the US is significantly driving the growth of the market.

Northeast Home Decor Market Trends:

The Northeast favors a polished yet minimalist approach to house decor, known in metropolitan areas as the "boy apartment" trend. This design combines mid-century modern furniture, selected artwork, and neutral hues to create attractive and well-organized environments. ABC Carpet & Home, a New York-based shop, caters to this trend by providing high-end furniture and decor pieces that strike a mix of refinement and comfort, appealing to professionals wanting a polished look.

Midwest Home Decor Market Trends:

The Midwest prefers rustic and warm homes with reclaimed wood, handcrafted furniture, and earthy tones that represent the region's relationship to nature. The Amish Furniture Factory in Iowa specializes in solid wood and handmade furniture, retaining the Midwest's skilled workmanship tradition. The rising desire for sustainable and long-lasting materials is consistent with the region's admiration for classic and functional home decor.

South Home Decor Market Trends:

The South continues to appreciate classic and opulent furniture, emphasizing warm color palettes, exquisite detailing, and hospitality-driven design. Havertys Furniture, based in Atlanta, Georgia, provides homes with classic items that complement traditional Southern charm. The appeal of antique-style furniture, ornate woodwork, and rich textiles shows the region's need for grandeur while being comfortable and functional.

West Home Decor Market Trends:

The West Coast, particularly California, promotes California Cool interiors, which emphasize on neutral tones, natural materials, and seamless indoor-outdoor flow. Nickey Kehoe, a Los Angeles-based brand, manufactures furniture and home furnishings that embody this easygoing yet polished look. Light woods, organic textures, and open layouts define West Coast houses, which appeal to a lifestyle that values comfort, style, and a strong connection to nature.

Top Companies Leading in the U.S. Home Decor Industry

Some of the leading U.S. home decor market companies have been mentioned in the report. Leading firms are increasing their digital presence to attract online buyers while also including eco-friendly items to fulfill sustainability standards. Omnichannel strategy investments improve smooth shopping, while partnerships with designers and artists aid in the creation of distinctive, individualized home decor collections for a wide range of consumer preferences. For example, in March 2024, Pottery Barn collaborated with Deepika Padukone to launch a unique home furnishings line available in the US and select international markets. The collection combines Indian-inspired themes with a neutral and natural color palette and includes bedding, embroidered pillows, decorative elements, and hand-knotted carpets.

U.S. Home Decor Market Segmentation Coverage

- Based on the product type, the market has been segmented into home furniture, home textiles, flooring, wall décor, lighting, and others. Demand is driven by multipurpose and ecological home furniture designs. Home textiles, such as curtains and upholstery, stress both comfort and beauty. Luxury vinyl and hardwood are now popular flooring options. Wall décor incorporates standout pieces and smart features, while lighting combines energy efficiency with ornamental appeal to enhance interiors.

- Based on the distribution channel, the market is categorized into home decor stores, supermarkets and hypermarkets, online store, gift shops, and others. Home decor stores provide selected options and personalized experiences. Supermarkets and hypermarkets provide affordability and convenience. Online stores thrive because of their large selection, customization, and quick delivery. Gift shops cater to specific clients, focusing on one-of-a-kind decorative goods for individualized home decorating and gifting purposes.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 185 Billion |

| Market Forecast in 2033 | USD 252 Billion |

| Market Growth Rate 2025-2033 | 3.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Décor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Home Decor Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)