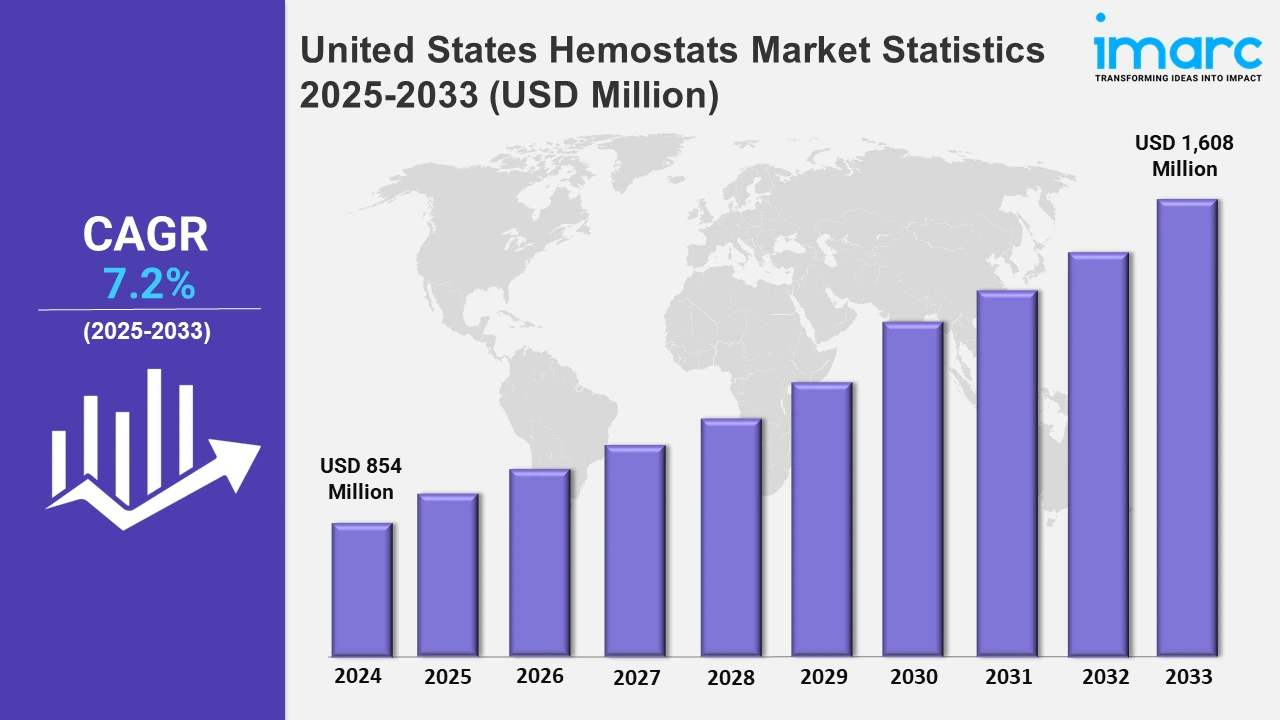

U.S. Hemostats Market Expected to Reach USD 1,608 Million by 2033, Exhibiting a CAGR of 7.2% from 2025 to 2033 - IMARC Group

U.S. Hemostats Market Statistics, Outlook and Regional Analysis 2025-2033

The U.S. hemostats market size was valued at USD 854 Million in 2024, and it is expected to reach USD 1,608 Million by 2033, exhibiting a growth rate (CAGR) of 7.2% from 2025 to 2033.

To get more information on this market, Request Sample

Hemostats market in the United States is witnessing significant growth driven by advancements in wound care technologies and surgical solutions. In contrast, an increasing number of FDA-approved products are designed to provide rapid bleeding control and effective wound protection. Also, companies are focusing on expanding their reach and ensuring consumers have easy access to cutting-edge hemostatic products. For instance, Medcura launched its rapid-seal gel in December 2022 on major retail platforms, such as Walmart, Amazon, and CVS. This FDA-cleared, high-performance antibacterial gel addresses the growing demand for quick and effective bleeding management while providing antibacterial protection, enhancing the standard of wound care products. In addition, the development of innovative surgical solutions further strengthens the growth of the hemostats sector. For instance, in November 2023, Ethicon, part of Johnson & Johnson MedTech, announced the approval of its ETHIZIA hemostatic sealing patch, which represents a leap forward in surgical hemostasis. This synthetic polymer-based patch is clinically proven to achieve rapid hemostasis in challenging bleeding cases, setting a new standard in surgical adjuncts. Meanwhile, the incorporation of such technology showcases how leading industry players are committed to enhancing surgical outcomes and supporting medical professionals with advanced tools, thereby positioning the U.S. hemostats market as a leader in innovation.

Moreover, these strategic product launches and technological breakthroughs indicate an ongoing trend of enhancing hemostatic efficiency through innovative solutions. Besides this, companies are committed to meeting market demand with products that offer precision, reliability, and superior performance. Furthermore, the market in the U.S. focus on quality and safety ensures a prominent level of consumer trust and uptake. While these domestic developments are pivotal, it is worth the expansion of hemostasis diagnostics outside the U.S., reflecting a global commitment to improving healthcare. For instance, in May 2022, Precision BioLogic Inc. launched its cryocheck Chromogenic Factor IX assay in regions like Canada, the European Union, the U.K., Australia, and New Zealand. This development highlights the interconnected nature of advancements in hemostasis technology and the emphasis on broadening diagnostic capabilities to support clinical practices worldwide.

U.S. Hemostats Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West.

Northeast Hemostats Market Trends:

The Northeast, with states like New York and Massachusetts, is witnessing growth driven by high surgical volumes in renowned hospitals and research centers. In contrast, the region focuses on innovative, minimally invasive hemostatic products to support complex procedures. For instance, advanced topical hemostats are increasingly used in cardiac surgeries at Boston medical institutions, reflecting the region's investment in cutting-edge surgical care.

Midwest Hemostats Market Trends:

In the Midwest, home to major healthcare hubs like Chicago, demand for hemostats is fueled by a mix of advanced healthcare services and a growing aging population requiring surgeries. Also, the use of absorbable hemostats is prominent in general and orthopedic surgeries. Institutions like the Cleveland Clinic highlight the region's commitment to high surgical standards, thereby boosting the adoption of effective hemostatic solutions.

South Hemostats Market Trends:

The Southern U.S., including states like Texas, shows significant market growth driven by expanding healthcare infrastructure and medical tourism. On the contrary, there is an increasing focus on cost-effective hemostatic agents that cater to varied procedures in both public and private hospitals. Houston's large medical complexes are adopting fast-acting hemostats for trauma and emergency care, showcasing the region’s practical approach to surgical needs.

West Hemostats Market Trends:

The Western U.S., especially California, leverages its strong biotech presence to incorporate innovative hemostatic technologies. The market benefits from advancements in bioengineered hemostats used in complex surgeries across major health centers in Los Angeles. There is a shift toward eco-friendly, sustainable surgical products, showcasing the region’s dedication to balancing high-tech solutions with environmental responsibility.

Top Companies Leading in the U.S. Hemostats Industry

Some of the leading United States hemostats market companies include Baxter International Inc., Ethicon Inc. (Johnson & Johnson), Pfizer Inc., and Teleflex Incorporated., among many others. In July 2023, Baxter International launched PERCLOT Absorbable Hemostatic Powder in the U.S., expanding its hemostat portfolio. PERCLOT, a passive, absorbable powder derived from plant starch, aids in mild bleeding control, enhancing surgical care and addressing intraoperative bleeding to optimize patient outcomes.

U.S. Hemostats Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into thrombin based, combination based, oxidized regenerated cellulose based, gelatin based, and collagen based. Thrombin, combination, oxidized cellulose, gelatin, and collagen hemostats rapidly control bleeding, supporting coagulation and tissue repair during surgeries by promoting blood clot formation and providing a protective barrier at bleeding sites.

- Based on the application, the market is categorized into orthopedic surgery, general surgery, neurological surgery, cardiovascular surgery, reconstructive surgery, gynecological surgery, and others. Hemostats are essential in orthopedic, general, neurological, cardiovascular, reconstructive, gynecological, and other surgeries for effective bleeding management, aiding in precision, minimizing blood loss, and enhancing patient recovery during complex procedures.

- On the basis of the formulation, the market has been divided into matrix and gel hemostats, sheet and pad hemostats, sponge hemostats, and powder hemostats. Matrix and gel, sheet and pad, sponge, and powder hemostats offer versatile solutions tailored to surgical needs, providing effective bleeding control and easy application, crucial for diverse surgical environments and wound types.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 854 Million |

| Market Forecast in 2033 | USD 1,608 Million |

| Market Growth Rate 2025-2033 | 7.2% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Thrombin Based, Combination Based, Oxidized Regenerated Cellulose Based, Gelatin Based, Collagen Based |

| Applications Covered | Orthopedic Surgery, General Surgery, Neurological Surgery, Cardiovascular Surgery, Reconstructive Surgery, Gynecological Surgery, Others |

| Formulations Covered | Matrix and Gel Hemostats, Sheet and Pad Hemostats, Sponge Hemostats, Powder Hemostats |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Baxter International Inc., Ethicon Inc. (Johnson & Johnson), Pfizer Inc., Teleflex Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)