United States Green Data Center Market Expected to Reach USD 39.2 Billion by 2033 - IMARC Group

United States Green Data Center Market Statistics, Outlook and Regional Analysis 2025-2033

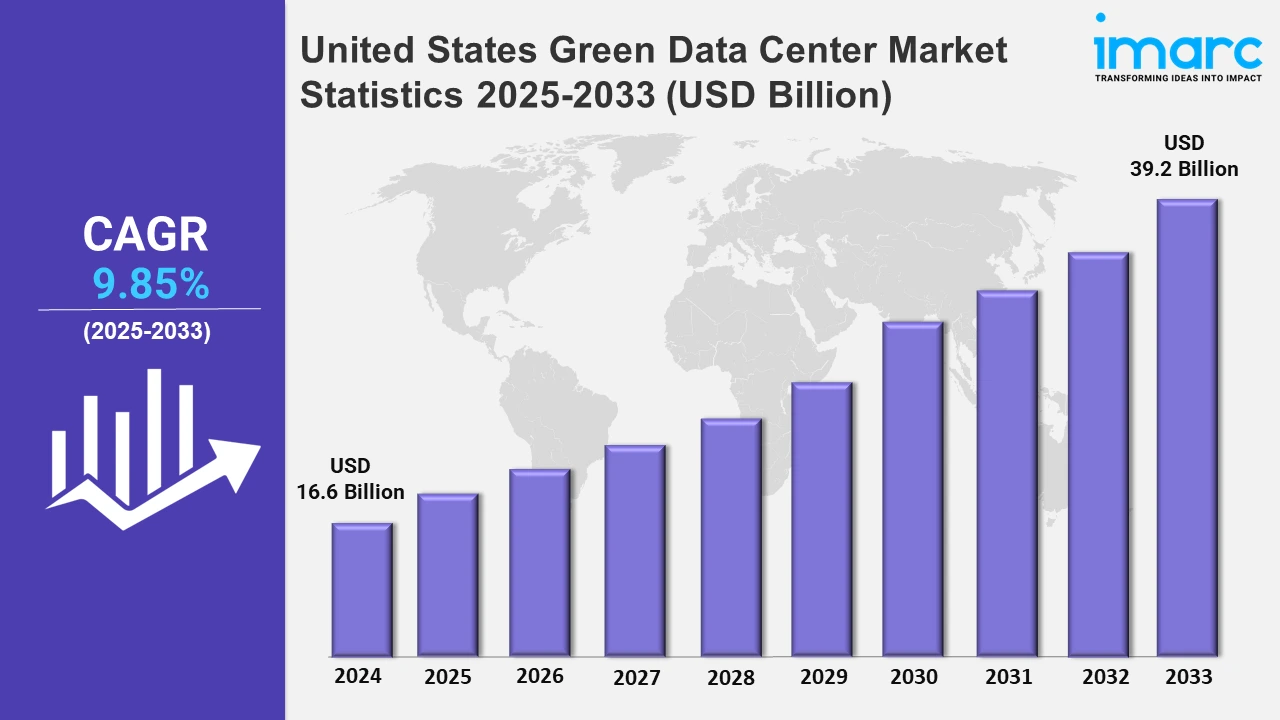

The United States green data center market size was valued at USD 16.6 Billion in 2024, and it is expected to reach USD 39.2 Billion by 2033, exhibiting a growth rate (CAGR) of 9.85% from 2025 to 2033.

To get more information on this market, Request Sample

The market is driven by the increasing demand for energy-efficient solutions, as data centers are known for their significant energy consumption, which contributes to high operational costs and carbon emissions. Many companies are investing in green technologies, such as efficient cooling systems, renewable energy integration, and energy-efficient IT equipment, to reduce power usage and environmental impact. For instance, in July 2024, Airedale by ModineTM, the critical cooling specialists, announced the U.S. launch of the Cooling System OptimizerTM in response to the industry demand for sustainable, stable, and secure cooling systems. The Optimizer is an intelligent controls layer that sits between product controls in chillers and CRAHs and below the site building management system (BMS). This shift aligns with corporate sustainability goals and is a critical strategy to minimize long-term energy expenses while enhancing system reliability.

The rising supportive government policies and regulations catalyze growth in the United States's green data centers. Through federal and state-level initiatives, the government promotes sustainable data center practices, offering incentives like tax breaks and grants for companies that adopt energy-efficient infrastructure. Moreover, companies are under pressure from stakeholders to meet Environmental, Social, and Governance (ESG) standards. Green data centers align with these goals, making them a preferred choice for businesses aiming to improve their sustainability profiles. For instance, in August 2024, STACK Infrastructure, a key developer and operator of data centres, announced the acquisition of an additional £2.3 billion ($3 billion) in green financing for four major data centre campuses. The collective capacity of the US data centre campuses is expected to be 900MW. The newly secured funds will support the development of campuses in Prince William County, Virginia; Phoenix, Arizona; and Atlanta, Georgia. STACK is working closely with cloud providers and other innovators who are focused on Environmental, Social, and Governance (ESG) principles. Through its emphasis on responsible growth and thoughtful design, STACK aims to ensure that its developments align with sustainability and energy efficiency goals.

United States Green Data Center Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. In the Northeast, strict environmental regulations and high energy costs are driving the adoption of green data centers to improve sustainability and reduce operational expenses. In the Midwest, the push for renewable energy sources, combined with lower land costs, encourages the development of eco-friendly data centers to optimize energy use. In the South, government incentives and a strong industrial base propel investment in green data centers to meet growing demand sustainably. In the West, advanced technology infrastructure and a commitment to reducing carbon footprints, drive strong growth in sustainable data center facilities.

Northeast Green Data Center Market Trends:

High energy costs and stringent environmental regulations in the Northeast drive demand for green data centers. Data centers in this region adopt energy-efficient technologies and renewable energy sources to cut operational costs and meet strict sustainability standards, which helps reduce their carbon footprint and improve regulatory compliance.

Midwest Green Data Center Market Trends:

The Midwest benefits from low land costs and access to renewable energy sources, making it an ideal region for green data center growth. Increasing investments in wind and solar energy support data centers aiming to achieve energy efficiency and cost savings while leveraging natural cooling advantages due to the climate.

South Green Data Center Market Trends:

The South is driven by strong government incentives and an expanding industrial sector, making green data centers attractive for sustainable growth. The growing interest from tech companies in eco-friendly operations, paired with favorable policies, fuels the adoption of efficient infrastructure that aligns with regional environmental and economic goals.

West Green Data Center Market Trends:

In the West, a tech-focused economy and ambitious carbon reduction goals drive green data center development. With access to renewable energy sources like solar and hydroelectric power, data centers in this region invest heavily in sustainable practices to align with both market demand and environmental standards.

Top Companies Leading in the United States Green Data Center Industry

The market in the United States is highly competitive, with major players such as Google, Amazon Web Services (AWS), Microsoft, Equinix, Aurum Group, and DigitalNexus leading the way in adopting sustainable practices. These companies focus on energy efficiency, renewable energy sourcing, and innovative cooling technologies to reduce environmental impact. Additionally, smaller players and startups are entering the market, offering specialized green solutions. As regulatory pressure and consumer demand for eco-friendly operations increase, the competition intensifies to provide energy-efficient, environmentally conscious data storage solutions.

In October 2024, Aurum Group and DigitalNexus Partners signed a joint venture (JV) agreement to form AuNex Datacenters. AuNex Datacenters will acquire, develop, and operate a new generation of AI-integrated, environmentally focused data centers that emphasize ESG principles and operational efficiency. The JV will focus on initially developing data centers in crucial US metropolitan areas, with plans for global expansion.

Global United States Green Data Center Market Segmentation Coverage

- On the basis of the component, the market has been categorized into solutions (power systems, servers, monitoring and management systems, networking systems, cooling systems, and others) and services (system integration services, maintenance and support services, and training and consulting services). Energy-efficient infrastructure solutions help data centers reduce power consumption and emissions, cost-effectively meeting sustainability goals. Specialized services, like energy optimization and maintenance, ensure data centers achieve and maintain efficient, sustainable operations, meeting regulatory and environmental standards.

- Based on the data center type, the market is classified into colocation data centers, managed service data centers, cloud service data centers, and enterprise data centers. Colocation centers offer shared, energy-efficient infrastructure, reducing environmental impact and costs for businesses. Managed service centers provide sustainable, outsourced data solutions, enabling companies to achieve efficiency without extensive in-house resources. Cloud centers use optimized, large-scale energy solutions, supporting sustainable growth as businesses increasingly migrate to the cloud. Enterprise centers invest in green technologies to meet regulatory standards and internal sustainability goals, driving significant market demand.

- On the basis of the industry vertical, the market has been segregated into healthcare, BFSI, government, telecom and IT, and others. Healthcare requires sustainable data centers to support large-scale data storage and strict regulatory compliance for sensitive information. BFSI relies on green data centers for secure, efficient data handling, aligning with cost-saving and environmental objectives. Government agencies prioritize green data centers to meet carbon reduction goals and manage secure, energy-efficient data storage. Telecom and IT depend on green data centers for scalable, low-energy infrastructure to support extensive data needs sustainably.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 16.6 Billion |

| Market Forecast in 2033 | USD 39.2 Billion |

| Market Growth Rate 2025-2033 | 9.85% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Data Center Types Covered | Colocation Data Centers, Managed Service Data Centers, Cloud Service Data Centers, Enterprise Data Centers |

| Industry Verticals Covered | Healthcare, BFSI, Government, Telecom and IT, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)