U.S. Edge Computing Market Expected to Reach USD 46.2 Billion by 2033 - IMARC Group

U.S. Edge Computing Market Statistics, Outlook and Regional Analysis 2025-2033

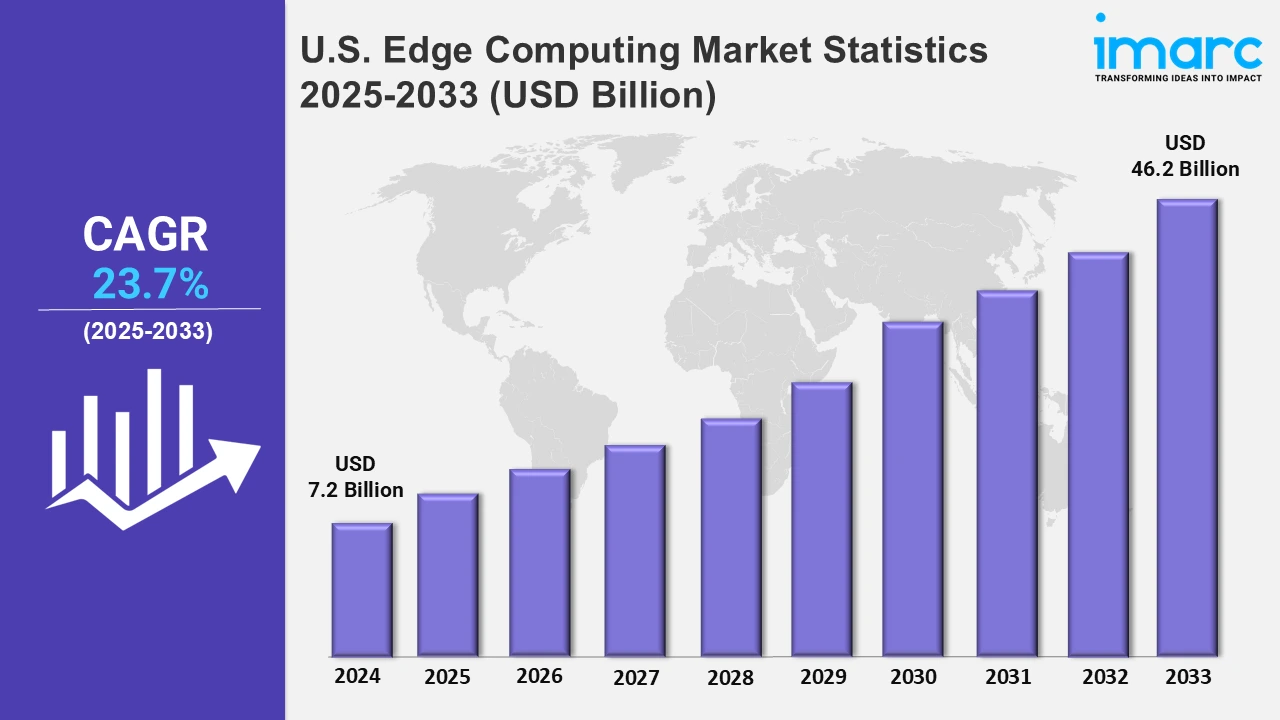

The U.S. edge computing market size is anticipated to reach USD 7.2 Billion in 2024, and it is expected to reach USD 46.2 Billion by 2033, exhibiting a growth rate (CAGR) of 23.7% from 2025-2033.

To get more information on this market, Request Sample

The edge computing market in the US is expanding with the introduction of advanced video and AI-based edge technology solutions. For example, in October 2024, Maris-Tech launched its new subsidiary, Maris North America, marking a significant expansion into the market with a focus on video and AI-based edge computing solutions. This expansion focuses on enhancing local data processing capabilities, boosting efficiency, and driving innovation in industries relying on real-time data analysis.

Additionally, the US edge computing market is seeing growth with the integration of rugged industrial hardware and cloud-native edge orchestration software. This solution simplifies the deployment, management, and scaling of edge computing workloads, helping enterprises streamline operations, improve security, and accelerate time-to-value across various industries. For example, in October 2024, ZEDEDA, an edge management company headquartered in the US, and OnLogic collaborated to launch a new solution that combines OnLogic’s rugged industrial hardware with ZEDEDA’s cloud-native edge orchestration software. This platform enables enterprises to efficiently deploy, manage, and scale edge computing workloads, streamlining operations and accelerating time to value. Apart from this, with growing data privacy concerns and the development of cybersecurity risks, more companies are turning to edge computing to strengthen data protection. They can decrease vulnerability to possible breaches by processing sensitive information at the edge, closer to its source, rather than transmitting it across vast distances to centralized servers. This strategy helps meet privacy rules while also protecting key infrastructure from attackers.

U.S. Edge Computing Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The escalating demand for real-time data processing across various industries, like healthcare, retail, manufacturing, etc., is driving the adoption of edge computing in the US.

Northeast Edge Computing Market Trends:

In the Northeast, edge computing is helping improve smart city projects, especially in New York City and Maryland. It processes data locally, which helps to manage traffic, save energy, and boost public safety in real-time. In December 2024, the Maryland Department of Transportation launched a new traffic management platform. It uses AI and edge computing to improve traffic flow and reduce gridlock.

Midwest Edge Computing Market Trends:

The expansion of data centers in the Midwest area, especially in Ohio, is fueling the market growth. Companies are investing in cutting-edge facilities to meet the growing need for faster and more localized processing. These data centers are critical for supporting 5G applications, allowing the industry to manage data in real-time efficiently and enhancing the region's position in advanced computing infrastructure. In November 2024, Cologix acquired land in Johnstown, Ohio, to build a new AI-ready data center campus.

South Edge Computing Market Trends:

The South is using edge computing to improve healthcare, especially in Texas and Florida. Edge technology helps with real-time data processing in telemedicine and emergency response. It reduces delays, improves patient care, speeds up decisions, and makes data management easier, making the region a leader in better healthcare solutions.

West Edge Computing Market Trends:

The West, particularly California, is leading the way in edge computing owing to increased investment in AI and edge technology. With significant funding boosting innovation, businesses are expanding their ability to offer advanced computer solutions, thereby accelerating the development of smarter infrastructure across. In July 2024, Armada, a California-based edge computing company, raised USD 40 Million in a fundraising round headed by Microsoft's venture fund M12, further escalating the market growth.

Top Companies Leading in the U.S. Edge Computing Industry

The market research study also includes a detailed analysis of the competitive landscape. In October 2024, Duos Edge AI formed a strategic alliance with Accu-Tech to strengthen the deployment of the edge computing ecosystem throughout the US. Furthermore, ZEDEDA, in October 2024, partnered with OnLogic to launch a platform that uses edge computing workloads efficiently. Apart from this, in February 2024, Casey’s General Stores Inc. allied with Acumera Reliant Platform to assist its edge computing ventures.

U.S. Edge Computing Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into hardware, software, and services. Among these, the hardware segment acquires the largest share as it includes edge devices and servers that help in local data processing. Improvements in energy-efficient designs are augmenting the market.

- Based on the organization size, the market has been bifurcated into small and medium-sized enterprises (SMEs), and large enterprises. Among these, large enterprises hold the dominant share. These organizations leverage edge computing to power advanced applications, like AI-based analytics.

- On the basis of the vertical, the market has been bifurcated into manufacturing, energy and utilities, government and defense, BFSI, telecommunications, media and entertainment, retail and consumer goods, transportation and logistics, healthcare and life sciences, and others. In manufacturing, edge computing supports automation and predictive maintenance. Moreover, energy and utilities leverage it for grid management and monitoring. Furthermore, government and defense use it for secure, real-time operations. Besides this, BFSI relies on edge for faster transactions, while telecommunications enhance network efficiency. Apart from this, media and entertainment streamline content delivery, and retail optimizes inventory.

| Report Features | Details |

|---|---|

| Market Size in 2025 | USD 7.2 Billion |

| Market Forecast in 2033 | USD 46.2 Billion |

| Market Growth Rate 2025-2033 | 23.7% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Organization Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Verticals Covered | Manufacturing, Energy and Utilities, Government and Defense, BFSI, Telecommunications, Media and Entertainment, Retail and Consumer Goods, Transportation and Logistics, Healthcare and Life Sciences, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Edge Computing Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)