UK Supply Chain Management Market Expected to Reach USD 4.6 Billion by 2033 - IMARC Group

UK Supply Chain Management Market Statistics, Outlook and Regional Analysis 2025-2033

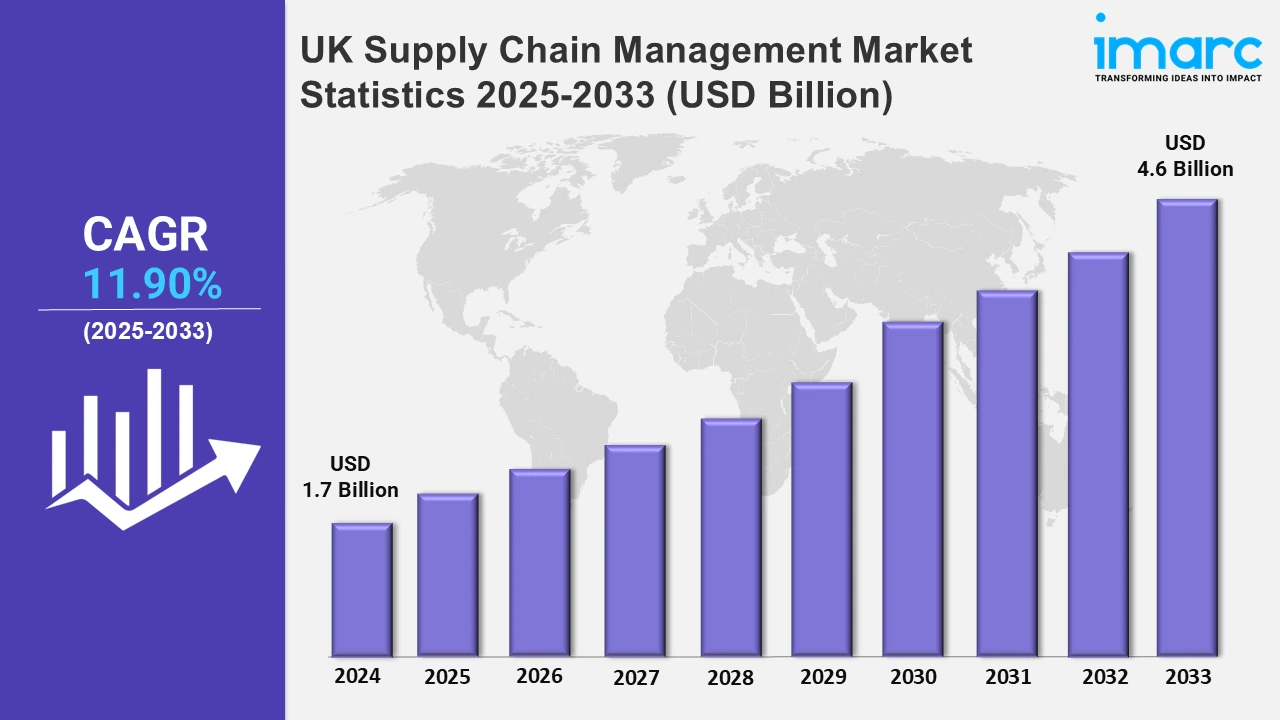

The UK supply chain management market size was valued at USD 1.7 Billion in 2024, and it is expected to reach USD 4.6 Billion by 2033, exhibiting a growth rate (CAGR) of 11.90% from 2025 to 2033.

To get more information on this market, Request Sample

The UK supply chain management market is experiencing robust growth, driven by technological advancements and evolving business demands. The adoption of artificial intelligence, blockchain, and big data analytics is transforming traditional supply chain operations, enabling enhanced visibility, predictive analytics, and decision-making capabilities. Moreover, the increasing focus on e-commerce is compelling businesses to prioritize agile and scalable supply chain models to meet rising consumer expectations for faster delivery and improved service. For instance, according to the International Trade Administration, UK is the third biggest e-commerce market globally, anticipated to experience annual average growth of 12.6% by the year 2025. Furthermore, sustainability is another significant driver, with organizations integrating eco-friendly practices and green logistics to align with regulatory standards and consumer preferences. Additionally, the demand for automation, including robotics and smart warehouses, is on the rise, enhancing operational efficiency and reducing labor costs.

Key trends shaping the market include digital transformation and an emphasis on resilience. Companies are actively investing in cloud-based solutions and the Internet of Things (IoT) technologies to optimize inventory management, streamline distribution, and mitigate risks associated with supply chain disruptions. Furthermore, recent geopolitical events and economic uncertainties have underscored the need for adaptability, resulting in greater adoption of multi-sourcing strategies and localized supply chains to reduce dependencies on single regions. Moreover, the growth of the UK's advanced manufacturing and retail sectors is fostering the integration of sophisticated supply chain tools. In addition, regional trade agreements and the expansion of global trade partnerships further bolster the market by creating opportunities for cross-border logistics and supply chain solutions. For instance, in November 2024, the government of UK declared the restart of negotiations for a free trade agreement with India. This initiative aims to establish a fresh strategic alliance with India, encompassing a comprehensive trade pact.

Global UK Supply Chain Management Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

London Supply Chain Management Market Trends:

London serves as the hub for the UK Supply Chain Management market, driven by its financial prominence and international trade connectivity. The city heavily benefits from advanced logistics networks, digital innovation, and a concentration of supply chain solution providers, making it a critical center for strategic operations and decision-making.

South East Supply Chain Management Market Trends:

The South East region is supporting the UK Supply Chain Management market due to its close proximity to major ports and airports, supporting significant import-export activities. The region has been actively focused on warehouse automation and efficient distribution networks for retailers, healthcare, and high-value manufacturing industries.

North West supply Chain Management Market Trends:

The North West drives the UK Supply Chain Management market through its industrial base and focus on manufacturing and logistics. Home to key infrastructure like rail freight terminals, the region leverages technology and workforce capabilities to streamline supply chain operations across various industries.

East of England Supply Chain Management Market Trends:

The East of England strengthens the UK Supply Chain Management market with its emphasis on agriculture, food processing, and pharmaceuticals. Proximity to major ports supports international trade, while investment in automation and smart warehouses enhances operational efficiency across key sectors.

South West Supply Chain Management Market Trends:

The South West region helps contribute to the UK Supply Chain Management market by making way for sectors such as food and beverages and advanced manufacturing. Its focus on sustainability and renewable energy incorporation into supply chain practices makes it a growing area for innovation and strategic operations.

Scotland Supply Chain Management Market Trends:

Scotland plays a critical role in the UK Supply Chain Management market mainly through its key sectors such as manufacturing, energy, and food. Tactical investments in transport infrastructure, mainly encompassing rail and maritime, facilitate upgraded operations, while sustainability objectives are prioritized to aid prolonged market expansion.

West Midlands Supply Chain Management Market Trends:

The West Midlands, known for its automotive and manufacturing industries, drives supply chain optimization through innovation and supplier collaboration. The region’s strong transport links and focus on just-in-time production make it a key contributor to the UK Supply Chain Management market.

Yorkshire and The Humber Supply Chain Management Market Trends:

Yorkshire and The Humber support the UK Supply Chain Management market with a focus on manufacturing, logistics, and food production. Proximity to key ports and rail hubs facilitates efficient supply chain networks, while digital adoption enhances operational transparency and competitiveness.

East Midlands Supply Chain Management Market Trends:

The East Midlands bolsters the UK Supply Chain Management market through its logistics expertise and central location. Known as a logistics hub, the region supports fast-moving consumer goods and retail industries with advanced distribution centers and a skilled workforce focused on efficiency.

Top Companies Leading in the UK Supply Chain Management Industry

The UK supply chain management market exhibits an intense competitive landscape, principally influenced by strategic mergers, advancements, and technological incorporation. Major industry players are increasingly emphasizing on utilizing automation, leading-edge analytics, and artificial intelligence to significantly lower expenditures and improve efficacy. Moreover, the market is represented by a mix of emerging domestic enterprises and established global firms, all competing to offer tailored solutions. In addition to this, tactical collaborations, acquisitions, and heavy investments in digital transformation play a pivotal role in steering market dynamics, while sustainability projects are rapidly becoming a diversifying factor among competitors. For instance, in October 2024, Yusen Logistics Co. Ltd, a leading global supply chain logistics provider, collaborated with Manhattan Active Warehouse Management for deployment at its advanced distribution center in the UK. Scheduled to open in Northampton in January 2026, the facility reflects Yusen Logistics' dedication to enhancing operational efficiency and performance through innovative distribution technology.

Global UK supply Chain Management Market Segmentation Coverage

- On the basis of the component, the market has been categorized into solution (transportation management system, planning and analytics, warehouse and inventory management system, procurement and sourcing, and manufacturing execution system) and services (professional services and managed services). Advanced solutions in the UK supply chain management market include transportation management systems for optimized logistics, planning and analytics tools for data-driven decision-making, warehouse and inventory management systems to enhance operational efficiency; meanwhile procurement and sourcing platforms to streamline supplier engagement, and manufacturing execution systems for real-time production monitoring. Moreover, professional services ensure implementation and customization, while managed services focus on seamless system operations.

- Based on the deployment mode, the market is classified into on-premises and on-demand. On-premises deployment offers robust control and customization, appealing to industries with stringent compliance needs. Conversely, on-demand solutions, leveraging cloud technologies, are gaining traction for their scalability, cost-efficiency, and seamless integration, particularly among SMEs and businesses emphasizing operational agility.

- On the basis of the enterprise size, the market has been divided into small and medium enterprises (SMEs), and large enterprises. The UK supply chain management market sees significant contributions from both small and medium enterprises (SMEs) and large enterprises. SMEs leverage agile strategies and innovative tools to optimize logistics and resource allocation, driving localized efficiency. Conversely, large enterprises capitalize on advanced technologies and extensive networks to achieve scalability and streamline complex operations, ensuring robust supply chain performance across diverse sectors.

- Based on the industry vertical, the market is segregated into retail and consumer goods, healthcare and pharmaceuticals, manufacturing, food and beverages, transportation and logistics, automotive, and others. Retail and consumer goods generally leverage efficient logistics to optimize inventory turnover, and healthcare and pharmaceuticals constantly emphasize on robust compliance and timely distribution. Moreover, manufacturing prioritizes streamlined operations for cost-effectiveness, while food and beverages focus on freshness and traceability. In addition, transportation and logistics ensure seamless connectivity, while the automotive sector emphasizes supplier collaboration for just-in-time production.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.7 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Market Growth Rate 2025-2033 | 11.90% |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, On-demand |

| Enterprise Sizes Covered | Small and Medium Enterprises (SMEs), Large Enterprises |

| Industry Verticals Covered | Retail and Consumer Goods, Healthcare and Pharmaceuticals, Manufacturing, Food and Beverages, Transportation and Logistics, Automotive, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on supply Chain Management Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)