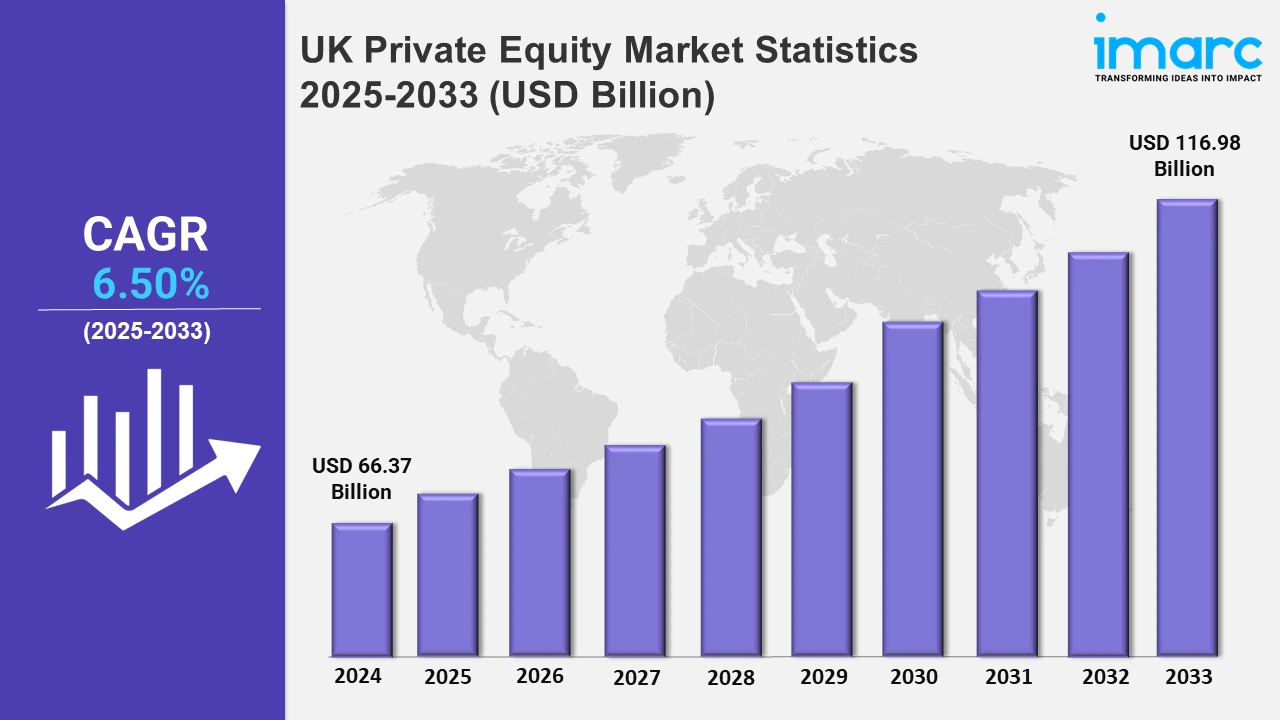

UK Private Equity Market Expected to Reach USD 116.98 Billion by 2033 - IMARC Group

UK Private Equity Market Statistics, Outlook and Regional Analysis 2025-2033

The UK private equity market size was valued at USD 66.37 Billion in 2024, and it is expected to reach USD 116.98 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% from 2025 to 2033.

To get more information on this market, Request Sample

UK private equity market is currently steering towards technological investments due to the growing demand for digital transformation across various industries.. Private equity companies are actively focusing on tech-enabled businesses, from SaaS providers to fintech companies, as such sectors have been showing robust growth potential. This trend also aligns with the greater market shift toward innovation as firms are using the best in artificial intelligence, cloud computing, and cybersecurity to grow portfolio value. For instance, in 2024, Thoma Bravo LP, a major private equity firm, agreed to an all-cash acquisition of Darktrace PLC, a UK-based cybersecurity artificial intelligence firm, for $5.21 billion, citing increasing investment in cutting-edge technology solutions. Furthermore, the UK is an important global hub for technology, with the strength of its workforce and the friendly regulatory environment all serving to speed up this process. Scalability and resilience are key attributes of technology, and attractive returns can be realized with reduced risk in uncertain economic conditions, attracting investors.

In the UK private equity landscape, environmental, social, and governance (ESG) considerations are becoming increasingly crucial. Firms are considering ESG criteria in their investment decisions, which are influenced by regulatory pressures, investor expectations, and growing awareness about sustainable practices. For instance, in February 2024, Blackstone, a leading private equity firm, initiated construction of its 226,000 sq ft European headquarters in London's Berkeley Square, supporting 5,000 jobs and reiterating its commitment to the UK and Europe in the face of growing operations. This trend is increasingly making private equity players align their investments with businesses showing strong ESG performance like renewable energy projects, sustainable manufacturing, and socially responsible business. This not only caters to the compliance aspects but also enhances long-term value creation for firms. The fact that the UK is considered a leader in global initiatives on sustainability further emphasizes the trend and makes ESG-focused investments a key driver of private equity activity.

UK Private Equity Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

London Private Equity Market Trends:

London private equity market is driven by great investments in the technology sector, healthcare sector, and ESG-focused sectors with regard to companies, firms emphasize tech-enabled businesses and sustainable initiatives within London's financial hub of skilled workers, and regulatory developments further enrich market dynamics, that promote innovation and long-term growth opportunities in a multitude of industries.

South East Private Equity Market Trends:

The South East private equity market is booming due to investment in technology, healthcare, and advanced manufacturing. Investor interest is drawn to the region's proximity to London, strong infrastructure, and innovation hubs. A growing emphasis on ESG-aligned opportunities and a vibrant entrepreneurial ecosystem expanding private equity activity and business.

North West Private Equity Market Trends:

The North West private equity market is growing, which is driven by investments in manufacturing, healthcare, and technology. The region has a strong industrial base, innovation hubs, and a skilled workforce, which attracts considerable interest. Private equity firms are supporting growth-oriented businesses, with an increasing focus on sustainability and regional economic development enhancing investment opportunities.

East of England Private Equity Market Trends:

The East of England private equity market is growing due to investments in the technology, life sciences, and agritech sectors. Proximity to the research hubs such as Cambridge adds to the innovative force and attracts investors' attention. Increasing focus on sustainability and regional business expansion further supports private equity activity, fostering long-term growth and economic development.

South West Private Equity Market Trends:

Momentum is growing in the South West private equity market, driven by renewable energy, tourism, and technology. Natural resources, a healthy SME ecosystem, and a strong sustainability orientation make the region attractive for private equity. Business growth and long-term investment opportunities are further supported through improved infrastructure and regional development initiatives.

Scotland Private Equity Market Trends:

Scotland's private equity market is booming due to investments in renewable energy, technology, and life sciences. The region benefits from a strong entrepreneurial ecosystem, government support for innovation, and skilled talent. Growing emphasis on sustainability and regional economic development further enhances private equity activity, fostering business growth and long-term investment opportunities.

West Midlands Private Equity Market Trends:

The West Midlands private equity market is exhibiting stable growth , supported by investments in the manufacturing, automotive, and technology sectors. Strong industrial heritage, innovation hubs, and a skilled workforce in the region are also an attractive proposition for investors. Green technologies and regional economic development initiatives are increasing the focus on private equity activity and long-term business opportunities.

Yorkshire and The Humber Private Equity Market Trends:

Yorkshire and The Humber's private equity market is growing significantly, with heavy investments in manufacturing, healthcare, and renewable energy. Investor interest is driven by the region's industrial base, innovation centers, and skilled talent pool. Growing interest in sustainability and regional development initiatives enhances private equity activity, supporting business growth and long-term economic opportunities.

East Midlands Private Equity Market Trends:

Investments in manufacturing, logistics, and technology are increasing the private equity market of the East Midlands. Strategically located with a solid industrial base and innovation centers, the region attracts heavy investment interest. Strong focus on sustainability, development of infrastructure, and regional economic growth further helps in the activities of private equity through long-term expansion of businesses and opportunities.

Competitive Landscape:

The UK private equity market is highly competitive, with global firms sitting alongside mid-sized and boutique firms focusing on niche sectors. Strong competition is derived from the search for technology-driven and ESG-compliant investments, reflecting the shift in market priorities. Increasing regulatory demands for transparency and governance are pushing for enhanced due diligence processes. Institutional investors, including pension and sovereign wealth funds, are increasing capital flows, which adds to the level of competition. Firms are using co-investments, strategic partnerships, and localized expertise to make their strategies unique. It is a dynamic landscape where innovation and adaptability have to be very high to capture value within the thriving private equity market of the UK. For instance, in December 2024, Grant Thornton UK’s 220 partners approved private equity investment deal from Cinven, among Europe’s leading firms. After exploring strategic options, the accountancy firm, which reported £654m revenue and £146m profit in 2023, aims to achieve £1bn turnover in the coming years.

UK Private Equity Market Segmentation Coverage

- On the basis of the fund type, the market has been categorized into buyout, venture capital (VCs), real estate, infrastructure, and others. Each category serves distinct investment objectives, with buyout funds focusing on acquiring control, VC funds supporting startups, and real estate and infrastructure funds targeting long-term asset growth and stability.

- Based on the sector, the market is classified into technology (software), healthcare, real estate and services, financial services, industrial, consumer and retail, energy and power, media and entertainment, telecom, and others. These sectors reflect diverse investment opportunities, catering to varying growth dynamics, innovation potential, and market demands across industries for private equity investments.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 66.37 Billion |

| Market Forecast in 2033 | USD 116.98 Billion |

| Market Growth Rate 2025-2033 | 6.50% |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Sectors Covered | Technology (Software), Healthcare, Real Estate and Services, Financial Services, Industrial, Consumer and Retail, Energy and Power, Media and Entertainment, Telecom, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Private Equity Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)