UK Mobile Payments Market Expected to Reach USD 14.4 Billion by 2033 - IMARC Group

UK Mobile Payments Market Statistics, Outlook and Regional Analysis 2025-2033

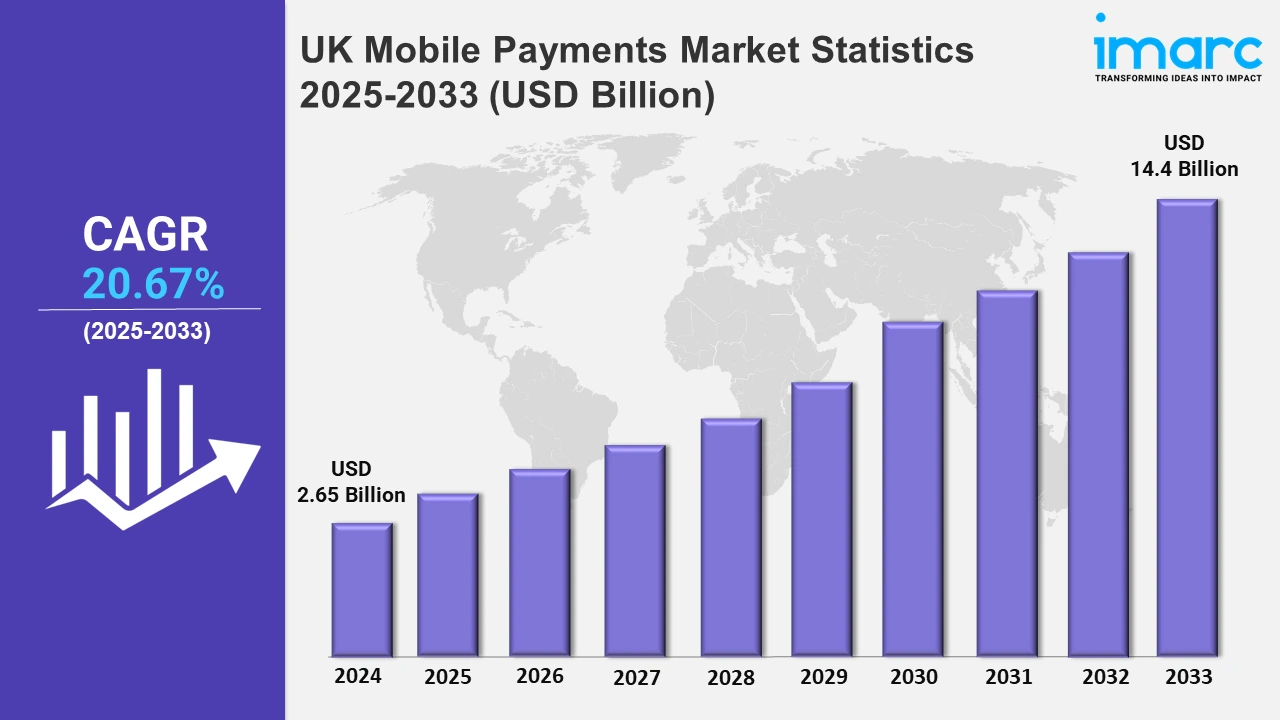

The UK mobile payments market size was valued at USD 2.65 Billion in 2024, and it is expected to reach USD 14.4 Billion by 2033, exhibiting a growth rate (CAGR) of 20.67% from 2025 to 2033.

To get more information on this market, Request Sample

Rapid growth of the UK mobile payments market is attributed to the increasing proliferation of smartphones, changes in the trends toward more cashless transactions, and evolving consumer preferences toward convenience and security. Significant trends shaping this market include adoption of contactless payments, integration of sophisticated security features, and the growing popularity of mobile wallets. Consumers are increasingly adopting contactless payment methods as they are fast and easy to operate. In addition, integration of biometric authentication methods such as fingerprint scanning and facial recognition into mobile payment systems is now on the rise to achieve better security. This shift toward more secure and seamless payment solutions is being driven by both consumer demand for frictionless transactions and the need for businesses to remain competitive in a digital-first economy. Moreover, the increasing popularity of mobile wallets and the proliferation of apps such as Apple Pay, Google Pay, and Samsung Pay are also driving the adoption of mobile payments.

The UK mobile payments market is being driven by the rapid adoption of contactless payments, which has gained significant traction among UK consumers. According to industry reports, more than half of all card transactions in the UK are now made via contactless methods, and this trend has influenced mobile payments. The ability to pay via a smartphone offers convenience for both the consumer and the business alike, thus translating to its wide adoption. Increasing availability in both physical and virtual store spaces further support the acceptance of mobile payments. Another very significant growth driver for this industry is the persistent technological progress in mobile payment systems. Technological innovations like near field communication (NFC) are furthering the ability of mobile payment applications to process fast and secure transactions among devices. This makes it increasingly possible for consumers to purchase various products and services through the smart phone, thus ensuring easy payments while simultaneously providing the companies with efficient transaction systems. According to Payment System Regulator, the use of digital and mobile wallets increased to 47% from only 14% of UK adults between 2017 and 2022. The increasing emphasis on security in mobile payments is also driving the growth of the market. Concerns regarding fraud and data breaches have fueled the integration of advanced security measures, such as biometrics and tokenization, to boost consumer confidence in mobile payments. Additionally, the advancement of open banking in the UK has helped popularize mobile payments and allowed consumers to make direct payments from their bank accounts through mobile apps. As financial institutions collaborate with tech companies to offer innovative solutions, mobile payments are becoming increasingly accessible to a wider range of consumers.

UK Mobile Payments Market Statistics, By Region:

The market research report has also provided a comprehensive analysis of all the major regional markets, which include London, Southeast, Northwest, East of England, Southwest, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

London Mobile Payments Market Trends:

The mobile payments market in London is experiencing growth due to the technological infrastructure of the city. Several people in London prefer using mobile payments owing to their convenience, speed, and security features. Contactless payments have gained high traction in this regard. Londoners regularly use mobile wallets like Apple Pay, Google Pay, and Samsung Pay for everyday transactions, from retail purchases to public transport. This change is facilitated by the strong contactless payment network within the city, including Transport for London (TfL), where a mobile device is used for tapping in and out.

Southeast Mobile Payments Market Trends:

The mobile payments market in the Southeast is growing at a fast pace, due to the rising use of smartphones, shifting toward cashless transactions, and the high digital infrastructure in the region. The Southeast region is relatively close to London and its technologically skilled population is on the rise, which makes it easy for mobile payments to gain momentum. Besides, improved security features like biometric authentication and tokenization are boosting the confidence of consumers toward mobile payment solutions. The strong e-commerce and retail sectors of Southeast contribute to the need for easy mobile payment options, setting this region up for further growth in the realm of digital payments.

Northwest Mobile Payments Market Trends:

The Northwest mobile payment market is steadily growing, following the increasing dependence on digital payments, by residents who are technologically proficient. Manchester, owing to its digital economy and innovation driven zones, is an important user of mobile payments, aided by the wide public transportation network that uses contactless mobile payments across the city. The region also has a high concentration of university students, who are more likely to use mobile payment solutions for ease of operation. As the region embraces advanced payment technologies, such as biometric authentication and NFC, the Northwest mobile payments market is poised for further growth.

East of England Mobile Payments Market Trends:

The mobile payments market in East of England is experiencing significant growth, with cities like Cambridge and Norwich, which are already famous for innovation and technology-driven sectors, leading the adoption of mobile payment platforms like Apple Pay, Google Pay, and Samsung Pay. Contactless payment terminals have increased in retail stores, restaurants, and public transport networks, making residents choose cashless transactions for ease and security. The East of England also has a considerable student population, especially in university towns like Cambridge, where mobile payments are being adopted due to the technologically savvy young consumer. Moreover, the region's strong agriculture and tourism sectors are increasingly embracing mobile payment solutions, with both consumers and businesses getting seamless experiences.

Southwest Mobile Payments Market Trends:

The mobile payments market in the Southwest UK is on the rise. Cities such as Bristol, which are recognized for their tech innovation and cultural activities, are on the front lines of this shift. Mobile payment platforms like Apple Pay, Google Pay, and Samsung Pay are gaining popularity, especially in retail, hospitality, and transport sectors. High tourism rates for the region, particularly in places such as Cornwall and Devon, have pushed up contactless payment due to visitors seeking convenient yet secure methods of transaction. Southwest's emphasis on sustainability and green technologies further shapes the trend of mobile payments as environmentally conscious customers seek to find seamless and digital-first solutions.

Scotland Mobile Payments Market Trends:

The mobile payments market in Scotland is growing rapidly due to increased smartphone usage and cashless transactions. Cities like Edinburgh and Glasgow are leading this change. The commitment of Scotland to sustainability is also changing payment trends, as more and more consumers opt for digital payment methods to reduce the use of physical cash. The strong tourism industry, specifically in destinations such as the Scottish Highlands and Isle of Skye, further promotes mobile payment adoption, since tourists desire seamless, secure means for spending. The high-tech innovation in Scotland is also coupled with government support for digital transformation and is helping to build a suitable environment for mobile payment growth.

West Midlands Mobile Payments Market Trends:

Strong growth in mobile payments is recorded in the West Midlands area, considering widespread smartphone penetration and uptake of new digital payment technologies in metropolitan cities like Birmingham, Coventry, and Wolverhampton. West Midlands is a region that holds industrial heritage and an emergent tech sector, thus perfectly ideal for mobile payments integration in day-to-day life. With large investment in smart city initiatives, including contactless payment on public transport, the region is ready for wider take-up. The high number of students at West Midlands, particularly at Birmingham, makes it an influential driving force for convenient cashless payment solutions.

Yorkshire and The Humbler Mobile Payments Market Trends:

The mobile payments market in Yorkshire and The Humber is likely to continue its growth trajectory. The diverse economic base and the increasing acceptance of cashless transactions are expected to drive the market further. Apart from a thriving retail and hospitality sector, mobile payment methods are gaining importance in the strong manufacturing and logistics industries of Yorkshire by providing efficiency and streamlined transactions. The increased availability of contactless payment options across public transport systems, especially in Leeds and Sheffield, drives further adoption. Besides, the rich cultural attractions of Yorkshire and The Humbler, including a historic city such as York and sea towns such as Scarborough, are contributing to the growth of mobile payments among both the locals and the tourists who increasingly prefer digital options for convenience and security.

East Midlands Mobile Payments Market Trends:

The East Midlands region's strong economic and technological development continues to drive expansion in the mobile payments market. Cities like Nottingham, Leicester, and Derby continue to invest in digital infrastructure, and consumers seek convenience, security, and speed through mobile payment solutions. Large numbers of small and medium-sized businesses also look into integrating mobile payment systems for enhancing customer experience and streamlining their operations. Additionally, a highly presence of universities such as University of Leicester and the University of Nottingham creates the increasing demand for digital payments due to high demand of them among the students and young generation.

Top Companies Leading in the UK Mobile Payments Industry

The report provides a comprehensive analysis of the competitive landscape in the UK mobile payments market with detailed profiles of all major companies.

- In October 2024, Apple Pay and Klarna announced an integration, after which Klarna’s payment facilities are available for use through Apple Pay in the UK and the US.

UK Mobile Payments Market Segmentation Coverage

- On the basis of the mode of transaction, the market is categorized into WAP (wireless application protocol), NFC (near field communications), SMS (short message service), USSD (unstructured supplementary service data), and others. WAP is a protocol designed to enable mobile devices to access the internet and web services. It allows smartphones and other mobile devices to interact with websites and applications over wireless networks, providing users with mobile-optimized content and services despite limited bandwidth and processing power. NFC is a short-range wireless communication technology that allows devices to exchange data when placed within close proximity, typically within 4 cm. SMS is a text messaging service that allows users to send short text messages via mobile networks. It is widely used for personal communication, marketing, and notifications. USSD is a communication protocol used by mobile phones to send short text messages between a mobile device and an application server. It is often used for real-time, interactive services such as mobile banking, balance checking, and pre-paid recharge, functioning without internet or data connectivity.

- Based on the application, the market has been classified into entertainment, energy and utilities, healthcare, retail, hospitality and transportation, and others. The mobile payments market in entertainment allows consumers to purchase tickets, subscriptions, and event access via mobile wallets and contactless methods. This offers convenience and speed, making it easier to access movies, concerts, live events, and digital content. Mobile payments in the energy and utilities enable consumers to pay for services like electricity, gas, and water bills quickly and securely. In healthcare, patients can now pay for appointments, prescriptions, and treatments via mobile devices. Contactless payments and mobile wallets are improving convenience, reducing wait times, and enhancing the overall patient experience. The retail sector has also adopted mobile payments, allowing customers to pay seamlessly via mobile wallets, contactless cards, or apps. Mobile payments in the hospitality sector enables guests to easily book accommodations, check in, and pay for services through mobile apps or wallets. The transportation market benefits from mobile payments by allowing passengers to pay for fares, tickets, and rides through mobile wallets or apps. Contactless payments make commuting more efficient and reduce cash handling.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.65 Billion |

| Market Forecast in 2033 | USD 14.4 Billion |

| Market Growth Rate 2025-2033 | 20.67% |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Transactions Covered | WAP (Wireless Application Protocol), NFC (Near Field Communications), SMS (Short Message Service), USSD (Unstructured Supplementary Service Data), Others |

| Applications Covered | Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality and Transportation, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Mobile Payments Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)