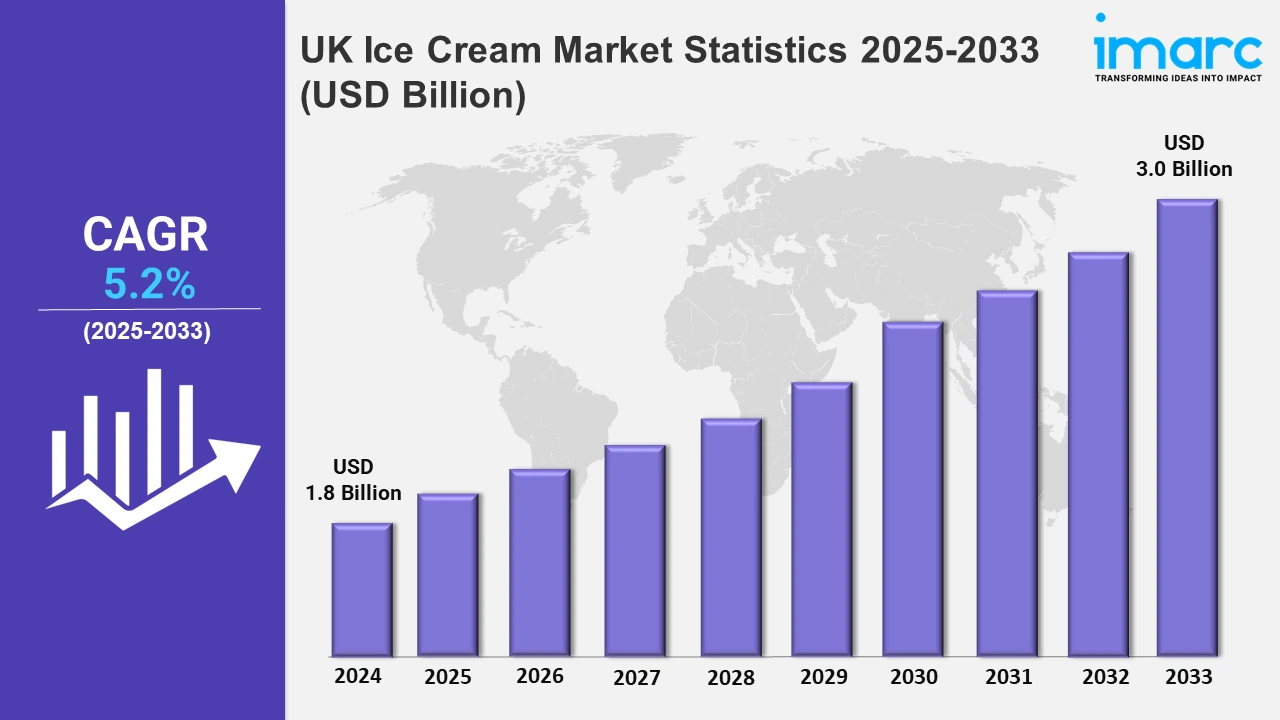

UK Ice Cream Market Expected to Reach USD 3.0 Billion by 2033 - IMARC Group

UK Ice Cream Market Statistics, Outlook and Regional Analysis 2025-2033

The UK ice cream market size was valued at USD 1.8 Billion in 2024, and it is expected to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% from 2025 to 2033.

To get more information on this market, Request Sample

The growing consumer demand for innovative flavors is one of the major factors driving the market in the country. In August 2024, Ferrero UK unveiled Nutella ice cream tubs in order to expand its product range. Also, various companies are focusing on launching unique ingredients and limited-edition flavors to attract consumers, which is further adding to the market demand in the country. Besides this, the surging inclination towards premium and artisanal ice creams that emphasize high-quality ingredients is acting as another growth-inducing factor.

Additionally, the increasing focus on health in the country is propelling the demand for ice cream in the UK. As individuals become more health-conscious, there is a growing trend of consuming low-calorie, dairy-free, and vegan ice cream options. In February 2024, Magnum launched Chill Blueberry Cookie Sticks, a vegan ice cream in the United Kingdom. This is a vegan vanilla biscuit flavor ice cream and a blueberry sorbet core. Additionally, eco-conscious shoppers are becoming more attracted to sustainable packaging and ethical sourcing practices. Similarly, in November 2024, Brand of Brothers partnered with Hershey to introduce Reese's ice cream in the UK. This new ice cream variant combines milk chocolate with peanut butter. To differentiate themselves and appeal to adventurous palates, brands are also experimenting with innovative ingredients and inventive pairings, such as lavender honey and matcha green tea. Furthermore, the growing preference for plant-based options is acting as another growth-inducing factor across the country. In June 2024, McDonald's introduced The Vegan Scoop, a vegan ice cream that is available in chocolate and strawberry flavors, further propelling the industry demand.

UK Ice Cream Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others. They play a crucial role in maintaining excitement and interest throughout the year. Furthermore, local sourcing strategies are also augmenting the market.

London Ice Cream Market Trends:

The ice cream market in London sees a surge in artisan and gourmet product variants. Moreover, with affluent consumers seeking unique experiences, brands like Gelupo and Chin Chin Labs thrive by offering flavors such as matcha or black sesame. Pop-ups and food festivals, such as the London Ice Cream Festival, further drive this trend. This will propel the market in the coming years.

South East Ice Cream Market Trends:

In the South East, farm-to-table ice creams are a popular trend. Additionally, local dairies like Mackie’s and Purbeck Ice Cream highlight ingredients such as Sussex strawberries and Kentish cherries. Tourists visiting coastal towns like Brighton frequently seek out these fresh and sustainable products, thereby driving their popularity in South East part of the UK.

North West Ice Cream Market Trends:

The growth in North West, including Liverpool and Manchester, is supported by a strong emphasis on traditional parlors and family-run businesses. In addition, Frederick’s and Mrs. Dowson’s are loved for their classic flavors like vanilla and mint chocolate chip. These parlors often feature in seaside destinations like Blackpool, where traditional ice cream cones are a staple of the tourist experience, blending nostalgia with quality.

East of England Ice Cream Market Trends:

In the East of England, vegan and plant-based ice creams are gaining traction. Also, brands like Booja-Booja, based in Norfolk, cater to the growing demand for dairy-free alternatives. Health-conscious consumers in cities like Cambridge and Norwich are driving the demand for these ice creams. Additionally, the presence of universities is further creating a positive outlook in the East of England.

South West Ice Cream Market Trends:

The South West is known for its particular specialty, clotted cream ice cream. Moreover, brands in Cornwall, like Roskilly's and Callestick Farm, benefit from the well-known dairy legacy of the area. Moreover, people visiting popular tourist destinations such as St. Ives and Devon gather to sample this creamy delicacy, which combines rich and local cream with traditional flavors such as honeycomb or fudge.

Scotland Ice Cream Market Trends:

The demand in Scotland is propelled by the introduction of whisky-infused flavors that combine two national symbols. Moreover, brands like Mackie's of Scotland provide unusual selections such as Scotch whiskey ice cream. This tendency appeals to both locals and tourists visiting places like Edinburgh and the Highlands. The combination of fine ice cream with Scotland's renowned alcohol creates a unique culinary experience.

West Midlands Ice Cream Market Trends:

In the West Midlands, cultural fusion flavors are one of the key factors propelling the growth of the market. Moreover, the diverse population impacts goods like mango lassi and kulfi-inspired ice cream. Also, Creams Café and local parlors in Birmingham meet these demands by combining cosmopolitan flavors with traditional ice cream textures, thereby appealing to a diverse clientele.

Yorkshire and The Humber Ice Cream Market Trends:

Yorkshire and the Humber region, including Sheffield, have a thriving market for innovative flavors. Moreover, local companies like Yorvale use ingredients like rhubarb, which is a regional staple, and Wensleydale cheese in their ice creams. The annual Yorkshire Food & Drink Festival celebrates these inventions, further boosting the market demand.

East Midlands Ice Cream Market Trends:

The East Midlands is known for its family-friendly ice cream experiences. Additionally, Bluebells Dairy in Derbyshire offers interactive farm trips as well as fresh, handcrafted ice cream. This emphasis on experience consumerism appeals to families seeking day-trip destinations. Popular tastes like raspberry ripple and salted caramel assure broad appeal.

Other Ice Cream Market Trends:

Other regions across the market support seasonal outdoor activities, which provide brands with opportunities to connect with community-focused individuals. Moreover, food festivals and fairs help them in expanding their presence across different areas.

Top Companies Leading in the UK Ice Cream Industry

The report has also provided a comprehensive analysis of the competitive landscape in the market. Marketing campaigns, strategic pricing, and seasonal promotions play an important role in market positioning in the country. Unilever, in September 2024, announced its plans to introduce novel snackable ice cream formats in the UK.

UK Ice Cream Market Segmentation Coverage

- On the basis of the flavor, the market has been bifurcated into vanilla, chocolate, fruit, and others. A vanilla flavor ice cream is made with vanilla essence and can be topped with various toppings like chocolate syrup. Moreover, chocolate ice cream is made with chocolate flavor and has a soft texture. Besides this, fruit flavor ice cream is made with fresh fruits, cream, and other ingredients.

- Based on the category, the market is categorized into impulse ice cream, take-home ice cream, and artisanal ice cream. Impulse ice cream is generally eaten immediately and is sold in sandwiches, tubes, cones, and sticks. Moreover, take-home ice cream is available in grocery stores. Besides this, artisanal ice cream is made in small batches. This ice cream is sold in high-end retail outlets.

- On the basis of the product, the market has been divided into cup, stick, cone, brick, tub, and others. Cup ice creams are popular for their portion control. These cups are popular for on-the-go consumption. Moreover, stick ice creams are known for their easy-to-eat format. Besides this, cone ice creams have crunchy texture with creamy flavors. Furthermore, brick ice creams are the most popular when it comes to take-home consumption.

- Based on the distribution channel, the market is categorized into supermarkets and hypermarkets, convenience stores, ice cream parlors, online stores, and others. Among these, supermarkets and hypermarkets dominate the overall market. These stores sell a variety of household products. The increasing availability of a wide range of products is propelling the segment’s growth.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Market Growth Rate 2025-2033 | 5.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Vanilla, Chocolate, Fruit, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, Cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Ice Cream Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)