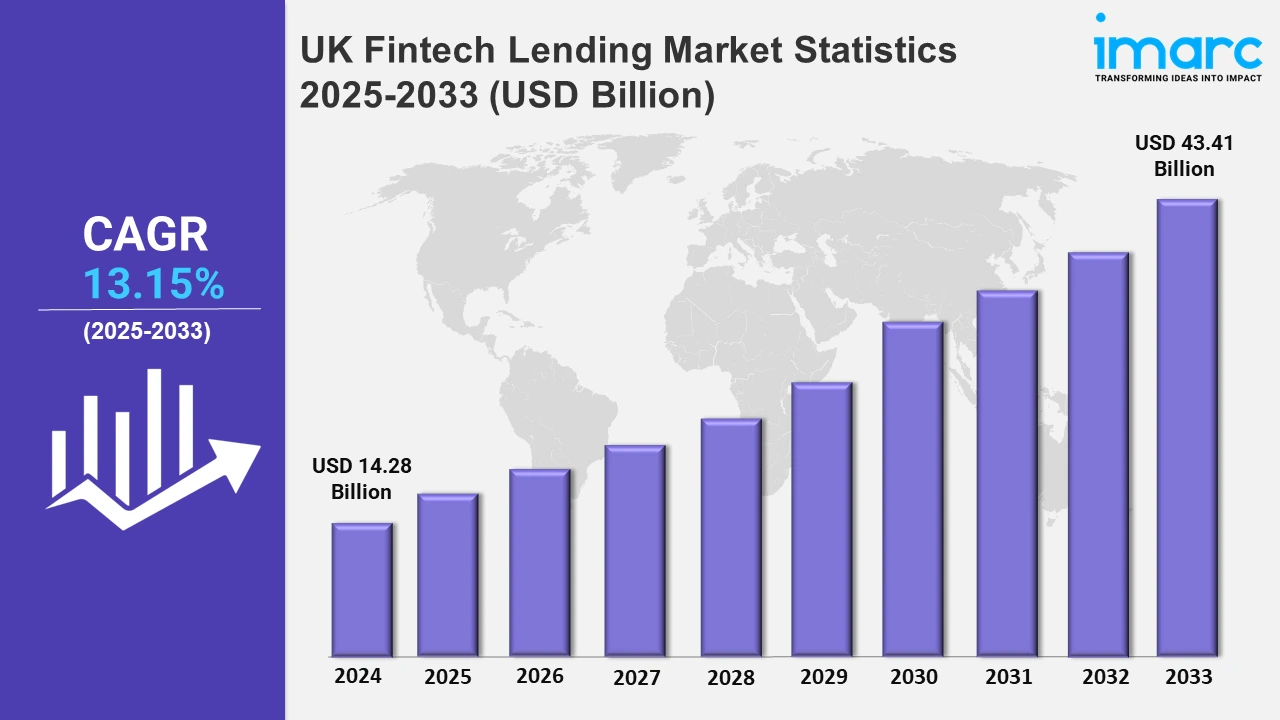

UK Fintech Lending Market Size Anticipated to Reach USD 43.41 Billion by 2033 - IMARC Group

UK Fintech Lending Market Statistics, Outlook and Regional Analysis 2025-2033

The UK fintech lending market size was valued at USD 14.28 Billion in 2024, and it is expected to reach USD 43.41 Billion by 2033, exhibiting a growth rate (CAGR) of 13.15% from 2025 to 2033.

To get more information on this market, Request Sample

The digitalization of financial services has changed the lending market in the UK. Fintech lenders use advanced technologies like artificial intelligence (AI), machine learning (ML), and big data analytics to facilitate loan approval processes, provide more accurate creditworthiness, and offer near-instant funding decisions. For instance, in December 2024, Zopa, UK's digital bank, secured £68m in funding to start its flagship current account in 2025 and its first generation of Generative AI tools for financial management. These innovations serve the rising demand for fast, hassle-free financial solutions for consumers and businesses alike. Mobile-first platforms have also allowed access to loan applications without any hassle, thus further adding to customer convenience and driving adoption in the market. As borrowers become increasingly digital savvy, seeking speed and user experience, fintech lenders are continually refining their offerings to remain competitive.

The UK government and regulatory bodies have supported the development of fintech lending through initiatives such as open banking. This is because open banking allows for the secure sharing of financial data, thereby enabling tailored lending solutions based on borrowers' financial behaviors, increasing transparency and trust in the market. Additionally, regulatory measures to promote competition within the financial sector have allowed fintech lenders to thrive, challenging traditional banking institutions and expanding access to credit for underserved segments. For instance, in November 2024, Chase, JP Morgan's digital bank, launched its first UK credit card with 0% interest, no fees, instant credit scores, and exclusive availability to 25,000 customers, challenging traditional high-street banks. These developments have made the UK as a leading hub for fintech innovation in lending.

UK Fintech Lending Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands.

London Fintech Lending Market Trends:

Growth in the London fintech lending market is driven by rapid development in AI-powered credit assessment, open banking, and a growing demand for digital-first financial solutions. Growing competition between fintech startups and banks integrating innovative technologies has led to improved customer experience and increased access to credit for underserved segments.

South East Fintech Lending Market Trends:

The South East fintech lending market is growing rapidly, fueled by strong demand for digital lending solutions among SMEs and tech-savvy consumers. Increasing adoption of AI and machine learning in credit evaluation, as well as open banking initiatives, is driving innovation, improving loan accessibility, and enhancing customer-centric financial services across the region.

North West Fintech Lending Market Trends:

The North West fintech lending market is booming, with the growing demand for SME financing and increasing adoption of digital platforms. Local fintech firms are using AI and data analytics to process loans efficiently, while regional development initiatives and open banking adoption improve access to tailored credit solutions for businesses and individuals.

East of England Fintech Lending Market Trends:

The East of England fintech lending market is growing as demand for SME financing and digital-first lending solutions increases. The region is also benefiting from advancements in AI-powered credit assessment, open banking initiatives, and a thriving entrepreneurial ecosystem that allows for tailored financial services and improved accessibility for businesses and consumers alike.

South West Fintech Lending Market Trends:

The South West fintech lending market is growing steadily, supported by increased adoption of digital lending platforms among SMEs and rural businesses. Advancements in AI-driven credit evaluation, open banking integration, and a focus on improving financial inclusion are driving innovation, making tailored lending solutions more accessible across the region.

Scotland Fintech Lending Market Trends:

Scotland's fintech lending market is rising to new heights, mainly owing to the strong underlying technology ecosystem and government-backed innovation centers. Improving AI, open banking technologies, loans efficiency, and accessibility bring out a positive impact on it and a focus on financing the SME and rural financial inclusion supports economic growth, leading to expansion in the country.

West Midlands Fintech Lending Market Trends:

The West Midlands fintech lending market is growing because of increasing SME demand and a thriving entrepreneurial ecosystem. Credit evaluation is being streamlined with the adoption of AI and open banking technologies, while regional initiatives boost innovation and access to digital financial solutions for growth opportunities in businesses and consumers.

Yorkshire and The Humber Fintech Lending Market Trends:

The fintech lending market in Yorkshire and The Humber is on the rise, fueled by increased SME demand and digital innovation. With open banking technologies and the development of AI-powered credit assessment, access to loans becomes easier, and regional economic initiatives help to promote the dynamic environment of fintech growth and customized financial services.

East Midlands Fintech Lending Market Trends:

The East Midlands fintech lending market is constantly developing and gaining impetus with growing needs of SME finance and improving technologies of digital lending. AI-based credit assessment, open banking, and other regional economic initiatives enhance the accessibility to customized financial solutions and create the right kind of environment that would drive innovation in support of businesses within this emerging fintech ecosystem.

Top Companies Leading in the UK Fintech Lending Industry

The UK fintech lending market is highly competitive as it has been dominated by established fintech leaders; traditional banks are incorporating solutions from fintech for competitiveness. Startups apply technologies like AI and blockchain to tap into niche markets, such as SMEs and underbanked customers. Partnerships with institutional investors and a focus on customer-centric digital solutions also shape the landscape, creating more innovation and growth in this evolving lending ecosystem. Furthermore, various fintech companies are incorporating ESG principles to aid long-term growth and competitiveness in the market. For instance, in April 2024, Funding Circle, a prominent UK-based fintech platform, announced it had joined forces with GreenTheUK as an integral component of its broader ESG strategy to make employee volunteering in impactful wildlife projects available across the UK to help benefit nature and communities.

UK Fintech Lending Market Segmentation Coverage

- On the basis of the service type, the market has been categorized into consumer lending, small business lending, and real estate lending. Consumer lending is thriving due to the high demand for personal loans and credit solutions, while small business lending supports SMEs. Furthermore, real estate lending is growing significantly, driven by digital mortgage and property financing platforms.

- Based on the business model, the market is classified into peer-to-peer (P2P) lending, marketplace lending, direct lending, crowdfunding, and hybrid models. P2P and marketplace lending are crucial models that connect borrowers with investors. Direct lending offers streamlined financing solutions, while crowdfunding supports niche projects. Hybrid models combine features, enhancing flexibility and broadening market reach.

- On the basis of the technology type, the market has been divided into artificial intelligence (AI) and machine learning (ML), blockchain, mobile technology, and big data analytics. AI and ML optimize credit risk assessment, blockchain enhances transaction security, mobile technology streamlines loan access and big data analytics improves decision-making, driving innovation and efficiency.

- Based on the end-user, the market is segregated into individuals and businesses. Individuals drive demand for personal loans, quick credit access, and tailored financial solutions, while businesses, particularly SMEs, rely on fintech lenders for streamlined funding, working capital, and growth financing, supported by advanced technologies and innovative digital platforms.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 14.28 Billion |

| Market Forecast in 2033 | USD 43.41 Billion |

| Market Growth Rate 2025-2033 | 13.15% |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Consumer Lending, Small Business Lending, Real Estate Lending |

| Business Models Covered | Peer-to-Peer (P2P) Lending, Marketplace Lending, Direct Lending, Crowdfunding, Hybrid Models |

| Technology Types Covered | Artificial Intelligence (AI) and Machine Learning (ML), Blockchain, Mobile Technology, Big Data Analytics |

| End-Users Covered | Individuals, Businesses |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)