Global UHT Milk Market Expected to Reach 205.4 Billion Litres by 2033 - IMARC Group

Global UHT Milk Market Statistics, Outlook and Regional Analysis 2025-2033

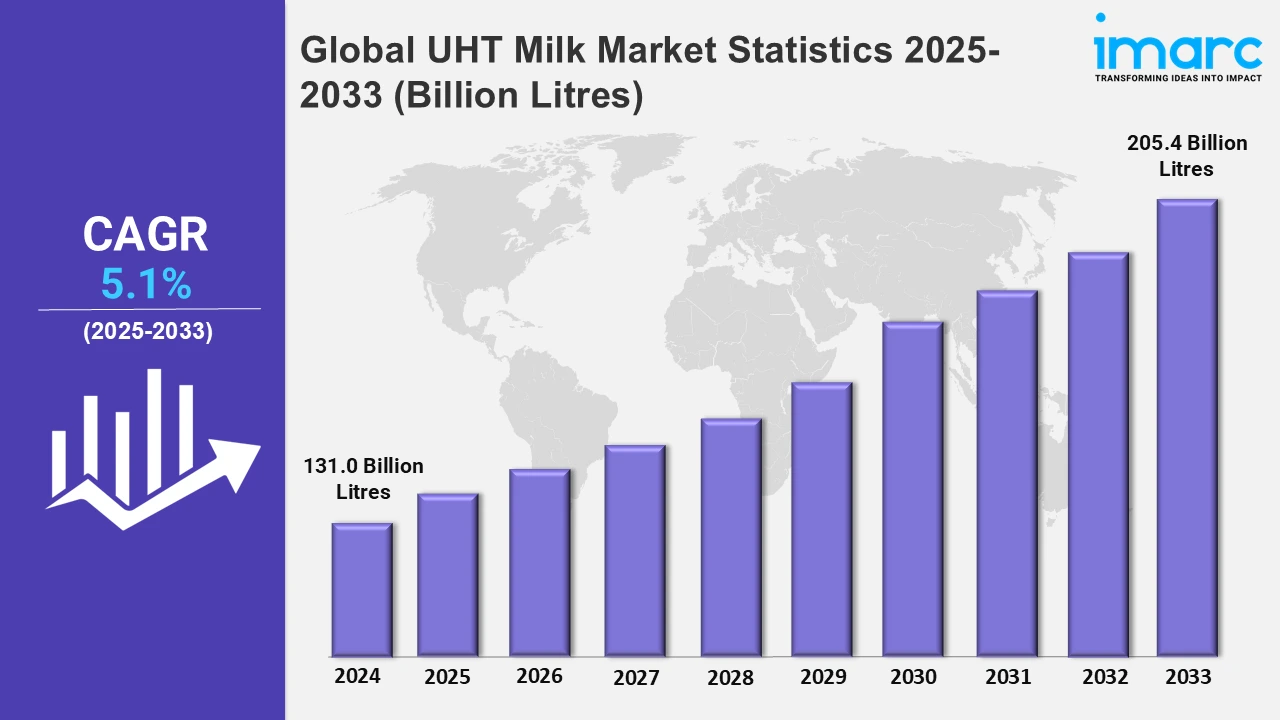

The global UHT milk market size was valued at 131.0 Billion Litres in 2024, and it is expected to reach 205.4 Billion Litres by 2033, exhibiting a growth rate (CAGR) of 5.1% from 2025 to 2033.

To get more information on this market, Request Sample

The rising working population is significantly driving the growth of the UHT milk market. Global employment reached nearly 3.5 billion in 2024. The rate in India climbed to 47.20% in the third quarter of 2024 from 46.80% in the second quarter of 2024. With increasingly hectic lifestyles and time constraints, working individuals are prioritizing convenience in their food and beverage choices. UHT milk, with its extended shelf life and ready-to-use nature, perfectly aligns with this demand, eliminating the need for refrigeration or frequent purchases.

Additionally, the increasing product innovations, like lactose-free UHT milk, are driving significant growth in the UHT milk market. With a rising prevalence of lactose intolerance globally, consumers are seeking alternative dairy options that cater to their dietary needs without compromising nutrition. Lactose-free UHT milk offers the added advantage of a long shelf life, making it both practical and accessible. Additionally, manufacturers are leveraging advanced processing techniques to enhance taste and nutritional value, broadening the product's appeal. For instance, in March 2023, Dairy Farmers of America introduced lactose-free UHT milk in the US market. This milk supports digestive and immune health. Each 12oz serving offers one billion probiotic cultures. Besides this, governments worldwide support the UHT milk market through subsidies, research funding, and infrastructure development to enhance production and affordability. They establish stringent quality regulations to ensure safety and promote exports via trade agreements and financial incentives. Investments in cold chain logistics and sustainable practices further bolster the industry’s growth.

Global UHT Milk Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the European Union, Asia, North America, Latin America, Eastern Europe, and the Middle East and Africa. According to the report, Asia currently dominates the overall market owing to surging disposable incomes and improving standards of living.

North America UHT Milk Market Trends:

The growing health consciousness among consumers is driving the growth of the market in the North America region. Moreover, various companies like Organic Valley offer lactose-free UHT milk and fortified variants. As urbanization and the need for portable, nutritious food options continue to grow, the UHT milk market in North America is poised for further expansion.

European Union UHT Milk Market Trends:

The increasing penetration towards sustainability in the European Union is acting as one of the major growth-inducing factors. Moreover, Arla Foods has adopted renewable energy for UHT milk processing. Besides this, EU regulations, like the Green Deal, encourage eco-friendly packaging and farming practices.

Eastern Europe UHT Milk Market Trends:

Eastern Europe emphasizes technological advancements in UHT milk production, improving efficiency and quality. Various countries like Poland and Hungary have modernized their dairy sectors with state-of-the-art UHT processing equipment. This has enabled producers to meet both domestic demand and export requirements while maintaining competitive pricing.

Asia UHT Milk Market Trends:

Asia dominates the overall market. The changing lifestyle across the region drives the demand for UHT milk. Various countries like India and China are also propelling the sales of the product. In July 2023, Akshayakalpa Organic, a certified organic dairy company that produces organic variants, launched UHT milk in more than 40 cities in India. The new UHT box combines organic benefits with a promise to provide nutritious milk to customers.

Latin America UHT Milk Market Trends:

In Latin America, countries like Brazil and Argentina focus on exporting UHT milk to meet international demand. Brazil's dairy giant, Itambé, exports UHT milk to the international markets. Favorable trade agreements and lower production costs make the region a competitive exporter, boosting its UHT milk market in Latin America.

Middle East and Africa UHT Milk Market Trends:

The escalating demand for long shelf life across the Middle East and Africa region is stimulating the market growth. Also, Almarai in Saudi Arabia dominates the UHT milk market, thereby catering to consumers in rural and urban areas. Furthermore, Koita's, a company based in UAE, introduced organic product variants, which are made with grass-fed cow milk in a tetra pack.

Top Companies Leading in the UHT Milk Industry

Some of the UHT milk market companies include Amul (GCMMF), Arla Foods amba, China Mengniu Dairy Company Limited, Dairy Group South Africa, Dana Dairy Group, FrieslandCampina, Hochwald Foods GmbH, Lactalis International, Saputo Dairy Australia Pty Ltd., and Sodiaal, among many others. For instance, in September 2024, the Lactalis Group acquired General Mills to expand its business in the United States. Moreover, KMF, i.e., the Karnataka Milk Federation, introduced its range of Nandini milk in November 2024 in Delhi, India.

Global UHT Milk Market Segmentation Coverage

- On the basis of the type, the market has been divided into whole, semi-skimmed, and skimmed. Among these, whole UHT milk represented the largest segment as it can be used in commercial applications like hotels and restaurants. Moreover, it has a creamy taste and is widely available.

- Based on the distribution channel, the market is categorized into supermarkets and hypermarkets, convenience stores, specialty stores, online retail, and others, amongst which supermarkets and hypermarkets account for the largest market share as they encompass numerous milk options under one roof. Besides this, they are extensively gaining traction, as these channels offer several packaging sizes, brands, flavors, etc.

| Report Features | Details |

|---|---|

| Market Size in 2024 | 131.0 Billion Litres |

| Market Forecast in 2033 | 205.4 Billion Litres |

| Market Growth Rate 2025-2033 | 5.1% |

| Units | Billion Litres, Billion USD |

| Segment Coverage | Type, Distribution Channel, Region |

| Region Covered | European Union, Asia, North America, Latin America, Eastern Europe, Middle East and Africa |

| Companies Covered | Amul (GCMMF), Arla Foods amba, China Mengniu Dairy Company Limited, Dairy Group South Africa, Dana Dairy Group, FrieslandCampina, Hochwald Foods GmbH, Lactalis International, Saputo Dairy Australia Pty Ltd., Sodiaal, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on UHT Milk Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)