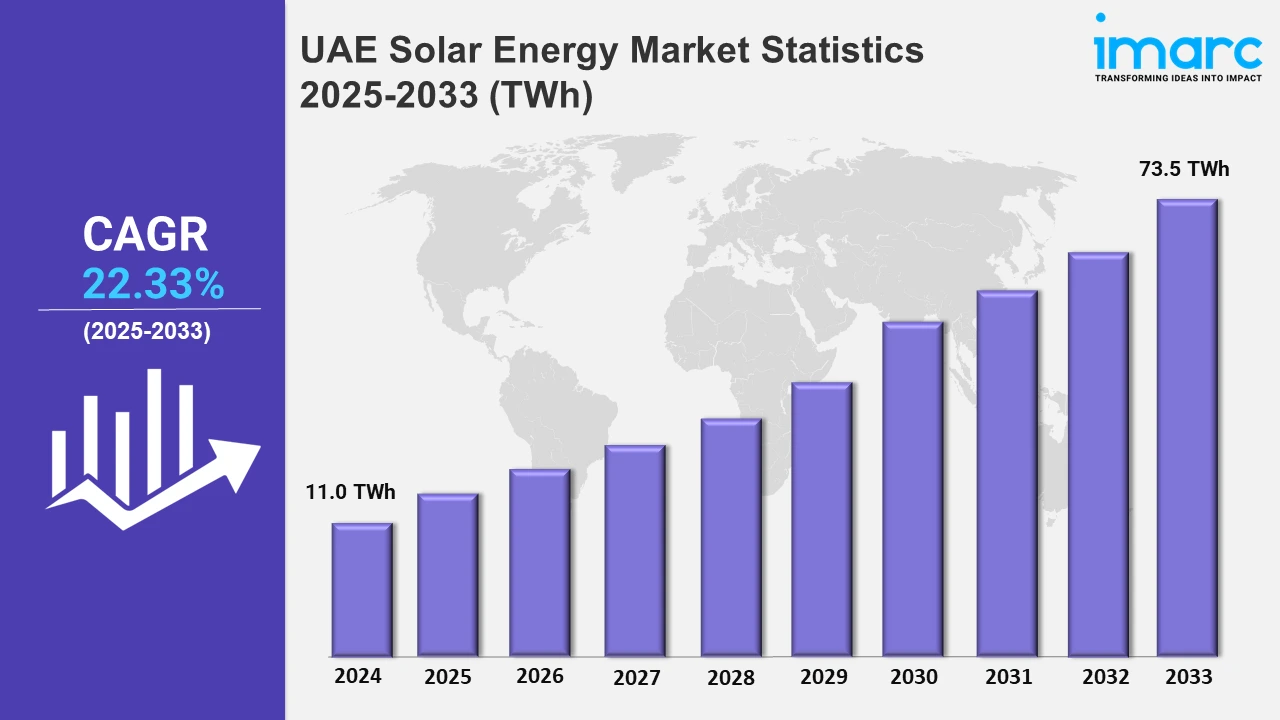

UAE Solar Energy Market Expected to Reach 73.5 TWh by 2033 - IMARC Group

UAE Solar Energy Market Statistics, Outlook and Regional Analysis 2025-2033

The UAE solar energy market size reached 11.0 TWh in 2024, and it is expected to reach 73.5 TWh by 2033, exhibiting a growth rate (CAGR) of 22.33% from 2025 to 2033.

To get more information on this market, Request Sample

In an effort to reduce environmental impact, transition to a sustainable energy future, and address climate change, the United Arab Emirates has been deploying solar energy at a rapid pace. This change supports the region's leadership in renewable energy, draws in foreign investment, fosters innovation, and reflects environmental protection efforts. One noteworthy instance is the opening of the world's largest single-site solar power plant in November 2023, in the advancement of the UN climate change conference COP28, by Abu Dhabi Future Energy Company PJSC (Masdar), in association with Abu Dhabi National Energy Company (TAQA), EDF Renewables, JinkoPower, and the procurer Emirates Water and Electricity Company.

Besides this, advancements such as grid infrastructure, energy storage, solar panel technology, etc., are assisting in lowering the price of solar energy projects. Bifacial solar panels, for instance, are increasing energy production and efficiency, as they can capture sunlight from both sides. Apart from this, high-capacity batteries are also increasing the dependability of solar power, guaranteeing that it can continuously supply the need for electricity. LONGi, for instance, unveiled the Hi-MO X6 Anti Dust Module in March 2024 to lessen the effect of dust collection on solar panels at the Abu Dhabi National Exhibition Centre. In order to contribute to the UAE's environmental objectives, solar enterprises are also developing photovoltaic (PV) and concentrated solar power technology. Their goal is to promote large-scale renewable energy projects by lowering costs and increasing efficiency. The increasing demand for cutting-edge solar solutions, such as CSP systems with thermal storage and bifacial PV panels, presents chances for producers and innovators to increase their market share. Besides this, companies and residential users are increasingly choosing innovative solar systems over traditional energy solutions to improve efficiency and sustainability. For example, the Mohammed bin Rashid Al Maktoum Solar Park in Dubai incorporates advanced bifacial PV modules and molten salt storage into its CSP stages. These developments support the UAE's target of producing about 50% of its energy from several crucial renewable sources by 2050.

UAE Solar Energy Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others. Continuous electrical energy needs are propelling the market. The UAE Energy Strategy 2050 also aims to generate clean energy across the region.

Dubai Solar Energy Market Trends:

In Dubai, the market for solar energy is growing through its Shams Dubai initiative, as the country is promoting photovoltaic system adoption in households and businesses by increasing solar rooftop installations. In September 2024, DEWA projected more than 7,000 installations, including industrial and educational facilities. Aligned with this, Dubai's Clean Energy Strategy 2050 is supported by this program.

Abu Dhabi Solar Energy Market Trends:

The Abu Dhabi solar energy market is experiencing growth with initiatives like Noor Abu Dhabi, one of the biggest solar plants in the world, which has generated 1.19 GW of power and provides electricity to approximately 90,000 families. Abu Dhabi has assumed the lead in large-scale solar energy. The country's goal of achieving more than 45% renewable energy by 2050 was furthered by the Al Dhafra Solar Project, which produced 2 GW by 2024.

Sharjah Solar Energy Market Trends:

Sharjah includes solar energy in its waste-to-energy projects. The Sharjah waste-to-energy plant, which has been active since 2023, uses solar power and garbage processing to create 30 MW of energy. This unique initiative, the first of its type in the emirate, helps Sharjah achieve its aim of reducing garbage transported to landfills while simultaneously expanding its usage of renewable energy sources.

Other Solar Energy Market Trends:

In other regions of the UAE, rural electrification programs are using solar energy. For example, small-scale solar systems are powering rural settlements in Fujairah as part of government-backed programs. These initiatives not only provide clean energy to neglected areas, but they also help the UAE meet its national sustainability goals by expanding renewable energy availability outside metropolitan areas.

Top Companies Leading in the UAE Solar Energy Industry

Some of the leading UAE solar energy market companies have been provided in the report. The companies are using diverse strategic initiatives, i.e., product launches, partnerships, and acquisitions, to hold a significant share of the market. Introductions, including the Hi-MO X6 anti-dust module by LONGi, are also creating a significant impact in the UAE market.

UAE Solar Energy Market Segmentation Coverage

- Based on the type, the market has been categorized into solar photovoltaic (PV) and concentrated solar power (CSP). Solar photovoltaic systems are used in large solar farms, whereas CSP technologies use mirrors to induce heat to generate electricity, thereby helping the government achieve its renewable energy goals.

| Report Features | Details |

|---|---|

| Market Size in 2024 | 11.0 TWh |

| Market Forecast in 2033 | 73.5 TWh |

| Market Growth Rate 2025-2033 | 22.33% |

| Units | TWh |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Solar Photovoltaic (PV), Concentrated Solar Power (CSP) |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Solar Energy Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)