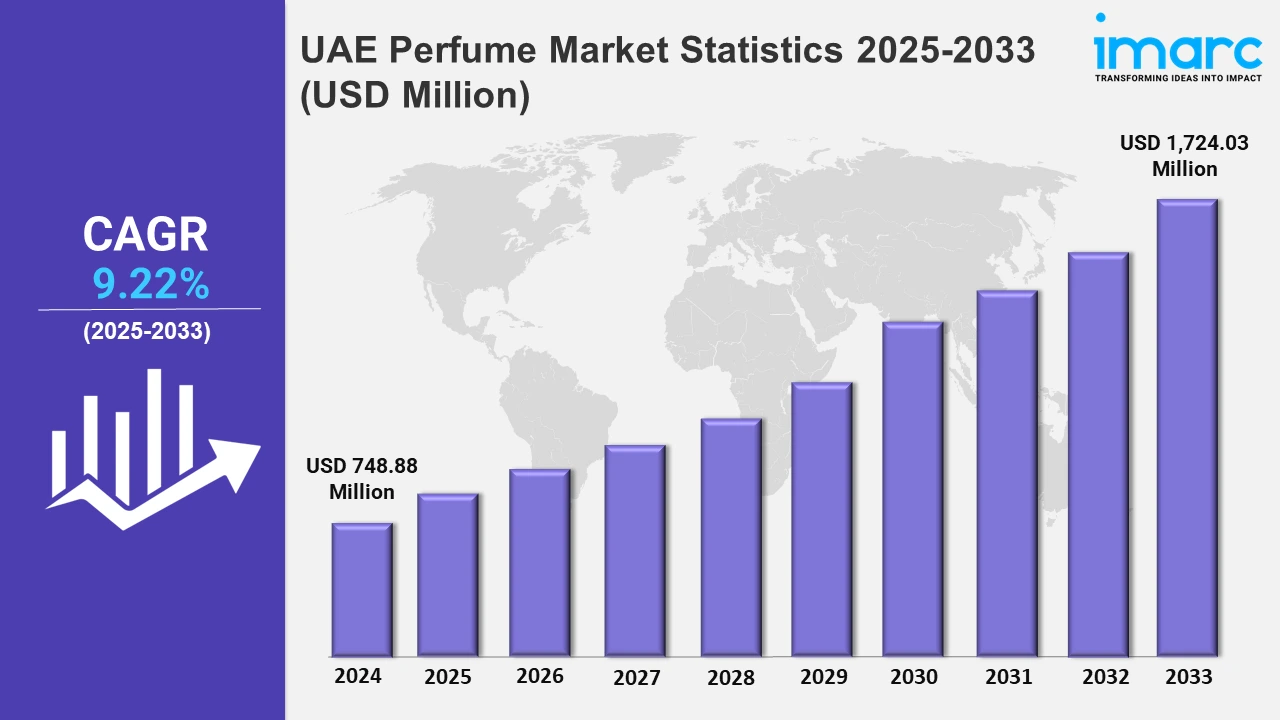

UAE Perfume Market Expected to Reach USD 1,724.03 Million by 2033 - IMARC Group

UAE Perfume Market Statistics, Outlook and Regional Analysis 2025-2033

The UAE perfume market size was valued at USD 748.88 Million in 2024, and it is expected to reach USD 1,724.03 Million by 2033, exhibiting a growth rate (CAGR) of 9.22% from 2025 to 2033.

To get more information on this market, Request Sample

The introduction of unique scent ranges aimed at inspiring elegance and luxury is bolstering the market in the UAE. New product innovations with complex smell profiles appeal to consumers' need for luxury experiences while reinforcing the country's reputation for high-end perfumes. For example, in October 2024, Ajmal Perfumes, a well-known fragrance-producing company, launched its special range of three new scents, namely, Golden Hawk, Blue Hawk, and Feather Blossom, in the UAE. These products are crafted to provide elegance and a sense of luxury.

Moreover, the industry is open to working together with famous master perfumers to produce one-of-a-kind perfumes. Such collaborations combine international experience with local talent, yielding unique scents that emphasize creativity and craftsmanship while appealing to the region's sophisticated customers. For instance, in February 2024, Emirates Pride, one of the prominent perfume manufacturers in UAE, announced its first-ever collaboration with Nathalie Lorson and Olivier Cresp in MENA. The agreement aimed to develop a unique fragrance that combines the essence of creativity and craftsmanship. Furthermore, the UAE perfume market is expanding, fueled by increased consumer demand for luxury and unique perfumes. Companies are innovating to meet changing consumer demands by implementing sustainable practices and individualized offers. Additionally, the growing middle-class population of the country provides a profitable potential for mass-market perfume manufacturers. Also, customers are increasingly choosing long-lasting and high-quality fragrances over traditional choices because of their superior performance and longevity. For example, the growing preference for customized and premium perfumes in the UAE has prompted luxury brands such as Dior and Chanel to launch unique collections suited to Middle Eastern tastes. Retailers, including Sephora and Paris Gallery, regularly hold events displaying these luxury labels, which draw scent enthusiasts. This dynamic market evolution emphasizes the UAE's position as a hub for unique and high-quality fragrances that combine luxury and cultural authenticity.

Top Companies Leading in the UAE Perfume Industry

Some of the leading UAE perfume market companies have been provided in the report. Businesses across the region are optimizing their distribution networks to make product offerings accessible through online platforms and retail networks. SAPIL developed a unique range of perfumes across the UAE in February 2024.

UAE Perfume Market Segmentation Coverage

- Based on the price, the market has been categorized into premium products and mass products, wherein premium products represent the most preferred segment. There is a high demand for premium products driven by a wealthy user base, particularly in cities like Dubai.

- Based on gender, the market has been divided into male, female, and unisex, amongst which unisex dominates the market. Unisex perfumes are favored because they appeal to both men and women while providing a balanced and varied smell profile.

- Based on the perfume type, the market has been divided into Arabic, French, and others. Among these, Arabic exhibits a clear dominance in the market owing to its deep cultural significance and unique composition.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 748.88 Million |

| Market Forecast in 2033 | USD 1,724.03 Million |

| Market Growth Rate 2025-2033 | 9.22% |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Prices Covered | Premium Products, Mass Products |

| Genders Covered | Male, Female, Unisex |

| Perfume Types Covered | Arabic, French, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Perfume Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)