UAE Online Food Delivery Market Expected to Reach USD 1,799.1 Million by 2033 - IMARC Group

UAE Online Food Delivery Market Statistics, Outlook and Regional Analysis 2025-2033

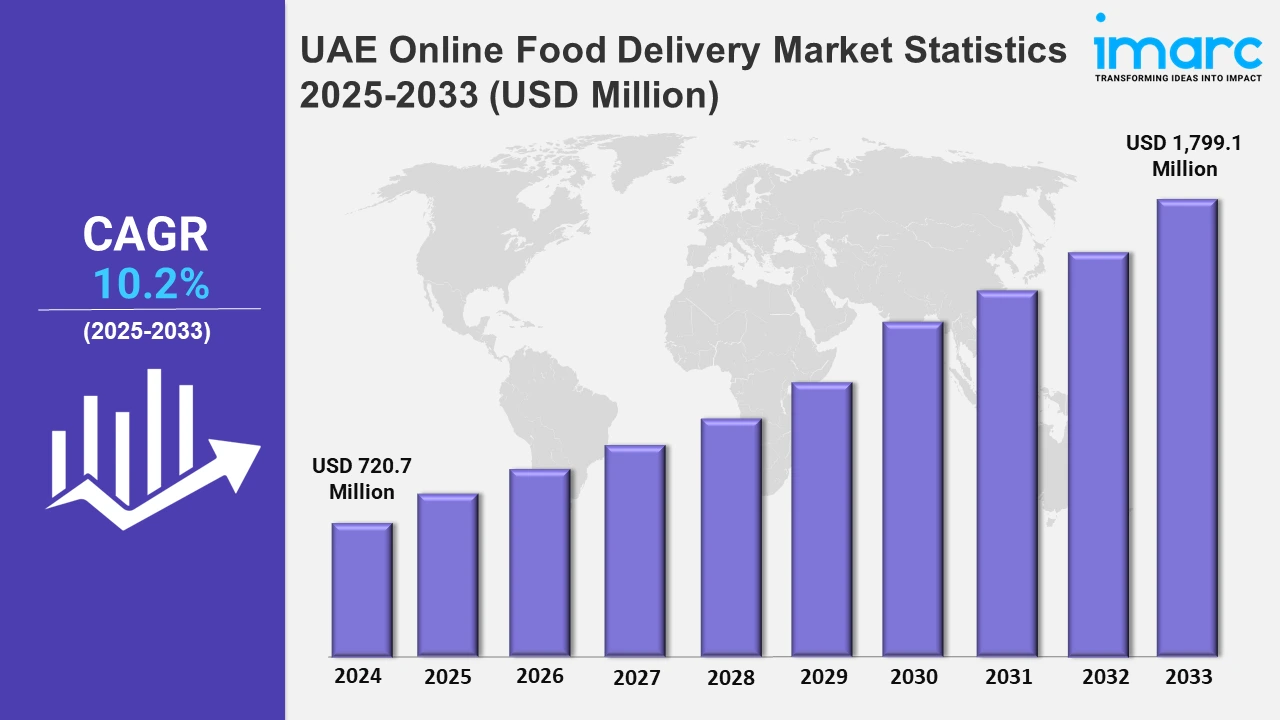

The UAE online food delivery market size was valued at USD 720.7 Million in 2024, and it is expected to reach USD 1,799.1 Million by 2033, exhibiting a growth rate (CAGR) of 10.2% from 2025 to 2033.

To get more information on this market Request Sample

The market in the UAE is primarily driven by the accelerating demand for convenient dining solutions among tech-savvy consumers. In line with this, the increasing adoption of smartphones with seamless internet connectivity, enabling users to order food on the go, is facilitating the market expansion. For instance, as per a report by Digital Portal, UAE's 2024 digital landscape presented high internet penetration at 99%, with about 9.46 million internet users and widespread mobile connectivity. Social media engagement was also strong, with approximately 10.73 million active users accounting for 112% of the total population, reflecting multiple account usage. The median mobile internet speed in the UAE is also 324.92 Mbps, indicating the country has advanced digital infrastructure that enables seamless online experiences.

Moreover, digital innovations with integrated platforms improve sourcing, menu management, and customer service. They also enhance operational efficiency and service quality, demonstrating the country's dedication to modernizing industries through cutting-edge technological advances. For example, in December 2024, Blast Catering introduced a new end-to-end digital platform that integrates procurement, menu management, and client services into a unified system, enhancing operational efficiency and service quality. The initiative aligns with the UAE's push for digital innovation, offering a seamless and modernized experience for both caterers and clients. Furthermore, UAE food delivery companies are developing ways to improve convenience and consumer satisfaction by employing new technologies like AI and machine learning. They are using personalized recommendation systems to increase interaction and optimize delivery routes to reduce delays. Additionally, specialist areas, such as healthy meal plans and gourmet cuisines, provide several potential platforms to attract a diversified consumer base. Also, users are increasingly preferring systems that provide several payment choices and real-time order status. For example, Talabat and Deliveroo, similar to major players like Uber Eats, have implemented AI-powered capabilities in the UAE. Deliveroo began its "Editions" cloud kitchens in 2024, focusing on high-demand areas like Al Ain and Ras Al Khaimah, where local cafes like Kcal and Just Salad collaborate to deliver bespoke menus, reflecting the increased demand for convenience and quality.

UAE Online Food Delivery Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others. They are investing extensively in building smart cities, which support the utilization of advanced delivery technologies.

Dubai Online Food Delivery Market Trends:

Dubai is a key city in the market due to its cosmopolitan lifestyle and a higher concentration of tech-savvy residents. The variety of cuisines required is driven by the diversified population, encouraging platforms to serve international tastes. In addition, the advanced digital infrastructure in Dubai, coupled with a growing trend of online shopping, contributes to the growth of the food delivery sector.

Abu Dhabi Online Food Delivery Market Trends:

The affluent population and a growing urbanization rate provide a significant contribution to the market from Abu Dhabi. The importance of sustainability and wellness creates a focus for the city, which matches the recent demand for organic and healthy food options. Additionally, the government's investment in smart city initiatives supports a higher adoption of advanced delivery technologies, enhancing efficiency and the satisfaction of customers in this market.

Sharjah Online Food Delivery Market Trends:

Sharjah’s role in the UAE food delivery market stems from its thriving residential communities and demand for affordable food options. The city’s strategic location connects it to major metropolitan areas, facilitating efficient delivery services. Furthermore, Sharjah’s emphasis on cultural and local cuisines creates a unique niche for food delivery platforms, catering to the city’s diverse population and fostering market expansion.

Other Online Food Delivery Market Trends:

In other smaller cities, such as Al Ain, platforms like Talabat and Zomato are expanding their reach to satisfy increased demand. For example, in 2024, Talabat collaborated with local eateries, including Al Fanar and Zadina, to provide real Emirati food. This expansion reflects greater digital penetration and customer demand for convenient eating options.

Top Companies Leading in the UAE Online Food Delivery Industry

Some of the leading UAE online food delivery market companies have been provided in the report. These companies collaborate with restaurants and integrate environmentally friendly packaging solutions. Blast Catering, in December 2024, launched a platform that changed the catering industry across the UAE.

UAE Online Food Delivery Market Segmentation Coverage

- Based on the platform type, the market is divided into mobile applications and websites. Mobile applications provide users with smooth and convenient ordering experiences. Websites offer a platform for desktop and mobile users who wish to order food items reliably.

- Based on the business model, the market is segregated into order focused food delivery system, logistics-based food delivery system, and full service food delivery system. An order-centric food delivery system emphasizes streamlining the ordering process through user-friendly apps and platforms. A logistics-based food delivery system ensures timely deliveries while maintaining food quality in the UAE. A full-service food delivery system allows for end-to-end solutions, from placing an order to delivering it.

- Based on the payment method, the market is categorized into online and cash on delivery. The online payment method offers consumers easy access to a wide variety of dining options through apps and websites. Cash on delivery (COD) provides consumers with ease and security as it attracts those unfamiliar with digital payments.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 720.7 Million |

| Market Forecast in 2033 | USD 1,799.1 Million |

| Market Growth Rate 2025-2033 | 10.2% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platform Types Covered | Mobile Applications, Websites |

| Business Models Covered | Order Focussed Food Delivery System, Logistics-based Food Delivery System, Full Service Food Delivery System |

| Payment Methods Covered | Online, Cash on Delivery |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Online Food Delivery Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)