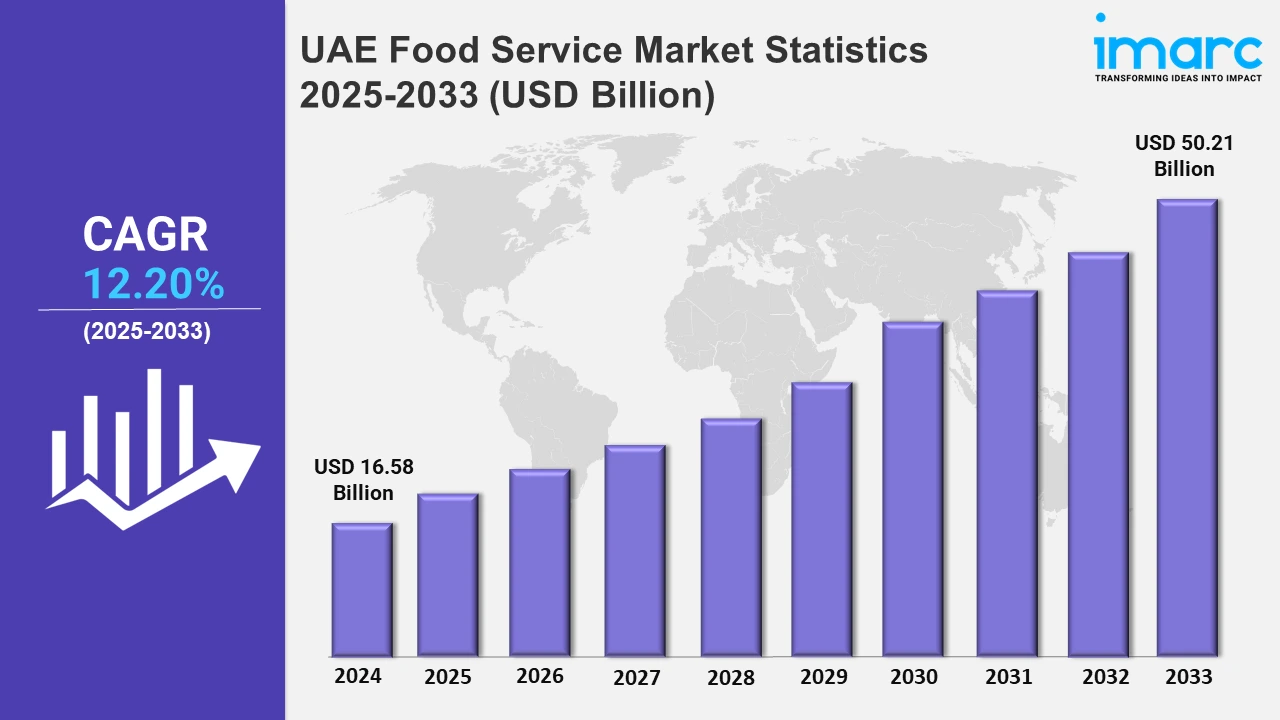

UAE Food Service Market Expected to Reach USD 50.21 Billion by 2033 - IMARC Group

UAE Food Service Market Statistics, Outlook and Regional Analysis 2025-2033

The UAE food service market size was valued at USD 16.58 Billion in 2024, and it is expected to reach USD 50.21 Billion by 2033, exhibiting a growth rate (CAGR) of 12.20% from 2025 to 2033.

To get more information on this market, Request Sample

The market in the UAE is booming through platforms that provide access to a diverse choice of eateries. By integrating famous establishments, these services improve convenience and meet the growing desire for smooth and varied dining alternatives. For example, in April 2024, Careem launched Careem Food and Careem Pay in Abu Dhabi as part of its expansion strategy. The app generally enables residents and visitors to order meals from numerous restaurants, including popular choices like Allo Beirut, PF Chang’s, Pizza Di Rocco, etc.

Moreover, the F&B sector is expanding through strategic acquisitions aimed at improving supply chains, increasing local manufacturing, and encouraging sustainability. Companies are using such movements to increase their market presence and contribute to the region's long-term food security objectives. For instance, in October 2024, Silal, UAE’s leading food and technology company, acquired a majority stake in Al Bakrawe Holding, expanding its presence in the country. This acquisition aimed to strengthen Silal’s supply chain capabilities, enhance local food production, and support sustainable growth. Furthermore, the market in the UAE is expanding rapidly due to changing customer tastes. Operators are implementing technologies like cloud kitchens and delivery platforms to meet the increasing demand for convenience. Additionally, the rising health consciousness has fueled demand for better menu alternatives, such as plant-based and organic cuisine. Independent restaurants are also focused on local tastes to differentiate themselves in a competitive market. For example, Deliveroo Editions, a cloud kitchen platform located in Dubai, has partnered with restaurants to increase their delivery reach without the need for new physical outlets. In addition, companies like Wild & The Moon are popular as they provide organic and vegan alternatives that correspond with health-conscious customer preferences. This diversification demonstrates how UAE food service enterprises use innovation and adaptation to satisfy client expectations for quality, sustainability, and convenience.

UAE Food Service Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others. These regions are expanding as the international food chains and restaurants are growing. They are also investing in infrastructure development.

Dubai Food Service Market Trends:

In Dubai, the food service business focuses on fine dining, combining creative concepts with luxury. For example, Dinner in the Sky provides a one-of-a-kind dining experience by raising meals over the metropolitan skyline. Dubai's thriving culinary sector draws worldwide companies and star chefs, making it a hotspot for food tourism and innovative dining experiences.

Abu Dhabi Food Service Market Trends:

In Abu Dhabi, the industry emphasizes family-friendly dining, with many establishments featuring play spaces and diversified menus for children. Restaurants at Yas Mall and Corniche appeal to families, offering inviting settings that combine convenience and diversity, reflecting the city's emphasis on community and enjoyment. This provides a balance of convenience, a variety of options, and inclusive environments that appeal to visitors.

Sharjah Food Service Market Trends:

The market is characterized by an increase in cheap dining, especially for local and regional cuisines in Sharjah. Al Qasba, known for its low-cost eateries such as Emirati Cafe, is a hub for various affordable dining options. Rolla Square reflects Sharjah's attraction to its ethnic population, with cafes that provide value-driven meals. This emphasis on price assures eating accessibility while preserving cultural authenticity, along with Sharjah's community-oriented outlook.

Other Food Service Market Trends:

Smaller emirates, like Fujairah and Ajman, are experiencing an increase in specialized cafes serving artisanal coffee and inventive treats. Cafes like Brew Fujairah attract both residents and visitors looking for unusual beverages in creative settings. These establishments meet the rising need for comfortable yet fashionable gathering locations. This increase represents a move toward specialist products in less-urbanized locations, which provide exciting experiences for inhabitants while also encouraging communal meeting spaces.

Top Companies Leading in the UAE Food Service Industry

Some of the leading UAE food service market companies have been provided in the report. Silal acquired AI Bakrawe to elevate its presence in the market across the country. Additionally, the deal held in October 2024 aimed to enhance the supply chain capabilities of the company.

UAE Food Service Market Segmentation Coverage

- Based on the type, the market has been classified into cafes and bars [by cuisine (bars and pubs, cafes, juice/smoothie/desserts bars,specialist coffee and tea shops)], cloud kitchen, full service restaurants [by cuisine (Asian, European, Latin American, Middle Eastern, North American, and others)], and quick service restaurants [by cuisine (bakeries, burger, ice cream, meat-based cuisines, pizza, and others)]. Cafes and bars provide stylish social spaces to hang out, whereas cloud kitchens meet expanding delivery demand with low expense. Full service restaurants offer elegant dining experiences, frequently presenting worldwide cuisines. Quick-service restaurants provide convenience-focused services, catering to fast-paced lives and city residents looking for quick and inexpensive meals.

- Based on the outlet, the market has been categorized into chained outlets and independent outlets. Chained outlets are common in metropolitan areas, providing consumers with convenience and consistency. Independent restaurants provide a distinct character, delighting diners with various cuisines and customized touches that create memorable eating experiences.

- Based on the location, the market has been divided into leisure, lodging, retail, standalone, and travel. Leisure places, such as malls and theme parks, provide informal and quick dining alternatives. Lodging establishments focus on fine meals for tourists. Moreover, retail areas include cafes and quick-service restaurants. Standalone outlets serve local communities, while transit hubs such as airports offer convenient on-the-go meals.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 16.58 Billion |

| Market Forecast in 2033 | USD 50.21 Billion |

| Market Growth Rate 2025-2033 | 12.20% |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Food Service Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)