Transparent Ceramics Market Size, Share, Trends and Forecast by Type, Material, Application, and Region, 2025-2033

Transparent Ceramics Market Size and Share:

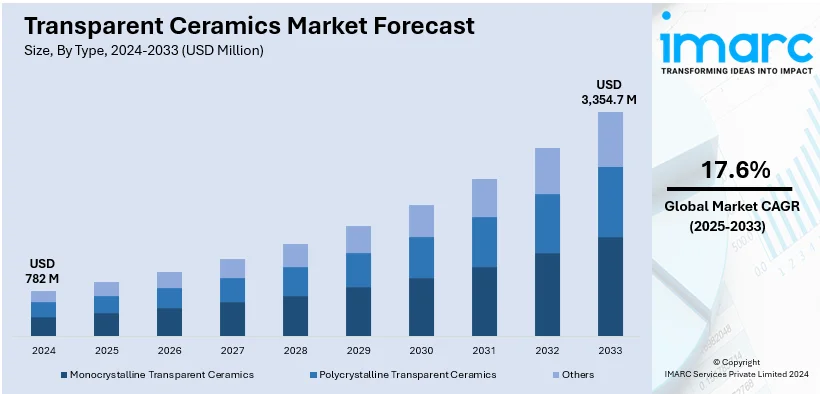

The global transparent ceramics market size was valued at USD 782 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,354.7 Million by 2033, exhibiting a CAGR of 17.6% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 56.7% in 2024. The rising demand in aerospace, defense, and optoelectronics, increasing use in construction, and advancements in materials offering superior durability and performance across a range of high-tech applications are bolstering the market growth in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 782 Million |

| Market Forecast in 2033 | USD 3,354.7 Million |

| Market Growth Rate (2025-2033) | 17.6% |

Demand from several high-performance applications for advanced materials in optics, defense, aerospace, and healthcare are the key factors impelling the global transparent ceramics market. The superior mechanical strength, thermal stability, and optical clarity of transparent ceramics make it ideal for its usage in laser systems, night vision devices, and transparent armor. Rising investment in the defense and aerospace sectors with material science advancements is the reason that the market expansion is expected to continue unabated. The increased application of transparent ceramics in the electronics and energy sectors for optical fibers and high-temperature insulators is also increasing demand. The miniaturization trend in electronics and medical devices supports the adoption of transparent ceramics, which further enhances their role in precision and high-durability components.

To get more information on this market, Request Sample

The United States is emerging as a leading market, holding a total of 84.50% share. The transparent ceramics market in the USA is growing rapidly because of the upsurge in its application, such as in optics, aerospace, and defense sectors. The key drivers include growth in demand for high-performance materials in laser systems, infrared windows, and sensors that require superior transparency and longevity. For instance, the U.S. Army has deployed 20-kilowatt Palletized High Energy Laser (P-HEL) systems overseas to combat enemy drones. The market is furthered by advancements in manufacturing technology that enable cost-effective and high-quality production of these transparent ceramics. In particular, the defense sector is quite important, which includes applications such as bulletproof glass and night vision systems. Increased U.S. government spending on defense and investments in emerging technologies are further driving market expansion.

Transparent Ceramics Market Trends:

Aerospace and Defense Industry Applications

Transparent ceramics are being increasingly used in the aerospace and defense industries for applications that demand durability, heat resistance, and stiffness. Their use in helicopter windows and optical domes illustrates their capability to withstand extreme conditions. Transparent ceramics are also crucial in the production of high-performance transparent armor that provides ballistic protection superior to laminated glass. This increasing demand for advanced protection solutions is fuelled by the increasing need for enhanced protection measures in military and civilian sectors. For example, defense infrastructure in most countries is receiving significant investment, which in turn increases adoption of transparent ceramics. All these factors make aerospace and defense a leading market growth influencer.

Integration into the Construction Industry

The construction industry has emerged as a significant consumer of transparent ceramics, using them for innovative applications such as tiles, bricks, and pipes. With the global buildings construction market size reaching $6.8 trillion in 2024, the demand for durable, heat-resistant, and lightweight materials is on the rise. Transparent ceramics are increasingly viewed as an effective substitute for conventional materials like glass, metal, and plastics, providing enhanced durability and aesthetics. Incorporation into construction projects also helps in enhancing structural strength while supporting energy efficiency measures. As urbanization and infrastructure growth are gaining pace, especially in the emerging economies, the use of transparent ceramics is expected to grow further in the construction sector.

Optoelectronics and Sensor Technologies

The application of transparent ceramics is quite vital in the optoelectronics sector as well for manufacturing devices of high precision such as optical switches, laser systems, lenses, and infrared night vision devices. The global optical switches market, which reached $7.2 billion in 2023, underscores the significance of these materials in advancing technology. Transparent ceramics are also widely used in infrared (IR) radiation, humidity, and temperature sensors, which are increasingly in demand across industrial, healthcare, and consumer applications. Furthermore, innovations in ceramics, including improved magneto-optic properties and IR lasing capabilities, are propelling their adoption in cutting-edge technologies. These trends are in line with global concerns for smart technologies and precision instrumentation, which add fuel to the fire.

Transparent Ceramics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global transparent ceramics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, material, and application.

Analysis by Type:

- Monocrystalline Transparent Ceramics

- Polycrystalline Transparent Ceramics

- Others

In 2024, monocrystalline transparent ceramics will be the leading type, accounting for about 53.6% of the market share. This is due to their exceptional optical and mechanical properties, such as high transparency, thermal stability, and hardness, which position them for critical applications in aerospace, defense, and optoelectronics. These ceramics are used widely in the production of high-performance laser systems, advanced optical components, and durable transparent armor. Their ability to perform under extreme conditions while providing precise optical clarity enhances their adoption in cutting-edge technologies. Additionally, continuous production technique improvement has enhanced cost-effectiveness, thereby fueling their market growth and reinforcing their status as the largest component within the transparent ceramics market.

Analysis by Material:

- Sapphire

- Yttrium Aluminum Garnet (YAG)

- Spinel

- Aluminum Oxynitride

- Others

In 2024, sapphire accounts for around 48.8% of the market share in the transparent ceramics market. It is used for its superior mechanical strength, thermal resistance, and optical clarity, making it a staple in high-performance applications. The fact that sapphire is used so widely in the manufacture of infrared windows, optical components, and durable watch crystals testifies to its versatility. It is also a favored material in the defense and aerospace industries for its use in transparent armor and optical domes, where longevity under intense conditions is the priority. It has also become a product demanded in consumer electronics in such applications as smartphone screens and camera lenses. The rising appeal of sapphire as a tougher substitute for traditional materials explains the market lead of transparent ceramics based on sapphire.

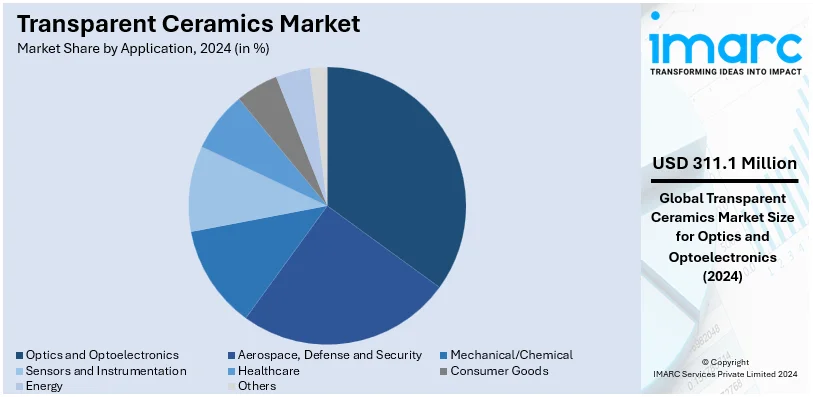

Analysis by Application:

- Optics and Optoelectronics

- Aerospace, Defense and Security

- Mechanical/Chemical

- Sensors and Instrumentation

- Healthcare

- Consumer Goods

- Energy

- Others

In 2024, the optics and optoelectronics segment dominate the transparent ceramics market with a market share of approximately 39.8%. The main reasons for this include the rising demand for sophisticated optical components, such as lenses, laser systems, and infrared windows, which depend on the superior transparency, thermal stability, and strength of transparent ceramics. With the rapid development of the optoelectronics industry and its applications in telecommunications, health care, and defense, this growth accelerates further. Transparent ceramics also find their applications in night vision systems, optical sensors, and high-power laser systems, catering to precision-driven industries. Technological advancement and the growth of smart devices and industrial automation contribute to the substantial share of the segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific is expected to have the largest share in the market for transparent ceramics in 2024, accounting for more than 56.7% of the global market share. That is because of rapid industrialization, increased investment in advanced manufacturing, and the growing demand for high-performance materials across diverse industries such as electronics, aerospace, and defense. Asia Pacific countries like China, Japan, and South Korea are leading, especially because of their strong industrial bases and technological advancements. The region also enjoys the growth of the construction and optoelectronics industries, where transparent ceramics are increasingly used for durability and precision. Furthermore, government initiatives to develop infrastructure and modernize defense in the Asia Pacific further support market growth, which reinforces the region's substantial contribution to the global transparent ceramics industry.

Key Regional Takeaways:

North America Transparent Ceramics Market Analysis

The transparent ceramics market in North America is driven by several factors. A key driver is the growing need for high-tech applications that involve advanced materials, which include aerospace, defense, and optoelectronics. Transparent ceramics are used in military optics, infrared domes, and laser technologies, all of which benefit from the region's growing defense budgets. In 2023, North America's military expenditure exceeded $940 billion, with the United States accounting for approximately $916 billion of this total. Another market growth factor is the ever-growing need for innovative materials in optical technologies, including advanced displays, lenses, and optical fibers. Sapphire-based transparent ceramics have many potential applications in fields such as electronics and energy because of their durability and optical properties.

United States Transparent Ceramics Market Analysis

The United States is experiencing significant growth in the transparent ceramics market, driven by robust demand from key sectors such as aerospace, defense, electronics, and healthcare. According to the Aerospace Industries Association (AIA), the aerospace and defense (A&D) industry generated USD 425 Billion in economic value in 2023, accounting for 1.6% of the U.S. nominal GDP. This substantial contribution underscores the critical role of advanced materials like transparent ceramics in aerospace applications, where they are used for cockpit windows, observation domes, and infrared windows due to their optical clarity, heat resistance, and durability. Transparent ceramics are also increasingly in demand within the defense sector, particularly for ballistic protection and optical components in military equipment. The electronics and healthcare industries further drive market growth, as transparent ceramics are used in displays, medical imaging, and diagnostic tools. Additionally, government investment in R&D is fostering innovation and supporting the development of new transparent ceramic applications. With increasing demand for energy-efficient technologies, such as advanced lighting and laser systems, the U.S. transparent ceramics market is poised for continued growth, supported by its established manufacturing base and skilled workforce.

Europe Transparent Ceramics Market Analysis

Europe is a key player in the transparent ceramics market, with demand primarily driven by advancements in aerospace, defense, and electronics industries. Transparent ceramics are widely used in aerospace for applications such as cockpit windows, observation domes, and infrared windows, owing to their high strength, optical clarity, and resistance to heat and radiation. The defense sector in Europe also increasingly adopts transparent ceramics for military vehicles and optical components, offering enhanced protection and visibility. The growing automotive sector, particularly in Germany, contributes to market growth, as transparent ceramics are utilized in advanced lighting systems and head-up displays. In addition, Europe’s strong focus on environmental sustainability is propelling the demand for energy-efficient solutions, such as transparent ceramics in solar panels and LED lighting. The European LED lighting market has reached USD 24.7 Billion in 2024, underscoring the region's commitment to energy-efficient technologies. Furthermore, significant investments in research and development across countries like France, Germany, and the UK are driving innovation in transparent ceramics, further supporting market expansion. The region's strong manufacturing capabilities and policies promoting green energy are expected to sustain market growth in the coming years.

Asia Pacific Transparent Ceramics Market Analysis

The Asia-Pacific (APAC) region is witnessing rapid growth in the transparent ceramics market, driven by strong demand across sectors such as automotive, defense, and electronics. The increasing adoption of transparent ceramics in automotive applications, including headlights and sensors, is boosting market expansion. In the defense sector, transparent ceramics are used for ballistic protection and optical components due to their durability and superior performance. APAC is also a major hub for electronics manufacturing, with India’s power electronics market reaching a size of USD 2.57 Billion in 2023, further fueling the demand for transparent ceramics in displays, touch panels, and optical lenses. The rapid development of smart cities and infrastructure projects in countries like China and India is driving the need for energy-efficient and durable materials, including transparent ceramics. Additionally, the growing interest in renewable energy technologies in APAC is contributing to market growth, with transparent ceramics playing a key role in solar panel and lighting applications.

Latin America Transparent Ceramics Market Analysis

In Latin America, the transparent ceramics market is expanding, driven by demand in the automotive, defense, and energy sectors. Brazil, for instance, is incorporating transparent ceramics into automotive applications like headlights and sensors, while the defense sector utilizes them for ballistic protection. The region is also increasingly focusing on renewable energy, with the IEA reporting that renewables account for 60% of electricity generation. Fossil fuels, which account for around two-thirds of the region’s energy mix, are significantly lower than the global average of 80%, as per the IEA, further promoting the adoption of transparent ceramics in energy-efficient solutions.

Middle East and Africa Transparent Ceramics Market Analysis

In the Middle East and Africa, the transparent ceramics market is driven by the region’s expanding aerospace, defense, and energy industries. Transparent ceramics are increasingly used in defense applications, including ballistic windows and optical devices, due to their superior strength and durability. Additionally, the region’s growing focus on renewable energy is boosting demand for transparent ceramics, particularly in solar panels and energy-efficient lighting. According to Rystad Energy, by 2030, around 30% of the region’s installed energy capacity is expected to come from renewable sources, with the potential to rise to 75% by 2050, further supporting the growth of transparent ceramics in the energy sector.

Competitive Landscape:

The global transparent ceramics market is highly competitive, with several key players leading innovation and market share. Prominent companies specialize in producing high-performance transparent ceramics used in the aerospace, defense, and optoelectronics sectors. These companies leverage their strong research and development (R&D) capabilities to enhance product quality, expand application areas, and meet the growing demand for durable and efficient transparent ceramics in various industries. Moreover, market players are focusing on strategic partnerships, acquisitions, and technological advancements to improve production efficiency and reduce costs. With rising demand from industries like electronics, telecommunications, and defense, competition is expected to intensify as companies strive to develop advanced, cost-effective materials. Furthermore, the increasing use of sapphire-based transparent ceramics is creating opportunities for firms to extend their product portfolios and capture a market share.

The report provides a comprehensive analysis of the competitive landscape in the transparent ceramics market with detailed profiles of all major companies, including:

- American Elements

- Ceranova

- CoorsTek Inc.

- Fraunhofer IKTS

- Konoshima Chemical Co., Ltd.

- KYOCERA Corporation

- Nippon Electric Glass Co., Ltd.

- Schott AG

- Surmet Corp.

Latest News and Developments:

- August 2024: The Fraunhofer IKTS opened a new R&D center for transparent ceramics in Hermsdorf, with Thuringia's Minister of Economics and Science, Wolfgang Tiefensee, in attendance. Transparent ceramics, offering glass-like transparency with superior heat resistance and durability, are expected to see broader use due to their cost-effectiveness and enhanced properties. The institute will collaborate with industry partners to develop innovative applications for these materials.

- September 2022: Surmet Corp. has opened an upgraded North Buffalo Facility, following a USD 14.5 Billion investment. The expansion includes renovations, specialized space, and new transparent ceramics manufacturing equipment, supported by funding from the U.S. Air Force. This facility will feature the largest production furnaces and custom-built equipment of its kind in the U.S., creating new engineering and manufacturing job opportunities.

- June 2022: Polycrystal, a German company, won the 2022 Exhibitors’ Grand Prix at EPHJ for its innovation in transparent ceramics, 20 years after the first German company registered at the event in 2002. The recognition reflects growing professional acknowledgment of their work in transparent ceramics, which had been previously presented the year before.

- April 2021: the Fraunhofer Institute for Ceramic Technologies and Systems IKTS has acquired the transparent ceramics division of CeramTec-ETEC, known for its PERLUCOR® brand. This acquisition strengthens the institute's expertise in transparent ceramics and provides the technical infrastructure needed to establish a new R&D center for these materials at its Hermsdorf site.

Transparent Ceramics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Monocrystalline Transparent Ceramics, Polycrystalline Transparent Ceramics, Others |

| Materials Covered | Sapphire, Yttrium Aluminum Garnet (YAG), Spinel, Aluminum Oxynitride, Others |

| Applications Covered | Optics and Optoelectronics, Aerospace, Defense and Security, Mechanical/Chemical, Sensors and Instrumentation, Healthcare, Consumer Goods, Energy, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Elements, Ceranova, CoorsTek Inc., Fraunhofer IKTS, Konoshima Chemical Co., Ltd., KYOCERA Corporation, Nippon Electric Glass Co., Ltd., Schott AG, Surmet Corp., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the transparent ceramics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global transparent ceramics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the transparent ceramics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Transparent ceramics are advanced materials with high optical clarity, thermal stability, and mechanical strength, making them suitable for applications like laser systems, infrared windows, and transparent armor in industries such as aerospace, defense, and optoelectronics.

The transparent ceramics market was valued at USD 782 Million in 2024.

IMARC estimates the global transparent ceramics market to exhibit a CAGR of 17.6% during 2025-2033.

Key drivers include rising demand in aerospace and defense, increased adoption in optics and electronics, advancements in material durability, and growing applications in renewable energy and healthcare sectors.

In 2024, monocrystalline transparent ceramics represented the largest segment by type, driven by their exceptional optical and mechanical properties.

Sapphire leads the market by material owing to its superior strength, thermal resistance, and optical clarity.

The optics and optoelectronics are the leading segment by application, driven by demand for high-performance optical components like lenses and infrared systems.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global transparent ceramics market include American Elements, Ceranova, CoorsTek Inc., Fraunhofer IKTS, Konoshima Chemical Co., Ltd., KYOCERA Corporation, Nippon Electric Glass Co., Ltd., Schott AG, Surmet Corp., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)