Global Thermal Spray Coating Market Expected to Reach USD 16.8 Billion by 2033 - IMARC Group

Global Thermal Spray Coating Market Statistics, Outlook and Regional Analysis 2025-2033

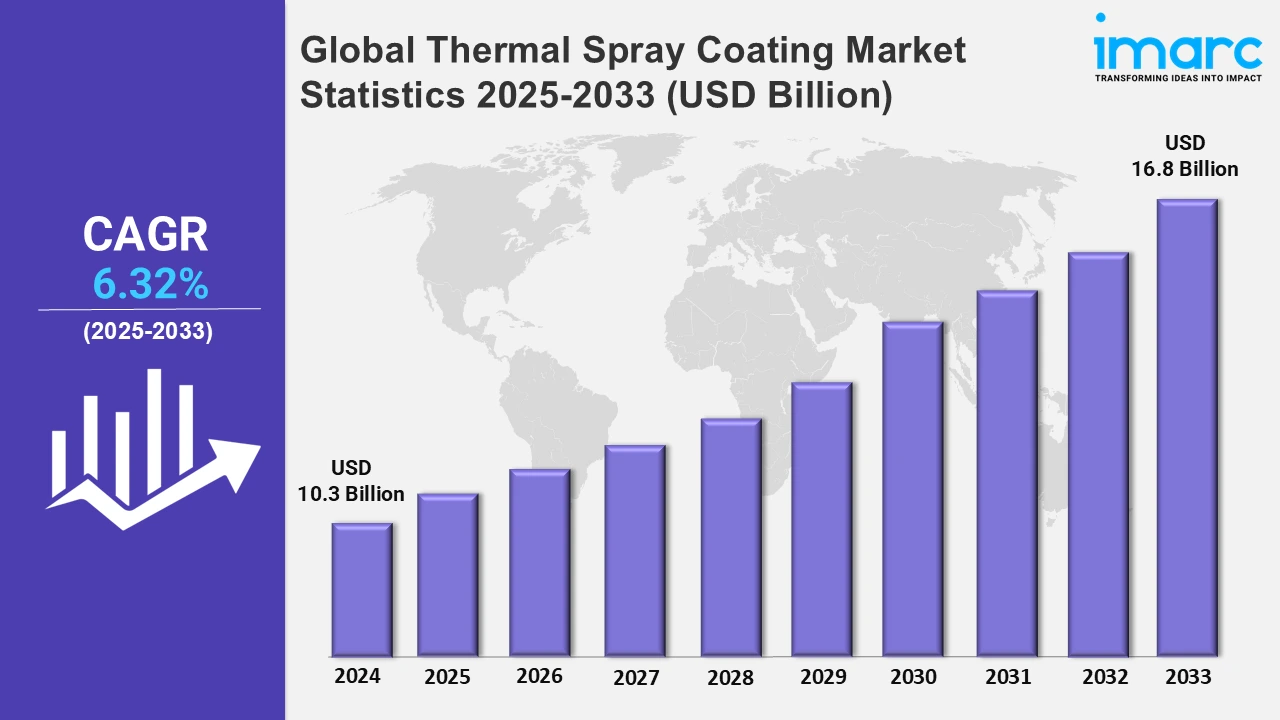

The global thermal spray coating market size was valued at USD 10.3 Billion in 2024, and it is expected to reach USD 16.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.32% from 2025 to 2033.

To get more information on this market, Request Sample

The expansion of global air traffic and increased defense budgets are significantly propelling the growth of the thermal spray coating market. For instance, according to Statista, in 2023, global air traffic elevated by more than 36% over the previous year, when passenger demand increased by nearly 64.3%. This figure is expected to rise by about 12% in 2024. In the aerospace sector, thermal spray coatings are essential for enhancing the durability and performance of critical components, such as turbine blades and engine parts. The surge in air travel necessitates the production of new aircraft and the maintenance of existing fleets, thereby boosting the demand for these coatings. Additionally, heightened defense spending leads to the procurement of advanced military aircraft and equipment, further driving the need for thermal spray coatings to ensure reliability and longevity under demanding conditions. This trend underscores the vital role of thermal spray coatings in meeting the rigorous requirements of both commercial and military aviation.

Moreover, the increasing sales of automotive vehicles are significantly driving the growth of the thermal spray coating market. For instance, according to an article published by the Society of Indian Automobile Manufacturers, total passenger vehicle sales in India rose from 30,69,523 to 38,90,114 units. In FY-2022-23, sales of passenger cars climbed from 14,67,039 to 17,47,376, utility vehicles from 14,89,219 to 20,03,718, and vans from 1,13,265 to 1,39,020 units, compared to the previous year. Overall commercial vehicle sales rose from 7,16,566 to 9,62,468 units. In FY-2022-23, medium and heavy commercial vehicle sales climbed from 2,40,577 to 3,59,003 units, while light commercial vehicle sales increased from 4,75,989 to 6,03,465 units compared to the previous year. In automotive vehicles, thermal spray coatings are extensively applied to enhance the durability and performance of various components, including engine parts, transmission systems, and braking mechanisms. These coatings provide superior wear resistance, corrosion protection, and thermal insulation, thereby extending the lifespan of automotive parts and improving overall vehicle efficiency. The rising demand for vehicles, particularly in emerging markets, coupled with advancements in automotive technology, is propelling the adoption of thermal spray coatings. This trend underscores the critical role of these coatings in meeting the industry's requirements for high-performance and long-lasting automotive components.

Global Thermal Spray Coating Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for thermal spray coating.

North America Thermal Spray Coating Market Trends:

The aerospace sector serves as a major growth driver due to its reliance on thermal spray coatings for protecting engine components, turbine blades, and landing gear from extreme conditions like high temperatures and corrosion. According to the Federal Aviation Administration (FAA), the total commercial aircraft fleet in the U.S. is projected to reach 8,270 by 2037, fueled by increasing air cargo demands and the replacement of aging fleets, with the mainliner carrier fleet expected to grow by 54 aircraft per year. This anticipated expansion underlines the rising need for thermal spray coatings to enhance the durability and performance of critical aerospace components, which is exhibiting a clear dominance in the market.

Europe Thermal Spray Coating Market Trends:

Thermal spray coatings across the region are extensively used in the aerospace industry to protect components like turbine blades and landing gear from wear, corrosion, and high temperatures. In the automotive sector, these coatings enhance the durability and performance of engine parts. Germany, with its robust automotive and aerospace industries, exemplifies this trend, hosting numerous manufacturers and suppliers that utilize thermal spray coatings to improve component longevity and efficiency.

Asia Pacific Thermal Spray Coating Market Trends:

Thermal spray coatings are extensively used to protect and repair aircraft components, enhancing their thermal resistance and longevity. For instance, in China, the demand for new commercial aircraft is projected to reach around 7,600 units, over the next two decades, significantly boosting the need for thermal spray coatings in the aerospace industry.

Latin America Thermal Spray Coating Market Trends:

Thermal spray coatings are extensively used to protect equipment, such as pipelines, valves, and pumps, from corrosion and wear. In Brazil, significant investments in offshore oil exploration and production have increased the demand for protective coatings to enhance equipment durability and performance.

Middle East and Africa Thermal Spray Coating Market Trends:

Thermal spray coatings are extensively used in the aerospace sector to protect components, including turbine blades and actuation systems, from extreme temperatures and pressures. For instance, Saudi Arabia plans to invest approximately US$2.1 Billion to boost its space program by 2030, which is expected to increase the demand for thermal spray coatings in aerospace applications.

Top Companies Leading in the Thermal Spray Coating Industry

Some of the leading thermal spray coating market companies include Air Products and Chemicals Inc., American Roller Company LLC, Durum Verschleißschutz GmbH, Lincotek Rubbiano S.p.A, Metallizing Equipment Co. Pvt. Ltd., Montreal Carbide Co. Ltd., Powder Alloy Corporation, Praxair Surface Technologies Inc. (Linde plc), Progressive Surface Inc., and Wall Colmonoy Corporation, among many others. For instance, in July 2024, Wall Colmonoy, a manufacturing corporation based in the United States, acquired Indurate Alloys, a Canadian developer of hard-facing products. The acquisition is expected to dramatically expand Wall Colmonoy's product range and improve its market positioning. Wall Colmonoy intends to enhance and grow its current range by leveraging Indurate Alloys' vast client network, high-quality thermal spray products, and well-established vendor relationships.

Global Thermal Spray Coating Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into metals, ceramics, intermetallics, polymers, carbides, abradables, and others, wherein ceramics represented the largest segment. Ceramic coatings exhibit an ability to withstand high temperatures and harsh environments, which makes them a preferred option for applications, such as gas turbines, where components must be able to operate in extremely hot and corrosive environments.

- Based on the technology, the market is categorized into cold, flame, plasma, high-velocity oxy-fuel (HVOF), electric arc and others, amongst which plasma accounted for the largest market share. Plasma technology offers numerous advantages over other types of thermal spray coating processes, including the ability to produce coatings with very high quality and uniformity, as well as the ability to spray a wide range of materials, further driving the segment’s growth.

- On the basis of the application, the market has been divided into aerospace, industrial gas turbine, automotive, medical, printing, oil and gas, steel, pulp and paper, and others. Among these, aerospace accounted for the largest market share. Thermal spray coatings are widely used to protect airframe components from corrosion and wear, further propelling the segment growth.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 10.3 Billion |

| Market Forecast in 2033 | USD 16.8 Billion |

| Market Growth Rate 2025-2033 | 6.32% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Metals, Ceramics, Intermetallics, Polymers, Carbides, Abradables, Others |

| Technologies Covered | Cold, Flame, Plasma, High-Velocity Oxy-Fuel (HVOF), Electric Arc, Others |

| Applications Covered | Aerospace, Industrial Gas Turbine, Automotive, Medical, Printing, Oil and Gas, Steel, Pulp and Paper, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Products and Chemicals Inc., American Roller Company LLC, Durum Verschleißschutz GmbH, Lincotek Rubbiano S.p.A, Metallizing Equipment Co. Pvt. Ltd., Montreal Carbide Co. Ltd., Powder Alloy Corporation, Praxair Surface Technologies Inc. (Linde plc), Progressive Surface Inc., Wall Colmonoy Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Thermal Spray Coating Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)