Global Telecom Power Systems Market Expected to Reach USD 10.8 Billion by 2033 - IMARC Group

Global Telecom Power Systems Market Statistics, Outlook and Regional Analysis 2025-2033

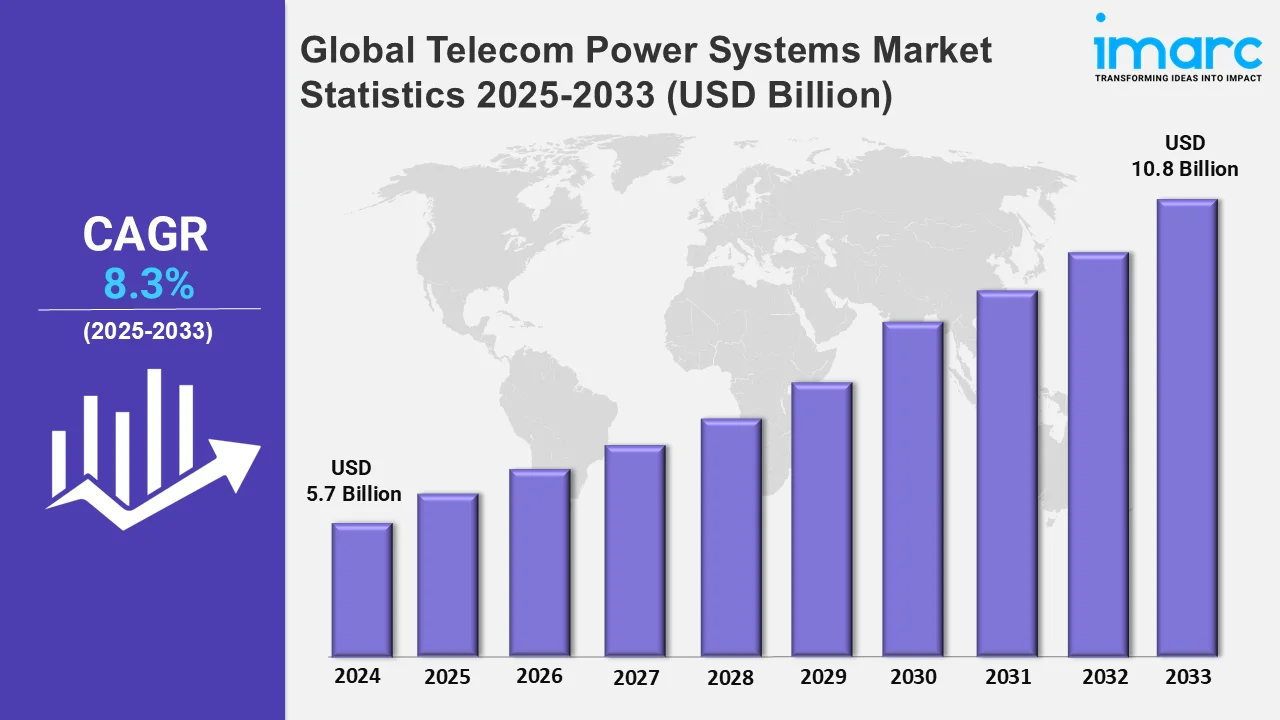

The global telecom power systems market size was valued at USD 5.7 Billion in 2024, and it is expected to reach USD 10.8 Billion by 2033, exhibiting a growth rate (CAGR) of 8.3% from 2025 to 2033.

To get more information on this market, Request Sample

The rapid rollout of fifth-generation (5G) networks is significantly bolstering the telecom power systems market. As 5G technology requires a dense network of base stations to ensure seamless coverage and high-speed connectivity, there is a heightened demand for reliable power systems to support these installations. Telecom power systems are critical in maintaining uninterrupted operations, as 5G infrastructure demands low-latency, high-efficiency energy solutions. Additionally, global 5G connections reached 1.76 billion in 2023, growing 66% with 700 million additions. North America saw 29% 5G penetration, 64% year-over-year (YOY) growth, and 77 million new connections. Also, the energy-intensive nature of 5G infrastructure necessitates advanced power solutions such as hybrid systems and renewable energy integration to meet sustainability goals. Telecom operators are heavily investing in modern power systems to ensure the scalability and efficiency of their networks, boosting market growth. Furthermore, governments and enterprises are providing financial incentives to accelerate 5G deployment, indirectly stimulating demand for telecom power systems. This trend reflects the growing importance of efficient power management in supporting next-generation connectivity technologies.

The key enabler in the telecom power systems market is the proliferation of edge computing. Edge computing decentralized data processing by bringing it closer to the end-user to reduce latency and enhance application performance. This has led to a significant increase in the deployment of edge data centers, each demanding robust and scalable power solutions to ensure continuous operation. This necessity for continuous power supply in these facilities has fueled innovation in battery storage, power conditioning systems, and renewable energy integration. In addition, the localized nature of edge computing has increased the demand for even smaller, highly energy-efficient power solutions tailored for distributed environments. Telecom operators have a big challenge to keep their networks fit with sophisticated power systems capable of addressing the demands of analytics and automation in industries such as healthcare, retail, and manufacturing, which are applying edge computing. This puts them at the forefront of telecom power systems in the enabling of the edge computing ecosystem.

Global Telecom Power Systems Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest market share in terms of advanced infrastructure, 5G deployment, and widespread edge computing adoption.

North America Telecom Power Systems Market Trends:

North America holds the largest share in the telecom power systems market due to its advanced telecommunications infrastructure and rapid adoption of 5G technology. The region is a leader in deploying 5G networks, necessitating efficient and reliable power solutions to support the energy-intensive infrastructure. Additionally, the rise of edge computing has spurred demand for scalable power systems in distributed data centers. North America's emphasis on integrating renewable energy into telecom operations further enhances its market position. Strong investments from telecom operators and supportive government initiatives aimed at modernizing infrastructure significantly contribute to the region's dominance in this market.

Asia-Pacific Telecom Power Systems Market Trends:

Asia Pacific is a rapidly growing market for telecom power systems, driven by widespread 5G adoption, urbanization, and expanding internet connectivity. Countries like China, India, and Japan are heavily investing in telecom infrastructure. Additionally, increasing energy demands and a shift toward renewable power solutions bolster market growth in this region.

Europe Telecom Power Systems Market Trends:

Europe's telecom power systems market is driven by 5G rollouts, strict energy efficiency regulations, and sustainable power initiatives. The region focuses on integrating renewable energy sources and advanced technologies in telecom infrastructure. Key countries like Germany, France, and the UK lead investments, enhancing network reliability and reducing carbon footprints.

Latin America Telecom Power Systems Market Trends:

Latin America's telecom power systems market growth is fueled by increasing smartphone adoption, improving broadband infrastructure, and expanding 4G/5G networks. Countries like Brazil and Mexico are witnessing significant investments in telecom upgrades. The region's focus on cost-effective, renewable energy-based power systems addresses challenges in maintaining reliable connectivity in diverse terrains.

Middle East and Africa Telecom Power Systems Market Trends:

MEA's telecom power systems market is expanding due to rising internet penetration, growing mobile user bases, and infrastructure development in rural areas. Governments and telecom operators are investing in hybrid power solutions to overcome energy challenges, supporting sustainable connectivity in underserved regions across Africa and the Middle East.

Top Companies Leading in the Telecom Power Systems Industry

Some of the leading telecom power systems market companies include Delta Electronics Inc., Eaton Corporation plc, ABB Ltd., Huawei Technologies Co. Ltd., Schneider Electric SE, Vertiv Group Corporation, Cummins Inc., Myers Power Products Inc., Ascot Industrial S.r.l., Unipower., among many others.

-

In May 2024, Delta Electronics Inc., a global leader in power management and a provider of IoT-based smart green solutions, demonstrated its unique capabilities to enhance energy efficiency, cooling, and ICT infrastructure solutions for cloud to edge AI data centres at COMPUTEX TAIPEI 2024.

Global Telecom Power Systems Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into DC and AC, wherein DC represent the leading segment due to its efficiency in supporting telecommunications equipment and base stations. DC systems are preferred for their reliability, compatibility with battery backup solutions, and ability to handle varying loads, making them essential for uninterrupted network operations in critical telecom infrastructure.

- Based on the component, the market is classified into rectifiers, converters, controllers, heat management systems, generators, and others, amongst which generators dominate the market due to their critical role in ensuring uninterrupted power supply during outages. They are vital to network uptime, especially in the most remote and off-grid locations. Their reliability and support for energy-intensive telecom operations make them essential to the industry's power infrastructure.

- On the basis of the power source, the market has been divided into diesel-battery, diesel-solar, diesel-wind, and multiple sources. Among these, diesel-battery accounts for the majority of the market share due to its reliability and cost-effectiveness. It ensures a consistent power supply even during an outage as it uses primary energy through diesel generators and backup energy through batteries. Its extensive use in remote and off-grid locations further reinforces its dominance in the market.

- Based on the grid type, the market is segregated into on grid, off grid and bad grid. Among these, bad grid accounts for the majority of the market share due to its prevalence in regions with unreliable electricity. Telecom operators in such areas rely on hybrid power solutions, combining generators and batteries, to ensure continuous network operations. This segment's growth is driven by increasing connectivity demands in underserved regions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.7 Billion |

| Market Forecast in 2033 | USD 10.8 Billion |

| Market Growth Rate 2025-2033 | 8.3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Telecom Power Systems Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | DC, AC |

| Components Covered | Rectifiers, Converters, Controllers, Heat Management Systems, Generators, Others |

| Power Sources Covered | Diesel-Battery, Diesel-Solar, Diesel-Wind, Multiple Sources |

| Grid Types Covered | On Grid, Off Grid, Bad Grid |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Delta Electronics Inc., Eaton Corporation plc, ABB Ltd., Huawei Technologies Co. Ltd., Schneider Electric SE, Vertiv Group Corporation, Cummins Inc., Myers Power Products Inc., Ascot Industrial S.r.l., Unipower, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Telecom Power Systems Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)