Global Synthetic Rubber Market Expected to Reach USD 44.8 Billion by 2033 - IMARC Group

Global Synthetic Market Statistics, Outlook and Regional Analysis 2025-2033

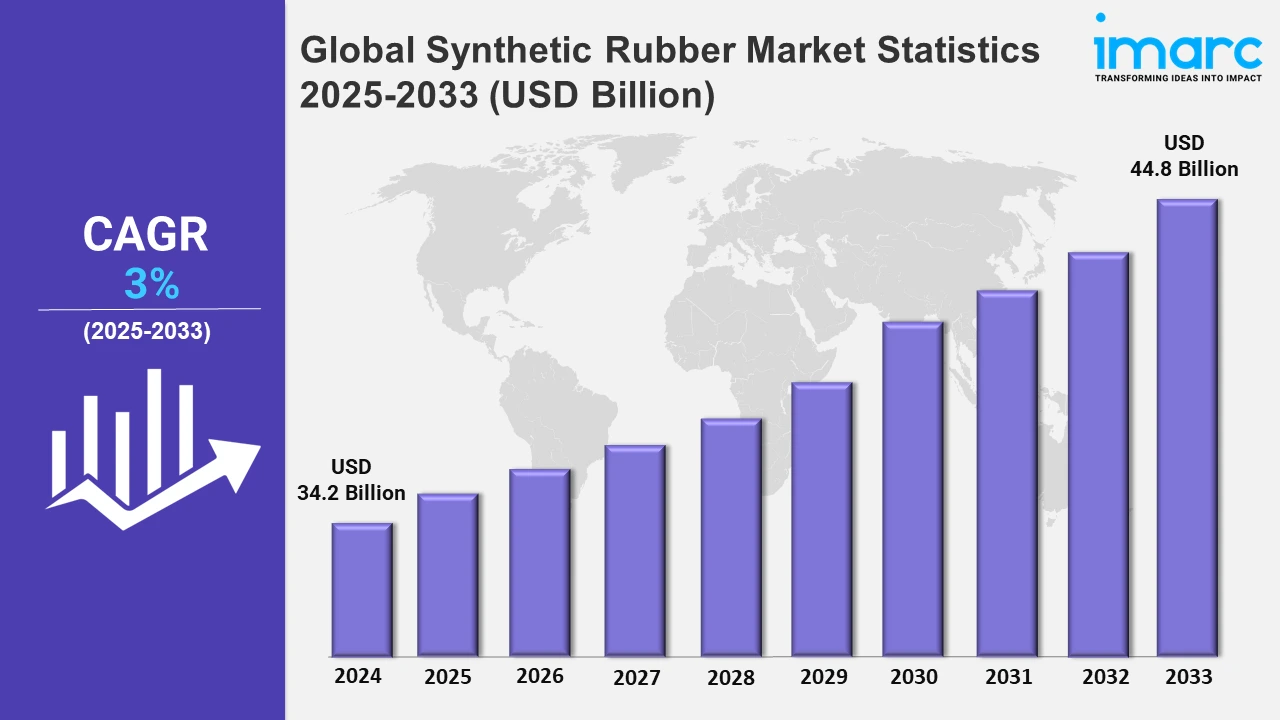

The global synthetic rubber market size was valued at USD 34.2 Billion in 2024, and it is expected to reach USD 44.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3% from 2025 to 2033.

To get more information on this market, Request Sample

The global synthetic rubber market is experiencing significant growth, driven by the increasing demand for high-performance materials from the automotive industry to improve safety, fuel efficiency, and comfort. Synthetic rubber is widely used in the automotive industry, especially for tires, hoses, belts, and other components, which is impelling the market growth. Around 50% of car tires are made of styrene-butadiene rubber blended with natural rubber. Moreover, according to the National Bureau of Statistics of China, the Chinese tire industry made about 859.19 million tires in 2022. Consequently, this growing demand for tires is strengthening the market growth. In addition to this, the shift toward electric vehicles (EVs) is acting as another significant growth-inducing factor, as they require specialized rubber materials for enhanced performance and longevity. According to the International Energy Agency (IEA), the unit volume of global EV sales share is projected to grow from around 15% in 2023 to almost 40% in 2030 and over 50% in 2035. This rise in vehicle production has propelled the need for synthetic rubber across the industry due to its critical role in manufacturing tires and various automotive components that require durability and high-performance materials. Furthermore, the push for eco-friendly, energy-efficient tires and advancements in rubber formulations are boosting synthetic rubber consumption, while the growing emphasis on fuel efficiency and carbon reduction is aiding in market expansion.

Concurrent with this, ongoing technological advancements in synthetic rubber are significantly boosting the market demand. Continuous innovations in manufacturing processes and material formulations have led to improved performance characteristics such as enhanced wear resistance, greater durability, and better heat and oil resistance. Moreover, the development of eco-friendly, bio-based synthetic rubbers in response to growing environmental concerns is encouraging the use of more sustainable alternatives, thus propelling the demand for synthetic rubber. This shift also aligns with the increasing consumer and regulatory focus on reducing the environmental impact of materials, creating a positive outlook for market expansion. In line with this, economic incentives and government policies supporting research and development (R&D) in rubber technologies are strengthening the market expansion. Additionally, the widespread product adoption across the aerospace industry to produce aircraft tires is providing an impetus to the market growth. For instance, Yang Xiaoniu, Director of the Changchun Institute of Applied Chemistry at the Chinese Academy of Sciences, announced that aircraft tires made from bionic synthetic rubber have a service life of 35% longer than those made from natural rubber, particularly under extreme working conditions. Tires produced with this innovation have a positive effect on fuel consumption during highway-speed testing, which is further contributing to the increasing demand for synthetic rubber.

Global Synthetic Rubber Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization, significant growth in the automotive sector, and the presence of key manufacturing hubs in various countries.

North America Synthetic Rubber Market Trends:

The demand for synthetic rubber in North America is driven by the region's need for durable, high-performance materials across various industries. This demand is particularly evident in the automotive and manufacturing sectors, where synthetic rubber is crucial for components such as tires, seals, and gaskets, ensuring reliability and performance.

Asia-Pacific Synthetic Rubber Market Trends:

The demand for synthetic rubber in the Asia Pacific region is propelled by the rapid industrialization and booming automotive industry of the region, with China and India being major contributors due to their large-scale vehicle production and infrastructure development. Based on the data from the China Association of Automobile Manufacturers (CAAM) China’s car production surpassed 30.16 million units in 2023, with total car sales reaching more than 30.09 million units. Synthetic rubber enables efficient material utilization, aligning with the region’s focus on expanding infrastructure and manufacturing capabilities. Moreover, it addresses the growing need for durable and high-performance materials, enhancing local production capabilities and reducing reliance on imports.

Europe Synthetic Rubber Market Trends:

The demand for synthetic rubber in Europe is largely driven by stringent environmental regulations and the automotive industry's push for sustainable, high-performance materials. The growing adoption of green technologies and ongoing investments in R&D are advancing the use of eco-friendly synthetic rubber alternatives, ensuring their wider application across various industries.

Latin America Synthetic Rubber Market Trends:

In Latin America, the demand for synthetic rubber is driven by the automotive and construction sectors as vehicle production and infrastructure development continue to grow, offering durable and cost-effective materials. Additionally, increasing consumer demand for modern transportation solutions and reliable construction materials is propelling the market forward, ensuring steady growth across various applications.

Middle East and Africa Synthetic Rubber Market Trends:

The market in the Middle East and Africa is driven by rapid urbanization and expanding infrastructure needs. Synthetic rubber provides a means to meet the growing demand for durable, high-performance materials, supporting the region's development. Additionally, the rising automotive manufacturing base, particularly in countries like South Africa, and a focus on industrial diversification are driving the consumption of synthetic rubber across various applications.

Top Companies Leading in the Synthetic Rubber Industry

Some of the leading synthetic rubber market companies include Apcotex Industries Limited, Asahi Kasei Corporation, China Petrochemical Corporation, Denka Company Limited, Exxon Mobil Corporation, JSR Corporation, Kumho Petrochemical Co. Ltd., Lanxess AG, LG Chem Ltd., PJSC Nizhnekamskneftekhim, Reliance Industries Limited, Saudi Basic Industries Corporation (Saudi Arabian Oil Co.), The Goodyear Tire & Rubber Company, TSRC Corporation, and Zeon Corporation, among many others.

- In July 2024, Zeon Corporation expanded its technical support capabilities for synthetic rubber products in India, focusing on providing timely service to meet growing market demands. The company will dispatch full-time local staff with technical expertise in synthetic rubber at Zeon India Private Limited (ZAIN), ensuring timely advice on compound design, vulcanization conditions, and compound properties for synthetic rubbers in high demand from customers in India.

- In October 2023, Goodyear Tire & Rubber Company and Visolis, a sustainable technology company, announced a collaboration project to produce isoprene through the upcycling of biobased materials. Isoprene, a hydrocarbon generated as a by-product from refining crude oil, is a synthetic rubber used as a raw material in manufacturing tires and other items.

Global Synthetic Rubber Market Segmentation Coverage

- On the basis of the type, the market has been categorized into styrene butadiene rubber, ethylene propylene diene rubber, polyisoprene, polybutadiene rubber, isobutylene isoprene rubber, and others, wherein styrene butadiene rubber (SBR) represent the leading segment. The dominance of SBR in the synthetic rubber market is due to its excellent balance of performance, cost-effectiveness, and versatility. It provides superior durability, abrasion resistance, and high-performance qualities, making it an ideal choice for use in tires, automotive parts, and industrial applications.

- Based on the form, the market is bifurcated into liquid rubber and solid synthetic rubber, amongst which solid synthetic rubber dominates the market due to its versatility in manufacturing durable, high-performance components. Its ease of processing and ability to provide strength, longevity, and reliability make it ideal for a wide range of applications, including tires, seals, and gaskets, ensuring performance in demanding industrial and automotive environments.

- On the basis of the application, the market has been divided into tire and tire component, non-tire automobile application, footwear, industrial goods, and others. Among these, the tire and tire component accounts for the majority of synthetic rubber demand as it requires materials with excellent wear resistance, durability, and heat stability. These properties are essential for ensuring tire longevity and performance. The growing automotive sector and innovations in tire technology further drive the demand for synthetic rubber in tire manufacturing.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 34.2 Billion |

| Market Forecast in 2033 | USD 44.8 Billion |

| Market Growth Rate 2025-2033 | 3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Styrene Butadiene Rubber, Ethylene Propylene Diene Rubber, Polyisoprene, Polybutadiene Rubber, Isobutylene Isoprene Rubber, Others |

| Forms Covered | Liquid Synthetic Rubber, Solid Synthetic Rubber |

| Applications Covered | Tire and Tire Component, Non-Tire Automobile Application, Footwear, Industrial Goods, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apcotex Industries Limited, Asahi Kasei Corporation, China Petrochemical Corporation, Denka Company Limited, Exxon Mobil Corporation, JSR Corporation, Kumho Petrochemical Co. Ltd., Lanxess AG, LG Chem Ltd., PJSC Nizhnekamskneftekhim, Reliance Industries Limited, Saudi Basic Industries Corporation (Saudi Arabian Oil Co.), The Goodyear Tire & Rubber Company, TSRC Corporation, Zeon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Synthetic Rubber Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)