Global Synthetic Leather Market Expected to Reach USD 55.7 Billion by 2033 - IMARC Group

Global Synthetic Leather Market Statistics, Outlook and Regional Analysis 2025-2033

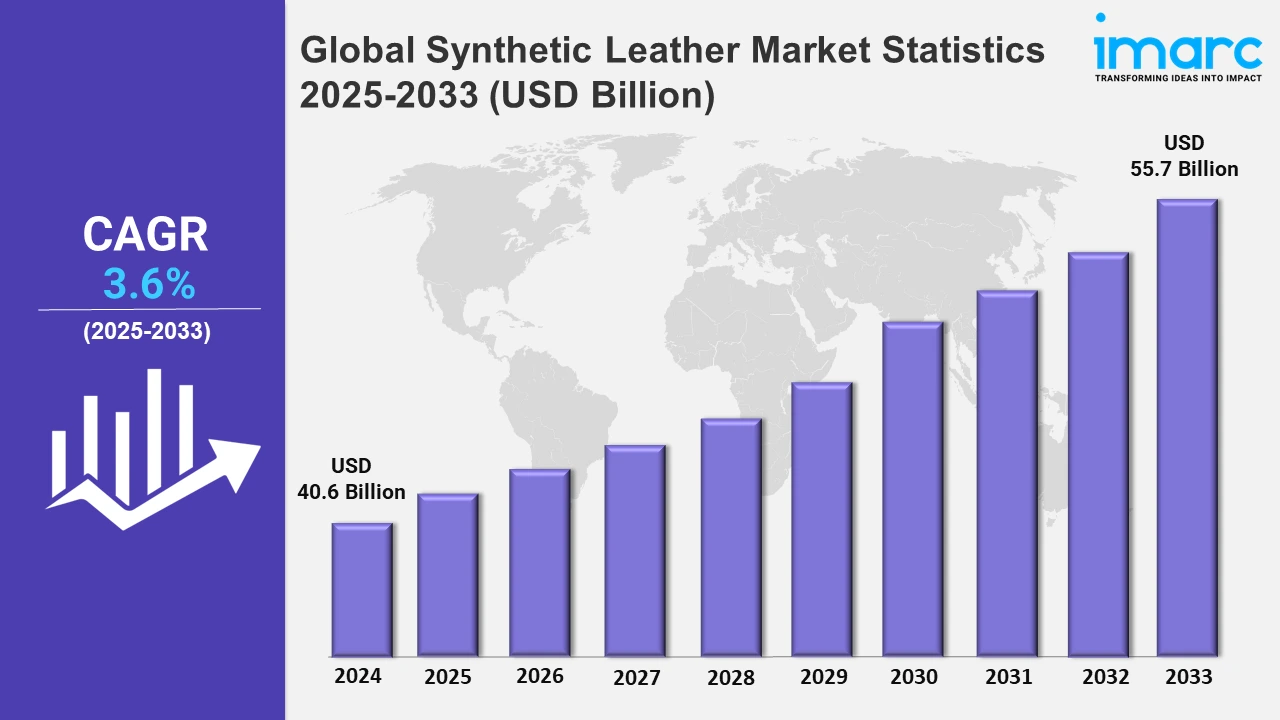

The global synthetic leather market size was valued at USD 40.6 Billion in 2024, and it is expected to reach USD 55.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.6% from 2025 to 2033.

To get more information on this market, Request Sample

The automobile industry is moving toward more sustainable and eco-friendly materials, with a growing demand for synthetic leather that is free of petroleum and does not contain carbon. Consumer demand for greener products is driving this transition, thereby leading manufacturers to develop novel automobile interior solutions. For example, in July 2022, Sage Automotive Interiors, a China-based synthetic leather supplier, announced the launch of innovative silicone synthetic leather for automotive applications. The company commenced manufacturing synthetic leather in Shanghai, China. The increasing consumer demand for sustainable products influenced the company to deliver silicone synthetic leather as an innovative, petroleum-free, and non-carbon-based solution for the latest automotive interiors.

Moreover, vegan synthetic leather is becoming increasingly popular among fashion accessories, such as bags, wallets, and shoes. Companies worldwide are responding by providing new and cruelty-free materials to fulfill the increased customer demand for environmentally friendly and ethical products. For instance, in April 2023, General Silicones Co., Ltd., a Taiwan-based silicone products manufacturer, announced the launch of vegan synthetic leather, namely Compo-SiL (SL series). It is designed for businesses that are manufacturers of bags, wallets, backpacks, and shoes and are seeking vegan leather supplies. Furthermore, as medical technology advances, the gene therapy industry grows significantly. With the growing frequency of genetic abnormalities and chronic illnesses, gene therapy is emerging as a viable treatment for previously untreatable problems. Additionally, large efforts are being made in R&D activities to increase the safety and efficacy of gene treatments. For example, Bluebird Bio received FDA clearance in 2023 for its gene therapy medication, Zynteglo, which treats beta-thalassemia, a severe hereditary blood condition. This milestone is a huge progress in gene therapy, providing patients with an option for lifelong blood transfusions. The approval of such medications demonstrates the rising acceptability and demand for gene therapies in the treatment of genetic illnesses, encouraging more innovation and investment in this field to address more complicated diseases.

Global Synthetic Leather Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest synthetic leather market share on account of the growing population and rising disposable income levels, which allow customers to spend on the fashion and automotive sectors.

North America Synthetic Leather Market Trends:

In North America, there is a growing trend for eco-friendly synthetic leather production, fueled by the rising customer demand for sustainable products. Plant-based materials have been launched by companies, such as Ultrafabrics, in the U.S., while labels, including Stella McCartney, are pioneering the use of eco-friendly leather substitutes in fashion. This tendency is fueled by strict environmental rules and a growing awareness of sustainability.

Europe Synthetic Leather Market Trends:

The market in Europe is focused on high-performance and long-lasting materials for automotive applications. Companies, such as BASF, are producing synthetic leathers that resemble real leather but are more durable and resistant to wear and tear. Leading automobile manufacturers, including BMW, are increasingly employing these materials for vehicle interiors, assisting Europe in maintaining its competitive advantage in the automotive industry.

Asia-Pacific Synthetic Leather Market Trends:

In the Asia-Pacific region, the industry is being driven by significant expansion in the fashion and footwear industries, thereby exhibiting a clear dominance in the market. China, as a significant participant, is experiencing an increase in demand for low-cost and attractive synthetic leather in consumer products. Companies, such as Mayur Uniquoters, are capitalizing on this growth by offering affordable, fashion-forward synthetic leather for shoes and garments, regulating both domestic and international demand.

Latin America Synthetic Leather Market Trends:

In Latin America, there is an explicit trend toward inexpensive and adaptable synthetic leathers for furniture and upholstery. Brazil and Mexico are large users of synthetic leather for home furnishings, as it is a low-cost and long-lasting alternative to real leather. Brands, such as San Fang Chemical, are addressing this need by manufacturing synthetic materials for the region's increasing middle class.

Middle East and Africa Synthetic Leather Market Trends:

The market in the Middle East and Africa is rising as demand for luxury synthetic leather items rises. In the UAE and Saudi Arabia, the demand for synthetic leather in luxury furniture and automotive interiors has increased. High-end firms, such as Teijin Limited, are creating eco-friendly and high-end synthetic leathers to meet the market's rising need for luxury mixed with sustainability.

Top Companies Leading in the Synthetic Leather Industry

Some of the leading synthetic leather market companies include Asahi Kasei Corporation, DuPont Tate & Lyle Bio Products Company LLC, FILWEL Co. Ltd. (Air Water Inc.), H.R. Polycoats Pvt. Ltd., Kuraray Co. Ltd., Mayur Uniquoters Limited, Nan Ya Plastics Corporation, San Fang Chemical Industry Co. Ltd., Teijin Limited, and Zhejiang Hexin Holdings Co. Ltd., among many others. For example, in July 2020, BASF South East Asia joined the ZDHC Foundation as a “Contributor” in its chemical industry category. The partnership with the Foundation and its extensive pool of experts from organizations in the textile, apparel, leather, and footwear industry underlines BASF’s commitment to being a synthetic leather industry leader in driving sustainable chemistry and innovation.

Global Synthetic Leather Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into bio-based, polyvinylchloride (PVC) based, and polyurethane (PU) based, wherein polyurethane (PU) based represents the most preferred segment. The rising popularity of polyurethane-based leather in many industries, including fashion, automotive, and furniture, is largely driving market expansion.

- Based on the application, the market is categorized into clothing, bags, shoes, purses and wallets, accessories, car interiors, belts, sports goods, and others, amongst which shoes dominate the market. This is primarily driven by the evolving consumer preferences toward cruelty-free and eco-friendly synthetic leather shoe options, on account of the rising environmental concerns.

- On the basis of the end use industry, the market has been divided into footwear, furniture, automotive, textile, sports, electronics, and others. Among these, footwear exhibits a clear dominance in the market on account of the growing e-commerce platforms that provide customers with a wide selection of footwear options.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 40.6 Billion |

| Market Forecast in 2033 | USD 55.7 Billion |

| Market Growth Rate 2025-2033 | 3.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Bio-Based, Polyvinylchloride (PVC) Based, Polyurethane (PU) Based |

| Applications Covered | Clothing, Bags, Shoes, Purses and Wallets, Accessories, Car Interiors, Belts, Sports Goods, Others |

| End Use Industries Covered | Footwear, Furniture, Automotive, Textile, Sports, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Kasei Corporation, DuPont Tate & Lyle Bio Products Company LLC, FILWEL Co. Ltd. (Air Water Inc.), H.R. Polycoats Pvt. Ltd., Kuraray Co. Ltd., Mayur Uniquoters Limited, Nan Ya Plastics Corporation, San Fang Chemical Industry Co. Ltd., Teijin Limited, Zhejiang Hexin Holdings Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Synthetic Leather Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)