Global Surgical Navigation Systems Market Expected to Reach USD 22.5 Billion by 2033 - IMARC Group

Global Surgical Navigation Systems Market Statistics, Outlook and Regional Analysis 2025-2033

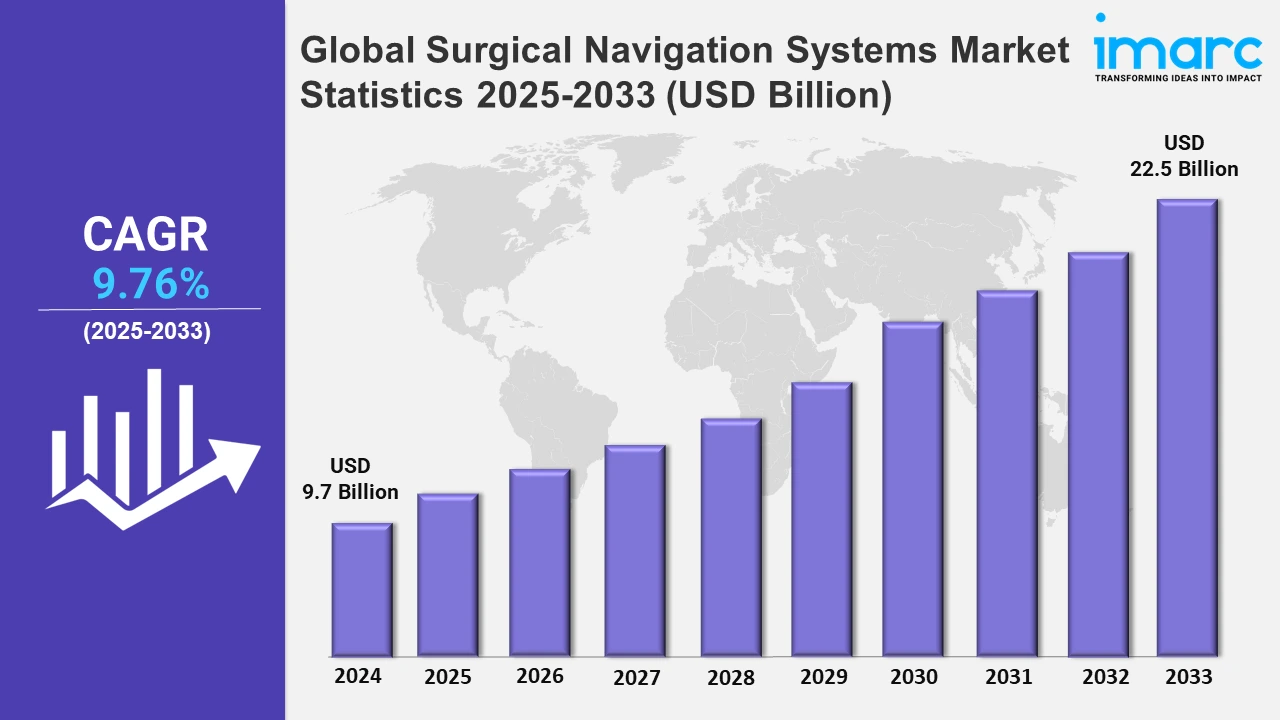

The global surgical navigation systems market size was valued at USD 9.7 Billion in 2024, and it is expected to reach USD 22.5 Billion by 2033, exhibiting a growth rate (CAGR) of 9.76% from 2025 to 2033.

To get more information on this market, Request Sample

The aging population has led to a significant surge in age-related conditions, such as osteoarthritis, and neurological disorders. The aging population contributes greatly to the increase in musculoskeletal and neurological problems. For example, the World Health Organization (WHO) reported in July 2022 that nearly 1.71 billion people suffer from musculoskeletal disease as the population ages, further propelling the demand for such systems. Aside from that, continuing innovations in surgical navigation technology, such as enhanced imaging modalities, augmented reality integration, and AI-driven navigation algorithms, improve these systems' ability to handle difficult musculoskeletal and neurological problems.

Moreover, robot navigation systems provide excellent precision and accuracy in directing surgical instruments during surgeries. These devices allow surgeons to navigate complex anatomical structures with greater precision, lowering the chance of errors and increasing surgical outcomes. For example, in December 2022, BLK-Max Super Specialty Hospital launched an integrated robotic system for spine surgeries to enhance surgical safety and accuracy. Furthermore, robot navigation systems improve surgeons' vision capabilities. This increased visualization enhances spatial orientation and depth perception, allowing for more precise navigation and tissue manipulation during surgery. For example, in September 2024, the FDA granted 510(k) clearance for eCential Robotics' 3D imaging, navigation, and robotics guidance system, allowing the French MedTech company to expand its unified robotic platform in the United States. The company develops a system that combines 2D/3D imaging, surgical navigation, and robotics. Besides this, minimally invasive surgical techniques need accurate navigation owing to the limited visibility and access to the surgical site. Navigation technologies offer real-time guidance, further allowing surgeons to more accurately navigate complicated anatomical structures during MIS procedures. For example, in August 2023, Orthofix Medical Inc., a global spine corporation, launched and completed the first cases in the United States with the 7D FLASH Navigation System Percutaneous Module 2.0. The Percutaneous Module 2.0 enhances Orthofix's 7D FLASH Navigation System with new planning features, enabling it to more effectively serve the Minimal Invasive Surgery (MIS) spine industry.

Global Surgical Navigation Systems Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest share owing to the growing healthcare infrastructure.

North America Surgical Navigation Systems Market Trends:

North America dominates the overall market. The growth of the region is supported by extensive adoption in neurosurgery and orthopedic surgeries. For example, Medtronic's StealthStation systems have become popular throughout the United States due to their accurate imaging capabilities. Also, increased investment in advanced technology and advantageous reimbursement regulations propel the industry growth, notably in the United States and Canada.

Europe Surgical Navigation Systems Market Trends:

Europe sees growth in the market through integration into minimally invasive procedures. Governments and healthcare institutions prioritize patient safety, leading to higher adoption rates in Germany, France, and the UK. For example, Brainlab’s Curve Navigation System, developed in Germany, enhances surgical precision in oncology. Additionally, EU regulations like MDR emphasize product safety, driving innovation and trust, making Europe a key region for surgical navigation advancements.

Asia Pacific Surgical Navigation Systems Market Trends:

The market in Asia Pacific is being driven by increased healthcare spending and the need for better surgical solutions. Moreover, emerging economies, including China and India, are seeing increased usage as people become more aware of precision technologies in ENT operations. Besides this, favorable government regulations that encourage medical device production through initiatives such as India's "Make in India" campaign are also strengthening the market growth.

Latin America Surgical Navigation Systems Market Trends:

The market demand in Latin America is driven by surging adoption of advanced technologies and a growing focus on improving surgical outcomes. For instance, according to an article published by PR Newswire in November 2023, the first cranial surgery in the Latin American region was performed with immersive AR surgical guidance, indicating an important advancement in medical technology acceptance in the region.

Middle East and Africa Surgical Navigation Systems Market Trends:

The region's growth is supported by the rising investments in specialized healthcare facilities. Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, prioritize advanced medical technologies under Vision 2030. For instance, Dubai’s Mediclinic City Hospital employs brain navigation systems for neurosurgery.

Top Companies Leading in the Surgical Navigation Systems Industry

Some of the leading surgical navigation systems market companies include Amplitude Surgical, B. Braun SE, Brainlab AG, Collin Medical, Fudan Digital Medical, Johnson & Johnson, Medtronic PLC, Siemens Healthcare Private Limited, Stryker Corporation, Zimmer Biomet Holdings Inc., among many others. For instance, in October 2024, B. Braun Medical planned to boost the production of intravenous (IV) saline fluids at its factories in California, Irvine, and Daytona Beach, Florida.

Global Surgical Navigation Systems Market Segmentation Coverage

- On the basis of the technology, the market has been bifurcated into electromagnetic navigation systems, optical navigation systems, and others, wherein electromagnetic navigation systems dominate the segment as they can track the position of equipment's position within the body, giving surgeons real-time guidance throughout surgeries.

- Based on the application, the market is categorized into neurosurgery, orthopedic, ENT, dental, and others, amongst which neurosurgery is the largest share of the segment. These systems help neurosurgeons precisely locate brain tumors, including those deep within the brain, further proliferating the segment growth.

- On the basis of the end user, the market has been divided into hospitals and ambulatory surgical centers. Among these, hospitals represented the largest segment. Surgeons can employ surgical navigation systems to plan their surgeries before entering the operating room, thereby adding to the segment growth.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 9.7 Billion |

| Market Forecast in 2033 | USD 22.5 Billion |

| Market Growth Rate 2025-2033 | 9.76% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Electromagnetic Navigation Systems, Optical Navigation Systems, Others |

| Applications Covered | Neurosurgery, Orthopedic, ENT, Dental, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amplitude Surgical, B. Braun SE, Brainlab AG, Collin Medical, Fudan Digital Medical, Johnson & Johnson, Medtronic PLC, Siemens Healthcare Private Limited, Stryker Corporation, Zimmer Biomet Holdings Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Surgical Navigation Systems Market

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)