Global Supply Chain Management Software Market Expected to Reach USD 52.2 Billion by 2033 - IMARC Group

Global Supply Chain Management Software Market Statistics, Outlook and Regional Analysis 2025-2033

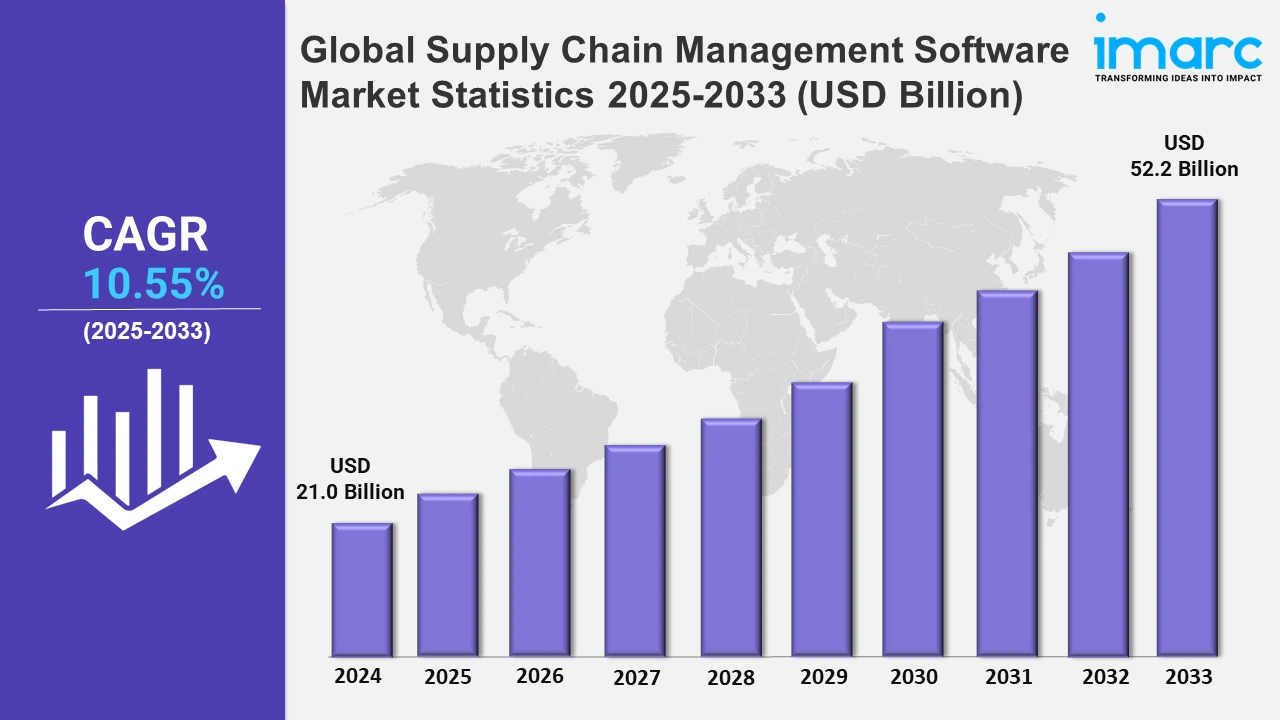

The global supply chain management software market size was valued at USD 21.0 Billion in 2024, and it is expected to reach USD 52.2 Billion by 2033, exhibiting a growth rate (CAGR) of 10.55% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing improvements in supply chain management software fuel efficiency, longevity, and performance, which represent primary factors bolstering the supply chain management software market's recent opportunities. Apart from this, various key players across the globe are widely investing in R&D activities to launch novel supply chain management software variants. For example, Pirelli introduced a new all-season supply chain management software called the P Zero AS Plus 3, designed for high-performance cars. Similarly, in June 2023, Michelin developed the Air X SkyLight supply chain management software for commercial aviation. The supply chain management software is lighter as compared to previous generations, with a weight reduction of 10%-20% leading to over 15-20% long-term lifespan and performance.

Moreover, as e-commerce continues to grow, consumer expectations for faster delivery times, better tracking, and more transparent processes are increasing. This puts pressure on companies to optimize their supply chains to meet these demands. SCM software helps businesses automate and streamline their processes to deliver goods more efficiently. Moreover, e-commerce businesses demand real-time visibility into their supply chains for both operational efficiency and customer satisfaction. SCM software allows companies to track products and shipments at every stage, providing transparency and helping to mitigate disruptions in the supply chain. For instance, in July 2024, Bigbasket unveiled BB Matrix, a software-as-a-service (SaaS)-based supply chain platform designed to assist new and established e-commerce enterprises in managing their supply chains and operations. The technology provides organizations with complete visibility across the whole supply chain on a global scale. It allows user companies to receive real-time updates, instantly identify bottlenecks, and make data-driven decisions to establish robust supply chains. BB Matrix can assist organizations in lowering transportation costs by roughly 50%, reducing lead times by around 60%, and ensuring up to 100% supply chain visibility. Besides this, advanced technologies like artificial intelligence (AI), Internet of Things (IoT), and blockchain are transforming supply chain operations. AI helps with predictive analytics, demand forecasting, and route optimization. For instance, in May 2024, Sawaca Business Machines Ltd., a chemical and trash trading company, expanded into the IT industry. The company collaborated with TCS Information Technology, a Dubai-based company, to create advanced AI-based Supply Chain Management (SCM) software aimed at improving supply chain efficiency in the Gulf Region, a key market for export-import transactions.

Global Supply Chain Management Software Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for supply chain management software, owing to the growing investment in improving the railway transportation system and the increasing automation of e-commerce businesses.

North America Supply Chain Management Software Market Trends:

North America dominates the overall market, owing to the expanding e-commerce sector. For instance, according to IMARC, the United States e-commerce market size reached US$ 1,087.54 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 2,083.97 Billion by 2032, exhibiting a growth rate (CAGR) of 6.80% during 2024-2032. The surge in online shopping has increased the demand for efficient supply chain solutions. Companies like Amazon utilize SCM software to manage complex logistics and meet customer expectations for rapid delivery.

Europe Supply Chain Management Software Market Trends:

The robust manufacturing sectors in countries, such as Germany and France, are substantial contributors to the demand for supply chain management software. For example, Germany's manufacturing industry, known for its high-tech production capabilities, relies on advanced SCM solutions to manage complex supply chains and maintain competitiveness, which is further propelling the market growth.

Asia-Pacific Supply Chain Management Software Market Trends:

The Asia-Pacific supply chain management (SCM) software market is driven by rapid industrialization in countries like China, India, and South Korea, fueling demand for efficient logistics. E-commerce expansion, particularly in China and India, boosts the need for advanced SCM tools to manage inventory and deliveries. Moreover, government initiatives, such as China’s digital transformation strategies and the adoption of cloud-based SCM by SMEs in India and Southeast Asia, further propel growth.

Latin America Supply Chain Management Software Market Trends:

As Latin American economies recover and governments emphasize digitization, there's a surge in foreign investments. For instance, in May 2018, DHL acquired Colombia's Suppla Group, enhancing its regional presence and boosting demand for comprehensive SCM solutions. Moreover, the rapid growth of e-commerce in the region necessitates efficient supply chain operations. SCM software provides real-time analytics and streamlines processes, enabling businesses to meet the demands of online consumers effectively.

Middle East and Africa Supply Chain Management Software Market Trends:

The Middle East and Africa supply chain management (SCM) software market is driven by factors, such as increasing digital transformation across industries, growing e-commerce penetration, and the need to streamline operations amidst complex regional logistics. Governments, like the UAE's "Operation 300bn," emphasize industrial growth and digital adoption, boosting SCM solutions in the Middle East and Africa.

Top Companies Leading in the Supply Chain Management Software Industry

Some of the leading supply chain management software market companies include Blue Yonder Group, Inc., Coupa Software Inc, e2open, LLC, Epicor Software Corporation, Infor, International Business Machines Corporation, Kinaxis Inc., Körber AG, Manhattan Associates, Oracle Corporation, SAP SE, and The Descartes Systems Group Inc, among many others. For instance, in April 2024, SAP SE unveiled AI improvements in its supply chain solutions, ushering in a new era of productivity, efficiency, and precise production. AI-powered insights from real-time data enable businesses to use their own data to improve supply chain decision-making, streamline product creation, and increase manufacturing efficiency.

Global Supply Chain Management Software Market Segmentation Coverage

- On the basis of the solution type, the market has been bifurcated into transportation management system, warehouse management system, supply chain planning, procurement and sourcing, and manufacturing execution system, wherein supply chain planning represented the largest segment as it enhances operational efficiency and enables optimization of the delivery of goods, services, and information from suppliers to customers.

- Based on the deployment mode, the market is categorized into on-premises and cloud-based, amongst which on-premises accounted for the largest market share, as it runs on computers on-premises of organizations rather than at a remote option, such as cloud or server farms.

- On the basis of the organization size, the market has been divided into small and medium-sized enterprises and large enterprises. Among these, large enterprises accounted for the largest market share as the presence of supply chain complexity is comparatively higher than that of small and medium-sized enterprises (SMEs).

- Based on the industry vertical, the market is bifurcated into retail and consumer goods, healthcare and pharmaceuticals, manufacturing, food and beverages, transportation and logistics, automotive, and others, wherein transportation and logistics accounted for the largest market share as it offers several benefits, including carrier procurement, shipment planning and execution, mode optimization, and freight brokerage.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 21.0 Billion |

| Market Forecast in 2033 | USD 52.2 Billion |

| Market Growth Rate 2025-2033 | 10.55% |

| Units | Billion USD |

| Segment Coverage | Solution Type, Deployment Mode, Organisation Size, Industry Vertical, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blue Yonder Group, Inc., Coupa Software Inc, e2open, LLC, Epicor Software Corporation, Infor, International Business Machines Corporation, Kinaxis Inc., Körber AG, Manhattan Associates, Oracle Corporation, SAP SE, The Descartes Systems Group Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Supply Chain Management Software Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)