Global Supply Chain Finance Market Expected to Reach USD 15.2 Billion by 2033 - IMARC Group

Global Supply Chain Finance Market Statistics, Outlook and Regional Analysis 2025-2033

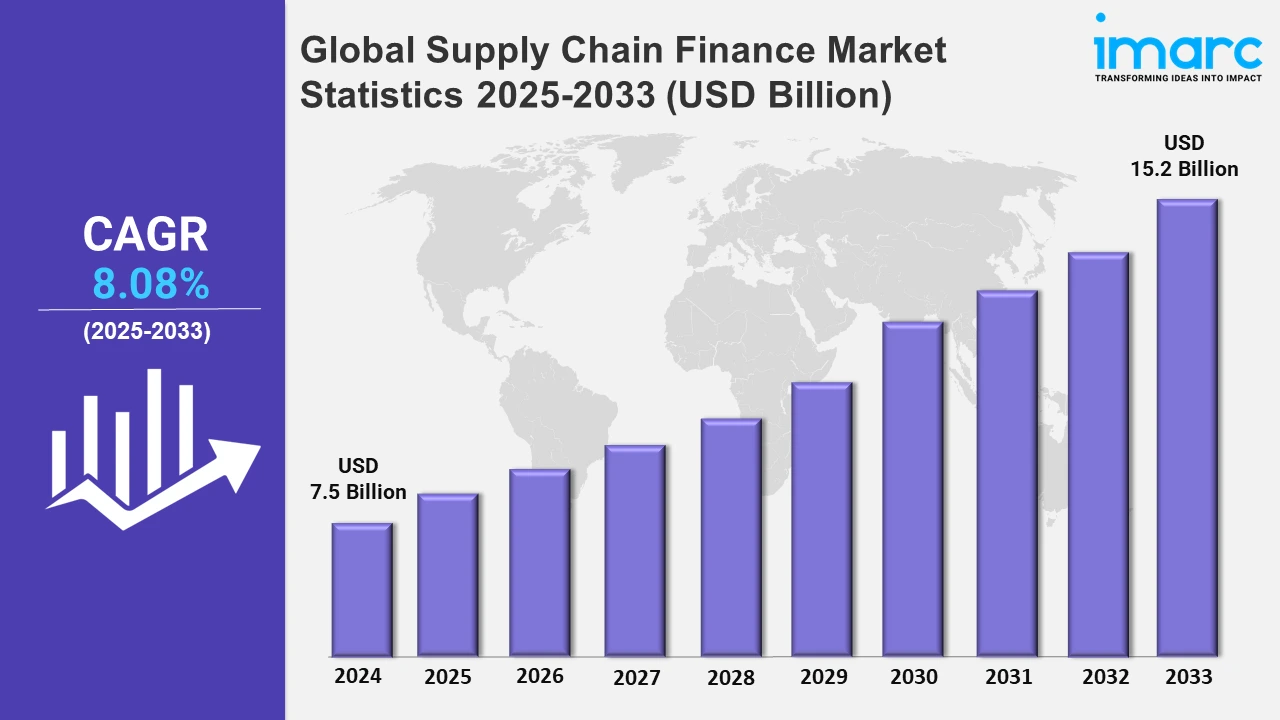

The global supply chain finance market size was valued at USD 7.5 Billion in 2024, and it is expected to reach USD 15.2 Billion by 2033, exhibiting a growth rate (CAGR) of 8.08% from 2025 to 2033.

To get more information on this market, Request Sample

The global supply chain finance market is growing steadily with increasing complexity and scale in supply chain management, as well as the rising demand for efficient financing solutions. According to the Association for Supply Chain Management, the global supply chain management application market is set to reach nearly $31 Billion by 2026, thus indicating increasing demand for innovative solutions to streamline operations. Businesses across industries are today maximizing the optimization of working capital to enhance liquidity and ensure fluid operations. Supply chain finance solutions meet these needs by providing early payments to the suppliers while extending the payment period for buyers, which, in turn, forms a win-win situation. Globalization has brought an increase in demand for cross-border trade financing due to risks in currency fluctuations, regulatory hurdles, and geopolitical uncertainties that companies seek to mitigate. Digital transformation is the most significant driver, as the integration of blockchain, artificial intelligence, and cloud-based platforms streamlines financing processes, improves transparency, and reduces costs.

The global market is increasingly driven by sustainability and ESG compliance. This has resulted in businesses making their supply chain financing strategies environmentally friendly by supporting green initiatives and reducing carbon footprints. Financial institutions innovate through the provision of green supply chain finance solutions, which promote sustainable practices throughout the value chain. Automotive, consumer goods, and electronics industries are adopting supply chain finance to manage large-scale, time-sensitive operations in a better way. With the growth of e-commerce, there is additional demand for scalable financing solutions to support rapid inventory turnover and dynamic trade volumes. The other growing trend is the focus on SMEs, as these businesses face greater challenges in accessing affordable financing. Governments and private financial institutions are introducing specialized programs to bridge the gap, fostering growth in the SME sector. Regionally, Asia-Pacific leads the market due to its expanding manufacturing base and significant investments in digital infrastructure. Europe is following closely, driven by regulatory advancements and a strong focus on trade efficiency. Meanwhile, North America has been experiencing growth due to technological adoption and cross-border trade. With the pace at which digitalization, sustainability, and globalization are constantly changing, the global supply chain finance market is bound for steady growth, and such offers massive opportunities for businesses and financial institutions to capitalize on.

Global Supply Chain Finance Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of robust financial resources and stability.

Asia Pacific Supply Chain Finance Market Trends:

The Asia Pacific supply chain finance market is witnessing rapid growth due to fast industrialization, expansion of manufacturing hubs, and an increase in cross-border trade. China, India, and the countries of Southeast Asia are some of the key contributors with massive investments in infrastructure and technology to improve supply chain operations. Digital platforms and blockchain technology are increasingly adopted in the region, transforming traditional trade finance into more transparent, efficient, and lower-cost transactions. Small and medium-sized enterprises, which form the backbone of many Asia-Pacific economies, are driving demand for supply chain finance solutions that address liquidity challenges and ensure smooth operations. Supportive policies and financial incentives by governments are enhancing supply chain resilience, thereby contributing to increased market growth. The emergence of e-commerce and globalization has, therefore, led to the need for effective financing solutions to support increasing volumes of trade, especially in fast-moving consumer goods, electronics, and textiles. Moreover, the market trend in the region has also started to be influenced by sustainability since businesses in South Asia started adopting green supply chain practices and looking for environmentally friendly financing options. According to the World Bank, South Asia's economic outlook, where output is expected to exceed expectations, reaching 6.4% in 2024 and 6.2% annually in 2025-26. This robust growth is expected to remain higher than that of other emerging markets and developing economies (EMDE), creating a favorable environment for the continued expansion of the supply chain finance market. The strong regional trade networks, and increasingly innovative financing models, stand well to place the Asia-Pacific supply chain finance market with high prospects of growth in years to come.

North America Supply Chain Finance Market Trends:

The North America supply chain finance market is highly driven by strong technological adoption and a significant focus on digital transformation. Businesses increasingly utilize advanced tools like blockchain and AI for smooth financing and real-time tracking. The emphasis on sustainability in the region is compelling companies to implement green supply chain practices with the support of financing solutions. In addition, the increasing need for cross-border trade solutions during rising globalization increases the usage of supply chain finance. Further, government support for local manufacturing and trade encourages steady growth in the market.

Europe Supply Chain Finance Market Trends:

The well-established trade networks of Europe and strict regulations of the region ensure financial transparency that helps in the growth of the supply chain finance market. The push for sustainability, in line with EU green policies, has been promoting businesses to include sustainable financing within their supply chains. The market is also growing due to increasing cross-border trade and the adoption of digital platforms to streamline financial processes. Demand from industries like automotive and pharmaceuticals, as well as initiatives to support small and medium-sized enterprises (SMEs), enhances the role of supply chain finance across the continent.

Latin America Supply Chain Finance Market Trends:

With regional economies strengthening their export capacity and industrial base, the market for supply chain finance in Latin America is expanding. Digital solution adoption is increasing, overcoming challenges such as complex trade regulation and limited financial inclusion. Governments are encouraging supply chain financing to help SMEs, as they are the dominant type of business in the region. With more e-commerce companies and the growth in free trade agreements, there is increasing demand for efficient financial instruments. Diversification in the economics of countries like Brazil and Mexico accelerates market growth within almost every industry.

Middle East and Africa Supply Chain Finance Market Trends:

Middle East and Africa supply chain finance market is driven by region-specific focus on infrastructure development as well as diversification away from the reliance of these countries on oil-based economies. Governments and financial institutions are spending on trade finance solutions to promote up-and-coming industries. Trade finance demand is also increased by free-trade zones and improved connectivity throughout key trade corridors. In addition to this, SMEs resort to supply chain finance solutions that help them overcome liquidity bottlenecks. Increasing deployment of digital platforms in such countries as the UAE and South Africa facilitates more efficient transaction of finances, thereby promoting demand in the market.

Top Companies Leading in the Supply Chain Finance Industry

Some of the leading Supply Chain Finance market companies include Asian Development Bank, Bank of America Corporation, BNP Paribas, DBS Bank India Limited, HSBC, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group Inc., Orbian Corporation, and Royal Bank of Scotland plc (NatWest Group plc, among many others.

- In November 2024, Asian Development Bank (ADB) and Gulf Renewable Energy Company agreed on an $820 million loan to fund 12 renewable energy projects across Thailand. The portfolio encompasses 8 solar PV plants, and 4 solar PV plants with battery storage. The contribution from ADB will be $260 million and supplementary funding by different international institutions. The projects support Thailand's ambitions to generate 50% of renewable energy by 2037.

- On November 26, 2024, HSBC introduced Smart Transact. It allows businesses to process their domestic and international payments under a single roof. The services it provides are access to current accounts, cross-border payments, and HSBCnet with an option to add more. Available at launch in India, the UK, and the US, the platform will roll out by year-end to China, the UAE, and Germany.

Global Supply Chain Finance Market Segmentation Coverage

- On the basis of the provider, the market is divided into banks, trade finance houses, and others. Banks represent the largest market segment as they possess an existing financial infrastructure, a wider geographical presence, and higher business trust. Banks come up with solutions that best address the requirements of supply chain participants such as suppliers and buyers. Their ability to incorporate high-tech innovations such as blockchain and artificial intelligence has improved the effectiveness and transparency of supply chain financing. Besides, banks provide competitive pricing and access to large capital sums, which are fundamental to funding large-scale supply chains. Their role as risk intermediaries to prevent events like non-payment further establishes their supremacy in the market.

- Based on offering, the market is segmented into letter of credit, export and import bills, performance bonds, and shipping guarantees, among others. The export and import bills account for the largest share of the supply chain finance market. Increasing globalization in trade concerning these transactions mainly boosts this domination. They will ensure timely payments and lessen the risk of non-payment in cross-border transactions, which is important in their business. They are ideal for businesses engaged in international trade as hey have options during settlement periods and several currencies to choose from. Digital platforms have also facilitated the management of export and import bills, increasing their attraction in the market.

- On the basis of the application, the market is categorized into domestic and international. Domestic represents the leading market due to the high volumes of local trade activities involved with relatively lesser risks attached to it. Domestic solutions of supply chain finance solutions take less time to execute, as regulatory and currency complexities are relatively lower. This segment is supported by government policies to strengthen local supply chains, especially in developing markets. Companies also prefer short-term liquidity management or better control over operations that occur through domestic financing solutions. The growth of e-commerce and regional trade agreements has boosted the demand for domestic supply chain financing.

- Based on the end user, the market is segmented into large enterprises and small and medium-sized enterprises. Large enterprises dominate the market as their very extensive and complex supply chains require a lot of working capital to function effectively. Such organizations benefit from favorable financing terms and economies of scale through negotiation. Supply chain financing ensures smooth operation for large enterprises by providing liquidity to suppliers and optimizing cash flow. Additionally, large enterprises usually have access to more advanced technological platforms, which enables them to handle financing processes better, thus further improving their market position. Their emphasis on strategic partnerships with financial institutions to design customized solutions also adds to their leadership in the segment.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 15.2 Billion |

| Market Growth Rate 2025-2033 | 8.08% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Providers Covered | Banks, Trade Finance House, Others |

| Offerings Covered | Letter of Credit, Export and Import Bills, Performance Bonds, Shipping Guarantees, Others |

| Applications Covered | Domestic, International |

| End Users Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asian Development Bank, Bank of America Corporation, BNP Paribas, DBS Bank India Limited, HSBC, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group Inc., Orbian Corporation, Royal Bank of Scotland plc (NatWest Group plc), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)