Global Supply Chain Analytics Market Expected to Reach USD 32.3 Billion by 2033 - IMARC Group

Global Supply Chain Analytics Market Statistics, Outlook and Regional Analysis 2025-2033

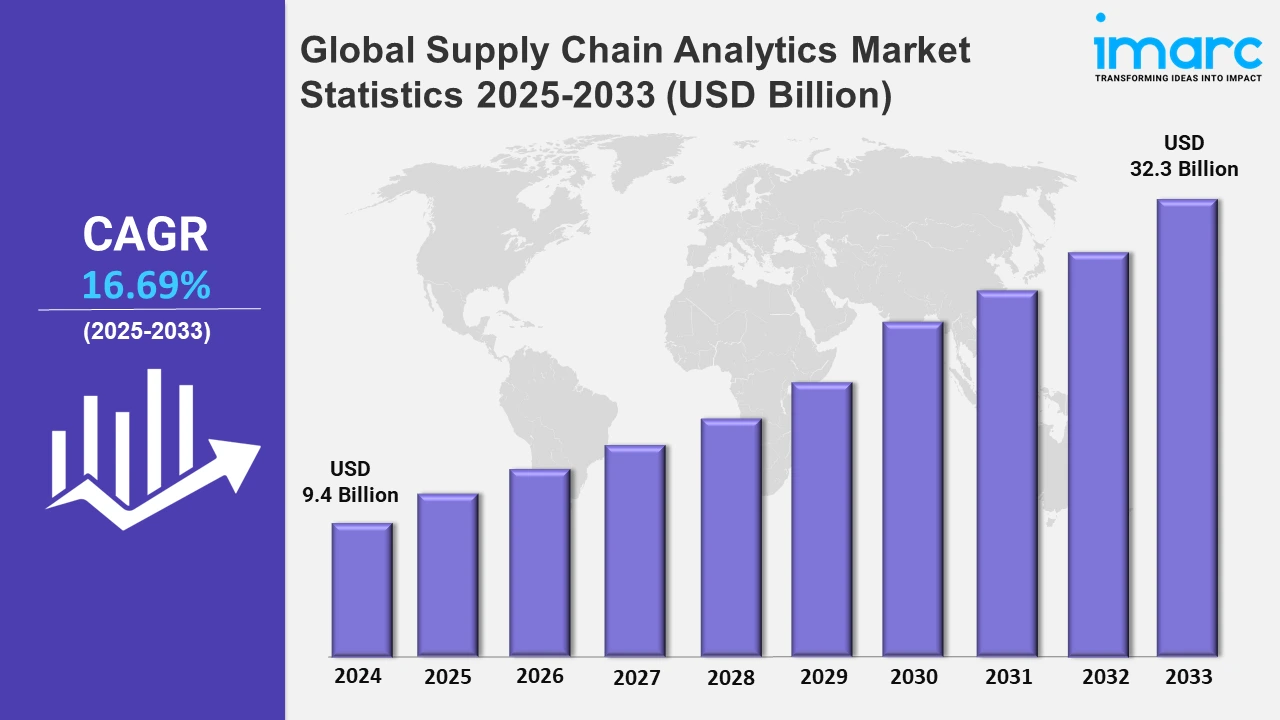

The global Supply Chain Analytics market size was valued at USD 9.4 Billion in 2024, and it is expected to reach USD 32.3 Billion by 2033, exhibiting a growth rate (CAGR) of 16.69% from 2025 to 2033.

To get more information on this market, Request Sample

The global supply chain analytics market is witnessing strong growth with an increasing demand for data-driven decision-making and the optimization of business operations in its supply chain. Such advanced analytics tools become even more important as complexity in the supply chain rises, a factor companies are encountering today due to various disruptions and changing consumer demands, not to mention globalization. The U.S. Department of Energy invested $33 Million focused on developing smart manufacturing technologies for clean energy, circular supply chains, sustainable transportation, high-performance materials, and competitive mining. Such innovations will push for more efficient and sustainable processes in manufacturing. The tools were found to help businesses boost operational efficiency, forecast demand, manage inventory, cut costs, and mitigate risks. It has further empowered businesses to leverage the use of AI, machine learning, and big data technologies to dig deeper into their supply chain processes for improvements in predictability and, subsequently, in agility and responsiveness.

Greater usage of cloud-based solutions delivers greater scalability, cost-efficient delivery, and accessibility across global supply networks. The rising trend toward digital transformation for the retail, manufacturing, and logistical sectors also pushes them to use analytics to further increase visibility and control in their supply chains. Growing demand for sustainability, strict regulatory compliance, and pressure from the regulator on organizations will be some additional momentum for analytics tools as companies want to track and thus monitor how resource consumption is occurring, where the waste lies, and hence what's being created. Consistent with the growth and improvement in technology, these will mark the global supply chain analytics market over the forecast period.

Global Supply Chain Analytics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of rising demand for defects early, reduce waste, and ensure products meet quality standards.

North America Supply Chain Analytics Market Trends:

The North America supply chain analytics market is growing rapidly, triggered by the rising demand to achieve supply chain efficiency, digitalization, and adoption of high-tech technologies. Expansion of e-commerce, especially in the United States and Canada, is a significant driver. Businesses rely on analytics to optimize inventory levels, streamline logistics, and respond to changing consumer expectations that are changing rapidly in nature. The U.S. Census Bureau reported that retail e-commerce sales increased 2.6% in Q3 2024 to $300.1 billion, up 7.4% compared with Q3 2023. E-commerce is now the source of 16.2% of total retail sales. This marks that there is a pressing need to rely on analytics to successfully manage large-scale inventory and complex delivery networks. Increasing utilization of advanced technologies, including AI and ML, is to establish widespread Internet of Things (IoT) to enable real-time visibility and predictive insights about things and operations. In those respective industries, manufacturing, retail, and logistics in particular, analytics are increasingly important in reducing costs and fast-track delivery times as well as complex supply chain management operations. The growing importance of sustainability, adherence to stringent environmental regulations, and reducing carbon footprint have accelerated the adoption of analytics tools for tracking and optimization of resource usage. In this context, the post-pandemic recovery efforts have accentuated the need for a resilient, agile supply chain that can respond to disruptions better.

Asia Pacific Supply Chain Analytics Market Trends:

The Asia Pacific region, mainly driven by the rise in e-commerce, diversified manufacturing industries, and rapidly expanding digitalization, is booming supply chain analytics adoption in that region. China and India are embracing advanced analytics solutions in logistics and inventory management practices. The region's emphasis on intelligent technologies, such as AI and IoT, makes the whole process more efficient. Further, booming investment in automation and government campaigns in favor of digital transformation within the supply chains are providing thrust to this market and leading to growth.

Europe Supply Chain Analytics Market Trends:

Europe is the forerunner in adopting sustainable practices in supply chain analytics, due to strict environmental regulations and the reduction of carbon emissions. Advanced manufacturing and retail sectors across the region utilize analytics for improved operational efficiency and cost control. Germany and the UK have been the pioneers, adopting AI-powered solutions for real-time tracking and demand forecasting. The need for cloud-based analytics and increased pressure for supply chain resilience are expected to further drive market growth.

Latin America Supply Chain Analytics Market Trends:

Infrastructural, logistics, and e-commerce investment is growing the Latin American supply chain analytics market. Brazil and Mexico employ analytics to address inefficiency issues in transportation and the management of inventory by companies. With increased cloud-based applications in this region, supply chains realize better visibility. The growth in the retail, food, and beverages sectors will drive demand for analytics for improving distribution efficiency and catering to consumer expectations in this emerging market.

Middle East and Africa Supply Chain Analytics Market Trends:

Rapid urbanization, industrial growth, and government investments in logistics infrastructure are driving the growth of supply chain analytics in the Middle East and Africa. The key players in this regard are the UAE and Saudi Arabia, using analytics to streamline operations in retail, oil and gas, and transportation sectors. Despite challenges such as the limited digital infrastructure in many regions, growing emphasis on improving supply chain visibility, minimizing costs, and integrating advanced technologies such as IoT and AI is driving market growth.

Top Companies Leading in the Supply Chain Analytics Industry

Some of the leading Supply Chain Analytics market companies include Axway, Capgemini SE, International Business Machines Corporation, Infor Inc. (Koch Industries Inc.), Kinaxis Inc., Manhattan Associates Inc., Microstrategy Incorporated, Oracle Corporation, QlikTech International AB, SAP SE, SAS Institute Inc., and Tableau Software LLC (Salesforce Inc.), among many others.

- In November 2024, Elida Beauty collaborated with Genpact and Kinaxis to implement the Kinaxis Maestro platform, improving demand planning, supply planning, and sales operations. The cloud capabilities of the platform and its machine learning features improved supplier collaboration and supply chain management.

Global Supply Chain Analytics Market Segmentation Coverage

- Based on the component, the market is segmented into software (demand analysis and forecasting, supplier performance analytics, spend and procurement analytics, inventory analytics, and transportation and logistics analytics) and services (professional, and support and maintenance). The software holds a more significant market share as it is the real foundation of real-time analysis in terms of data and operational optimization on each of the supply chain processes involved. These tools offer actionable insights to enable organizations to forecast demand with accuracy, monitor supplier performance, and manage procurement spending efficiently. The increased adoption of digital transformation, big data, and AI-driven analytics further enhances the use of software solutions. Companies prefer software over services for its scalability, integration capabilities, and cost-effectiveness in long-term operations. Additionally, as the complexities of the supply chain rise, firms are investing in strong software platforms to stay ahead of the competition.

- On the basis of the deployment mode, the market is divided into on-premises and cloud-based. On-premises is the largest segment in the market due to its attraction to industries that require strict regulatory and security compliance. In these healthcare, manufacturing, and defense-related industries, on-premises solutions are preferred as they can always have full control over their data and ensure compliance with severe data protection laws. In addition, this model has robust customization capabilities, whereby businesses can align the system functionalities according to their unique operational needs. Although cloud-based solutions are gaining popularity due to their flexibility and lower up-front costs, on-premises deployment is the preferred choice for large-scale enterprises that value system control, performance reliability, and data sovereignty. The scalability and robust integration features of on-premises systems further support their widespread adoption in critical industries.

- Based on the enterprise size, the market is categorized into large enterprises and small and medium enterprises (SMEs). The market is largely dominated by large enterprises with substantial resources and complex supply chain structures that require sophisticated analytics solutions. These companies operate massive supplier networks, global logistics operations, and diversified product portfolios, for which supply chain analytics has become an essential tool in optimizing operations. Large organizations are more likely to invest in expensive technologies like AI, machine learning, and predictive analytics to achieve maximum efficiency and better decision-making. Additionally, customer satisfaction improvement, cost of operations reduction, and attainment of sustainability objectives also boost their investment in analytics solutions. In comparison, supply chain analytics is gradually being adopted by SMEs. However, the limited budget and smaller operational scope limit their market share.

- On the basis of the industry vertical, the market is classified into automotive, food and beverages, healthcare and pharmaceuticals, manufacturing, retail and consumer goods, transportation and logistics, and others. Amongst these, manufacturing is the largest segment as it depends on supply chain analytics to make production processes leaner, optimize inventory, and manage distribution networks. Industry 4.0 technologies, including IoT and automation, have increased the demand for data-driven insights in manufacturing operations. Advanced analytics helps manufacturers forecast demand, minimize waste, and improve productivity, making it a vital component of their supply chain strategies. Additionally, the growing focus on lean manufacturing, sustainability, and real-time visibility into supply chain activities further drives adoption in this sector. The manufacturing industry’s scale and complexity make analytics indispensable for maintaining operational efficiency and meeting market demands.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 9.4 Billion |

| Market Forecast in 2033 | USD 32.3 Billion |

| Market Growth Rate 2025-2033 | 16.69% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | Automotive, Food and Beverages, Healthcare and Pharmaceuticals, Manufacturing, Retail and Consumer Goods, Transportation and Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Axway, Capgemini SE, International Business Machines Corporation, Infor Inc (Koch Industries Inc.), Kinaxis Inc., Manhattan Associates Inc., Microstrategy Incorporated, Oracle Corporation, QlikTech International AB, SAP SE, SAS Institute Inc., Tableau Software LLC (Salesforce Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Supply Chain Analytics Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)