Global Sugar Market Expected to Reach 223.1 Million Tons by 2033 - IMARC Group

Global Sugar Market Statistics, Outlook and Regional Analysis 2025-2033

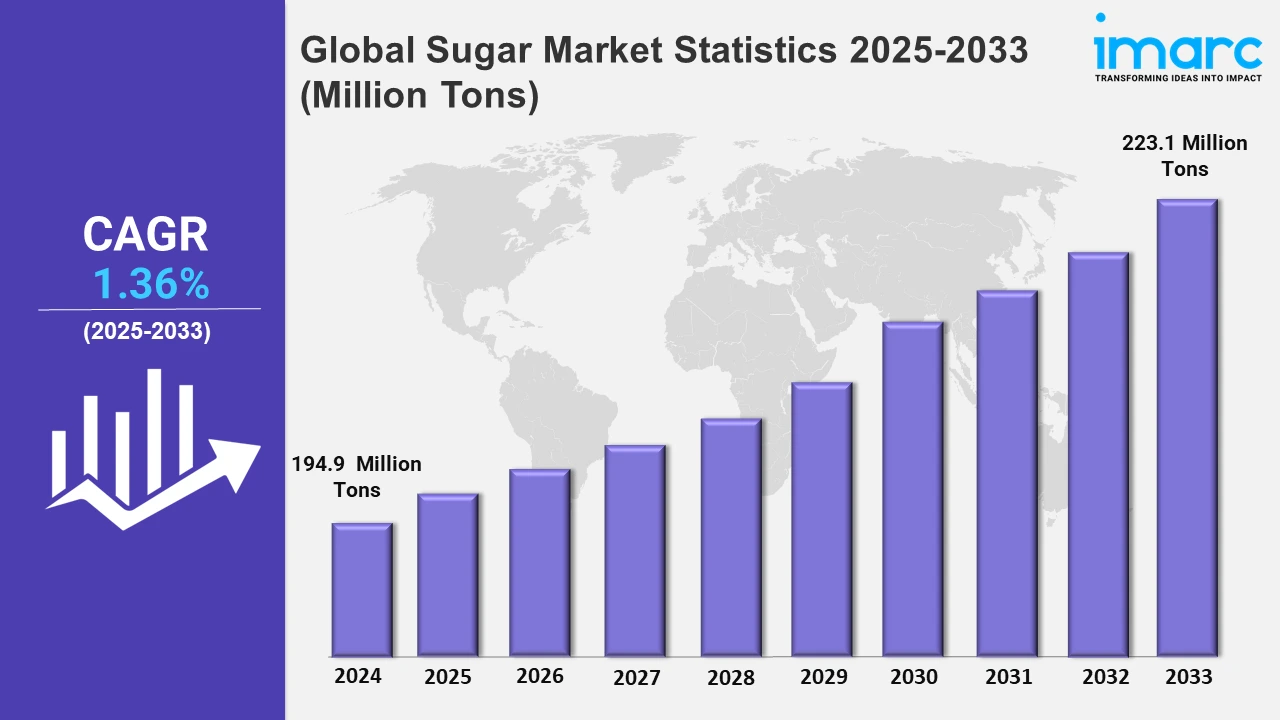

The global sugar market size was valued at 194.9 Million Tons in 2024, and it is expected to reach 223.1 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.36% from 2025 to 2033.

To get more information on this market, Request Sample

The sugar market is influenced by a great combination of demographic, economic, and industrial factors. Additionally, population growth and rapid urbanization have resulted in a greater intake of convenience foods and drinks, which widely contain sugar as a primary ingredient. This is especially evident in developing countries where rising middle-class population have growing disposable incomes, allowing them to further contribute to the market growth. Besides, industrial applications of sugar in pharmaceuticals, cosmetics, and even bioplastics are creating new avenues for sugar usage, thus further propelling the market growth. For instance, on 16 January 2024, SucroCan Sourcing LLC announced its plan to establish Canada’s largest sugar refinery at the Port of Hamilton. The $135 Million project will create a facility at Pier 15 with an annual refining capacity of 1 million metric tonnes. The 20-acre refinery is expected to begin operations in 2025.

Moreover, technological advancements, particularly in precision farming, have also significantly contributed to the market's expansion. Precision agriculture techniques enable sugar cane and beet farmers to optimize inputs and improve yields through data-driven decisions. This includes the use of satellite imagery, IoT devices, and AI to monitor crop health, optimize water usage, and predict yields more accurately, leading to more efficient sugar production processes. For instance, on 7 October 2024, Planet Labs PBC announced a partnership with American Crystal Sugar Company through SatAgro, a precision agriculture firm, to enhance sugar beet crop monitoring in the northern United States. This collaboration leverages daily Planet satellite data, enabling American Crystal Sugar to track harvest progression and crop size more effectively. As the leading U.S. beet sugar producer, the company will use SatAgro's specialized interface to analyze data for informed crop management decisions. Joe Hastings, General Agronomist at American Crystal Sugar, highlighted the critical role of real-time monitoring in managing resources and improving yield predictions. SatAgro's digital tools integrate various data sources, including Planet's imagery, to enhance agricultural productivity and sustainability, marking a significant improvement in digital farming practices.

Global Sugar Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, India, the United States, the European Union, China, Thailand, and others. According to the report, Brazil accounted for the largest market share on account of its competitive edge in sugarcane production, facilitated by vast agricultural lands and an optimal climate.

Brazil Sugar Market Trends:

Brazil is one of the world's largest sugar producers owing to its large arable land area and favorable climate for sugarcane production. The country has developed its infrastructure in ways that it can process and deliver its supplies to local and international markets effectively. Furthermore, Brazil's strategic focus on bioethanol production from sugarcane diversifies its sugar industry and strengthens its market position globally. For instance, on 19 November 2024, Louis Dreyfus Company (LDC) announced plans to build a new sugar transshipment terminal in Pederneiras, São Paulo, Brazil. The facility will comprise a warehouse with a static capacity of 90,000 tons and a handling capacity of 500 tons per hour. The terminal will offer a new sugar mill logistics method to the Center-South of Brazil, providing sugar mills a new option for transporting their sugar production via rail to the Port of Santos.

India Sugar Market Trends:

The sugar market is expanding primarily owing to its rising population and increasing disposable incomes, which boost consumer spending on sweets and processed foods that contain sugar. Moreover, India’s sugar industry is also benefiting from government subsidies and support, which encourage domestic production and stabilize sugar prices.

United States Sugar Market Trends:

In the United States, the sugar market is primarily driven by consistent demand in the food and beverage sector, where sugar is a key ingredient in a vast array of products. The trend toward convenience foods and ready-to-eat (RTE) products among American consumers further fuels sugar consumption.

European Union Sugar Market Trends:

The sugar market in the European Union (EU) is growing due to changes in EU sugar policy, such as the removal of sugar output limits, allowing producers to freely meet the growing demand for sugar across the globe. Additionally, consumers are widely choosing fair-trade and organic sugar products as they are considered healthier and more environmentally friendly options.

China Sugar Market Trends:

The market in China is growing due to urbanization and the growing middle class, which have led to an increased consumption of sugar-laden products such as beverages and baked goods. The government's investment in agricultural technology and infrastructure has improved yield and production efficiencies, making sugar easily available.

Thailand Sugar Market Trends:

Thailand’s sugar market is witnessing significant growth owing to its growing sugar business and robust worldwide demand. The nation benefits from a climate that is conducive to high sugarcane crop output and quality. Additionally, government programs to support bioenergy have increased domestic demand for sugarcane, which is used to make sugar and bioethanol, contributing to the sugar industry's overall expansion.

Top Companies Leading in the Sugar Industry

Some of the leading sugar market companies include Al Khaleej Sugar, Associated British Foods plc, Canal Sugar, Dwarikesh Sugar Industries Limited, Lantic Inc., Louis Dreyfus Company, Michigan Sugar Company, Mitr Phol Sugar Co., Ltd., Nordzucker, Rajshree Sugars & Chemicals Ltd, Suedzucker AG, Tereos, Thai Roong Ruang Group, and Wilmar International Limited, among many others. For instance, in October 2024, Tereos completed the sale of its Tereos UK and Ireland (TUKI) production facility in Normanton, West Yorkshire, along with its consumer business to Tate & Lyle Sugars Limited (TLS). This transaction, which was officially sanctioned by the United Kingdom Competition Authority on September 5, involves the Tereos UK plant that handles the packaging and distribution of white granulated, bakery, and specialty sugars. These products are supplied to UK retailers and food wholesalers under the Whitworths Sugar brand and various private labels. This deal pertains solely to the consumer segment (B2C), with Tereos maintaining its business operations with industrial clients (B2B) under the TUKI branding. Tereos expresses satisfaction with the outcome of this transaction with Tate & Lyle Sugars, which ensures the continuation of employment, as well as packing and storage operations for its business-to-business sales in the UK.

Global Sugar Market Segmentation Coverage

- On the basis of the product type, the market has been categorized into white sugar, brown sugar and liquid sugar, wherein white sugar represents the leading segment. White sugar is the preferred choice in many households and food service industries due to its purity and fine texture, which make it ideal for baking and cooking. It's heavily used as it dissolves and blends more easily compared to other types of sugar, enhancing the aesthetic and flavor profiles of prepared foods.

- Based on the form, the market is classified into granulated sugar, powdered sugar, and syrup sugar, amongst which granulated sugar dominates the market. The granulated sugar is favored for its fine, free-flowing nature and ease of measurement, which is essential in commercial food production and home cooking. It is the most commonly available form of sugar, suitable for several culinary applications, from sweetening beverages to creating syrups.

- On the basis of the end-use sector, the market has been divided into food and beverages, pharma and personal care, and household. Among these, food and beverages accounts for the majority of the market share as it relies heavily on sugar as a fundamental ingredient for flavor enhancement, preservation, and texture modification in countless products. Moreover, sugar's role in fermentation, browning, and providing bulk in processed foods underpins its extensive use in this sector.

- Based on the source, the market is bifurcated into sugarcane and sugar beet, wherein sugarcane holds the largest market segment. Additionally, sugarcane is the primary source of sugar, accounting for about most of global production, due to its efficiency in converting sunlight into energy, thus yielding more sugar per acre than sugar beets. Its cultivation in tropical and subtropical regions aligns with the conditions needed for optimal growth, supporting higher output levels.

| Report Features | Details |

|---|---|

| Market Size in 2024 | 194.9 Million Tons |

| Market Forecast in 2033 | 223.1 Million Tons |

| Market Growth Rate 2025-2033 | 1.36% |

| Units | Million Tons, Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | White Sugar, Brown Sugar, Liquid Sugar |

| Forms Covered | Granulated Sugar, Powdered Sugar, Syrup Sugar |

| End-Use Sectors Covered | Food and Beverages, Pharma and Personal Care, Household |

| Sources Covered | Sugarcane, Sugar Beet |

| Regions/Countries Covered | European Union, Brazil, India, United States, China, Thailand |

| Companies Covered | Al Khaleej Sugar, Associated British Foods plc, Canal Sugar, Dwarikesh Sugar Industries Limited, Lantic Inc., Louis Dreyfus Company, Michigan Sugar Company, Mitr Phol Sugar Co., Ltd., Nordzucker, Rajshree Sugars & Chemicals Ltd, Suedzucker AG, Tereos, Thai Roong Ruang Group, Wilmar International Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Sugar Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)