Global Stout Market Expected to Reach USD 15.03 Billion by 2033 - IMARC Group

Global Stout Market Statistics, Outlook and Regional Analysis 2025-2033

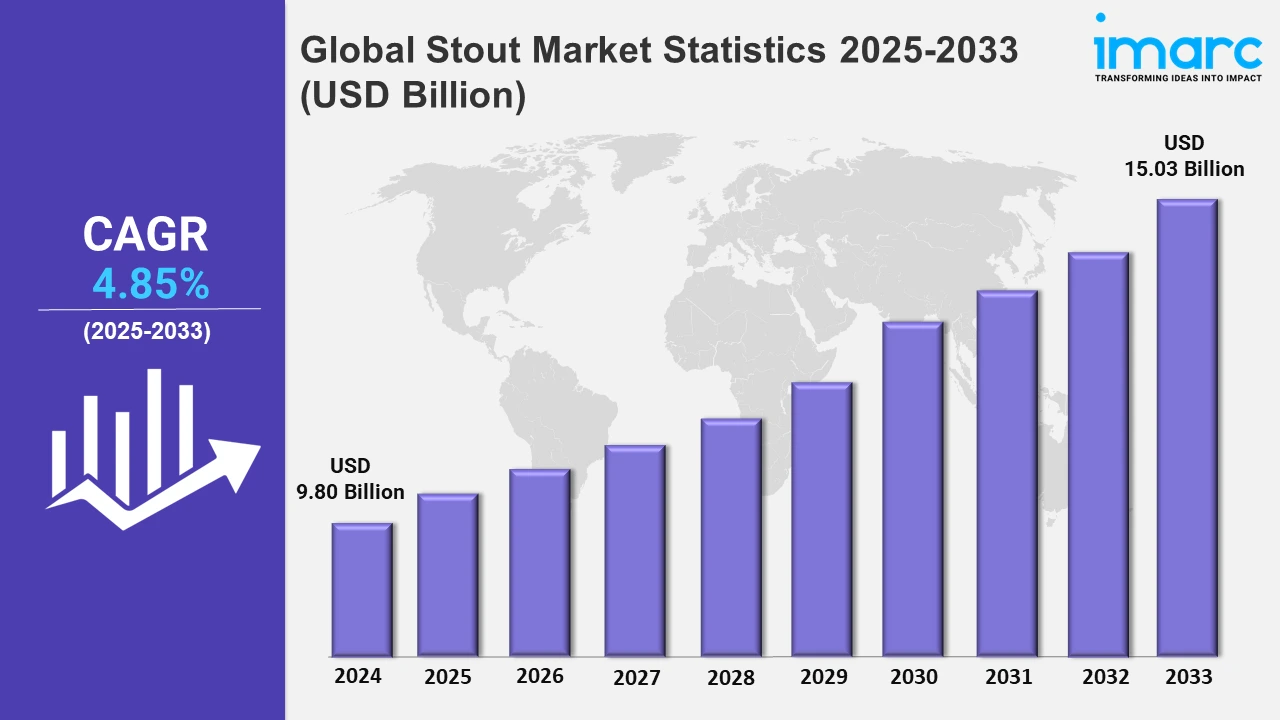

The global stout market size was valued at USD 9.80 Billion in 2024, and it is expected to reach USD 15.03 Billion by 2033, exhibiting a growth rate (CAGR) of 4.85% from 2025 to 2033.

To get more information on this market, Request Sample

Due to the changing customer preferences, inventive brewing methods, and the growing consumer demand for high-end beverages, the market is expanding significantly. Breweries have diversified their product lines and used innovative technologies in response to the rising emphasis on preparing stouts with distinctive flavors and smoother textures. Along with this, the growth of craft beer culture in emerging countries and the increasing disposable incomes are primary factors contributing to the market's expansion. Automation and data analytics are becoming essential components of businesses' operations as they investigate technology-driven solutions, thereby simplifying procedures like risk assessment and quality control. Aligned with this trend, stout integrated AlphaPipe, a platform for managing the data of private funds, highlights the application of technology-driven solutions. Moreover, product innovations also reflect the focus on meeting evolving consumer demands. ABC Smooth Stout was introduced by HEINEKEN Cambodia's lineup of stouts in November 2024. This premium variant, which comes in a striking gold can, has a balanced flavor and an alcohol content of 5.3%, thereby making it suitable for a wider range of consumers in the retail and hospitality industries across the country.

Concurrently, the growing need for options for at-home consumption and the premiumization of product offers are other factors propelling the robust industry. The emergence of nitrogen-based stouts, which have a creamier and smoother texture than their carbon dioxide-based counterparts, is consistent with this trend. Breweries are able to stand out from the competition and draw in more clients because of these advances. For instance, in April 2024, Singapore-based Lion Brewery released nitrogen-infused stout in cans. This product, which makes use of cutting-edge UK technology, improves the satisfaction of drinking stout at home and positions itself as a competitor to established market leaders like Guinness. Lion Brewery hopes to take a sizable chunk of the Asia Pacific market, where demand for premium beer is rising quickly, by utilizing innovative brewing techniques.

Global Stout Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe is accountable for the total majority share in the market driven by factors such as a strong consumer base for dark ales, rich brewing heritage, presence of renowned breweries, etc.

North America Stout Market Trends:

The North America stout market thrives on craft beer innovations and premium offerings, with the U.S. and Canada gaining prominence. The growing demand for seasonal stouts and barrel-aged variants drives the market across the region. In November 2024, Guinness partnered with Brooklyn Brewery to launch Guinness Fonio Stout in New York, blending heritage with sustainability. The rise in taprooms and microbreweries emphasizes unique and local flavors, attracting diverse consumer segments.

Europe Stout Market Trends:

Europe dominates the overall market due to the region's focus on premiumization and innovation in brewing, which has set international standards and made it a center for stout manufacturing. Its standing is further improved by combining traditional components with contemporary brewing methods. Guinness and Brooklyn Brewery collaborated to introduce Guinness Fonio Stout, a limited-edition beer made with the ancient West African grain fonio, in November 2024. This 6.2% ABV stout combines sustainability with legacy, satisfying the changing customer need for distinctive and environmentally friendly goods. Such collaborations highlight Europe's influence in shaping stout innovations, further solidifying its market dominance.

Asia Pacific Stout Market Trends:

Asia Pacific’s stout market sees growing urbanization and rising disposable incomes driving demand for premium beverages. Singapore’s Lion Brewery introduced its Nitro Stout in April 2024, leveraging nitrogen technology for smoother textures. The region's focus on at-home consumption aligns with consumer shifts toward convenience. Markets like India and China exhibit increased stout adoption due to changing preferences, particularly among younger demographics exploring global beer styles.

Latin America Stout Market Trends:

Latin America’s stout market gains traction with increasing craft beer culture and brewery expansions. In Mexico, local breweries have integrated regional ingredients like cacao and coffee to create unique stouts. The growing popularity of combining stouts with traditional foods emphasizes on the versatility of dark ales. Cooperation between worldwide and small-scale brewers boosts market expansion by providing creative products while catering to local palates.

Middle East and Africa Stout Market Trends:

The Middle East and Africa stout market remains niche but grows steadily, driven by premium non-alcoholic options. South Africa, a key market, fosters a vibrant craft beer scene with stout varieties gaining popularity. Guinness's efforts to localize products, such as incorporating regional grains, underline its strategy in Africa. Innovations catering to both alcoholic and non-alcoholic consumers ensure broader market appeal, enhancing the stout's presence.

Top Companies Leading in the Stout Industry

Some of the leading stout market companies include Anheuser-Busch InBev, Asahi Group Holdings Ltd., Carlsberg Breweries A/S, Diageo plc, Heineken N.V., Kirin Brewery Co. Ltd., Molson Coors Beverage Company, Port Brewing Company, Stone Brewing Co., and The Boston Beer Company Inc., among many others. In 2023, Carlsberg Breweries A/S recently acquired Waterloo Brewing in Canada to expand its overall market reach.

Global Stout Market Segmentation Coverage

- On the basis of the distribution channel, the market has been bifurcated into on-trade and off-trade, wherein on-trade represents the most preferred segment. On-trade venues often work directly with breweries or through specialized distributors to offer a wide range of stouts, including local, craft, and international options.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 9.80 Billion |

| Market Forecast in 2033 | USD 15.03 Billion |

| Market Growth Rate 2025-2033 | 4.85% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anheuser-Busch InBev, Asahi Group Holdings Ltd., Carlsberg Breweries A/S, Diageo plc, Heineken N.V., Kirin Brewery Co. Ltd., Molson Coors Beverage Company, Port Brewing Company, Stone Brewing Co., The Boston Beer Company Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Stout Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)