Global Sterilization Equipment Market Expected to Reach USD 31.4 Billion by 2033 - IMARC Group

Global Sterilization Equipment Market Statistics, Outlook and Regional Analysis 2025-2033

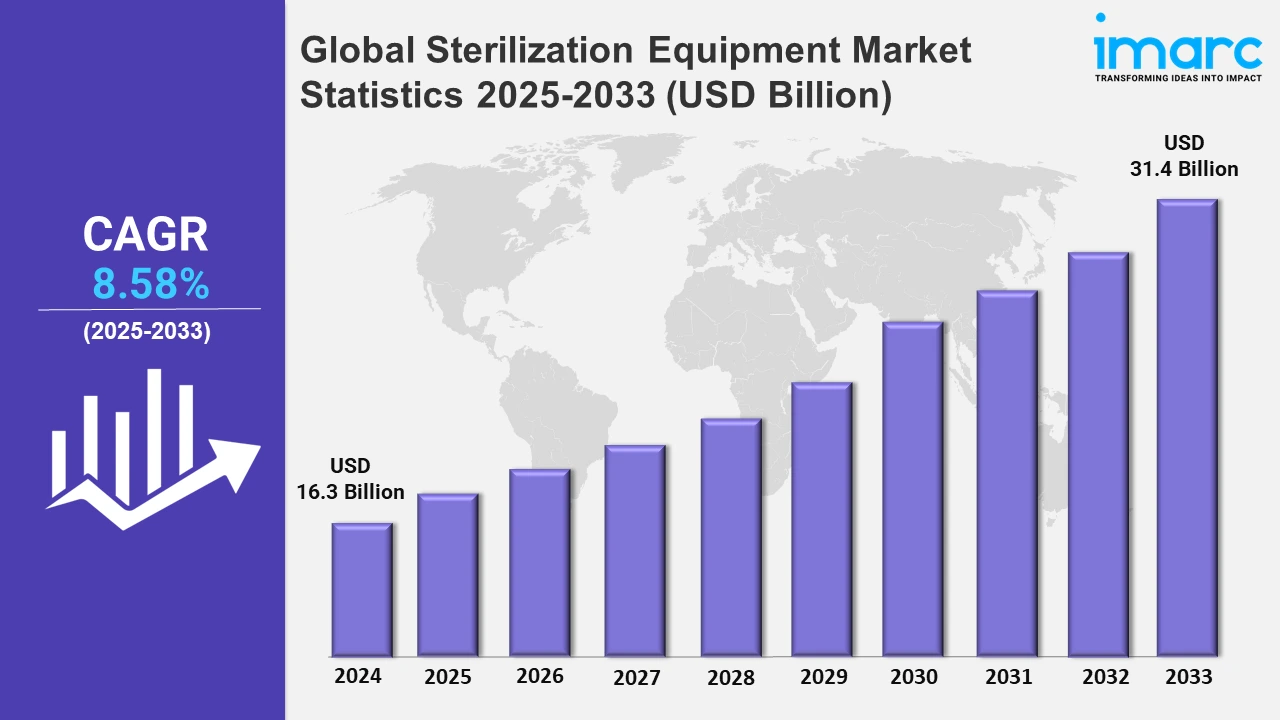

The global sterilization equipment market size was valued at USD 16.3 Billion in 2024, and it is expected to reach USD 31.4 Billion by 2033, exhibiting a growth rate (CAGR) of 8.58% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing prevalence of hospital-acquired infections (HAIs) has heightened the need for effective sterilization methods to prevent infection transmission in healthcare settings. For instance, according to the Centers for Disease Control and Prevention, approximately one in every 31 hospital patients has a healthcare-associated infection. Patients in the 2015 HAI Hospital Prevalence study were at least 16% less likely than those in the 2011 study to have HAIs. This surge has led to a greater demand for sterilization equipment across hospitals and clinics.

Moreover, the growing number of surgical interventions worldwide necessitates the use of sterilized instruments to ensure patient safety. For instance, according to 2023 ASPS Procedural Statistics, there was nearly a 5% increase in plastic surgeries and a 7% increase in minimally invasive treatments over the previous year. Also, as per yearly plastic surgery procedural statistics, there were 15.9 million surgical and minimally invasive cosmetic treatments performed in the United States in 2015, representing a 2% increase over 2014. This surge in surgeries directly boosts the demand for sterilization equipment. Besides this, low-temperature sterilization procedures, such as plasma sterilization and ethylene oxide (EO) gas sterilization, are increasingly employed to sterilize heat-sensitive medical equipment. Furthermore, incorporating automation and robotics into sterilizing operations increases productivity, eliminates human error, and boosts safety. For instance, in January 2024, Multiply Labs, a robotics company developing automated manufacturing systems to produce individualized drugs, and Fedegari Group, a global leader in the design and manufacture of customized systems for producing sterile drugs and MDs, collaborated on automating the sterilization of cell therapy robotic systems. Using Multiply Labs' cell therapy robotic cluster and Fedegari's sterilization and bio-decontamination technology, this collaboration will effectively reduce contamination risk by automating sterilizing capabilities.

Global Sterilization Equipment Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America currently dominates the global market, owing to the demand for packaged food products, on account of busy lifestyles and the rising trend of nuclear families.

North America Sterilization Equipment Market Trends:

North America accounts for the largest regional segment. The increasing incidence of HAIs has heightened the focus on infection control within healthcare settings. For instance, in 2015, an estimated 687,000 HAIs occurred in acute care hospitals across the United States. Approximately 72,000 hospital patients with HAIs died during their stays. This has led to a greater demand for effective sterilization equipment to ensure patient safety and reduce infection rates. Moreover, advanced healthcare infrastructure and high adoption of innovative sterilization technologies, such as low-temperature sterilizers and hydrogen peroxide systems, are widely used in hospitals and surgical centers. For example, major hospitals in New York and California are increasingly investing in automated sterilization systems to meet growing patient demands and regulatory compliance.

Europe Sterilization Equipment Market Trends:

HAIs present significant challenges to patient safety and healthcare costs. In Europe, approximately 8.9 million HAIs occur annually, affecting 1 in 15 patients. This alarming statistic has intensified the demand for effective sterilization solutions to mitigate infection risks. Furthermore, the National Health Service (NHS) in the UK has implemented state-of-the-art sterilization methods in surgical units to reduce hospital-acquired infections (HAIs) and improve patient outcomes.

Asia-Pacific Sterilization Equipment Market Trends:

Countries like India, Thailand, and Malaysia have become hubs for medical tourism, attracting patients from around the world. This influx has increased the demand for high-quality healthcare services, including stringent sterilization practices, thereby driving the market for sterilization equipment. Apart from this, the increasing number of hospitals and surgical procedures in cities like Delhi, Mumbai, and Bangalore across India has significantly boosted the demand for sterilization equipment. For example, leading hospitals such as the All India Institute of Medical Sciences (AIIMS) in Delhi and Kokilaben Dhirubhai Ambani Hospital in Mumbai are investing in advanced sterilization systems like ethylene oxide and hydrogen peroxide-based sterilizers to ensure infection prevention in high-risk medical environments.

Latin America Sterilization Equipment Market Trends:

Countries like Brazil and Mexico are investing in healthcare infrastructure, leading to the establishment of new hospitals and clinics. This expansion necessitates the procurement of sterilization equipment to maintain hygiene standards. Moreover, the launch of favorable policies by government bodies in the healthcare sector will continue to drive the market in Latin America over the foreseeable future.

Middle East and Africa Sterilization Equipment Market Trends:

Countries like the United Arab Emirates and Turkey are becoming prominent medical tourism destinations, leading to higher demand for sterilization equipment to cater to the influx of patients seeking medical services. For instance, in 2016, Dubai saw a 12% increase in medical tourism as patients sought treatment for orthopedic issues and cosmetic operations. This is acting as a significant growth-inducing factor across the MEA region.

Top Companies Leading in the Sterilization Equipment Industry

Some of the leading sterilization equipment market companies include Belimed AG (Metall Zug), Cantel Medical Corp, E-BEAM Services Inc., Fortive Corporation, Getinge AB, H.W.Andersen Products Ltd., Matachana Group, MMM Group, Sotera Health Company, STERIS plc, Stryker Corporation, and Systec GmbH, among many others. For instance, in August 2024, Getinge, a medical technology company, introduced two new products: the Maquet Corin OR table and the Maquet Ezea surgical light. These improvements are intended to simplify medical professionals' daily responsibilities by stressing ease of use, safety, and advanced functionality.

Global Sterilization Equipment Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into heat sterilizers (depyrogenation oven and steam autoclaves), low-temperature sterilizers (ethylene oxide sterilizers, hydrogen peroxide sterilizers, and others), sterile membrane filters, radiation sterilization devices (electron beams, gamma rays, and others), wherein low-temperature sterilizers currently hold the majority of the total market share. The growing number of surgeries, particularly minimally invasive procedures that use complex, sensitive instruments, is driving the need for low-temperature sterilization.

- Based on the end user, the market is categorized into hospitals and clinics, medical device companies, pharmaceutical companies, food and beverages industry, and others, amongst which hospitals and clinics exhibit a clear dominance in the market. Hospitals and clinics prioritize sterilization to prevent HAIs, which can lead to prolonged hospital stays, higher costs, and increased morbidity.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 16.3 Billion |

| Market Forecast in 2033 | USD 31.4 Billion |

| Market Growth Rate 2025-2033 | 8.58% |

| Units | Billion USD |

| Segment Coverage | Product, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Belimed AG (Metall Zug), Cantel Medical Corp, E-BEAM Services Inc., Fortive Corporation, Getinge AB, H.W.Andersen Products Ltd., Matachana Group, MMM Group, Sotera Health Company, STERIS plc, Stryker Corporation, Systec GmbH |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Sterilization Equipment Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)