Global Spices and Seasonings Market Expected to Reach USD 41.87 Billion by 2033 - IMARC Group

Global Spices and Seasonings Market Statistics, Outlook and Regional Analysis 2025-2033

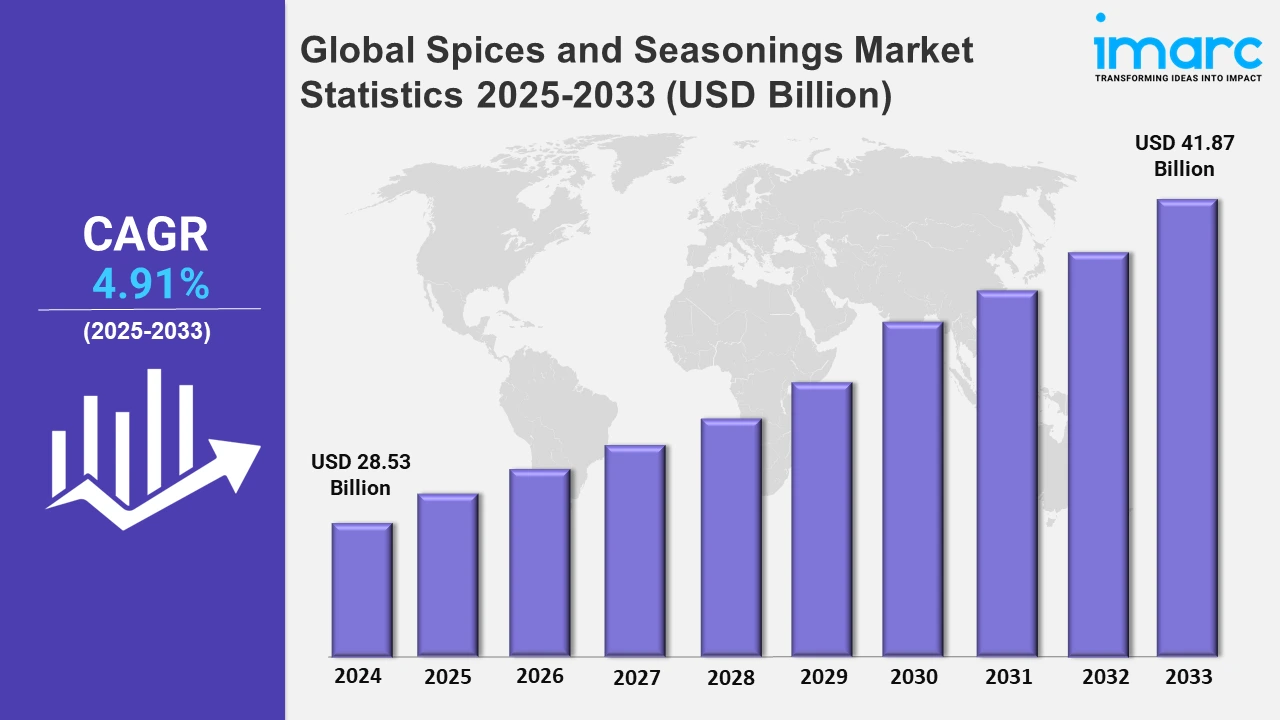

The global spices and seasonings market size was valued at USD 28.53 Billion in 2024, and it is expected to reach USD 41.87 Billion by 2033, exhibiting a growth rate (CAGR) of 4.91% from 2025 to 2033.

To get more information on this market, Request Sample

The escalating focus on easy and varied seasoning solutions to meet the growing requirement for fast and tasty home-cooked meals is fueling the growth of the market. Compact and easy-to-use sachets with a variety of spice selections meet current customer preferences for flavor and time efficiency. For example, in September 2024, Flava and MOBIt announced their collaboration on a new range of spice sachets aimed at improving the flavor and convenience of home cooking. These sachets provide a variety of spice options to meet the needs of modern clients seeking easy-to-cook meal alternatives.

Moreover, the shift toward diversification with the introduction of blended spices is catalyzing the market. Top companies are focusing on enhancing their portfolio by expanding into new product categories, capturing a greater customer interest in varied and savory seasoning solutions. For instance, in September 2024, Sunpure announced the availability of blended spices as its first product in a new category. This expansion is a strategic endeavor to extend its holdings while capitalizing on its strong market position in the spices and seasonings industry. Furthermore, consumer interest in traditional cuisines and global flavors drives the rising demand for original and regional spice mixes. To meet changing culinary preferences, manufacturers are focusing more on high-quality and distinctive spices. This change is encouraged by the thriving food service sector and the emergence of food tourism. Countries such as the U.A.E. are witnessing a growth in demand for authentic regional spices as their tourist and hospitality sectors grow. Saudi Arabia has set an ambitious objective for its tourism industry, aiming to attract 39 million overnight tourists by 2030. This indicates the country's goal of becoming a key player in the global tourist industry, hence generating demand for local culinary experiences. The combination of tourism and genuine cuisines is altering the industry, offering possibilities for producers and suppliers worldwide.

Global Spices and Seasonings Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific held the largest market share due to the elevating number of consumers seeking authentic flavors, including traditional Asian cuisines such as Indian, Chinese, Thai, and Indonesian.

North America Spices and Seasonings Market Trends:

In North America, the rising awareness of the health benefits of spices, as well as anti-inflammatory and antioxidant properties, is increasing their consumption. For example, the U.S. reported importing turmeric worth more than USD 50 Million in 2023, demonstrating the need for health-promoting spices. The market also values innovation, as shown by companies like McCormick and Kerry Group, which are producing new spice mixes and prioritizing healthier goods.

Europe Spices and Seasonings Market Trends:

The market in Europe is focusing on enhanced quality and organic goods, owing to rising health consciousness and demand for clean-label products. For example, European companies such as Schwartz (U.K.) and Fuchs (Germany) emphasize organic, sustainable sourcing, appealing to environmentally aware consumers. The growing popularity of Mediterranean and Middle Eastern cuisine, which includes Za'atar and Harissa mixtures, suggests an urge for multinational tastes while preserving high spice manufacturing standards.

Asia Pacific Spices and Seasonings Market Trends:

Asia Pacific holds the largest share of the market owing to the extensive history of spice usage in everyday cooking. India became the world's top exporter in 2021-2022, exporting USD 4.1 Billion in spices and spice-related items. In September 2024, iD Fresh Food, India's fresh food brand, launched three new spices, namely, Pure Spice (Red Chilli Powder), Blended Spice (Garam Masala), and Sambar Powder, marking its debut in the spices market.

Latin America Spices and Seasonings Market Trends:

In Latin America, the preference for flavors and spices has increased due to ethnic impacts, with spices such as cumin, coriander, and chili selling well. According to Tradeimex statistics, Mexico was one of the region's top exporters in 2023, with spice exports worth about USD 1 Billion. Peru stood in second place, with spice exports worth more than USD 515.56 Million. Moreover, in 2023, Colombia exported spices worth USD 209.07 Million, highlighting the country's importance in the global spice trade.

Middle East and Africa Spices and Seasonings Market Trends:

The market in the Middle East and Africa region is expanding due to a rising inclination toward authentic spices used in traditional recipes such as Baharat, Ras el Hanout, and Berbere. Companies like Rajah Spices (South Africa) specialize in mixtures adapted to local tastes. Also, the region's spice trade heritage is robust, with a growing trend of saffron, black cumin, and cardamom exports to worldwide markets, highlighting their cultural and economic importance.

Top Companies Leading in the Spices and Seasonings Industry

Some of the leading spices and seasonings market companies include Ajinomoto Co. Inc., ARIAKE JAPAN Co. Ltd., Associated British Foods plc, Baria Pepper Co. Ltd., Döhler, DS Group, EVEREST Food Products Pvt. Ltd., The Kraft Heinz Company, Kerry Group plc, McCormick & Company, Olam International, Sensient Technologies Corporation, SHS Group, Spice Hunter (Sauer Brands Inc.), Unilever plc, Worlée-Chemie GmbH, among many others. For example, in May 2023, The Kraft Heinz Company introduced a new range of spices, i.e., Just Spices, designed to provide consumers with a more varied and enjoyable cooking experience. By providing natural ingredients without any artificial additives, this product line seeks to address the growing need for healthier and cleaner food solutions.

Global Spices and Seasonings Market Segmentation Coverage

- Based on the product, the market has been classified into salt and salt substitutes, herbs (thyme, basil, oregano, parsley, and others), spices (pepper, cardamom, cinnamon, clove, nutmeg, and others), and others wherein spices lead the market. Spices are widely used in both traditional and modern cuisines due to their capacity to infuse flavors and provide health benefits.

- Based on the application, the market is categorized into meat & poultry products, snacks & convenience food, soups, sauces and dressings, bakery & confectionery, frozen products, beverages, and others, amongst which meat & poultry products dominate the market. This is primarily driven by the growing recognition as these products are rich sources of protein in many main course meals across the world.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 28.53 Billion |

| Market Forecast in 2033 | USD 41.87 Billion |

| Market Growth Rate 2025-2033 | 4.91% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Meat & Poultry Products, Snacks & Convenience Food, Soups, Sauces and Dressings, Bakery & Confectionery, Frozen Products, Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ajinomoto Co. Inc., ARIAKE JAPAN Co. Ltd., Associated British Foods plc, Baria Pepper Co. Ltd., Döhler, DS Group, EVEREST Food Products Pvt. Ltd., The Kraft Heinz Company, Kerry Group plc, McCormick & Company, Olam International, Sensient Technologies Corporation, SHS Group, Spice Hunter (Sauer Brands Inc.), Unilever plc, Worlée-Chemie GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Spices and Seasonings Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)