Global Soft Magnetic Materials Market Size Anticipated to Reach USD 62.6 Billion by 2033 - IMARC Group

Global Soft Magnetic Materials Market Statistics, Outlook and Regional Analysis 2025-2033

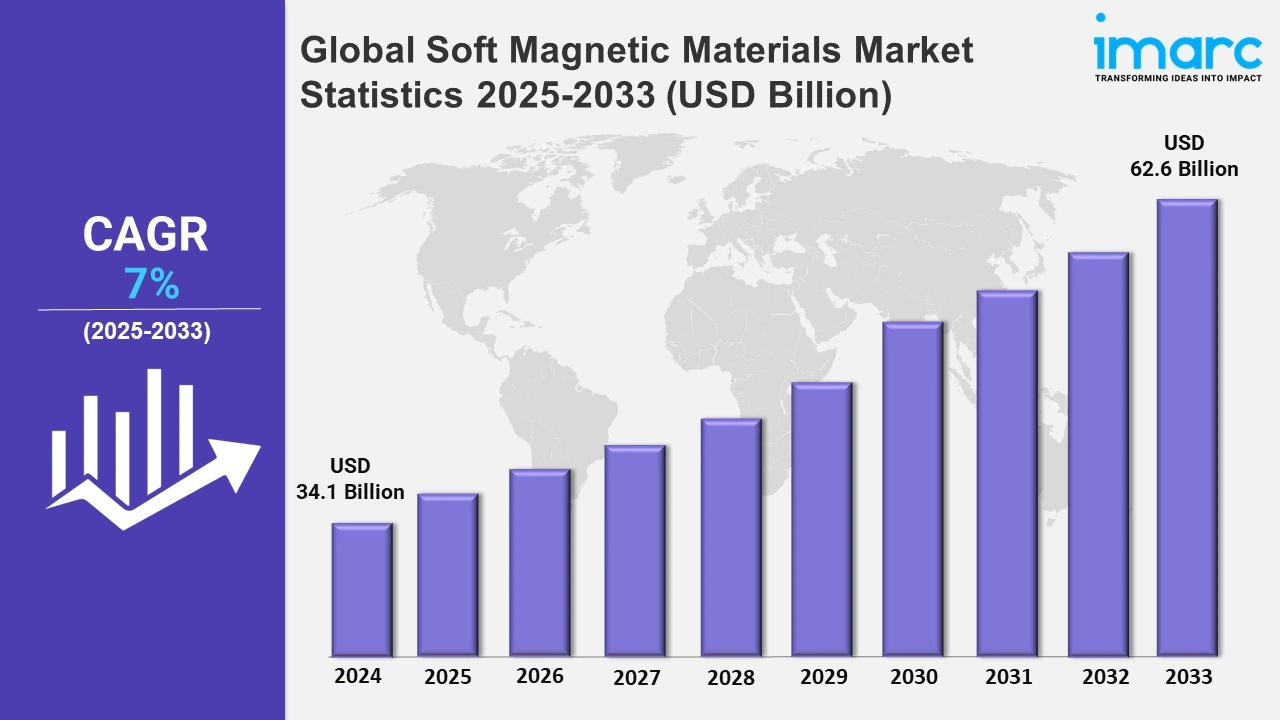

The global soft magnetic materials market size was valued at USD 34.1 Billion in 2024, and it is expected to reach USD 62.6 Billion by 2033, exhibiting a growth rate (CAGR) of 7% from 2025 to 2033.

To get more information on this market, Request Sample

The rapid growth of electric vehicles (EVs) is one of the major drivers boosting the soft magnetic materials market growth. For instance, in Europe, electric vehicles accounted for 22.7% of new car registrations and 7.7% of new van registrations in the year 2023. In total, 2.4 million new electric cars were registered, up from two million in 2022. This increased adoption rate boosts the need for magnetic materials in EVs for components like electric motors, inductors, and transformers. As a result, soft magnetic materials, such as silicon steel, are integral in the construction of these components as they efficiently manage and direct magnetic fields within electric motors. Along with this, the ongoing need for clean and sustainable energy sources, particularly wind and solar power, is driving the market growth. In 2023, the total primary energy consumption in the United States was equal to about 94 quadrillion Btu, among which the electric power sector accounted for 96%. The increased need for energy has boosted the adoption of renewable energy sources to lower the environmental impact. In this context, soft magnetic materials play a crucial role in renewable energy generation by improving the efficiency of power conversion and transmission.

The rising industrialization and urbanization of emerging economies, particularly in Asia-Pacific and Latin America, are also contributing to the growth of the soft magnetic materials market. For example, China’s industrial production rose 5.4 % year-on-year (YoY) in September 2024, following an increase of 4.5% YoY in the previous month. This hike has been creating the need for advanced electrical components, including transformers, inductors, and motors, in large-scale construction projects, such as new power plants, transportation networks, and industrial facilities. Along with this, the rising urbanization that leads to the expansion of the consumer electronics sector, as people in these regions increasingly adopt technologies such as smartphones, home appliances, and EVs, is favoring the market growth. For example, as per the IMARC Group report, the smartphone market in India is expected to showcase a growth rate of 4.86% between 2024 and 2032.

Global Soft Magnetic Materials Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid adoption of electric vehicles (EVs), rising urbanization, and economic growth.

Asia-Pacific Soft Magnetic Materials Market Trends:

Asia Pacific is dominating the soft magnetic materials market, driven by rapid industrialization, urbanization, and technological advancements. Moreover, the growing manufacturing, electronics, automotive, and renewable energy sectors in the region, which depend on soft magnetic materials for various applications like electric motors, transformers, power supplies, and inductors, is fueling the market growth. For instance, China is the largest consumer and producer of soft magnetic materials due to its massive automotive industry, which is shifting toward electric vehicles (EVs). China’s new electric car registrations reached 8.1 million in 2023, increasing by 35% relative to 2022. In addition to this, Asia Pacific is the hub for many of the world’s largest electronics manufacturers, creating a high demand for advanced soft magnetic materials in consumer electronics, appliances, and industrial machinery.

North America Soft Magnetic Materials Market Trends:

North America’s market for soft magnetic materials is driven by the growing adoption of electric vehicles (EVs) and increasing investments in renewable energy infrastructure. Moreover, the presence of large industrial companies that adopt energy-efficient technologies, are driving the demand for soft magnetic materials. Besides this, the increasing commitment to sustainability, coupled with strong research and development (R&D) capabilities in materials science, is fueling the market growth.

Europe Soft Magnetic Materials Market Trends:

Europe is another significant market for soft magnetic materials, driven by stringent environmental regulations, a strong focus on sustainability, and technological innovation. Furthermore, the ongoing transition towards renewable energy, such as wind, solar, and energy storage systems that rely on soft magnetic materials for efficient power conversion and transmission, is favoring the market growth.

Latin America Soft Magnetic Materials Market Trends:

Latin America is an emerging market for soft magnetic materials, driven by increasing industrialization, urbanization, and infrastructure development. Moreover, the rising demand for energy-efficient technologies, particularly in the industrial, automotive, and power generation sectors, is bolstering the market growth. Furthermore, the increasing investment in renewable energy projects, such as wind and solar power, that use soft magnetic materials for the construction of generators, turbines, and inverters is enhancing the market growth.

Middle East and Africa Soft Magnetic Materials Market Trends:

The Middle East and Africa (MEA) region is showing significant growth potential in the market, driven by large-scale infrastructure projects, industrial development, and an expanding renewable energy market. Along with this, the heightened investment in diversifying their economies and building infrastructure, which includes power generation, transportation, and manufacturing sectors, is boosting the market growth.

Top Companies Leading in the Soft Magnetic Materials Industry

Some of the leading soft magnetic materials market companies include Arnold Magnetic Technologies, Daido Steel Co. Ltd., GKN Sinter Metals Engineering GmbH, Hitachi Ltd., Mate Co. ltd., Meyer Sintermetall AG, SG Technologies, Steward Advanced Materials, Sumitomo Metal Mining Co. Ltd., Toshiba Materials Co Ltd (Toshiba Corporation), and Vacuumschmelze GmbH & Co KG., among many others.

In March 2024, Vacuumschmelze GmbH & Co KG introduced PERMENORM 5000 H2, which is a soft magnetic standard Ni-Fe alloy with about 50 % Ni content, combining a high saturation induction and high maximum permeabilities. PERMENORM 5000 H2 is machined into complex shapes and is known to develop its signifying magnetic properties after final high-temperature annealing in a protective atmosphere.

Global Soft Magnetic Materials Market Segmentation Coverage

- On the basis of the material, the market has been categorized into cobalt, iron, nickel, electric steel, and others, wherein electric steel represents the leading segment. This is due to its high magnetic permeability and low core loss, making it ideal for applications in motors, transformers, and generators. Moreover, its superior performance in electrical applications, especially in the automotive and energy sectors, is fueling the market growth.

- Based on the application, the market is classified into motors, transformers, alternators, and others, amongst which motors dominate the market, as they are essential in a wide variety of industries, including automotive, consumer electronics, and industrial automation. Besides this, the growth of electric vehicles (EVs) and renewable energy systems, which heavily rely on electric motors, is boosting the market growth.

- On the basis of the end use, the market has been divided into automotive, electrical and electronics, telecommunication, energy and power, and others. Among these, electrical and electronics account for the majority of the market share, due to the increasing demand for energy-efficient power supplies, transformers, and inductive components. Moreover, the ongoing shift toward smart grids, renewable energy, and energy-efficient devices is favoring the market growth.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 34.1 Billion |

| Market Forecast in 2033 | USD 62.6 Billion |

| Market Growth Rate (2025-2033) | 7% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Cobalt, Iron, Nickel, Electric Steel, Others |

| Applications Covered | Motors, Transformers, Alternators, Others |

| End uses Covered | Automotive, Electrical and Electronics, Telecommunication, Energy and Power, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arnold Magnetic Technologies, Daido Steel Co. Ltd., GKN Sinter Metals Engineering GmbH, Hitachi Ltd., Mate Co. ltd., Meyer Sintermetall AG, SG Technologies, Steward Advanced Materials, Sumitomo Metal Mining Co. Ltd., Toshiba Materials Co Ltd (Toshiba Corporation), Vacuumschmelze GmbH & Co KG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)