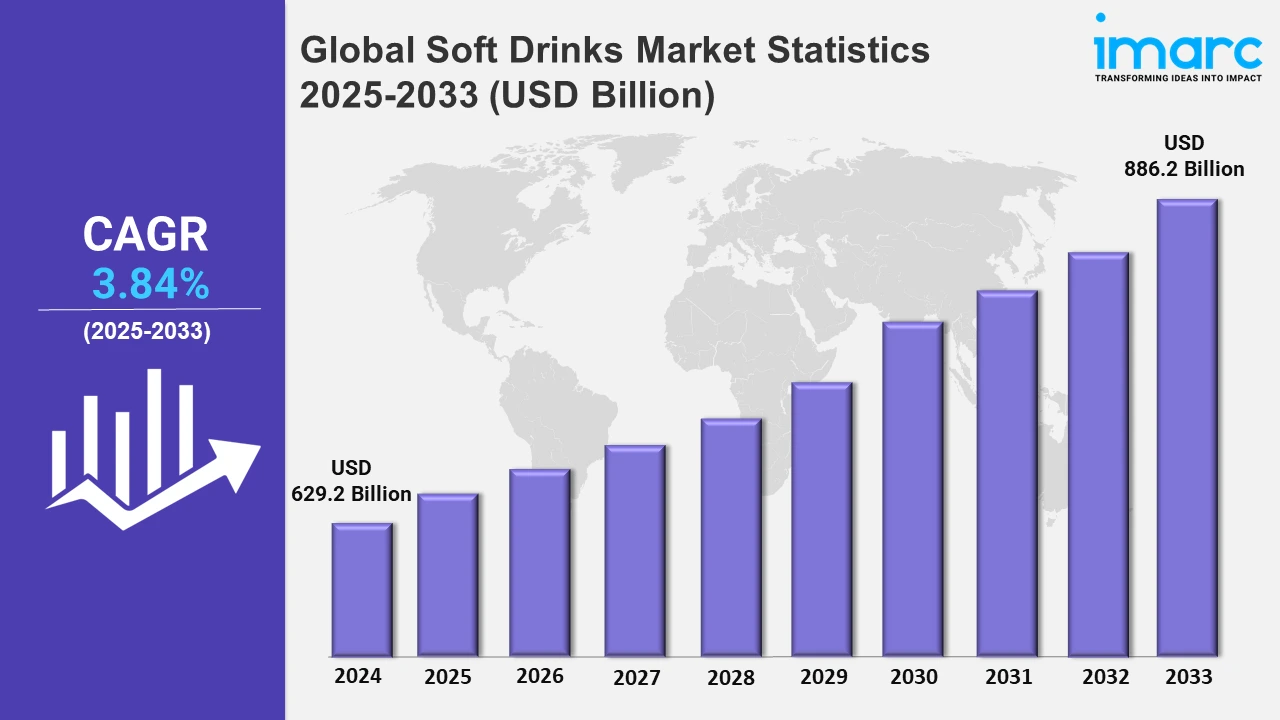

Global Soft Drinks Market to Reach USD 886.2 Billion by 2033, Growing at a CAGR of 3.84% during 2025–2033 - IMARC Group

Global Soft Drinks Market Statistics, Outlook and Regional Analysis 2025-2033

The global soft drinks market size was valued at USD 629.2 Billion in 2024, and it is expected to reach USD 886.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.84% from 2025 to 2033.

To get more information on this market Request Sample

The global soft drinks market is experiencing steady growth driven by the changing consumer preferences, increasing demand for healthier beverage options, and expansion of emerging markets. Additionally, the increasing focus on healthier alternatives by consumers is resulting in the adoption of beverages that offer functional benefits. This shift has led to the popularity of low-sugar, sugar-free, and fortified drinks, such as functional waters, sparkling water, and energy drinks. For instance, on 24 October 2024, Keurig Dr Pepper (KDP) is a beverage company based in North America that produces and supplies beverages, including soft drinks. It reached a final agreement to purchase GHOST Lifestyle LLC and GHOST Beverages LLC, known collectively as GHOST which operates as a lifestyle sports nutrition company, featuring GHOST Energy at the forefront of its product line. This leading ready-to-drink (RTD) energy brand has seen its net sales increased fourfold in the last three years.

Additionally, soft drink manufacturers are creating a digital presence through marketing campaigns to provide goods that reach various customers. For instance, in June 2024, Purity Soft Drinks promoted its well-known Juice Burst brand with Punchy to The Core, its biggest marketing campaign to date. The vivid flavor of the best-selling Juice Burst Apple variety is highlighted in this promotion. The goal of the Punchy to The Core campaign was to keep Juice Burst Apple in the spotlight throughout the summer by emphasizing its health advantages and refreshing flavor. It gives customers a healthy option by helping them meet one of their five a day, with no added sugar, artificial flavors, or sweeteners. Moreover, the new advertisement has received a strong positive response from consumers, with 92% indicating their approval. Also, with 174 million views, the campaign is expected to reach more than 30 million people in the UK. The Punchy To The Core campaign, which has a six-figure investment behind it, will use digital and social media platforms, nationwide product sampling, and effective out-of-home (OOH) advertising, which includes large placements on phone kiosks and bus t-sides in 21 major UK cities. Along with this, Juice Burst Apple is making significant strides in the Drink Now category, which itself is outpacing the overall soft drinks category with a growth of +13%. Apple flavor is performing even stronger, growing at +18.2%, setting Juice Burst Apple as the top on-the-go refreshment for the summer. Apart from this, the easy availability of soft drinks in several flavors, packaging, and sizes has made these beverages more appealing to diverse demographics across the globe.

Global Soft Drinks Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of high per capita consumption, established brands, and strong distribution networks.

North America Soft Drinks Market Trends:

North America's leadership in the soft drinks market is driven by high consumption rates and a strong focus on product innovation to meet changing consumer preferences. Besides, major beverage companies headquartered in the region invest in research and development, enhancing product offerings with healthier, functional, and premium soft drinks. For instance, on 14 March 2024, Coca-Cola company introduced Coca-Cola Spiced to the lineup. It enhances the iconic Coca-Cola flavor with refreshing raspberry notes and a carefully selected mix of warm spices. Moreover, Coca-Cola spiced, and Coca-Cola spiced zero sugar, both are on sale throughout the United States and Canada. These drinks are available in stylish packaging that draws inspiration from the raspberry theme.

Asia-Pacific Soft Drinks Market Trends:

The market represents a rapidly expanding segment in the soft drinks market driven by increasing disposable income and a growing middle class. Consumers in countries such as China, India, and Southeast Asia are inclining toward innovative and exotic flavors, boosting market growth. Additionally, the region’s hot climate and young demographic contribute to sustained demand, while investments in advertising and distribution networks by major beverage companies enhance market penetration.

Europe Soft Drinks Market Trends:

The market is distinguished by its maturity and emphasis on wellness and health trends. As customers look for healthier options, there is a growing demand for low-calorie, natural, and functional beverages. Manufacturers have also been forced to reformulate goods and launch new lines that appeal to this health-conscious consumer base as a result of the region's governmental emphasis on lowering sugar content, which has supported the ongoing development and expansion of the industry.

Latin America Soft Drinks Market Trends:

The Latin American soft drinks market is marked by diverse consumer preferences influenced by cultural factors and local flavors. Additionally, economic fluctuations pose challenges, however, the market remains resilient due to the popularity of carbonated beverages and fruit-based drinks. Expansion efforts by multinational beverage brands and the development of distribution networks are contributing to growth, particularly as local producers innovate to capture market share with affordable, locally tailored options.

Middle East and Africa Soft Drinks Market Trends:

The market is primarily driven by the growing youthful population, rising urbanization, and expanding retail sectors. Additionally, non-alcoholic beverages are particularly popular due to cultural and religious practices which are escalating the demand for a variety of soft drinks. Besides, the increasing investments by global and regional beverage companies, coupled with the rise of modern retail formats, are enhancing product availability and consumption across different income groups.

Top Companies Leading in the Soft Drinks Industry

Some of the leading soft drinks market companies include Arizona Beverage Company, Asahi Group Holdings Ltd., Keurig Dr Pepper Inc., National Beverage Corp., Nestle S.A., Pepsico Inc., Purity Soft Drinks Ltd., Red Bull GmbH, Refresco Group BV, and The Coca-Cola Company, among many others. For instance, in August 2024, National Beverage Corp., unveiled its latest flavor creation, Strawberry Peach LaCroix Sparkling Water. This new blend offers the sweet, lively taste of strawberries combined with the rich, juicy essence of peaches, delivering a refreshing and delightful experience. LaCroix strives to bring joy to loyal consumers with unique flavors and visually appealing packaging. The company’s greatest satisfaction comes from spreading happiness and promoting well-being across America with unmatched flavors and innovative offerings.

Global Soft Drinks Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into carbonated and non-carbonated, wherein carbonated represents the leading segment. The segment leads the market due to its widespread consumer appeal and strong brand presence established by major players. Additionally, the consistent demand for diverse flavors and the introduction of healthier, low-sugar options cater to traditional and health-conscious consumers. Moreover, effective marketing strategies and product availability across various price points further strengthen this segment’s dominance in the soft drinks market.

- Based on the distribution channel, the market is classified into hypermarkets and supermarkets, convenience store, online, and others, amongst which hypermarkets and supermarkets dominate the market. This is primarily driven by the broad reach of hypermarkets and supermarkets and the comprehensive product variety that attracts a diverse customer base. These stores offer an immersive shopping experience with promotions, bundled deals, and strategic product placement, making them the preferred choice for soft drink purchases. Moreover, the extensive distribution networks and convenient locations of hypermarkets and supermarkets further enhance their market significance across the globe.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 629.2 Billion |

| Market Forecast in 2033 | USD 886.2 Billion |

| Market Growth Rate (2025-2033) | 3.84% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Carbonated, Non-Carbonated |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Store, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arizona Beverage Company, Asahi Group Holdings Ltd., Keurig Dr Pepper Inc., National Beverage Corp., Nestlé S.A., Pepsico Inc., Purity Soft Drinks Ltd., Red Bull GmbH, Refresco Group BV, The Coca-Cola Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Soft Drinks Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)