Global Sodium Silicate Market Projected to Reach USD 11.5 Billion by 2033 - Rising Concerns About Water Scarcity Catalyzing the Overall Demand

Global Sodium Silicate Market Statistics, Outlook and Regional Analysis 2025-2033

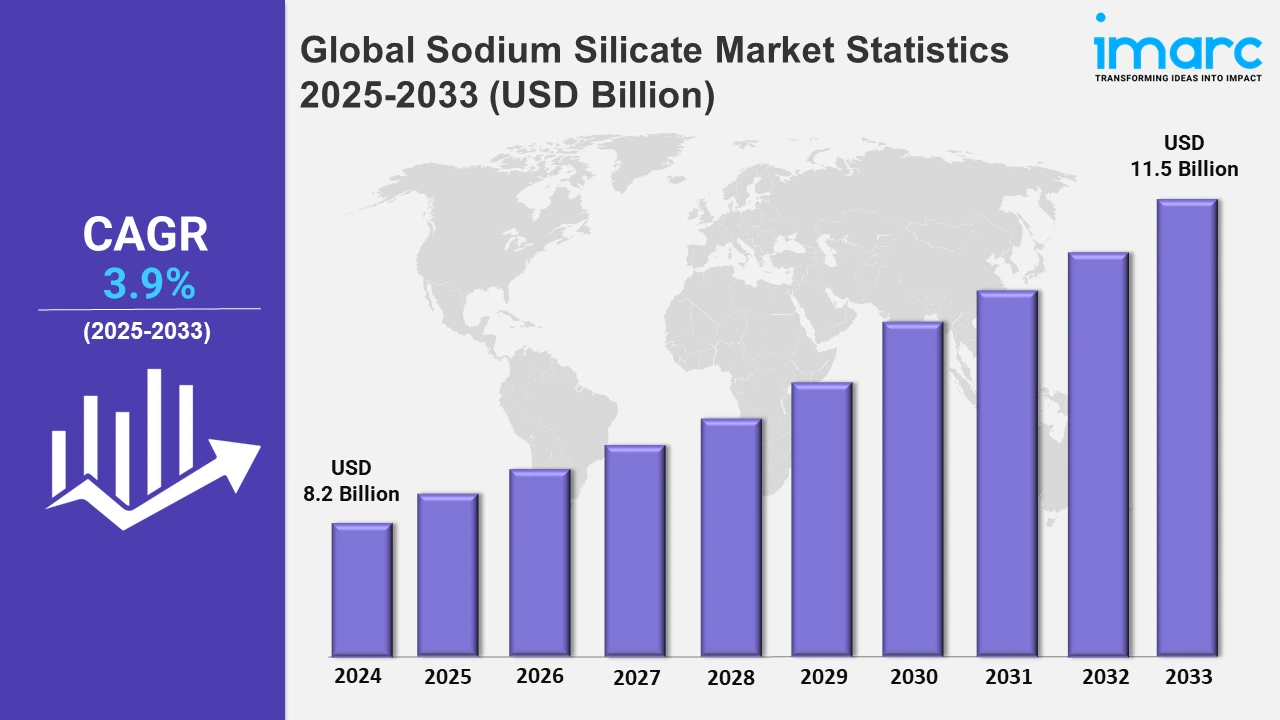

The global sodium silicate market size was valued at USD 8.2 Billion in 2024, and it is expected to reach USD 11.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.9% from 2025 to 2033.

To get more information on the this market, Request Sample

According to the IMARC Group’s report, the global buildings construction market size reached USD 6.8 Trillion in 2024. In concrete compositions, sodium silicate is frequently added to increase hardness, decrease permeability, and improve water resistance. It is useful in infrastructure projects as it can be used as a concrete hardener to prolong the life of structures. The need for sodium silicate in concrete is growing as more building projects are being undertaken worldwide, particularly in metropolitan areas and emerging economies. Soil stabilization is frequently necessary in building projects to enhance ground conditions and stop soil erosion. Sodium silicate is frequently utilized in projects like retaining walls, foundations, and road building because it effectively stabilizes soil. Large-scale infrastructure projects like highways, bridges, and commercial buildings that are growing due to urbanization, especially in developing regions, are positively influencing the market.

Because of its coagulating and flocculating qualities, which aid in the removal of contaminants and suspended particles, sodium silicate is utilized in the treatment of both municipal and industrial wastewater. Governments and businesses around the world are prioritizing water recycling and reuse as the scarcity of water is worsening. As it helps in making recovered water safe and useful, sodium silicate is becoming more in demand in wastewater treatment facilities. Sodium silicate works well to neutralize acidic wastewater, particularly from manufacturing, metal processing, and mining, which frequently produce acidic effluents. Sodium silicate's demand in areas with water constraints is further supported by the fact that its usage in treating acidic wastewater complies with stronger environmental laws and initiatives to prevent water contamination. As per the data published on the website of the World Meteorological Organization (WMO) in 2024, it is projected that around 5 billion people will face water shortages by 2050.

Global Sodium Silicate Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounts for the largest market share due to rapid industrialization, urbanization, and significant demand from key end-use sectors, such as construction, water treatment, and detergents, particularly in emerging economies like China and India.

Asia-Pacific Sodium Silicate Market Trends:

The Asia Pacific region enjoys the leading position because of the strong demand from sectors including detergents, water treatment, and construction, especially in nations with fast expanding economies like China, India, and Southeast Asia. The need for building chemicals is increasing due to urbanization and industrial growth, and sodium silicate is essential for waterproofing, stabilizing soil, and hardening concrete. Additionally, the area boasts thriving paper and textile sectors, both of which utilize sodium silicate. Furthermore, the usage of sodium silicate in the automotive sector to manufacture tires is propelling the growth of the market in the region. The IMARC Group’s report shows that the Asia Pacific tire market is expected to reach 1,800 Million Units by 2032.

North America Sodium Silicate Market Trends:

The demand for sodium silicate in North America is mostly driven by the water treatment, detergent, and building sectors. Sodium silicate is used in several well-established industrial areas in the United States and Canada, such as adhesives, detergent additives, and concrete reinforcement. The use of sodium silicate in wastewater treatment is growing due to regulatory pressures and growing environmental concerns. This is important for sustainable water management in North America.

Europe Sodium Silicate Market Trends:

Strict environmental laws, especially in the wastewater treatment and construction industries, are driving the sodium silicate market in Europe. Because of the strong emphasis on sustainable practices in European nations, sodium silicate is a popular choice for contaminant removal and water purification in water treatment facilities.

Latin America Sodium Silicate Market Trends:

The market for sodium silicate is growing in Latin America as a result of increased building activity brought on by rapid urbanization and government spending on infrastructure projects. Construction activities are expanding in nations like Brazil, Mexico, and Argentina, which is catalyzing the demand for sodium silicate for soil stabilization and concrete.

Middle East and Africa Sodium Silicate Market Trends:

Increasing number of building projects, along with the rising demand for water treatment solutions, are driving the Middle East and Africa's sodium silicate market's steady growth. Nations like Saudi Arabia and the United Arab Emirates are making significant investments in infrastructure, especially in commercial projects and smart cities, where sodium silicate is utilized for soil stabilization and concrete treatment.

Top Companies Leading in the Sodium Silicate Industry

Some of the leading sodium silicate market companies include Adwan Chemical Industries Co. Ltd., Evonik Industries AG, FUJI CHEMICAL Co., Ltd., Kiran Global Chem Limited, Merck KGaA, Nippon Chemical Industrial CO., LTD, Occidental Petroleum Corporation, Oriental Silicas Corporation, PQ Corporation, Qemetica, Silmaco, Sinchem Silica Gel Co. Ltd., among many others. In November 2024, PQ Corporation, a leading global producer of sodium silicates, specialty silicas, and derivative products, announced the successful completion of the expansion of its silica production facility in Pasuruan, Indonesia to strengthen its position in the Asian market.

Global Sodium Silicate Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into liquid and solid. Liquid represents the leading segment. Because of its ability to effectively reinforce and bind materials, it is commonly employed in construction for waterproofing, soil stabilization, and concrete hardening. Furthermore, liquid sodium silicate is utilized extensively as a binding and deflocculating ingredient in the detergent business. It is also perfect for uses like adhesives and water treatment that call for quick chemical reactions owing to its high solubility.

- Based on the grade, the market has been classified into neutral and alkaline. Alkaline currently dominates the market. In the detergent and cleaning industries, the potent alkalinity of sodium silicate strengthens its function as a cleaning and degreasing agent. Additionally, its high alkalinity provides greater efficiency in water treatment applications, where it helps to neutralize acidic waste. The construction industry also benefits from alkaline sodium silicate for concrete reinforcement and fireproofing.

- On the basis of the form, the market has been divided into crystalline and anhydrous. Among these, crystalline accounts for the majority of the market share. For applications like adhesives and sealants, where exact, stable formulas are required, crystalline forms are perfect because they are seamless for businesses that need simple to handle, store, and transport materials. In manufacturing operations, the crystalline form also guarantees effective dispersion and reactivity, especially in the creation of ceramics and building materials. In many industrial applications, crystalline sodium silicate is the material of choice due to its long shelf life and rapid dissolution when required.

- Based on the application, the market has been segregated into detergent, paints, adhesives, catalyst, refractories, tube winding, and others. Detergent exhibits a clear dominance in the market. Because of its high alkalinity, it effectively breaks away stains and grease, increasing the detergents' overall cleaning effectiveness. Additionally, sodium silicate stabilizes the mixture and keeps it from re-soiling, which is particularly useful in cleaning products for the home and business. Additionally, sodium silicate is a crucial component of detergent manufacture, which is bolstering the market growth.

- On the basis of the end-user, the market has been categorized into pulp and paper, construction, automotive, and others. In the pulp and paper industry, sodium silicate is used to strengthen paper and improve pulping efficiency. Apart from this, sodium silicate is important in the construction sector because it is used for concrete hardening, soil stabilization, and as a waterproofing agent in a variety of building applications. In addition, sodium silicate is employed in the automotive industry to make tires and other components that need to be heat and fire resistant.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 8.2 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Market Growth Rate 2025-2033 | 3.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Liquid, Solid |

| Grades Covered | Neutral, Alkaline |

| Forms Covered | Crystalline, Anhydrous |

| Applications Covered | Detergent, Paints, Adhesives, Catalyst, Refractories, Tube Winding, Others |

| End Users Covered | Pulp and Paper, Construction, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adwan Chemical Industries Co. Ltd., Evonik Industries AG, FUJI CHEMICAL Co., Ltd., Kiran Global Chem Limited, Merck KGaA, Nippon Chemical Industrial CO., LTD, Occidental Petroleum Corporation, Oriental Silicas Corporation, PQ Corporation, Qemetica, Silmaco, Sinchem Silica Gel Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)