Global Smart Agriculture Market Expected to Reach USD 37.1 Billion by 2033 - IMARC Group

Global Smart Agriculture Market Statistics, Outlook and Regional Analysis 2025-2033

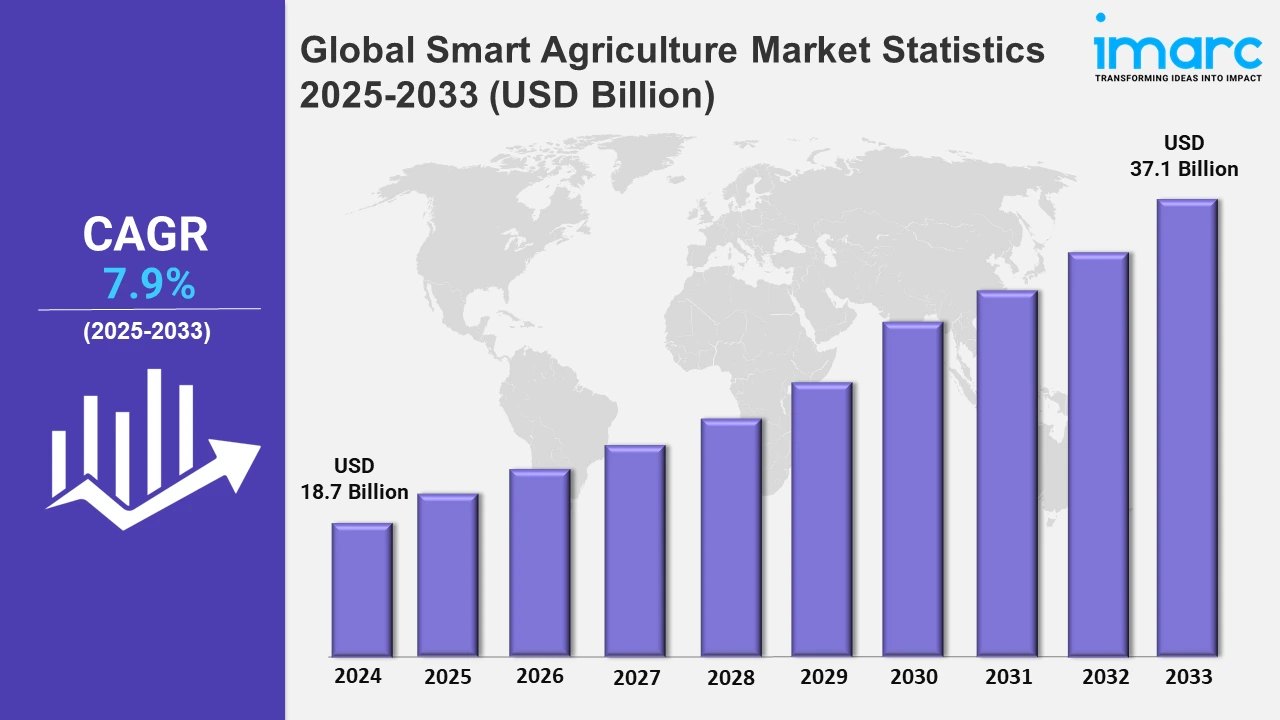

The global smart agriculture market size was valued at USD 18.7 Billion in 2024, and it is expected to reach USD 37.1 Billion by 2033, exhibiting a growth rate (CAGR) of 7.9% from 2025 to 2033.

To get more information on this market, Request Sample

Transformative advancements, driven by the integration of artificial intelligence (AI) and sustainable practices, are responsible for smart agriculture market growth. In addition, the increasing food demand, coupled with limited arable land, is encouraging stakeholders to adopt innovative technologies for optimized farming. Also, the sector is benefiting from the rising emphasis on sustainability, where resource-efficient solutions play a critical role. AI-powered systems are emerging as game-changers, offering precision in irrigation, fertilization, and pest management, which is ensuring higher crop yields and lower environmental impact. For instance, in April 2024, C-DAC Pune introduced the smart farm system, marking a milestone in India’s smart agriculture landscape. This system aims to maximize crop output while conserving resources by leveraging AI to analyze soil and environmental conditions. In line with this, in April 2024, Cropin Technology launched akṣara, an open-source micro language model tailored for farmers that offers tailored crop advisories and optimizes resource use, thereby empowering underserved communities with scalable AI-driven solutions. Furthermore, these developments underscore the growing role of technology in addressing challenges, such as climate variability, resource scarcity, and economic disparities in agriculture.

Moreover, regional initiatives are shaping the smart agriculture ecosystem, with Africa making notable progress. In October 2024, ABAN and SAIS launched the Climate Smart Agriculture Angel Investor Capacity Development (CAICD) program. This initiative strengthens Africa’s investment framework by supporting startups that focus on climate-smart agriculture. The program facilitates funding and innovative solutions to enhance crop quality and optimize agricultural value chains, which is driving sustainable growth in the region. Also, the integration of AI, open-source platforms, and targeted investments highlights the global commitment to transforming traditional farming into a sustainable, technology-driven sector.

Global Smart Agriculture Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and Others); and the Middle East and Africa. According to the report, North America dominates the smart agriculture market due to advanced technological adoption, strong infrastructure, government support, and significant investments in precision farming and AI-driven agricultural solutions.

North America Smart Agriculture Market Trends:

North America is the leading region in the market due to its advanced technological infrastructure and the presence of key market players, such as AGCO Corporation. Also, the region benefits from the widespread adoption of precision farming practices, driven by the need to optimize crop yields and reduce resource wastage. In August 2024, AGCO unveiled innovative smart farming solutions at the Farm Progress Show, including Fendt's 600 vario tractor, PTx Trimble's autonomous OutRun grain cart, and Precision Planting's symphony nozzle. In addition, strong government support, the increasing awareness among farmers, and the growing integration of IoT and AI technologies contribute to North America's leadership in the smart agriculture sector.

Europe Smart Agriculture Market Trends:

Europe is embracing precision farming techniques, focusing on reducing environmental impacts while enhancing productivity. Moreover, countries like Germany are adopting IoT-based smart irrigation systems and sensors for real-time soil monitoring. The European Union's policies promoting sustainable agriculture are driving these advancements. For example, Germany's "Digital Farming Solutions" program supports farmers in adopting AI and robotics, boosting the region's smart agriculture market growth.

Asia-Pacific Smart Agriculture Market Trends:

The Asia-Pacific region is leveraging AI and machine learning to address challenges like climate change and food security. India, for instance, is advancing with AI-powered tools like the smart farm system, optimizing irrigation and fertilization. Furthermore, government initiatives like India's PM-Kisan scheme are promoting digital solutions in farming, aiding smallholders in adopting sustainable and tech-driven practices. This is fueling the market's expansion. Besides this, adoption rates have increased because of initiatives like China's push for AI-driven farming solutions and India's Digital Agriculture Mission.

Latin America Smart Agriculture Market Trends:

Key players across Latin America are focusing on precision agriculture to optimize resource use in crop cultivation, which is acting as a significant growth-inducing factor. Brazil, a leading agricultural hub, is utilizing satellite-based technologies for large-scale monitoring and yield optimization. For instance, programs like "AgriTech Brazil" encourage startups to develop smart farming solutions, thereby catalyzing the market across Latin America. Moreover, these advancements help the region improve productivity while conserving resources, which is positioning the region as a key contributor to global smart agriculture innovation.

Middle East and Africa Smart Agriculture Market Trends:

In the Middle East and Africa, water conservation technologies are a priority in smart agriculture due to scarce resources. South Africa exemplifies this trend with smart irrigation systems and climate-resilient farming solutions. Also, initiatives like the Climate Smart Agriculture Angel Investor Capacity Development (CAICD) program enhance investments in innovative startups, thereby fostering sustainable growth in agriculture across the region while addressing environmental challenges effectively.

Top Companies Leading in the Smart Agriculture Industry

Some of the leading smart agriculture market companies include G Leader Technology, AGCO Corporation, AgJunction Inc. (Kubota Corporation), CLAAS KGaA mbH, CropMetrics LLC (CropX inc.), Deere & Company, DICKEY-john, Farmers Edge Inc., Gamaya, Granular Inc. (Corteva Inc.), Raven Industries Inc. (CNH Industrial N.V.), Trimble Inc., among many others. In July 2023, Deere & Company acquired Smart Apply, Inc., a company specializing in precision spraying equipment, which aims to improve spraying precision, reduce chemical use, and support sustainability efforts. This acquisition expands Deere's footprint in smart agriculture, focusing on technology that increases efficiency and minimizes environmental impact.

Global Smart Agriculture Market Segmentation Coverage

- On the basis of the agriculture type, the market has been bifurcated into precision farming, livestock monitoring, smart greenhouse, and others, wherein precision farming represents the most preferred segment. Precision farming leverages IoT devices, sensors, and data analytics to optimize crop yields, conserve resources, and enhance decision-making, thereby revolutionizing modern farming practices.

- Based on the offering, the market is categorized into hardware, software, and service, amongst which hardware dominates the market. Cutting-edge hardware like drones, GPS systems, and automated machinery empower farmers to monitor crops, analyze soil conditions, and improve efficiency with real-time data.

- On the basis of the farm size, the market has been divided into small, medium, and large. Among these, medium exhibits a clear dominance in the market. Smart agriculture thrives through digital platforms, cloud-based systems, and connected applications, enabling seamless integration of data and decision-making across the agricultural value chain.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 18.7 Billion |

| Market Forecast in 2033 | USD 37.1 Billion |

| Market Growth Rate 2025-2033 | 7.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Agriculture Types Covered | Precision Farming, Livestock Monitoring, Smart Greenhouse, Others |

| Offerings Covered | Hardware, Software, Service |

| Farm Sizes Covered | Small, Medium, Large |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AG Leader Technology, AGCO Corporation, AgJunction Inc. (Kubota Corporation), CLAAS KGaA mbH, CropMetrics LLC (CropX inc.), Deere & Company, DICKEY-john, Farmers Edge Inc., Gamaya, Granular Inc. (Corteva Inc.), Raven Industries Inc. (CNH Industrial N.V.), Trimble Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Smart Agriculture Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)