Global Security Market Expected to Reach USD 311.1 Billion by 2033 - IMARC Group

Global Security Market Statistics, Outlook and Regional Analysis 2025-2033

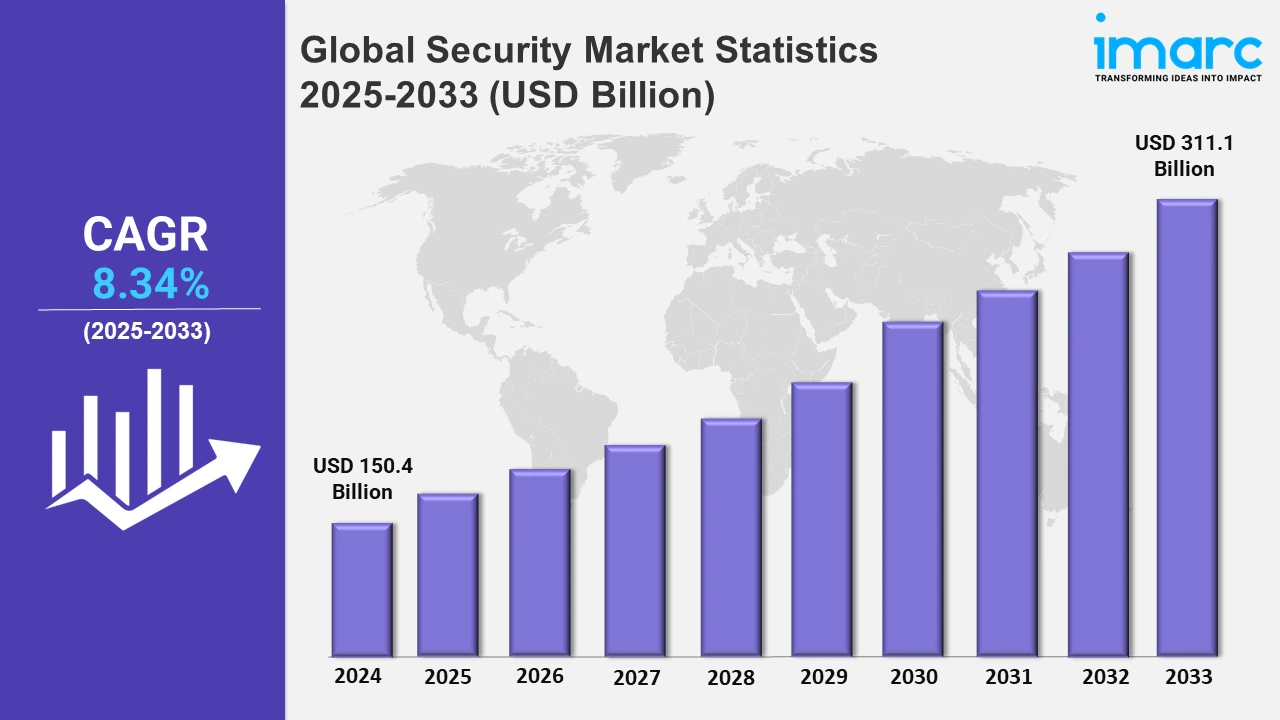

The global security market size was valued at USD 150.4 Billion in 2024, and it is expected to reach USD 311.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.34% from 2025 to 2033.

To get more information on this market, Request Sample

The global security market is witnessing a significant shift with the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies. These advancements increase the threat perception by recognizing the patterns and irregularities which the conventional techniques may fail to identify. AI-driven systems are enabling real-time responses to cybersecurity threats, reducing reaction times, and mitigating potential damage, thereby propelling the market. Machine learning models are continuously improving as they process larger datasets, making them more effective in preventing advanced threats like ransomware and phishing attacks. For instance, in August 2024, IBM introduced generative AI capabilities to its Threat Detection and Response Services, enhancing security operations for clients. Built on the watsonx platform, the new Cybersecurity Assistant accelerates threat detection, investigation, and response by using historical correlation analysis and an advanced conversational engine. This innovation aims to improve security teams' efficiency and accuracy amid growing cybersecurity challenges. Furthermore, this trend reflects the market’s focus on leveraging intelligent tools to address the growing complexity of modern security challenges.

The escalating complexity and frequency of cyber threats are driving significant investments in the global security market. Advanced tactics such as ransomware, phishing, and zero-day exploits are targeting organizations across industries, compromising sensitive data and operational integrity. Businesses are responding by prioritizing robust cybersecurity frameworks to prevent financial losses and reputational damage. Governments and regulatory bodies worldwide are also introducing stricter data protection laws, compelling organizations to adopt advanced security solutions. For instance, in November 2024, the Australian Government introduced the Cyber Security Act 2024 (Cth) as part of a broader legislative package. This includes the Intelligence Services and Other Legislation Amendment (Cyber Security) Act 2024 and the Security of Critical Infrastructure and Other Legislation Amendment (Enhanced Response and Prevention) Act 2024, aimed at strengthening the nation’s cyber security framework. This rising threat landscape has catalyzed the adoption of innovative tools like endpoint detection and response (EDR) systems, cloud security platforms, and real-time threat monitoring, making the evolving cybersecurity needs a key driver for growth in the global security market.

Global Security Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of robust advanced technological adoption, significant investments, and stringent regulatory frameworks.

North America Security Market Trends:

North America remains the leading region in the global security market, driven by its rapid adoption of advanced technologies and substantial investments in cybersecurity infrastructure. For instance, in August 2024, Cyberbit Inc., a leading provider of cybersecurity skill development and training platform, secured new funding from existing investors, including Charlesbank Capital Partners, to support acquisitions, expansion, and product development. With full North American ownership, Cyberbit aims to strengthen its presence in North America and expand globally. The region’s strong regulatory environment, enforces stringent data protection measures, prompting businesses to implement robust security solutions. High levels of digital transformation across industries, coupled with the proliferation of cloud computing and IoT applications, have further accelerated demand for advanced security systems. With a well-established network of key market players and increasing awareness of cybersecurity risks, North America continues to set benchmarks in the global security landscape.

Asia-Pacific Security Market Trends:

Asia Pacific is emerging domain for security market growth because of the growing process of companies’ digitalization, the increase in the number of cyber threats, and the actions of governments to improve security protection. The effects of integrating complex technologies such as artificial intelligence and the internet of things increase the need for strict security systems for industries across this region.

Europe Security Market Trends:

Europe holds a significant share of the global security market, driven by stringent data protection regulations and increasing investments in advanced security technologies. Another additive factor is the region’s emphasis on securing critical infrastructure and a continuously increasing use of artificial intelligence in providing security services.

Latin America Security Market Trends:

Latin America is emerging as a growing region in the global security market, fueled by increasing cyber threats and investments in digital transformation. Public and private sectors are investing in efficient solutions to safeguard important installations and information, boosting the consumption of complex security technologies to ensure cybersecurity in the region.

Middle East and Africa Security Market Trends:

The Middle East & Africa region is gradually growing in the global security market due to increased investment in technologies like critical infrastructure protection and surveillance. Moreover, the region’s market is strengthening because people have grown more conscious of cyber risks while implementing smart solutions.

Top Companies Leading in the Security Industry

Some of the leading security market companies include Ameristar Perimeter Security (Assa Abloy AB), ATG Access Ltd., Avon Barrier Corporation Ltd. (Perimeter Protection Group), Barrier1 Systems LLC, CIAS Elettronica Srl, Delta Scientific Corporation, EL-Go Team, Frontier Pitts Ltd., Honeywell International Inc., Johnson Controls International PLC, Senstar Corporation (Senstar Technologies Ltd.), Teledyne FLIR LLC (Teledyne Technologies Incorporated), among many others. For instance, in September 2024, Johnson Controls International PLC introduced the Illustra Edge AI License Plate Recognition (LPR) Camera, an advanced AI-driven security solution designed to enhance safety and efficiency. This product aims to support security teams by enabling automatic parking access, real-time threat detection, and seamless integration with management systems, ensuring smarter and more secure environments for people and businesses.

Global Security Market Segmentation Coverage

- On the basis of the system, the market has been categorized into access control systems, alarms and notification systems, intrusion detection systems, video surveillance systems, barrier systems, and others, wherein video surveillance systems represent the leading segment. The leading segment is propelled by the developments in AI-powered analytics and integration with IoT technologies. These systems are crucial for the real time monitoring, threat detection and evidence management and therefore are indispensable in various sectors including banking, retail, and government.

- Based on the service, the market is classified into system integration and consulting, risk assessment and analysis, managed services, and maintenance and support, amongst which system integration and consulting dominates the market, fueled by the growing complexity of security infrastructures. These services make it possible to implement sophisticated technologies such as artificial intelligence, internet of things, and cloud-based systems that enhance security management. The demand of consulting expertise is magnifying in order to resolve threats, hence further boosting the market globally.

- On the basis of the end user, the market has been divided into government, military and defense, transportation, commercial, industrial, and others. Among these, military and defense accounts for the majority of the market share, driven by the rising geopolitical tensions followed by the need to protect national assets. Furthermore, increasing investments in advanced technologies, such as AI-driven surveillance, threat detection systems, and cybersecurity, further enhance readiness of action.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 150.4 Billion |

| Market Forecast in 2033 | USD 311.1 Billion |

| Market Growth Rate 2025-2033 | 8.34% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Systems Covered | Access Control Systems, Alarms and Notification Systems, Intrusion Detection Systems, Video Surveillance Systems, Barrier Systems, Others |

| Services Covered | System Integration and Consulting, Risk Assessment and Analysis, Managed Services, Maintenance and Support |

| End Users Covered | Government, Military and Defense, Transportation, Commercial, Industrial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ameristar Perimeter Security (Assa Abloy AB), ATG Access Ltd., Avon Barrier Corporation Ltd. (Perimeter Protection Group), Barrier1 Systems LLC, CIAS Elettronica Srl, Delta Scientific Corporation, EL-Go Team, Frontier Pitts Ltd., Honeywell International Inc., Johnson Controls International PLC, Senstar Corporation (Senstar Technologies Ltd.), Teledyne FLIR LLC (Teledyne Technologies Incorporated), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)