Global Sectionalizer Market Expected to Reach USD 1,985.23 Million by 2033 - IMARC Group

Global Sectionalizer Market Statistics, Outlook and Regional Analysis 2025-2033

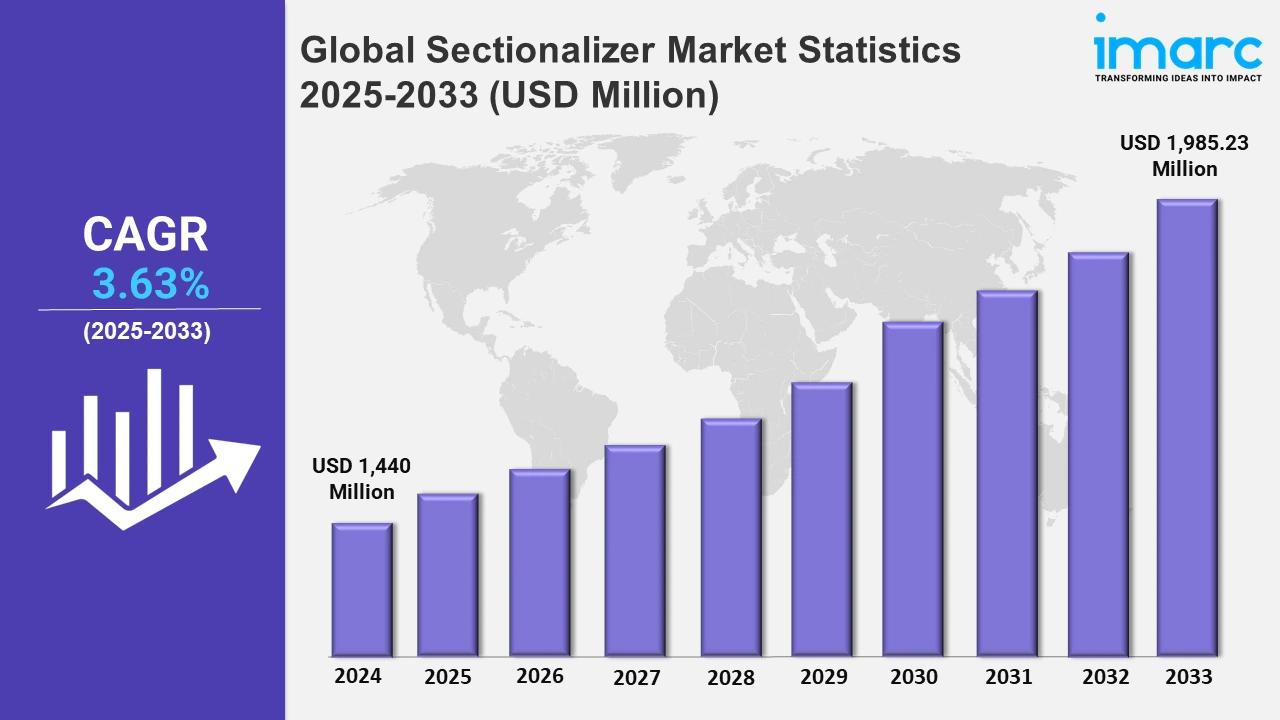

The global sectionalizer market size was valued at USD 1,440 Million in 2024, and it is expected to reach USD 1,985.23 Million by 2033, exhibiting a growth rate (CAGR) of 3.63% from 2025 to 2033.

To get more information on this market, Request Sample

The growing focus on modernizing power distribution systems to ensure efficiency and sustainability is significantly driving the sectionalizer market. In line with this, the adoption of advanced technologies for fault detection and isolation coupled with a surge in investments to enhance grid infrastructure, underscores the rising demand for sectionalizer. Also, leading companies are continuously introducing innovative solutions to meet these evolving requirements. For instance, in November 2024, Eaton launched the Xiria NGX, a modular medium-voltage switchgear platform featuring sectionalizer panels. This platform utilizes Air-GIS technology, offering natural air insulation, reduced maintenance, and advanced fault isolation capabilities. At the same time, the rising emphasis on automation in power systems is propelling the sectionalizer market. The integration of remote-control technologies further boosts the efficiency of power restoration processes. For example, in July 2023, students from Goa Engineering College, in collaboration with the Goa Electricity Department, developed an SMS-based remote controller for sectionalizer. This device, inaugurated by Power Minister Sudin Dhavalikar, facilitates real-time fault isolation and reduces downtime significantly. It exemplifies how technological advancements are enhancing grid reliability and addressing challenges associated with manual operations in power systems.

Moreover, the increasing investments in grid infrastructure to accommodate renewable energy sources and electric vehicles (EVs) are further driving the demand for sectionalizer. The European electricity industry, for instance, is focusing on upgrading aging grid infrastructures to ensure efficiency and resilience. In September 2023, Eurelectric highlighted the need to increase annual investments in European grids by 84% until 2050. This initiative aims to modernize grids to accommodate renewables, EVs, and smart grids, emphasizing the crucial role of sectionalizer in ensuring grid stability and reliability. Such developments indicate a strong market trajectory for sectionalizer, aligning with global efforts toward energy efficiency and sustainability.

Global Sectionalizer Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America dominates the sectionalizer market due to its advanced energy infrastructure, the increasing adoption of smart grid technologies, and stringent regulations promoting energy efficiency.

North America Sectionalizer Market Trends:

North America is leading in the market, driven by the adoption of smart grid technologies and stringent regulations promoting energy efficiency. In December 2023, the United Nations Environment Programme (UNEP) highlighted the importance of energy efficiency in reducing refrigeration emissions by 60% by 2050. Sectionalizer, critical for enhancing grid reliability, contributes significantly to optimizing energy systems in the refrigeration sector, aligning with UNEP's vision. The region's commitment to renewable energy integration and investments in modernizing aging grid infrastructure. Also, government incentives and the presence of key market players drive innovation, ensuring North America remains at the forefront of the sectionalizer market.

Europe Sectionalizer Market Trends:

In Europe, the growing emphasis on decarbonization and grid modernization supports sectionalizer adoption is positively influencing the regional market. In contrast, countries like Germany invest in advanced sectionalizer systems to handle increased renewable energy inputs. For instance, Germany’s focus on smart grids includes installing automated sectionalizer to manage fluctuating wind and solar energy, which is boosting grid stability and efficiency across the region.

Asia-Pacific Sectionalizer Market Trends:

Rapid urbanization and industrial growth in Asia-Pacific are propelling the market growth, especially in developing economies. India, for example, is integrating automated sectionalizer in rural electrification projects to ensure fault isolation and reduce downtime. Furthermore, these initiatives are essential for strengthening power delivery in underserved regions, aligning with the country's energy development goals.

Latin America Sectionalizer Market Trends:

In Latin America, the growing energy sector especially in Brazil, drives sectionalizer installations to improve grid reliability. Brazil deploys sectionalizer in remote areas to enhance power supply and minimize disruptions caused by frequent thunderstorms. Meanwhile, these developments align with the region's focus on reducing power outages and improving energy distribution networks.

Middle East and Africa Sectionalizer Market Trends:

The Middle East and Africa see rising sectionalizer adoption driven by renewable energy projects. In South Africa, sectionalizer is implemented to support solar and wind farms in isolated regions, ensuring fault isolation and minimal downtime. Moreover, this system is critical to sustaining the region’s push toward renewable energy and addressing infrastructure challenges. In the Middle East, as part of their Vision 2030 plans, nations like the United Arab Emirates and Saudi Arabia are making significant investments in grid upgrading.

Top Companies Leading in the Sectionalizer Industry

Some of the leading sectionalizer market companies include ABB Ltd., Bevins Co., Eaton Corporation plc, Elektrolites (Power) Pvt. Ltd, G&W Electric Company, Hubbell Incorporated, Hughes Power System AB, and Schneider Electric SE, among many others. In August 2024, Schneider Electric SE unveiled innovative solutions during ‘Innovation Days 2024’ in Mumbai, enhancing energy management and automation. These include sectionalizer for improved efficiency, reliability, and sustainability in power distribution systems.

Global Sectionalizer Market Segmentation Coverage

- On the basis of the phase type, the market has been bifurcated into single phase and three phase, wherein three phase represents the most preferred segment. These systems are known for their efficiency in power distribution. They significantly reduce the copper or aluminum needed for electrical distribution, making it economically attractive.

- Based on the control type, the market is categorized into resettable electronic sectionalizer and programmable resettable sectionalizer, amongst which resettable electronic sectionalizer dominates the market. Resettable electronic variants offer the ability to automatically reset after isolating fault conditions, enhancing system reliability and reducing downtime, unlike traditional counterparts that may need manual intervention or replacement after the operation.

- On the basis of the voltage rating, the market has been divided into up to 15 KV, 16-27 KV, and 28-38 KV. Up to 15 KV sectionalizer is designed to operate in systems with a voltage rating of 15 kilovolts (KV) or less, whereas sectionalizer in the category of 16-27 KV is tailored for medium voltage networks. 28-38 KV represents high-end medium voltage sectionalizer mainly used in heavy industrial areas and large commercial establishments.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,440 Million |

| Market Forecast in 2033 | USD 1,985.23 Million |

| Market Growth Rate 2025-2033 | 3.63% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phase Types Covered | Single Phase, Three Phase |

| Control Types Covered | Resettable Electronic Sectionalizer, Programmable Resettable Sectionalizer |

| Voltage Ratings Covered | Up To 15 KV, 16-27 KV, 28-38 KV |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Bevins Co., Eaton Corporation plc, Elektrolites (Power) Pvt. Ltd, G&W Electric Company, Hubbell Incorporated, Hughes Power System AB, Schneider Electric SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)